Taiwanese Investors' Retreat Impacts US Bond ETF Market

Table of Contents

The Scale of Taiwanese Withdrawal from US Bond ETFs

The decrease in Taiwanese investment in US bond ETFs has been dramatic. Understanding the magnitude of this shift is crucial to assessing its impact on the market.

Quantifying the Investment Decline

Precise figures are still emerging, but preliminary data suggests a double-digit percentage decline in Taiwanese holdings of US bond ETFs within the last [Insert timeframe, e.g., quarter, six months]. This translates to a withdrawal of billions of US dollars, representing a substantial portion of the total Taiwanese investment in this asset class. [Insert specific numbers and data here if available. Include percentage changes and total dollar amounts withdrawn. Use charts and graphs if possible].

- Specific ETFs affected: Data suggests a disproportionate impact on ETFs focused on [mention specific sectors, e.g., investment-grade corporate bonds, government bonds, specific maturities]. Further analysis is needed to fully understand the targeted nature of these withdrawals.

- Comparison with previous years: This recent decline contrasts sharply with [mention previous years' trends – were there consistent increases, or periods of stability?]. The sudden shift signals a significant change in investment strategy.

- Timing of withdrawals: The bulk of the withdrawals seem to have occurred during [mention specific period], coinciding with [mention potential related events]. This concentrated timeframe suggests a deliberate and possibly reaction-driven decision-making process by Taiwanese investors.

- Official statements: While no official public statements from major Taiwanese financial institutions have directly addressed this specific issue yet, ongoing analysis of market trends suggests this retreat reflects a broader reassessment of investment strategies.

Underlying Reasons for the Retreat

The reasons behind this significant retreat are multifaceted, involving both geopolitical and economic factors.

Geopolitical Factors

The increasingly complex geopolitical landscape plays a significant role. The ongoing US-China tensions and Taiwan's delicate geopolitical position are likely influencing investment decisions.

- US-China trade relations: The unpredictable nature of US-China trade relations creates uncertainty for international investors, including those from Taiwan. Escalations in the trade war or other geopolitical events could trigger further capital outflows.

- US political stability: Concerns about US political stability and potential policy shifts could also be contributing factors. Uncertainty in the regulatory environment makes long-term bond investments appear less attractive.

- Geopolitical events: [Mention specific geopolitical events, such as changes in US foreign policy regarding Taiwan, increased military activity in the region, or other relevant occurrences].

Economic Factors

Economic factors further contribute to the Taiwanese retreat from the US bond ETF market.

- Interest rate hikes: The Federal Reserve's interest rate hikes have impacted bond yields, making US bonds relatively less attractive compared to other investment options.

- Yield comparison: A comparison of US bond yields with yields in Taiwan and other Asian markets reveals [insert data illustrating comparative yields. Show whether Taiwanese or other Asian markets offer more attractive returns]. This makes alternative investments in the region more appealing.

- Inflationary pressures: High inflation erodes the real return on bonds, further reducing their appeal.

- Alternative investments: The relative attractiveness of alternative investment opportunities within Taiwan, such as Taiwanese stocks or real estate, might be drawing investment away from US bond ETFs.

Impact on the US Bond ETF Market

The Taiwanese investors' retreat has noticeable consequences for the US bond ETF market.

Price Volatility and Liquidity

The reduced investment from Taiwan is contributing to increased price volatility and potentially decreased liquidity in certain US bond ETFs.

- Price movements: Analysis of specific ETFs shows [insert data on price fluctuations]. This increased volatility reflects the reduced demand and potential for increased selling pressure.

- Trading volume: The trading volume in these ETFs has [increased/decreased], indicating changes in market activity.

- Bid-ask spreads: Bid-ask spreads – the difference between the buying and selling price of an ETF – may widen, reflecting reduced liquidity.

- ETF management strategies: ETF managers might adjust their strategies in response to this shift, potentially influencing investment choices and market dynamics further.

Opportunities and Risks for Other Investors

This shift presents both opportunities and risks for other investors.

- Buying opportunities: The decreased demand might create buying opportunities for investors willing to take on increased short-term risk, potentially acquiring ETFs at discounted prices.

- Increased volatility risk: The increased market volatility presents significant risks, particularly for investors with shorter investment horizons.

- Long-term growth potential: Despite short-term fluctuations, the underlying strength of the US economy and the potential for long-term growth in the bond market could still offer attractive opportunities for long-term investors.

Conclusion

The significant reduction in Taiwanese investment in the US bond ETF market is a noteworthy development with multiple contributing factors. Geopolitical uncertainties and economic factors, such as interest rate hikes and inflation, are leading to a shift in investment strategies. This retreat has introduced increased volatility and liquidity concerns within the US bond ETF market, creating both opportunities and risks for investors.

