Onex's WestJet Investment: A Successful Exit Strategy With 25% Stake Sale To International Carriers

Table of Contents

Onex's Initial WestJet Investment and its Objectives

Onex's acquisition of WestJet represented a significant investment in the Canadian airline industry. Their stated goals for the investment encompassed several key areas, including driving revenue growth, expanding WestJet's market share, both domestically and internationally, and enhancing operational efficiency. Onex aimed to leverage its expertise in private equity and operational improvements to transform WestJet into a more competitive player in the global aviation market.

- Investment Timeline and Initial Investment Amount: Onex's acquisition of WestJet occurred in [Insert Year], with an initial investment of [Insert Amount]. This marked a significant transaction in the Canadian business landscape.

- Onex's Strategic Vision for WestJet's Development: Onex envisioned WestJet's expansion into new markets, the development of new routes, and the enhancement of its customer service offerings. Fleet modernization and operational streamlining were also key components of their strategy.

- Key Performance Indicators (KPIs) Targeted by Onex: Onex likely focused on KPIs such as revenue growth, passenger numbers, load factors, on-time performance, and return on investment (ROI). Meeting these KPIs would be crucial for a successful investment.

- Initial Challenges and Opportunities Faced by Onex in Managing WestJet: Onex likely faced challenges related to integrating its management style, navigating regulatory hurdles, adapting to the competitive airline landscape, and managing economic fluctuations impacting the travel industry. Opportunities included expanding into underserved markets and capitalizing on WestJet's strong brand reputation in Canada.

The Sale of a 25% Stake to International Carriers: Details and Implications

The sale of a 25% stake in WestJet to a consortium of international carriers represents a significant development. [Insert Names of Acquiring Carriers] acquired the stake for [Insert Sale Price]. This strategic move by Onex reflects their ability to successfully cultivate value within their investment, achieving a strong return and securing a strategic partnership for WestJet.

- Names and Backgrounds of the Acquiring International Carriers: [Provide details on each acquiring carrier – their size, market position, and strategic goals in acquiring a stake in WestJet]. This partnership provides WestJet with access to invaluable resources and market expertise.

- The Total Value of the 25% Stake Sale: [Insert Total Value]. This signifies a significant return on investment for Onex and validates their investment strategy.

- Onex's Remaining Stake in WestJet: Onex retains a [Insert Percentage]% stake in WestJet, demonstrating continued confidence in the airline's long-term prospects.

- Potential Benefits for WestJet from this Partnership: This partnership opens doors to new international routes, code-sharing agreements, access to superior technology, and potentially improved operational efficiencies. The combined expertise could lead to enhanced service offerings and a broader global reach.

- Impact on WestJet’s Stock Price Following the Announcement: The announcement of the stake sale likely resulted in [Describe the impact – positive increase, negative decrease, or neutral effect] on WestJet’s stock price.

