China's Steel Industry Slowdown: Implications For Iron Ore Demand

Table of Contents

Decreased Steel Production in China: The Driving Forces

Several factors contribute to the recent decline in China's steel production. Understanding these forces is crucial for predicting the future trajectory of iron ore demand. Keywords: Steel production, China government policy, carbon emissions, steel overcapacity, real estate market, steel demand.

-

Government Policies Targeting Carbon Emissions and Overcapacity: China's commitment to reducing its carbon footprint has led to stricter environmental regulations on steel mills. This includes limitations on production and increased penalties for exceeding emission limits. Simultaneously, the government continues its efforts to address overcapacity within the steel sector, leading to production cuts in less efficient facilities.

-

Weakening Domestic and Global Demand for Steel: Slower economic growth both within China and globally has impacted steel demand. Reduced infrastructure projects and a decline in manufacturing activity have lessened the need for steel, directly impacting production levels.

-

Real Estate Market Slowdown: The Chinese real estate sector, a major consumer of steel, has experienced a significant downturn. This contraction in construction activity has dramatically reduced the demand for construction steel, further contributing to the slowdown in steel production.

-

Increased Production Costs and Reduced Profitability: Rising energy prices, raw material costs, and stricter environmental regulations have increased the cost of steel production. This reduced profitability for steel mills has incentivized further production cuts.

The Ripple Effect: Impact on Iron Ore Prices and Supply Chains

The decreased steel production in China has had a direct and significant impact on the iron ore market. Keywords: Iron ore prices, iron ore supply chain, Australia iron ore, Brazil iron ore, iron ore producers, commodity price volatility.

-

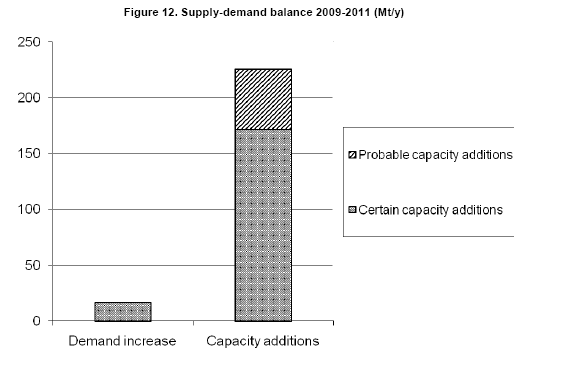

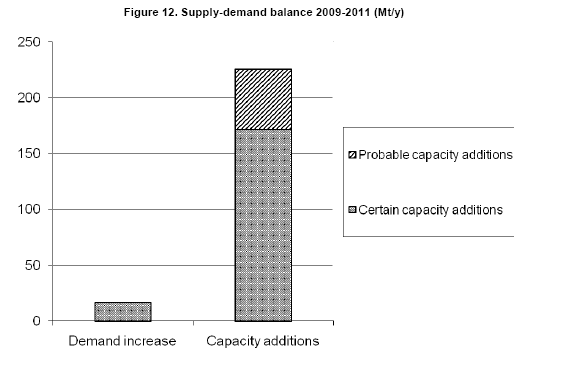

Decreased Demand and Price Declines: The reduced need for steel has led to a substantial drop in demand for iron ore, the primary raw material in steelmaking. This decreased demand has resulted in falling iron ore prices, impacting the profitability of major iron ore producers.

-

Impact on Major Iron Ore Producers (Australia, Brazil): Australia and Brazil, the world's largest iron ore exporters, are significantly affected by the reduced demand from China. They are experiencing lower export volumes and reduced revenue, leading to adjustments in their production strategies.

-

Supply Chain Disruptions and Inventory Adjustments: The slowdown has created uncertainty within the iron ore supply chain. Producers are adjusting their output and inventory levels to account for the reduced demand, potentially leading to disruptions and price volatility.

Alternative Demand Sources for Iron Ore: Exploring Opportunities

While China remains the dominant consumer of iron ore, exploring alternative demand sources is crucial for mitigating the risks associated with the current slowdown. Keywords: Infrastructure development, renewable energy, global iron ore demand, diversification of iron ore demand.

-

Infrastructure Projects in Other Developing Economies: Infrastructure development in other rapidly growing economies, such as India and Southeast Asia, presents potential alternative demand sources for iron ore.

-

Growth in Renewable Energy Sectors: The burgeoning renewable energy sector, particularly wind and solar power, requires significant amounts of steel for manufacturing components. This presents an opportunity for increased iron ore demand in the long term.

-

Increased Demand from Other Manufacturing Sectors: Other manufacturing sectors, such as automotive and shipbuilding, also contribute to iron ore demand, and growth in these areas can offset some of the slowdown in China.

