Tariff Shock: How Bond Markets Are Responding

Table of Contents

Rising Yields and Inflationary Pressures

Tariffs increase the cost of imported goods, leading to inflation. This inflationary pressure puts upward pressure on bond yields. Investors demand higher returns to compensate for the erosion of their purchasing power caused by rising inflation. This fundamental economic principle is at the heart of the bond market's response to a tariff shock.

- Increased production costs passed on to consumers: Businesses facing higher import costs often pass these increased expenses onto consumers through higher prices.

- Reduced consumer spending due to higher prices: Higher prices lead to reduced consumer spending, potentially slowing economic growth.

- Central bank responses to inflation (potential interest rate hikes): To combat inflation, central banks may raise interest rates, further impacting bond yields. Higher interest rates make newly issued bonds more attractive, potentially reducing the value of existing bonds.

- Impact on inflation-protected securities (TIPS): Inflation-protected securities (TIPS), designed to protect investors from inflation, may see increased demand during periods of high inflation, but their yields can also be impacted by overall market conditions.

Flight to Safety and Increased Volatility

Uncertainty surrounding the economic impact of tariffs can trigger a "flight to safety," driving investors towards traditionally safer government bonds like US Treasuries. This increased demand for perceived safety can push down yields on these bonds. However, this increased demand can also lead to greater volatility in bond markets as investors react to changing economic data and policy announcements.

- Increased demand for government bonds (e.g., US Treasuries): Investors seek the perceived safety of government bonds, driving up their prices and pushing down yields.

- Reduced demand for corporate bonds and emerging market debt: Riskier assets, such as corporate bonds and emerging market debt, often see reduced demand during periods of uncertainty, leading to wider yield spreads.

- Impact on bond market indices (e.g., Barclays Aggregate Bond Index): Major bond market indices reflect the overall performance of the bond market and will show the effects of a tariff shock, reflecting changes in yields and volatility.

- Increased spread between government and corporate bond yields: The yield spread – the difference between yields on government bonds and corporate bonds – widens as investors demand a higher risk premium for holding corporate bonds during uncertain times.

Sector-Specific Impacts

The impact of tariffs isn't uniform across all sectors. Certain industries heavily reliant on imported goods or those facing retaliatory tariffs will experience greater financial stress, significantly impacting their bonds' performance. This sector-specific impact requires a nuanced approach to bond investment.

- Analysis of specific sectors affected (e.g., manufacturing, agriculture): Sectors heavily reliant on imports or facing retaliatory tariffs are disproportionately affected.

- Impact on corporate bond credit ratings: Companies in heavily impacted sectors may see their credit ratings downgraded, increasing the risk associated with their bonds.

- Potential for defaults and distressed debt situations: Companies facing severe financial distress may default on their debt obligations, creating opportunities (and risks) in the distressed debt market.

- Opportunities for selective bond investing: Careful analysis can identify sectors and companies that may benefit from tariff changes, offering potential investment opportunities.

Currency Fluctuations and International Bond Markets

Trade wars often lead to currency fluctuations, affecting the value of international bonds held by investors. This adds another layer of complexity to the impact of tariff shocks on bond markets. Investors with international bond holdings need to carefully consider the currency risk.

- Impact on foreign exchange rates: Tariff disputes can significantly impact exchange rates, affecting the value of investments denominated in foreign currencies.

- Effect on the value of international bond holdings: Fluctuations in exchange rates can either increase or decrease the value of international bond holdings for investors.

- Hedging strategies for international bond investors: Investors can use hedging strategies to mitigate the risk of currency fluctuations.

- Opportunities and risks in international bond markets: Currency volatility can create both opportunities and risks for investors in international bond markets.

Conclusion

The "Tariff Shock" presents a multifaceted challenge to bond markets, influencing yields, volatility, and investment strategies. Understanding the inflationary pressures, flight-to-safety dynamics, sector-specific impacts, and currency fluctuations is crucial for navigating this complex environment. Investors need to carefully monitor economic indicators, policy changes, and market sentiment to effectively manage their bond portfolios amidst the ongoing tariff uncertainty. Stay informed about the evolving situation to make sound investment decisions concerning your bond holdings and learn more about mitigating the risks associated with Tariff Shock and its effect on the bond market.

Featured Posts

-

Selena Gomezs Private Life With Benny Blanco An Unintended Reveal

May 12, 2025

Selena Gomezs Private Life With Benny Blanco An Unintended Reveal

May 12, 2025 -

Car Crash Involving Virginia Giuffre Prince Andrew Accusers Life Threat Claim

May 12, 2025

Car Crash Involving Virginia Giuffre Prince Andrew Accusers Life Threat Claim

May 12, 2025 -

Crazy Rich Asians Tv Series Release Date Cast And Plot Details

May 12, 2025

Crazy Rich Asians Tv Series Release Date Cast And Plot Details

May 12, 2025 -

Marvels Nova Could Henry Cavill Be The Star Rumor Analysis

May 12, 2025

Marvels Nova Could Henry Cavill Be The Star Rumor Analysis

May 12, 2025 -

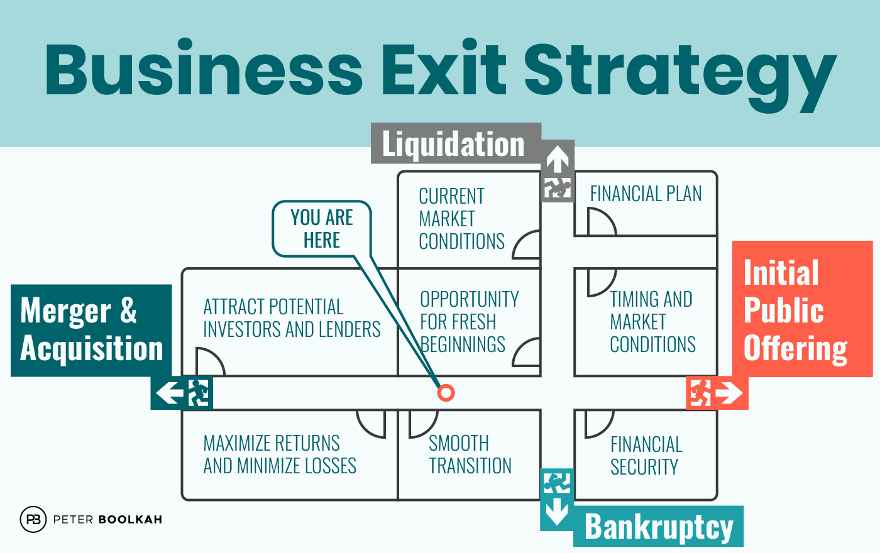

Onexs West Jet Investment A Successful Exit Strategy With 25 Stake Sale To International Carriers

May 12, 2025

Onexs West Jet Investment A Successful Exit Strategy With 25 Stake Sale To International Carriers

May 12, 2025

Latest Posts

-

Herthas Struggles A Head To Head With Boateng And Kruse

May 13, 2025

Herthas Struggles A Head To Head With Boateng And Kruse

May 13, 2025 -

Razreshenie Na Religioznuyu Deyatelnost Rpts V Myanme

May 13, 2025

Razreshenie Na Religioznuyu Deyatelnost Rpts V Myanme

May 13, 2025 -

The Boateng Kruse Debate Unpacking Herthas Challenges

May 13, 2025

The Boateng Kruse Debate Unpacking Herthas Challenges

May 13, 2025 -

Boateng And Kruse Weigh In On Herthas Recent Poor Form

May 13, 2025

Boateng And Kruse Weigh In On Herthas Recent Poor Form

May 13, 2025 -

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025