Tesla's Q1 Financial Results: Political Headwinds And Profitability

Table of Contents

Record Vehicle Deliveries Despite Supply Chain Challenges

Tesla's Q1 2024 witnessed record vehicle deliveries, a testament to the company's manufacturing prowess and growing global demand for its EVs. However, these impressive numbers were achieved despite persistent supply chain challenges.

Production and Delivery Figures:

- Total Deliveries: [Insert Actual Q1 2024 Delivery Figures Here] This represents a [Insert Percentage]% increase compared to Q4 2023 and a [Insert Percentage]% year-over-year growth.

- Model 3: [Insert Q1 2024 Delivery Figures]

- Model Y: [Insert Q1 2024 Delivery Figures]

- Model S: [Insert Q1 2024 Delivery Figures]

- Model X: [Insert Q1 2024 Delivery Figures]

Analyst expectations for Q1 2024 were [Insert Analyst Expectations], indicating that Tesla [Exceeded/Met/Missed] those projections.

- Challenges: Ongoing semiconductor shortages, logistical bottlenecks, and geopolitical instability continued to impact production and delivery timelines throughout the quarter. Tesla's ability to navigate these challenges highlights its efficient supply chain management. Specific regions like [Mention a strong performing region] experienced particularly robust growth, while [Mention a region with weaker performance] faced greater headwinds.

Impact of Price Cuts and Increased Competition

Tesla's aggressive price cuts, implemented throughout late 2023 and into Q1 2024, significantly impacted both sales volume and profit margins. This strategy was a direct response to increasing competition within the burgeoning EV market.

Pricing Strategy and Market Share:

- Price Adjustments: Tesla implemented average price reductions of approximately [Insert Percentage]% across its vehicle lineup.

- Sales Volume Impact: The price cuts resulted in a [Insert Percentage]% surge in sales volume during the quarter.

- Competitive Landscape: Competitors like [Mention Key Competitors – e.g., BYD, Volkswagen, Ford] have responded with their own pricing strategies and new model launches, intensifying the competition.

- Long-Term Strategy: Tesla's strategy appears to prioritize market share expansion through aggressive pricing, potentially sacrificing short-term profitability for long-term growth. The long-term impact of this strategy on Tesla's financial health remains to be seen.

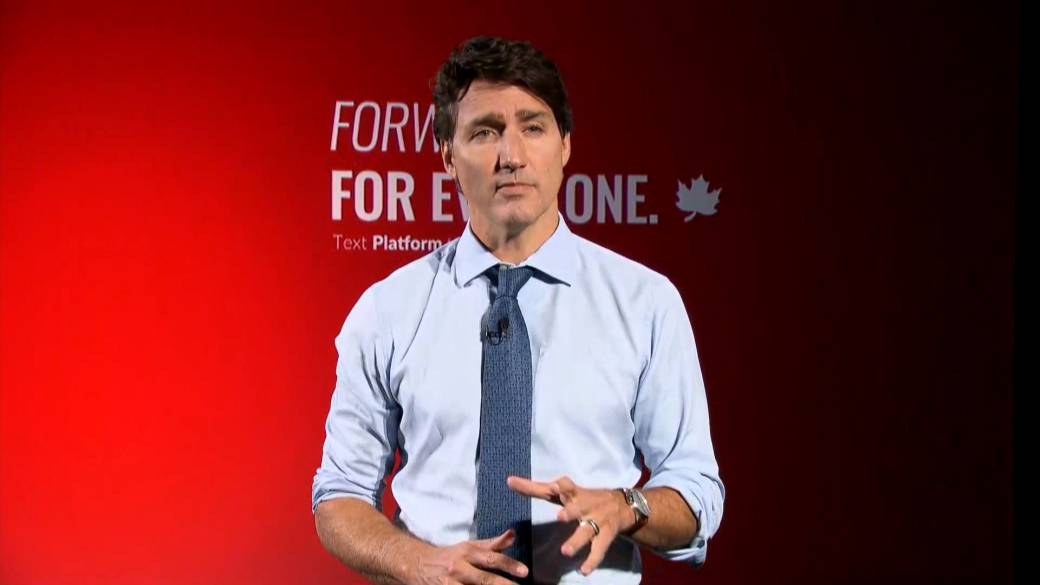

Navigating Political and Regulatory Headwinds

Tesla's global operations expose it to a complex web of political and regulatory environments. Geopolitical risks, evolving government regulations, and international trade tensions significantly impacted Tesla's Q1 performance.

Geopolitical Risks and Regulatory Uncertainty:

- Regulatory Challenges: Specific examples include [Mention specific regulatory challenges faced – e.g., import tariffs, environmental compliance issues in specific regions].

- Geopolitical Impact: [Mention specific geopolitical events and their impact on Tesla’s supply chains or sales – e.g., impact of the war in Ukraine on supply chains].

- Future Regulatory Hurdles: Potential future challenges include [Mention potential future challenges – e.g., stricter emissions standards, changes in government subsidies].

- Risk Mitigation Strategies: Tesla is actively engaging with governments and regulatory bodies to navigate these complexities, employing strategies such as [Mention strategies – e.g., lobbying efforts, diversification of supply chains].

Energy Generation and Storage Performance

Tesla's energy generation and storage business, encompassing solar panel installations (Solar Roof and Solar Panels) and energy storage solutions (Powerwall and Powerpack), continues to demonstrate growth, albeit at a slower pace than its automotive segment.

Growth in Solar and Energy Storage:

- Growth Percentages: Solar panel installations grew by [Insert Percentage]%, and energy storage deployments increased by [Insert Percentage]% compared to the previous quarter.

- Revenue Generation: This segment generated [Insert Revenue Figures] in revenue during Q1 2024, contributing [Insert Percentage]% to Tesla's overall revenue.

- Profitability Contribution: The energy business contributed [Insert Percentage]% to Tesla's overall profitability during Q1 2024.

- Future Growth Potential: This sector offers significant long-term growth potential as the demand for renewable energy solutions continues to rise globally.

Conclusion

Tesla's Q1 2024 financial results paint a picture of continued growth in vehicle deliveries despite considerable challenges. While record deliveries are a positive indicator, the aggressive pricing strategy to maintain market share has impacted profit margins. Navigating the complex landscape of political headwinds and regulatory uncertainty remains a key challenge. Finally, the energy generation and storage segment continues to grow steadily, but at a less dramatic pace than the automotive division. Tesla's ability to balance aggressive growth strategies with profitability will be a critical factor in determining its long-term success.

Stay updated on the latest news regarding Tesla's profitability and its navigation of political headwinds by subscribing to our newsletter for in-depth analysis of future Tesla Q[number] results.

Featured Posts

-

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Perspective

Apr 24, 2025

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Perspective

Apr 24, 2025 -

William Watsons Advice Examining The Liberal Platform Before Election Day

Apr 24, 2025

William Watsons Advice Examining The Liberal Platform Before Election Day

Apr 24, 2025 -

Over The Counter Birth Control Implications For Reproductive Health Post Roe

Apr 24, 2025

Over The Counter Birth Control Implications For Reproductive Health Post Roe

Apr 24, 2025 -

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025 -

Tesla Q1 2024 Lower Profits And The Musk Administration Connection

Apr 24, 2025

Tesla Q1 2024 Lower Profits And The Musk Administration Connection

Apr 24, 2025