Tesla Stock Plummets: How Elon Musk's Actions Affected Dogecoin

Table of Contents

Elon Musk's Influence on Dogecoin

Musk's Tweets and Dogecoin Volatility

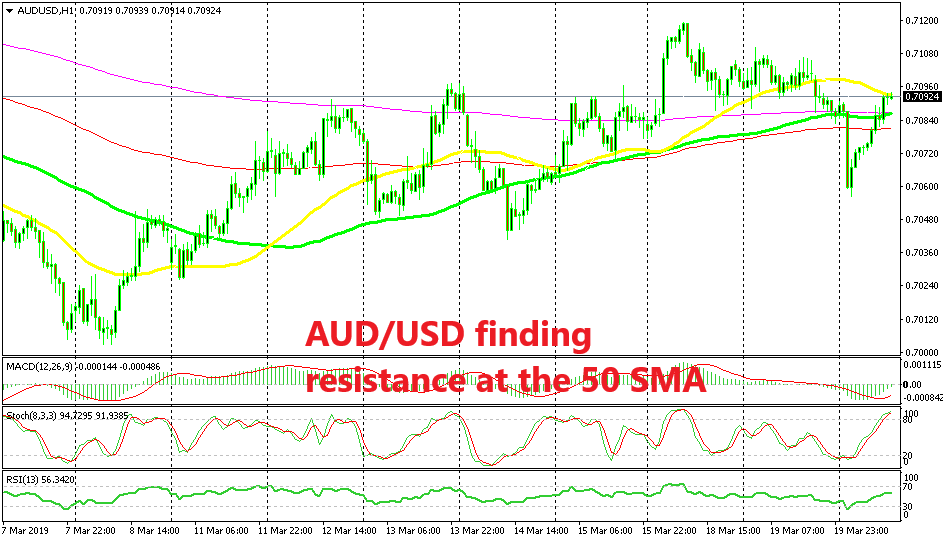

Elon Musk's tweets have become infamous for their immediate and dramatic effect on Dogecoin's price. His pronouncements, whether positive or negative, often trigger significant price swings, illustrating the immense power he wields over this cryptocurrency's market.

- Example 1: In February 2021, a single tweet from Musk mentioning Dogecoin sent its price soaring by over 20% in a matter of hours. [Insert chart illustrating price spike].

- Example 2: Conversely, a subsequent tweet expressing doubts about Dogecoin led to a sharp price drop. [Insert chart illustrating price drop].

- This volatility raises concerns about "pump and dump" schemes, where individuals manipulate the market to inflate the price before selling their holdings, leaving other investors with losses. The regulatory scrutiny surrounding Musk's influence on Dogecoin's price is intensifying, with increasing calls for greater transparency and accountability in the cryptocurrency market.

- Keywords: Elon Musk Dogecoin, Musk tweets Dogecoin, Dogecoin price volatility, pump and dump, cryptocurrency regulation.

Tesla's Acceptance of Dogecoin and Subsequent Reversal

Tesla's brief acceptance of Dogecoin as payment for certain merchandise created a significant ripple effect. This decision initially boosted Dogecoin's price and market sentiment. However, Tesla's subsequent reversal of this policy, citing environmental concerns related to Dogecoin's energy consumption, resulted in another sharp decline in Dogecoin's value.

- Timeline:

- [Date]: Tesla announces acceptance of Dogecoin.

- [Date]: Dogecoin price surges.

- [Date]: Tesla reverses Dogecoin payment policy.

- [Date]: Dogecoin price plummets.

- Tesla's justification for the change emphasized environmental responsibility, impacting market sentiment. The press release announcing the reversal [link to press release, if available] further fueled market speculation.

- Keywords: Tesla Dogecoin payment, Tesla cryptocurrency policy, Dogecoin acceptance, Tesla stock price, market sentiment.

The Correlation Between Tesla Stock and Dogecoin

Investor Sentiment and Shared Risk

Many investors hold both Tesla stock and Dogecoin, creating a shared risk profile. Positive news regarding Tesla often boosts investor confidence in Dogecoin, and vice-versa. However, negative news surrounding one asset often spills over, negatively impacting the other.

- Investors who bet on Musk's success often hold both assets, seeing them as interconnected components of his broader entrepreneurial vision.

- The correlation highlights the risks associated with holding assets heavily reliant on a single entity's success or failure.

- Diversification strategies that minimize this shared risk are crucial for investors in this space.

- Keywords: Tesla investor sentiment, Dogecoin investor sentiment, correlated assets, risk diversification, investment portfolio.