Long-Term Outlook: Forecasting the Future of Iron Ore Demand from China

Predicting the future of iron ore demand from China requires careful consideration of various factors. Keywords: China economic recovery, long term iron ore forecast, future of steel industry, iron ore market outlook.

-

China's Economic Recovery: The pace of China's economic recovery will significantly influence the future demand for steel and, consequently, iron ore. A robust recovery could lead to a rebound in steel production.

-

Government Policies and Technological Advancements: Continued government policies aimed at reducing carbon emissions and addressing overcapacity will impact the steel industry's trajectory. However, technological advancements in steel production, such as improved efficiency and reduced emissions, could mitigate some of these negative impacts.

Conclusion: Navigating the Uncertainties in China's Steel Industry and Iron Ore Market

The slowdown in China's steel industry presents significant challenges to the global iron ore market. While the current situation is concerning, the long-term outlook is not solely bleak. The diversification of demand sources and potential technological advancements offer some optimism. However, it is crucial to closely monitor developments in China's steel industry and its impact on iron ore demand. Stay ahead of the curve by following industry news, analyzing market trends, and understanding the evolving dynamics. Make informed investment decisions and deepen your understanding of the iron ore market by consulting specialized reports and analysis. Understanding the intricacies of China's steel industry and its impact on iron ore demand is paramount for navigating the uncertainties ahead.

Featured Posts

-

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 09, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 09, 2025 -

Dakota Johnsons Siblings Attend Materialist La Screening

May 09, 2025

Dakota Johnsons Siblings Attend Materialist La Screening

May 09, 2025 -

Briatores Authority Jack Doohan And The I Control You Netflix Scene

May 09, 2025

Briatores Authority Jack Doohan And The I Control You Netflix Scene

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse

May 09, 2025 -

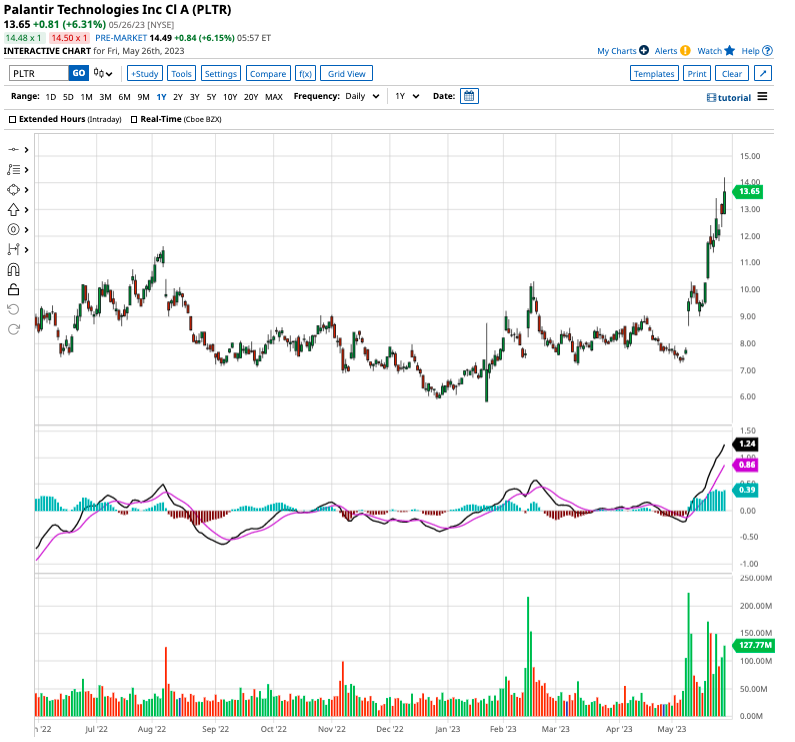

Should I Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 09, 2025

Should I Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 09, 2025

Latest Posts

-

Police Investigate Dozens Of Car Break Ins In Elizabeth City Apartment Complexes

May 09, 2025

Police Investigate Dozens Of Car Break Ins In Elizabeth City Apartment Complexes

May 09, 2025 -

Residents Warned After Numerous Car Break Ins At Elizabeth City Apartments

May 09, 2025

Residents Warned After Numerous Car Break Ins At Elizabeth City Apartments

May 09, 2025 -

Increased Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025

Increased Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025 -

Maldives Holiday Elizabeth Hurleys Bikini Style

May 09, 2025

Maldives Holiday Elizabeth Hurleys Bikini Style

May 09, 2025 -

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 09, 2025

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 09, 2025