Sensex And Nifty 50 End Choppy Trading Session Unchanged: Impact Of Bajaj Twins And India-Pakistan Relations

Table of Contents

Main Points: Deciphering the Day's Market Behavior

2.1 Bajaj Twins' Performance and its Ripple Effect on Indices

The performance of Bajaj Finance and Bajaj Auto, often considered bellwethers of the Indian financial and automotive sectors, played a crucial role in shaping the day's market sentiment. While specific percentage changes require referencing real-time data (replace with actual data if available), their individual performances had a noticeable ripple effect.

- Bajaj Finance: (Insert actual percentage change and trading volume here). A (positive/negative) movement in Bajaj Finance's share price typically influences the broader financial sector, impacting overall market sentiment.

- Bajaj Auto: (Insert actual percentage change and trading volume here). Similar to Bajaj Finance, Bajaj Auto's performance significantly affects the automotive sector and its related indices. The (positive/negative) movement observed today (explain impact on overall market sentiment).

The combined effect of the Bajaj twins' performance contributed to a (positive/negative) influence on the overall market capitalization, partially counteracting other potential negative pressures. The sectoral impact was significant, demonstrating their weight in shaping the Sensex and Nifty 50. This highlights the importance of monitoring these large-cap stocks for insights into market trends.

2.2 Geopolitical Tensions: India-Pakistan Relations and Market Sentiment

Geopolitical events invariably cast a shadow over market sentiment, and today was no exception. (Mention the specific event impacting India-Pakistan relations that day, e.g., border skirmishes, diplomatic tensions). Historically, heightened India-Pakistan tensions have led to increased market volatility and investor uncertainty.

- Investor Sentiment: News related to escalating geopolitical risks often prompts investors to adopt a risk-averse approach, potentially leading to capital flight. However, today's market reaction suggests a degree of resilience, possibly due to (explain potential reasons - e.g., market already priced-in the risk, investors focused on other factors).

- Long-Term Effects: While the immediate impact may be limited, prolonged geopolitical instability could negatively affect foreign direct investment (FDI), impacting long-term economic growth and, consequently, the performance of the Sensex and Nifty 50.

2.3 Other Contributing Factors to Market Stability

The relatively stable closing of the Sensex and Nifty 50 wasn't solely determined by the Bajaj twins and India-Pakistan relations. Several other factors contributed to this surprising equilibrium:

- FIIs and DIIs Activity: (Discuss the net investment by FIIs and DIIs. Were they net buyers or sellers? How did this impact the market?)

- Global Market Trends: (Mention any significant global events or trends, e.g., movements in US markets, oil prices, that might have influenced the Indian market.)

- Rupee Volatility and Inflation: (Analyze the impact of rupee fluctuations and inflation on market stability. Did these factors contribute to the market's resilience or cause some countervailing pressures?)

- Sectoral Balance: (Were there any significant positive movements in other sectors that offset the negative impacts of other sectors?)

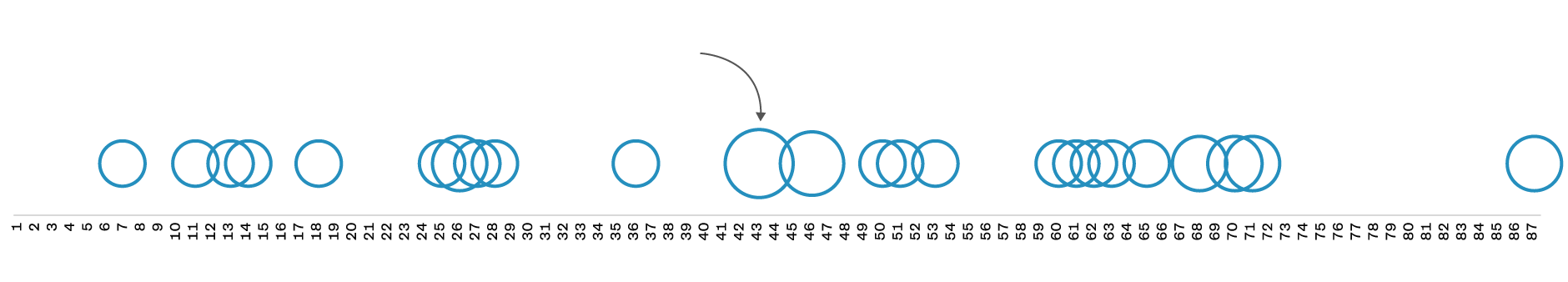

2.4 Technical Analysis of Sensex and Nifty 50

A technical analysis of the Sensex and Nifty 50 charts reveals (describe observed chart patterns, support and resistance levels, moving averages, and trading volume). (Explain how these technical indicators contributed to the unchanged closing values. For example, did the market find support at a key level? Did trading volume indicate a lack of significant buying or selling pressure?)

Conclusion: Understanding the Dynamics of Sensex and Nifty 50

Today's relatively unchanged closing of the Sensex and Nifty 50 underscores the complex interplay of factors influencing the Indian stock market. While the performance of the Bajaj twins and the geopolitical backdrop presented potential for volatility, other counterbalancing forces ensured a surprising degree of stability. The resilience exhibited by the market highlights its ability to absorb shocks, but vigilance remains crucial. Understanding the nuanced interplay between macroeconomic indicators, sectoral performances, and global events is vital for navigating the Indian stock market's dynamics.

To stay informed about the latest developments affecting the Sensex and Nifty 50, and for deeper insights into Indian stock market trends, subscribe to our newsletter or follow us on social media. Keep a close watch on the Sensex and Nifty 50 for further analysis and insights.

Featured Posts

-

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

Space X Valuation Soars Elon Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025

Space X Valuation Soars Elon Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025 -

Muutokset Britannian Kruununperimysjaerjestyksessae Ketkae Ovat Perijoeitae Nyt

May 10, 2025

Muutokset Britannian Kruununperimysjaerjestyksessae Ketkae Ovat Perijoeitae Nyt

May 10, 2025 -

Apples Ai Development Challenges And Opportunities

May 10, 2025

Apples Ai Development Challenges And Opportunities

May 10, 2025 -

Save On Elizabeth Arden Skincare At Walmart

May 10, 2025

Save On Elizabeth Arden Skincare At Walmart

May 10, 2025

Latest Posts

-

Behind The Scenes Of Celebrity Antiques Road Trip An Insiders Look

May 10, 2025

Behind The Scenes Of Celebrity Antiques Road Trip An Insiders Look

May 10, 2025 -

Wynne And Joanna All At Sea Themes And Symbolism

May 10, 2025

Wynne And Joanna All At Sea Themes And Symbolism

May 10, 2025 -

Celebrity Antiques Road Trip How To Participate And Become A Part Of The Action

May 10, 2025

Celebrity Antiques Road Trip How To Participate And Become A Part Of The Action

May 10, 2025 -

Wynne And Joanna All At Sea Review And Critical Reception

May 10, 2025

Wynne And Joanna All At Sea Review And Critical Reception

May 10, 2025 -

Katya Joness Unexpected Exit From Strictly The Wynne Evans Connection

May 10, 2025

Katya Joness Unexpected Exit From Strictly The Wynne Evans Connection

May 10, 2025