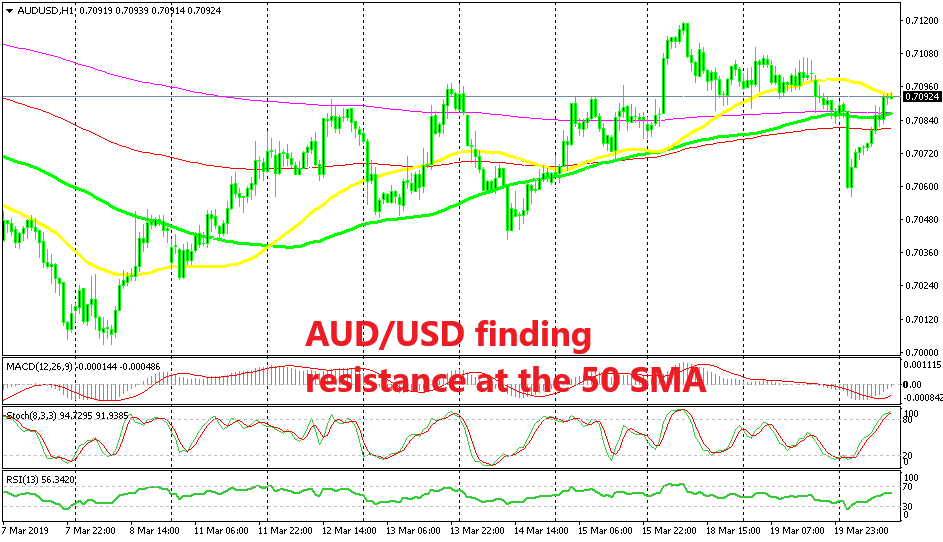

Falling Iron Ore Prices: Analyzing China's Steel Production Cuts

Table of Contents

China's Steel Production Slowdown: The Primary Driver

China's reduced steel output is the primary driver behind the falling iron ore prices. This slowdown is a result of a confluence of factors, primarily government regulations and weakening domestic demand.

Government Regulations and Environmental Concerns

The Chinese government has implemented increasingly stringent environmental regulations aimed at curbing carbon emissions and improving air quality. These policies directly impact steel mills, which are significant contributors to pollution. The resulting production cuts have significantly reduced demand for iron ore, a key ingredient in steelmaking.

- Increased scrutiny of steel mills' environmental compliance: Regular audits and stricter enforcement of environmental laws have forced many mills to curtail operations or invest heavily in cleaner technologies, impacting overall output.

- Stricter emission limits and penalties for violations: Heavier fines and potential shutdowns for non-compliance are deterrents to maintaining high production levels.

- Emphasis on sustainable steel production methods: The push towards greener steel production necessitates technological upgrades and operational changes that temporarily reduce output. This transition, while crucial for long-term sustainability, contributes to the current market slowdown.

Weakening Domestic Demand

Beyond government regulations, a slowdown in China's domestic steel demand further contributes to falling iron ore prices. This weakening is primarily driven by the cooling construction sector and reduced infrastructure spending.

- Decreased construction activity: A slowdown in real estate development and a shift away from large-scale infrastructure projects have reduced the demand for steel used in construction.

- Lower demand for steel in infrastructure projects: Government efforts to control debt and prioritize sustainable development have led to a decrease in large-scale infrastructure projects, impacting steel consumption.

- Impact of the property market crisis on steel consumption: The ongoing crisis in China's real estate sector has significantly reduced demand for steel, as construction projects are delayed or canceled.

Global Market Dynamics and Supply Chain Disruptions

While China's actions are central, global market dynamics and supply chain disruptions also play a role in the falling iron ore prices.

Increased Iron Ore Supply from Other Producers

Increased iron ore production from countries like Australia and Brazil has added to the global supply. This increased supply, coupled with reduced demand from China, has put downward pressure on prices.