Impact of Musk's Overall Actions on Investor Confidence

Elon Musk's controversial actions extend far beyond his pronouncements on Dogecoin. His acquisition of Twitter, his ambitious SpaceX ventures, and other activities significantly impact Tesla's stock price and indirectly affect Dogecoin. These actions create market uncertainty and influence investor confidence in both assets.

- The Twitter acquisition, for example, diverted significant resources and attention away from Tesla, impacting investor confidence.

- Negative press surrounding Musk's management style and public statements also influences investor sentiment towards both Tesla and, by association, Dogecoin.

- Keywords: Elon Musk controversies, Tesla stock performance, investor confidence, market uncertainty, risk assessment.

The Future of Tesla and Dogecoin's Intertwined Fate

Predicting Future Price Movements

Predicting future price movements for both Tesla stock and Dogecoin is inherently challenging. Numerous factors influence their values, including macroeconomic conditions, technological advancements, regulatory changes, and, most significantly, Elon Musk's actions.

- Expert opinions vary widely on the future trajectory of both assets. Some analysts predict continued growth, while others foresee further volatility or even decline.

- It's crucial to approach investment decisions with caution and avoid speculative trading based solely on short-term price fluctuations.

- Keywords: Dogecoin price prediction, Tesla stock prediction, market analysis, future outlook, cryptocurrency investment.

Diversification and Risk Management Strategies

Given the inherent volatility of both Tesla stock and Dogecoin, a diversified investment portfolio is essential. Over-reliance on either asset can lead to significant financial losses.

- Investors should carefully assess their risk tolerance before allocating funds to these volatile assets.

- Diversification across various asset classes, including stocks, bonds, and other cryptocurrencies, can significantly reduce overall portfolio risk.

- Seeking advice from a qualified financial advisor is recommended before making any investment decisions.

- Keywords: Investment strategy, risk management, portfolio diversification, responsible investing, financial advice.

Conclusion

Elon Musk's actions have undeniably had a profound impact on both Tesla's stock price and the value of Dogecoin. The strong correlation between these two assets highlights the risk associated with investing in assets heavily influenced by a single individual's unpredictable pronouncements. Understanding this complex relationship is crucial for investors navigating the turbulent waters of the cryptocurrency market and the stock market. While the future remains uncertain, careful consideration of risk and a diversified investment strategy are essential for mitigating potential losses when dealing with the volatility surrounding Tesla stock and Dogecoin. By staying informed about the ongoing developments and engaging in responsible investment practices, you can better manage your exposure to these volatile assets. Further research into the intricacies of Tesla stock and Dogecoin is highly recommended.

Featured Posts

-

Trump Administration Tariffs Result In 174 Billion Net Worth Decline For Top 10 Billionaires

May 09, 2025

Trump Administration Tariffs Result In 174 Billion Net Worth Decline For Top 10 Billionaires

May 09, 2025 -

Champions League Semi Final Draw Barcelona Inter Arsenal And Psg Match Dates

May 09, 2025

Champions League Semi Final Draw Barcelona Inter Arsenal And Psg Match Dates

May 09, 2025 -

Falling Iron Ore Prices Analyzing Chinas Steel Production Cuts

May 09, 2025

Falling Iron Ore Prices Analyzing Chinas Steel Production Cuts

May 09, 2025 -

Inter Milans Shock De Ligt Pursuit Loan Move With Option To Buy

May 09, 2025

Inter Milans Shock De Ligt Pursuit Loan Move With Option To Buy

May 09, 2025 -

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025

Dakota Dzhonson Proval Goda Po Versii Zolotoy Maliny

May 09, 2025

Latest Posts

-

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Applicants

May 09, 2025

Uk Visa Crackdown Increased Scrutiny For Nigerian And Other Applicants

May 09, 2025 -

Solve Nyt Strands Game 377 March 15 Hints And Answers

May 09, 2025

Solve Nyt Strands Game 377 March 15 Hints And Answers

May 09, 2025 -

March 15 Nyt Strands Game 377 Complete Solution Guide

May 09, 2025

March 15 Nyt Strands Game 377 Complete Solution Guide

May 09, 2025 -

Nyt Strands April 12 2024 Game 405 Hints And Answers

May 09, 2025

Nyt Strands April 12 2024 Game 405 Hints And Answers

May 09, 2025 -

Nyt Strands April 10th Game 403 Hints And Answers Guide

May 09, 2025

Nyt Strands April 10th Game 403 Hints And Answers Guide

May 09, 2025