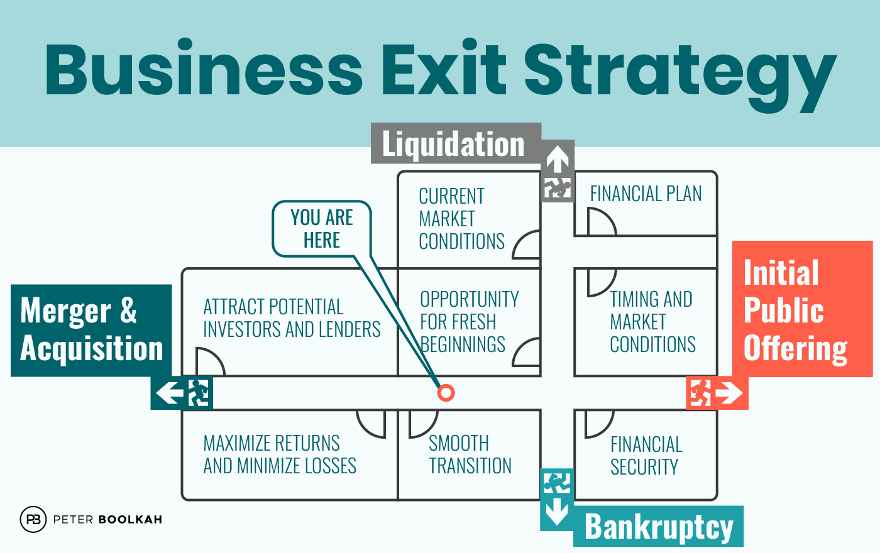

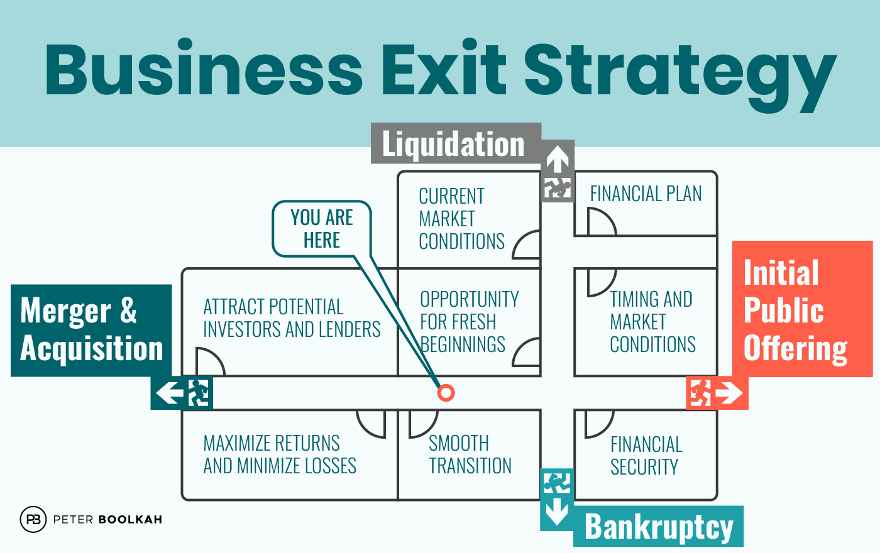

Analyzing Onex's Exit Strategy and its Success

Onex's exit strategy regarding its WestJet investment appears highly successful. By strategically selling a portion of its stake while retaining a significant ownership interest, Onex has secured a substantial return on its initial investment and established a valuable strategic partnership for WestJet.

- Comparison of the Sale Price with the Initial Investment, Highlighting ROI: [Provide a comparative analysis to calculate and highlight the ROI achieved by Onex]. This demonstrates the effectiveness of Onex’s investment and management strategies.

- Assessment of Onex’s Strategic Decision-Making Process: Onex's decision to partially divest while retaining a stake suggests a calculated approach prioritizing both capital gains and long-term strategic partnerships for WestJet.

- Long-Term Implications for Onex's Investment Portfolio: This successful exit strategy enhances Onex's reputation as a savvy investor in the aviation industry, potentially attracting future investment opportunities in similar sectors.

- Potential Future Investment Strategies in the Aviation Sector for Onex: This successful venture will likely encourage Onex to explore further investment opportunities within the aviation sector, seeking similar growth potential.

- Lessons Learned from This Investment That Other Private Equity Firms Can Apply: This case study provides valuable insights into successful strategies for managing and exiting airline investments, including choosing strategic partners and fostering long-term value creation.

The Future of WestJet under Partial International Ownership

The new ownership structure is anticipated to bring significant changes to WestJet's operations and growth trajectory.

- Predicted Changes in WestJet’s Management and Corporate Strategy: The partnership could lead to changes in WestJet's management team and the adoption of more internationalized business practices.

- Potential Expansion into New International Routes: Access to the new partner's network and resources should facilitate WestJet's expansion into lucrative international markets previously inaccessible.

- Expected Impact on Competition within the Canadian and International Airline Markets: The enhanced capabilities of WestJet will intensify competition within the Canadian and international airline markets.

- The Outlook for WestJet's Profitability and Sustainability under the New Ownership Structure: The new structure positions WestJet for enhanced profitability and long-term sustainability through increased market share, access to capital, and improved operational efficiency.

Conclusion

Onex's WestJet investment showcases a successful private equity exit strategy. The partial sale of the stake to international carriers generated significant returns while ensuring WestJet's continued growth and development under a strategic partnership. This transaction highlights Onex’s expertise in identifying and cultivating value within the aviation sector. The strategic decision-making process, coupled with the resulting financial success, sets a precedent for future investments and illustrates the potential of strategic partnerships within the airline industry.

Call to Action: Learn more about successful private equity investment strategies in the aviation industry and stay updated on the latest developments in Onex’s investment portfolio. Follow our blog for further analysis of Onex’s WestJet investment and similar case studies.