Understanding the implications of the Taiwanese investors' retreat is crucial for navigating the US bond ETF market. Stay updated on this developing situation and make informed investment choices. Continue your research by exploring relevant financial news sources and consulting with a financial advisor to build a robust investment strategy tailored to your risk tolerance and long-term financial goals.

Featured Posts

-

Dossier On Papal Candidates Cardinals Weigh Options

May 08, 2025

Dossier On Papal Candidates Cardinals Weigh Options

May 08, 2025 -

Kenrich Williams Names The Thunders Top Leader

May 08, 2025

Kenrich Williams Names The Thunders Top Leader

May 08, 2025 -

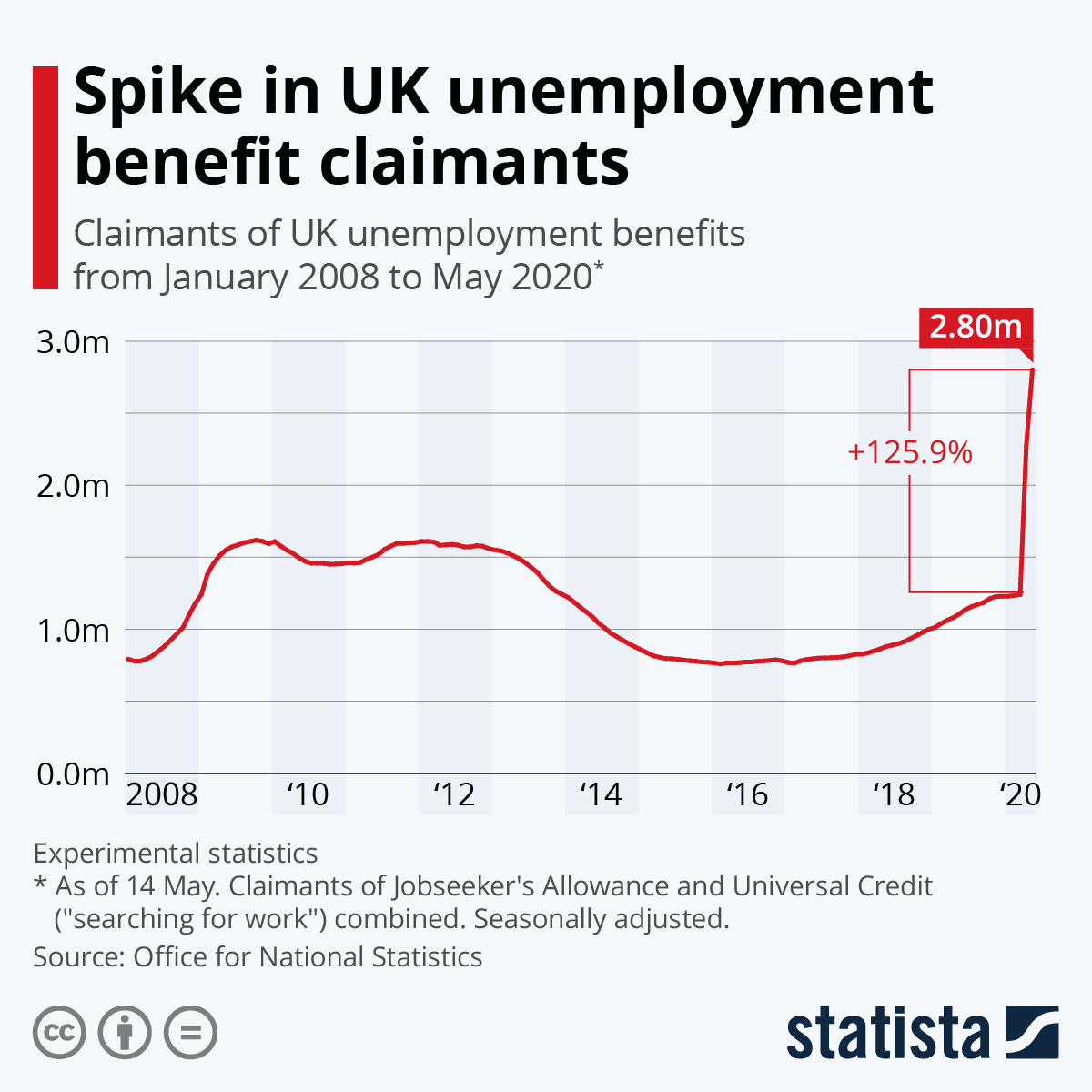

Dwp Benefit Claimants Receive Letters April 5th Changes Explained

May 08, 2025

Dwp Benefit Claimants Receive Letters April 5th Changes Explained

May 08, 2025 -

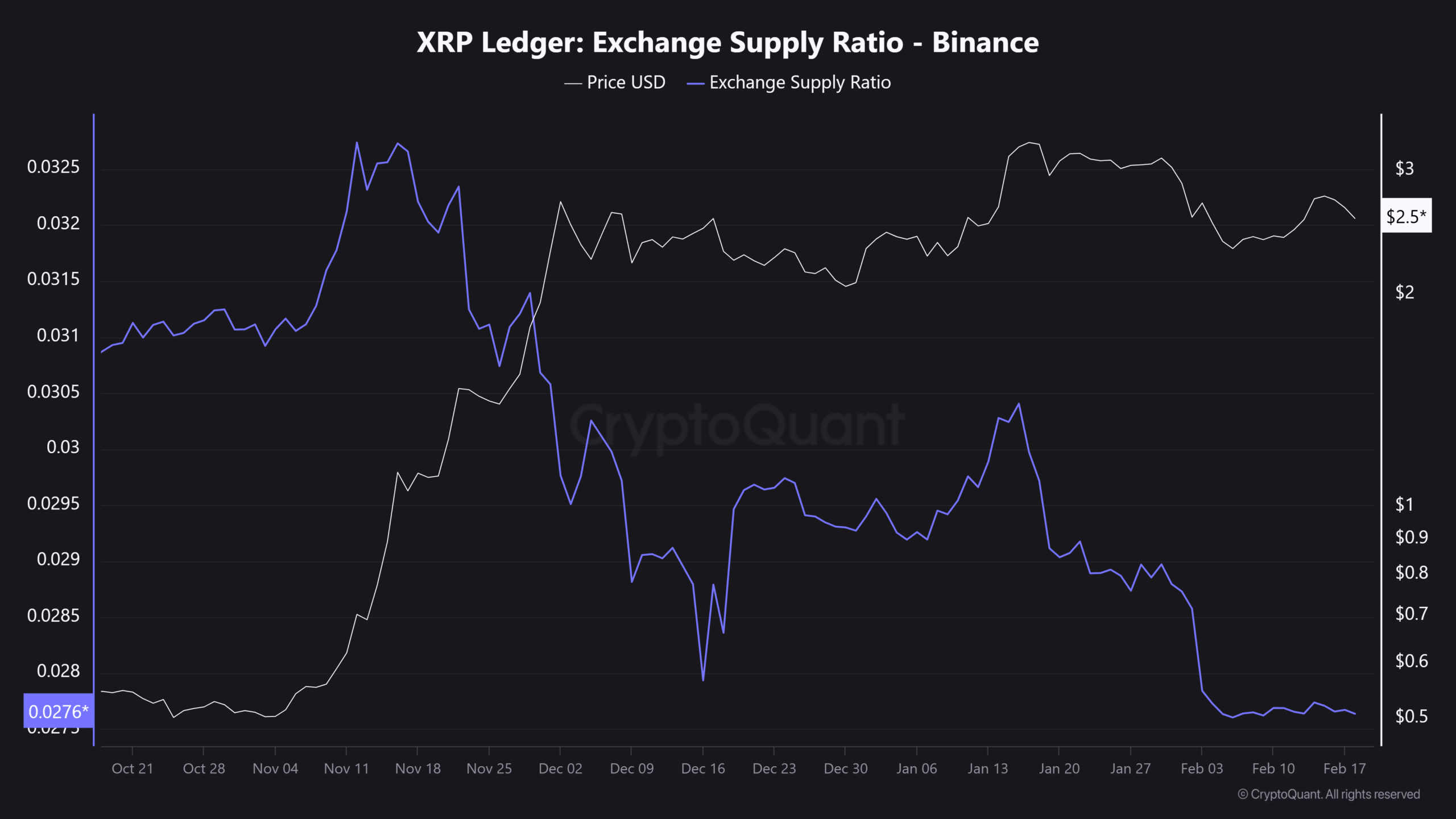

Evaluating Xrp Ripple A Long Term Investment Strategy

May 08, 2025

Evaluating Xrp Ripple A Long Term Investment Strategy

May 08, 2025 -

Xrp On The Verge Of A Breakthrough Etf Applications Sec Case Update And Future Predictions

May 08, 2025

Xrp On The Verge Of A Breakthrough Etf Applications Sec Case Update And Future Predictions

May 08, 2025