Suncor Energy: Record Production Despite Slower Sales Volume Growth

Table of Contents

Record Production in Upstream Operations

Suncor's impressive production numbers primarily stem from significant gains in its upstream operations, particularly in oil sands production. This surge in bitumen production and crude oil production can be attributed to several key factors:

- Improved extraction techniques and technological advancements: Suncor has consistently invested in cutting-edge technology to optimize its oil sands extraction processes. This includes advancements in in-situ recovery methods and improved steam-assisted gravity drainage (SAGD) techniques, leading to increased efficiency and higher yields.

- Optimized maintenance schedules resulting in less downtime: Strategic planning and proactive maintenance have significantly reduced operational downtime, maximizing production capacity across Suncor's oil sands projects. This optimized approach minimizes disruptions and ensures consistent output.

- Strategic investments in upgrading facilities: Suncor's substantial investments in upgrading facilities have enhanced its ability to process bitumen into higher-value synthetic crude oil. This increases profitability and reduces reliance on external refining capacity.

Bullet Points:

- Production at Suncor's Fort Hills operation increased by X% in Q[Quarter], exceeding initial projections.

- Operational efficiency improvements resulted in a Y% reduction in operating costs per barrel in the same period.

- Implementation of new automation technologies has contributed to a Z% increase in production uptime.

Slower Sales Volume Growth in Downstream Operations

Despite the remarkable success in upstream operations, Suncor's downstream sales volume growth has lagged behind expectations. This discrepancy can be attributed to several factors impacting refining capacity and product demand:

- Lower-than-anticipated demand for refined products: Global economic conditions and shifting consumer behavior have resulted in softer-than-projected demand for gasoline and other refined products, impacting sales volumes.

- Increased global competition in the refining sector: The global refining market is highly competitive, with numerous players vying for market share. This intensified competition has put pressure on refining margins and impacted Suncor's sales volume growth.

- Challenges in marketing and distribution networks: Effective marketing and distribution are crucial for downstream success. Potential inefficiencies or challenges within Suncor's distribution network could contribute to the slower sales volume growth.

Bullet Points:

- Sales volume for gasoline decreased by A% compared to the previous quarter.

- Refining margins have been compressed by B% due to increased global competition.

- Suncor is currently reviewing its marketing strategies to enhance market penetration and boost sales.

Financial Performance and Investor Implications

The contrasting performance of Suncor's upstream and downstream operations significantly impacts its overall financial health and investor sentiment. Analyzing Suncor's latest financial reports reveals:

- Impact of record production on profitability: The record production in upstream operations has positively impacted profitability, although this is partly offset by lower downstream margins.

- How slowing sales volume growth affects earnings: While upstream profitability is robust, the slower downstream sales volume growth has limited overall earnings growth.

- Implications for investor sentiment and Suncor's stock price: The mixed performance has led to some uncertainty among investors, impacting Suncor's stock price.

Bullet Points:

- Suncor's Q[Quarter] earnings report showed a C% increase in upstream revenue, but only a D% increase in overall revenue.

- The company maintained its dividend payout, indicating confidence in its long-term prospects.

- Analysts are closely monitoring the situation, with forecasts for Suncor's stock price varying depending on the market's reaction to the company's future strategies.

Future Outlook for Suncor Energy

Navigating the evolving energy landscape requires a strategic approach. Suncor is addressing challenges and focusing on a sustainable future:

- Strategies for addressing the challenges in downstream operations: Suncor is actively exploring new marketing strategies, optimizing its refining processes, and seeking strategic partnerships to strengthen its downstream operations.

- Investment in renewable energy and other sustainable initiatives: Suncor is investing in renewable energy sources, reflecting a commitment to reducing its carbon footprint and aligning with global sustainability goals.

- Suncor’s long-term growth prospects: Despite the current challenges, Suncor's long-term growth prospects remain positive, driven by its strong upstream operations and ongoing strategic initiatives.

Bullet Points:

- Suncor has committed to investing E$ in renewable energy projects over the next five years.

- The company is actively exploring opportunities in carbon capture, utilization, and storage (CCUS) technologies.

- Suncor's long-term growth strategy involves diversification across various energy sectors, mitigating risk and fostering long-term sustainability.

Conclusion

Suncor Energy's achievement of record production despite slower sales volume growth highlights the intricate relationship between upstream efficiency and downstream market dynamics within the Canadian energy sector. While the strong upstream performance is encouraging, addressing the challenges in downstream operations is crucial for sustained and balanced growth. The company's strategic investments in renewable energy demonstrate a commitment to long-term sustainability, but investor confidence will be closely tied to improvements in downstream performance.

Call to Action: Stay informed about Suncor Energy's progress and the evolving dynamics of the Canadian energy sector. Continue reading our analyses of Suncor Energy's performance to understand the long-term implications of this intriguing development in the context of Suncor Energy's record production and its effect on the broader energy market. Understanding Suncor's evolving strategy is critical for anyone interested in the Canadian energy sector and its future.

Featured Posts

-

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025 -

The Latest On Doohan And Colapinto Williams Official Statement

May 09, 2025

The Latest On Doohan And Colapinto Williams Official Statement

May 09, 2025 -

Find Your Perfect Boston Celtics Outfit At Fanatics Nba Finals Edition

May 09, 2025

Find Your Perfect Boston Celtics Outfit At Fanatics Nba Finals Edition

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

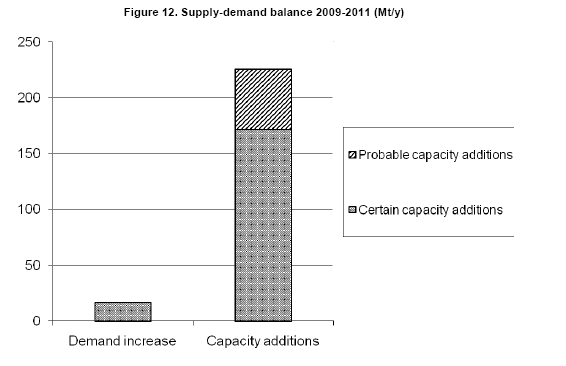

Chinas Steel Industry Slowdown Implications For Iron Ore Demand

May 09, 2025

Chinas Steel Industry Slowdown Implications For Iron Ore Demand

May 09, 2025