Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Key Arguments for a Less-Bearish Outlook

BofA's recent research presents a compelling case for a more optimistic outlook on current stock market valuations. They base their analysis on several key factors, suggesting that while risks exist, the market isn't necessarily poised for a dramatic downturn.

Moderate Valuation Metrics

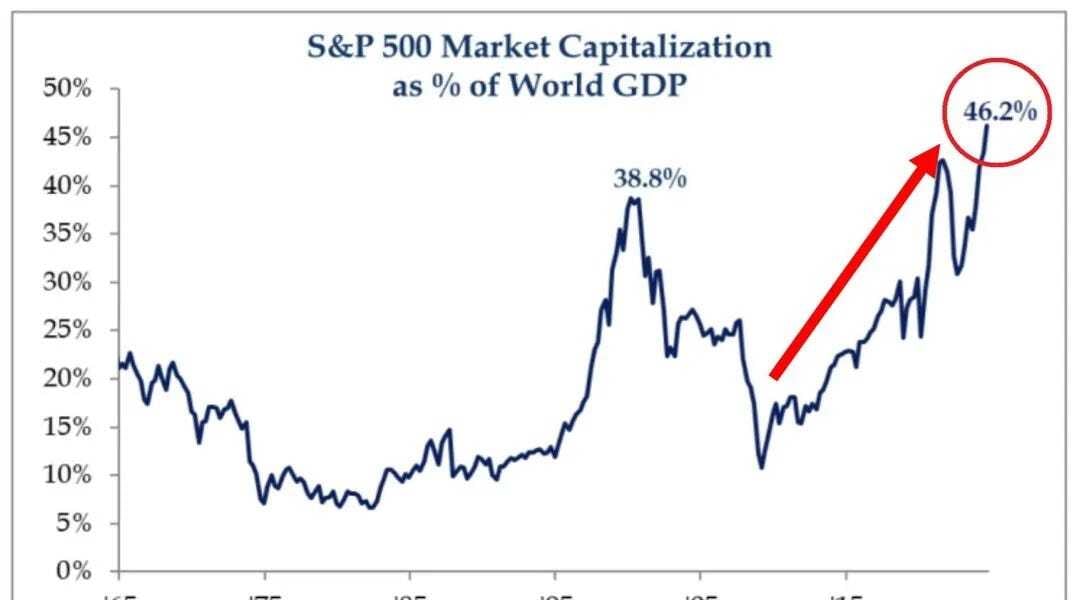

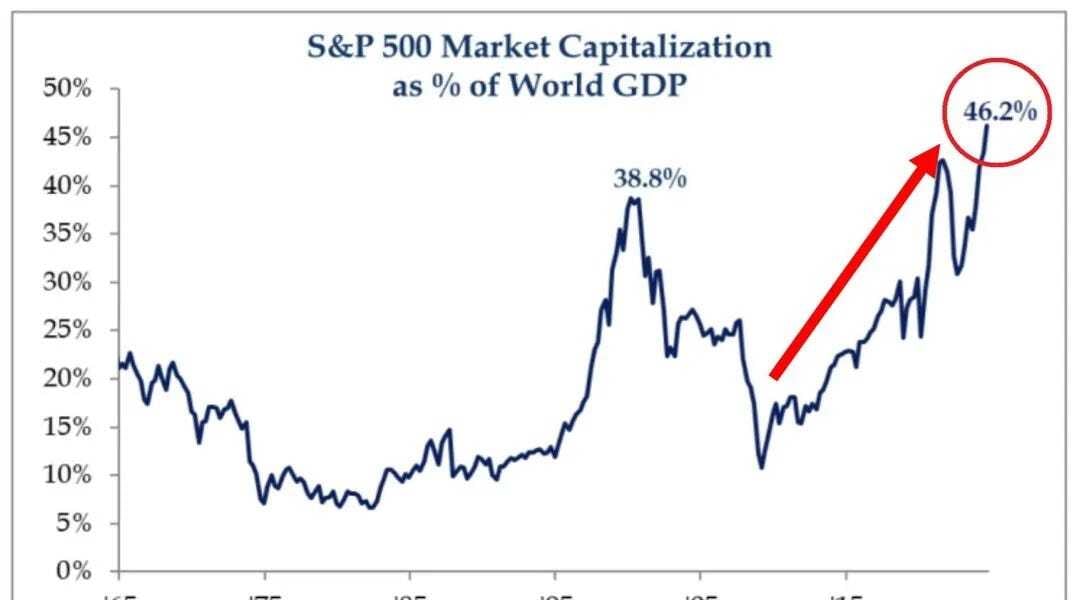

BofA's assessment focuses on key valuation metrics, particularly the Price-to-Earnings (P/E) ratio. While P/E ratios are currently above their historical averages, BofA argues that the increase is not excessively high compared to previous market cycles, especially considering the current inflationary environment. This suggests that the market isn't drastically overvalued. Their analysis also incorporates other market multiples, providing a more comprehensive picture of valuation levels.

