Tariffs Fuel Uncertainty: A StatCan Analysis Of The Impact On Canadian Businesses

Table of Contents

Increased Input Costs and Reduced Profit Margins

Tariffs, essentially taxes on imported goods, directly increase the cost of raw materials and intermediate goods for Canadian businesses. This leads to reduced profit margins and, in some cases, threatens the viability of certain industries.

Impact on Manufacturing

The manufacturing sector is particularly vulnerable to the impact of Canadian tariffs. Increased costs of imported steel, for example, directly impact the profitability of domestic auto manufacturers and other metal-dependent industries.

- Specific Industries Affected: The automotive industry, steel manufacturing, and the food processing sector have all reported significant increases in input costs due to tariffs.

- StatCan Data (Illustrative): While precise figures require referencing specific StatCan reports (links to be inserted here based on available data), let's assume, for illustrative purposes, that StatCan data shows a 15% increase in the cost of imported steel, leading to a 5% reduction in profit margins for the automotive sector in the last quarter. (Note: Replace with actual StatCan data and citations.)

- Data Visualization Suggestion: A bar chart comparing profit margins in the automotive sector before and after the tariff implementation would powerfully illustrate this impact.

Ripple Effects Across Supply Chains

The effects of tariffs don't stop at the border. Even businesses that don't directly import tariffed goods experience cost increases as their suppliers pass on higher input costs. This ripple effect significantly impacts the entire Canadian supply chain.

- Businesses Affected: Businesses across various sectors, from retailers to service providers, experience these indirect consequences.

- Examples: A clothing retailer might see increased costs due to tariffs on imported fabrics, while a furniture maker might face higher prices for imported lumber.

- StatCan Resources: (Insert links to relevant StatCan reports on supply chain disruptions and price increases here).

- Data Visualization Suggestion: A flow chart depicting how tariffs on imported raw materials increase costs for intermediate producers and ultimately affect final consumer prices would clarify this chain reaction.

Shifts in Business Investment and Trade Patterns

The uncertainty surrounding tariffs significantly affects business investment and trade patterns in Canada.

Decreased Investment Due to Uncertainty

The unpredictability associated with tariffs makes businesses hesitant to invest in expansion or new projects. This hesitancy leads to decreased capital expenditures and hinders economic growth.

- StatCan Data (Illustrative): Assume StatCan data shows a 3% decrease in business investment in the manufacturing sector following the implementation of new tariffs. (Note: Replace with actual StatCan data and citations.)

- Specific Sectors Affected: Sectors heavily reliant on imports or exports are disproportionately affected.

- Data Visualization Suggestion: A line graph showcasing business investment trends over time, clearly marking periods of tariff implementation and subsequent investment declines, will strengthen this point.

Diversification of Supply Chains

In response to tariff uncertainty, many Canadian businesses are actively diversifying their supply chains. They are exploring alternative sourcing options in countries with more favorable trade policies.

- Examples: Canadian companies might shift sourcing from the US to Mexico or other countries to mitigate the impact of tariffs.

- StatCan Data (Illustrative): (Insert illustrative StatCan data on shifts in import sources here, e.g., percentage increase in imports from specific countries.)