- Australia's consistent iron ore exports: Australia remains a dominant player in the global iron ore market, maintaining consistent exports despite fluctuating demand.

- Brazil's recovering iron ore production: Brazil's iron ore production has been recovering, adding to the global supply.

- Impact of new mining projects on global supply: New mining projects coming online in various countries further contribute to the increased supply of iron ore.

Global Economic Slowdown and Reduced Steel Demand

The global economic slowdown is another factor contributing to falling iron ore prices. Reduced steel demand in various regions impacts global prices.

- Reduced steel demand in Europe and the US: Economic uncertainty and reduced industrial activity in developed economies have lowered steel demand.

- Impact of inflation and rising interest rates: High inflation and rising interest rates globally are impacting investment and consumer spending, thus reducing demand for steel.

- Geopolitical factors affecting global steel trade: Geopolitical instability and trade tensions can disrupt supply chains and further contribute to price volatility.

Impact of Falling Iron Ore Prices on the Market

The falling iron ore prices have significant implications for various stakeholders in the market.

Implications for Iron Ore Producers

The decline in prices directly impacts the profitability of major iron ore mining companies. Producers are likely to respond with production adjustments and cost-cutting measures.

- Reduced profitability for iron ore miners: Lower prices mean reduced revenues and potentially lower profit margins for mining companies.

- Potential for mergers and acquisitions: Facing reduced profitability, some companies may seek mergers or acquisitions to consolidate operations and reduce costs.

- Investment implications for the mining sector: The falling prices may lead to decreased investment in new mining projects or exploration activities.

Effects on Steel Producers and Consumers

Lower iron ore prices are a boon for steel producers, reducing their input costs. However, the overall impact on steel prices depends on various factors. Downstream industries using steel will see lower input costs.

- Lower input costs for steel production: Lower iron ore prices translate to lower production costs for steel mills, improving their profitability.

- Potential for increased steel production profitability: This could lead to increased steel production if demand picks up.

- Impact on manufacturing and construction costs: Lower steel prices could potentially reduce costs for manufacturing and construction projects.

Conclusion

The decline in iron ore prices is a complex issue driven by multiple interacting factors. China's reduced steel production, stemming from government regulations and weakening domestic demand, is a primary driver. Increased global supply and a global economic slowdown further contribute to the price fall. The impact is felt across the entire supply chain, from iron ore miners to steel producers and consumers. Stay informed about the fluctuating dynamics of falling iron ore prices and their implications for the global steel industry. Continue to monitor news and analysis to understand the future trajectory of this crucial commodity.

Featured Posts

-

Greenlands Closer Ties To Denmark Analyzing Trumps Impact

May 09, 2025

Greenlands Closer Ties To Denmark Analyzing Trumps Impact

May 09, 2025 -

A New Theory On Davids High Potential And Morgans Vulnerability

May 09, 2025

A New Theory On Davids High Potential And Morgans Vulnerability

May 09, 2025 -

Champions League Prediction Rio Ferdinands Choice Before Arsenal Vs Psg

May 09, 2025

Champions League Prediction Rio Ferdinands Choice Before Arsenal Vs Psg

May 09, 2025 -

Mujer Polaca Detenida En Reino Unido Sospechosa De Ser Madeleine Mc Cann

May 09, 2025

Mujer Polaca Detenida En Reino Unido Sospechosa De Ser Madeleine Mc Cann

May 09, 2025 -

Brekelmans India Strategie Maximalisatie Van Samenwerking

May 09, 2025

Brekelmans India Strategie Maximalisatie Van Samenwerking

May 09, 2025

Latest Posts

-

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025 -

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025 -

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025 -

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025

Europes Nuclear Shield A French Ministers Perspective

May 09, 2025 -

French Minister Champions Joint Nuclear Deterrence In Europe

May 09, 2025

French Minister Champions Joint Nuclear Deterrence In Europe

May 09, 2025