- BofA's specific P/E ratio findings: BofA's research may highlight, for example, a current average P/E ratio of 20, compared to a historical average of 16, with a caveat that specific sectors show lower multiples. (Note: Replace with actual data if available.)

- Comparison to previous market cycles: The analysis may show that current P/E ratios are comparable to those seen during similar periods of economic uncertainty in the past, suggesting a less extreme valuation than some fear.

- Mention of specific sectors with attractive valuations: BofA may identify sectors like energy or technology sub-sectors that show relatively lower P/E ratios and possess significant growth potential, providing a more nuanced view of the overall market. [Insert chart or graph illustrating P/E ratio comparisons here, if available].

The Impact of Interest Rate Hikes

The Federal Reserve's interest rate hikes are a major concern for investors. BofA acknowledges the negative impact higher rates can have on stock valuations by increasing borrowing costs for companies and potentially dampening economic growth. However, BofA counters the purely negative narrative by highlighting the positive side of this policy: Rate hikes are aimed at curbing inflation, which ultimately benefits the economy in the long run.

- BofA's forecast for future interest rate movements: BofA's economists might predict a slower pace of rate hikes in the future, suggesting that the most aggressive tightening phase may be nearing its end.

- Impact on corporate profitability: While some companies will experience reduced profitability due to higher borrowing costs, BofA likely argues that many will adapt and remain profitable. This might particularly apply to companies with strong balance sheets and pricing power.

- Potential positive effects on certain sectors: Sectors like financials, which benefit from rising interest rates, might actually experience increased earnings.

Long-Term Growth Potential Remains Strong

Despite near-term challenges, BofA maintains a positive long-term outlook for the stock market. Technological advancements, demographic shifts, and ongoing innovation across various sectors contribute to their optimism. They emphasize that focusing solely on short-term market fluctuations can be detrimental to achieving long-term investment goals.

- Key economic drivers supporting long-term growth: BofA may point to factors like increasing global demand, technological innovation (AI, renewable energy), and ongoing investments in infrastructure.

- Technological innovations and their impact: The analysis may include discussion on the transformative potential of AI, automation, and other emerging technologies on driving future economic growth.

- BofA's long-term market projections: BofA's research likely includes projections indicating continued, albeit potentially slower, market growth over the next several years.

Conclusion: Navigating Stock Market Valuations with Confidence

BofA's analysis offers a measured perspective on current stock market valuations. By highlighting moderate valuation metrics, addressing the impacts of interest rate hikes, and emphasizing the enduring strength of long-term growth potential, they provide a counterpoint to excessive bearish sentiment. Investors should remember that market volatility is normal, and a long-term investment strategy, informed by thorough research, is crucial for achieving financial goals. BofA's research provides a valuable tool for navigating this period of uncertainty. To learn more about BofA's comprehensive analysis and gain a more informed perspective on stock market valuations, visit [insert link to relevant BofA resources here].