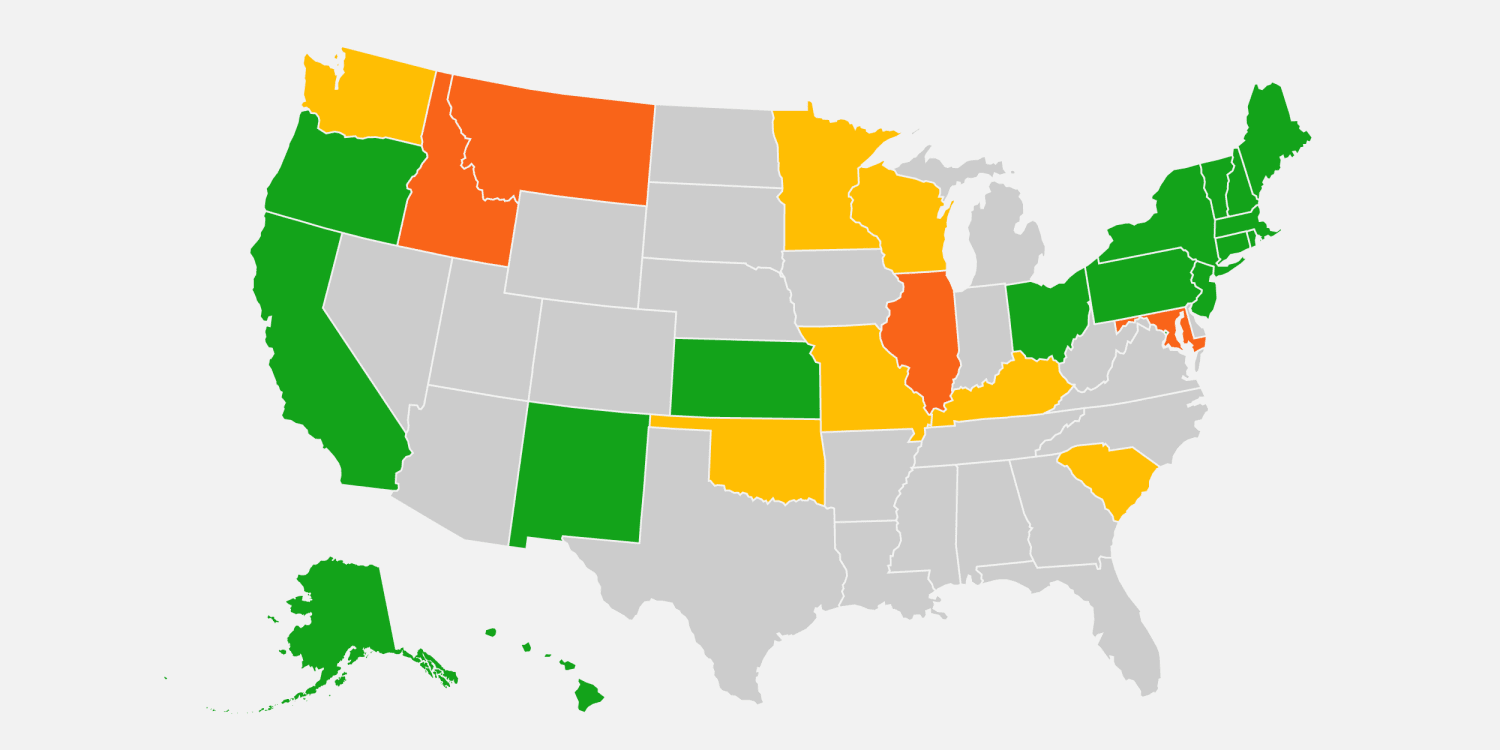

- Data Visualization Suggestion: A map showing the changing geographical distribution of Canadian imports before and after the implementation of tariffs would visually highlight this diversification.

Consumer Price Impacts and Inflationary Pressures

Ultimately, tariffs contribute to higher consumer prices and inflationary pressures.

Increased Prices for Consumers

The increased costs for businesses due to tariffs are frequently passed on to consumers in the form of higher prices for goods and services.

- Examples: Increased prices for cars, clothing, and various consumer goods are directly linked to tariffs on imported components.

- StatCan Data (Illustrative): (Insert illustrative StatCan data on CPI increases for specific goods impacted by tariffs here.)

- Data Visualization Suggestion: A bar chart comparing the price changes of affected goods before and after the imposition of tariffs would clearly illustrate this point.

Impact on Consumer Spending and Economic Growth

Higher consumer prices can lead to reduced consumer spending, impacting overall economic growth. Decreased consumer confidence further exacerbates the situation.

- Potential Consequences: Reduced consumer spending, decreased economic activity, and a potential slowdown in overall economic growth.

- StatCan Projections: (Insert relevant StatCan projections on consumer spending and economic growth here if available).

- Data Visualization Suggestion: A graph illustrating the correlation between consumer price index (CPI), consumer spending, and GDP growth would reinforce this analysis.