Featured Posts

-

Complete Ufc 315 Main Event And Fight Card Breakdown

May 12, 2025

Complete Ufc 315 Main Event And Fight Card Breakdown

May 12, 2025 -

Shevchenkos Retirement Fight Fiorots Tough Test At Ufc 315

May 12, 2025

Shevchenkos Retirement Fight Fiorots Tough Test At Ufc 315

May 12, 2025 -

Mask Singer 2025 L Autruche Une Identite Revelee Chantal Ladesou Et Laurent Ruquier Surpris

May 12, 2025

Mask Singer 2025 L Autruche Une Identite Revelee Chantal Ladesou Et Laurent Ruquier Surpris

May 12, 2025 -

Rahal Announces Plans For Youth Driver Development Program

May 12, 2025

Rahal Announces Plans For Youth Driver Development Program

May 12, 2025 -

John Wick 5 Analyzing Keanu Reeves Statements And Future Possibilities

May 12, 2025

John Wick 5 Analyzing Keanu Reeves Statements And Future Possibilities

May 12, 2025

Latest Posts

-

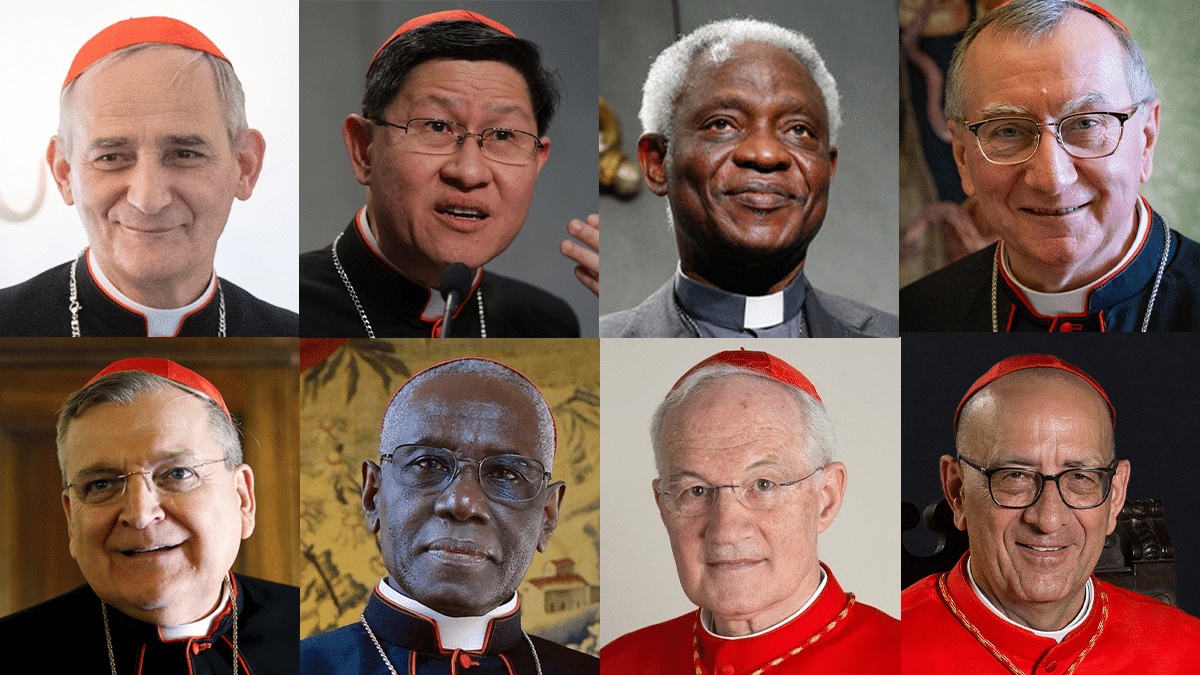

Who Will Be The Next Pope Analyzing The Top 9 Contenders

May 12, 2025

Who Will Be The Next Pope Analyzing The Top 9 Contenders

May 12, 2025 -

Conociendo A Los Posibles Sucesores Del Papa Francisco

May 12, 2025

Conociendo A Los Posibles Sucesores Del Papa Francisco

May 12, 2025 -

Vatican Conclave Weighing The Future With Nine Potential Popes

May 12, 2025

Vatican Conclave Weighing The Future With Nine Potential Popes

May 12, 2025 -

Nine Cardinals Could Be The Next Pope Examining Their Strengths And Challenges

May 12, 2025

Nine Cardinals Could Be The Next Pope Examining Their Strengths And Challenges

May 12, 2025 -

9 Potential Popes Examining The Leading Candidates For The Papacy

May 12, 2025

9 Potential Popes Examining The Leading Candidates For The Papacy

May 12, 2025