Featured Posts

-

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025 -

Bryan Cranston Predicted Pete Roses Scandal A How I Met Your Mother Story

May 29, 2025

Bryan Cranston Predicted Pete Roses Scandal A How I Met Your Mother Story

May 29, 2025 -

Real Madrid Golazo Reaccion Inmediata A La Victoria 2 0 Sobre Sevilla

May 29, 2025

Real Madrid Golazo Reaccion Inmediata A La Victoria 2 0 Sobre Sevilla

May 29, 2025 -

June 2025 Air Jordan Releases Must Know Details For Sneaker Collectors

May 29, 2025

June 2025 Air Jordan Releases Must Know Details For Sneaker Collectors

May 29, 2025 -

Pokemon Tcg Pocket New Crown Zenith What Cards Surprised Fans

May 29, 2025

Pokemon Tcg Pocket New Crown Zenith What Cards Surprised Fans

May 29, 2025

Latest Posts

-

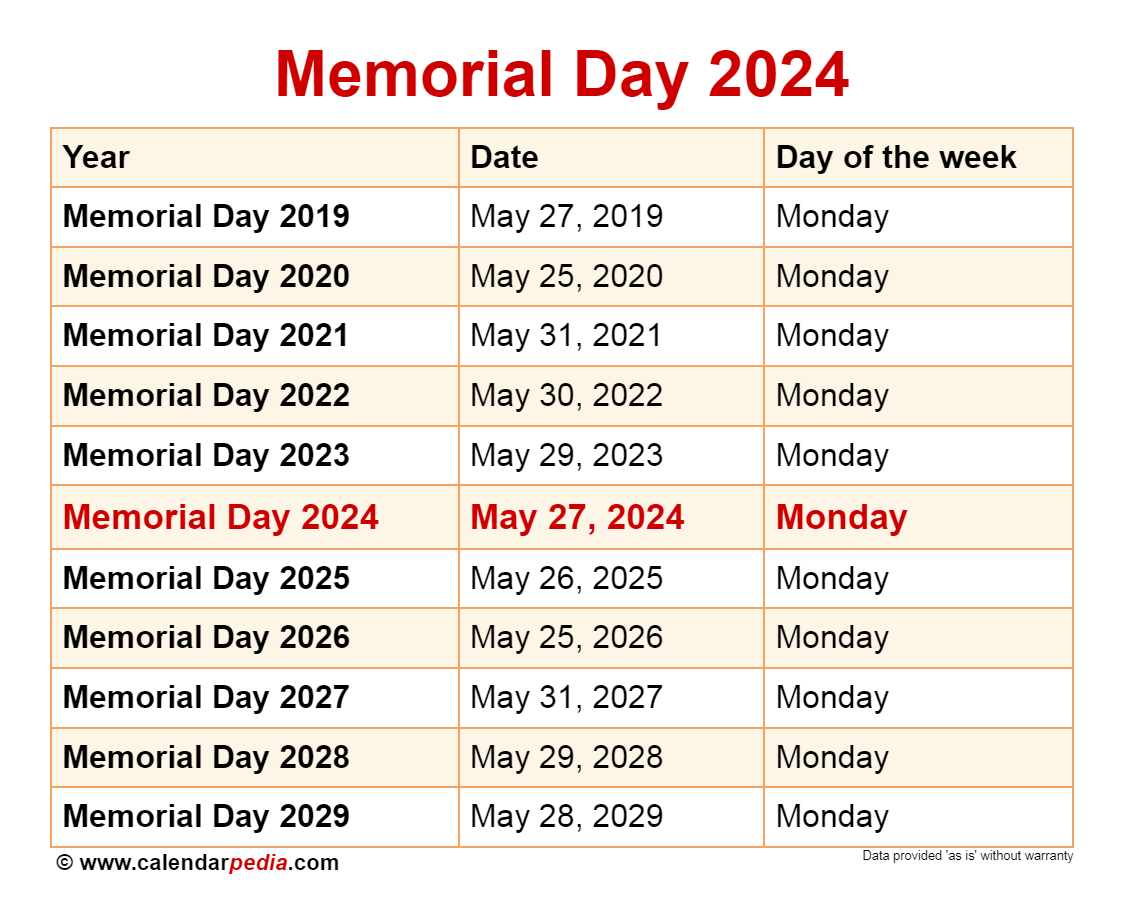

Detroits Memorial Day Weekend A 150 000 Visitor Forecast

May 31, 2025

Detroits Memorial Day Weekend A 150 000 Visitor Forecast

May 31, 2025 -

150 000 Expected In Detroit For Crowded Memorial Day Weekend

May 31, 2025

150 000 Expected In Detroit For Crowded Memorial Day Weekend

May 31, 2025 -

Detroit Expects 150 000 Visitors For Busy Memorial Day Weekend

May 31, 2025

Detroit Expects 150 000 Visitors For Busy Memorial Day Weekend

May 31, 2025 -

Updated Schedule Tigers To Play Doubleheader After Friday Game Delay

May 31, 2025

Updated Schedule Tigers To Play Doubleheader After Friday Game Delay

May 31, 2025 -

White Stripes Jack White Discusses Baseball And The Hall Of Fame On Tigers Broadcast

May 31, 2025

White Stripes Jack White Discusses Baseball And The Hall Of Fame On Tigers Broadcast

May 31, 2025