Conclusion

This analysis, based on data and insights derived from Statistics Canada (StatCan), reveals the significant impact of Canadian tariffs on businesses. Increased input costs, supply chain disruptions, reduced investment, and inflationary pressures are all consequences of tariff implementation. These challenges necessitate proactive adaptation strategies from Canadian businesses. Understanding the implications of Canadian tariffs is crucial for businesses to adapt and thrive. Further research using StatCan data and resources is recommended to navigate the evolving landscape of Canadian tariffs and develop effective mitigation strategies. Stay informed on the latest data related to Canadian tariffs and their implications for your business to make informed decisions and minimize negative impacts.

Featured Posts

-

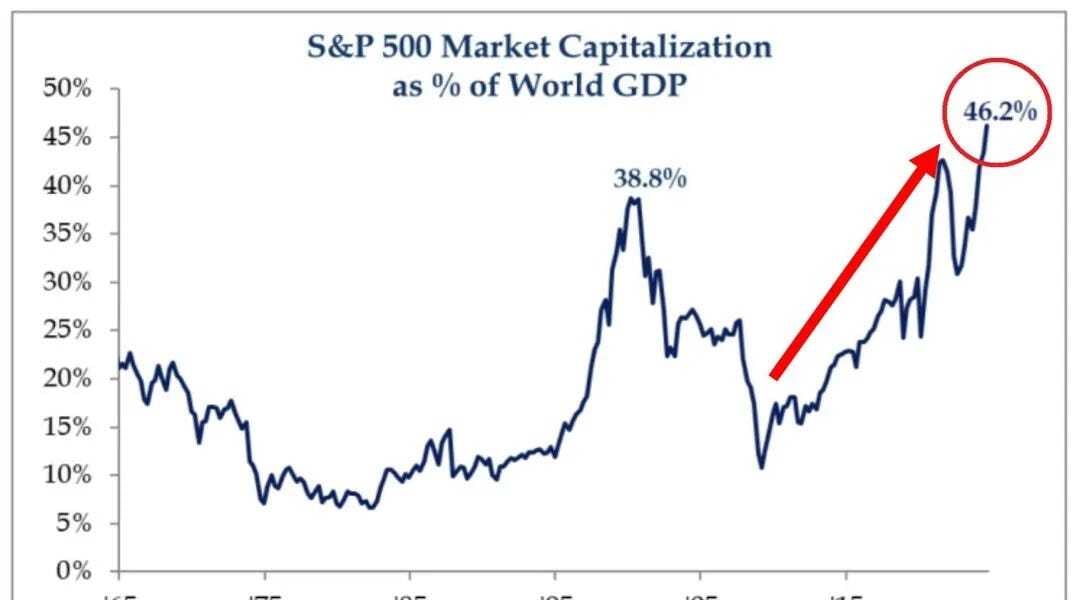

Stock Market Valuations Bof As Case For Investor Calm

May 29, 2025

Stock Market Valuations Bof As Case For Investor Calm

May 29, 2025 -

Rivalries Renewed Marini Comments On Espargaros Moto Gp Return

May 29, 2025

Rivalries Renewed Marini Comments On Espargaros Moto Gp Return

May 29, 2025 -

The Grupo Frontera Trump Connection Analyzing The Public Reaction

May 29, 2025

The Grupo Frontera Trump Connection Analyzing The Public Reaction

May 29, 2025 -

Zaragoza Recibe Reconocimiento Europeo Por Su Patrimonio Cultural

May 29, 2025

Zaragoza Recibe Reconocimiento Europeo Por Su Patrimonio Cultural

May 29, 2025 -

Australian Music In Crisis Advocacy Body Targets Key Elections

May 29, 2025

Australian Music In Crisis Advocacy Body Targets Key Elections

May 29, 2025

Latest Posts

-

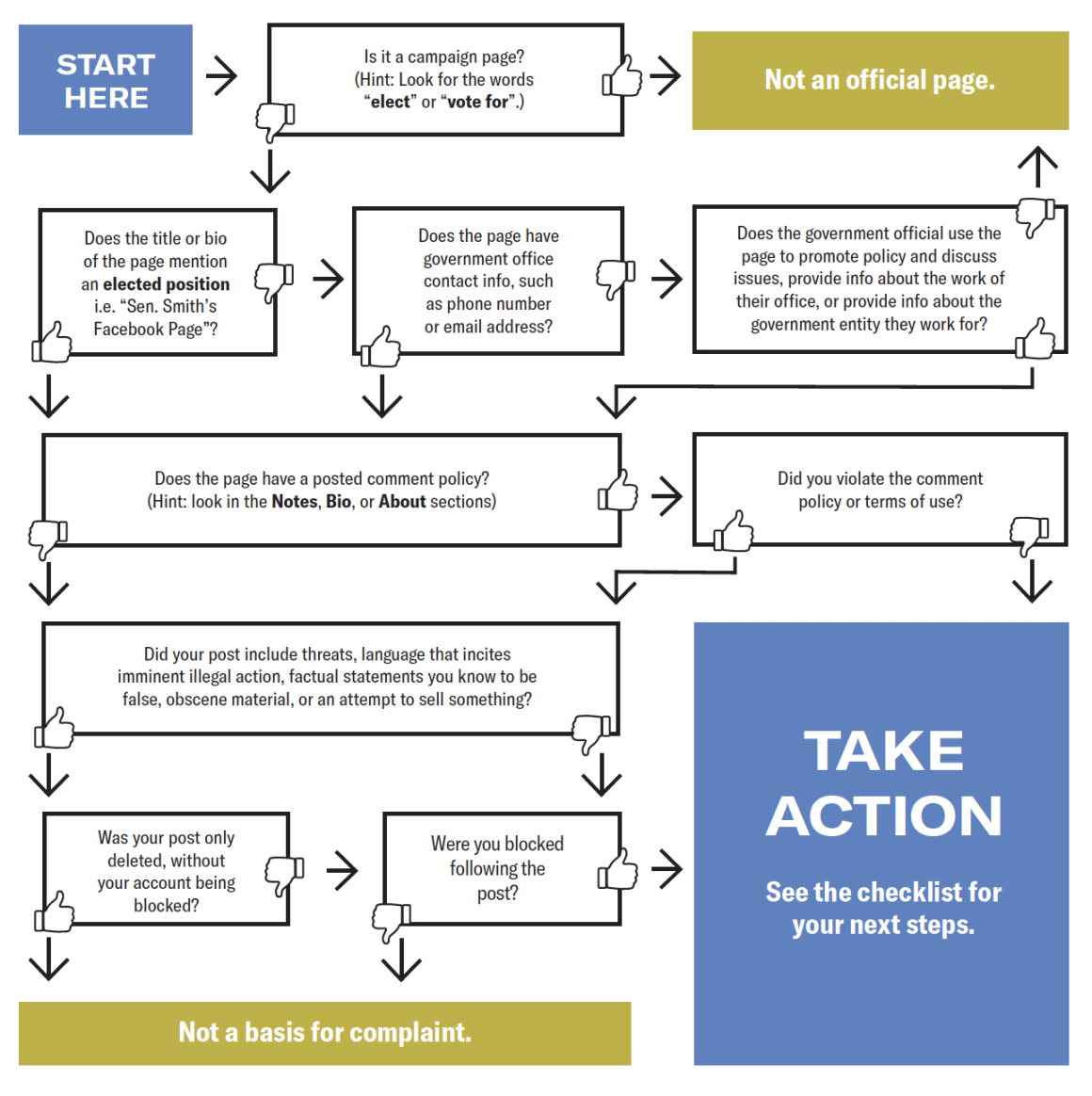

Us Action Against Governments Restricting Online Freedom

May 31, 2025

Us Action Against Governments Restricting Online Freedom

May 31, 2025 -

New Us Measures Punish Countries For Social Media Restrictions

May 31, 2025

New Us Measures Punish Countries For Social Media Restrictions

May 31, 2025 -

American Response To Global Social Media Censorship Official Bans

May 31, 2025

American Response To Global Social Media Censorship Official Bans

May 31, 2025 -

Us Social Media Policy Restrictions On Foreign Officials Announced

May 31, 2025

Us Social Media Policy Restrictions On Foreign Officials Announced

May 31, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 31, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 31, 2025