Strong Performance Of Emerging Market Stocks Despite US Market Weakness

Table of Contents

Diversification Away from US-centric Investments

Over-reliance on the US market exposes portfolios to significant risks. The strength of emerging markets offers a powerful counterbalance. Diversification into emerging markets reduces this reliance, creating a more resilient investment strategy. Emerging markets diversification provides several key benefits:

- Reduced correlation with US market fluctuations: Emerging markets often move independently of the US market, offering a natural hedge against downturns. This reduced correlation is a crucial factor contributing to portfolio stability.

- Exposure to different growth drivers: Emerging markets present opportunities tied to factors distinct from those influencing the US economy, such as rapid urbanization, technological advancements, and rising consumer spending. This exposure to diverse growth drivers minimizes the impact of sector-specific downturns.

- Opportunities in untapped markets: Many emerging markets offer access to previously untapped sectors and industries, presenting unique high-growth potential absent in mature markets. This access to new markets provides exciting avenues for investment. Global diversification, achieved through strategic emerging market investments, effectively spreads risk and unlocks potentially higher returns.

Stronger Growth Prospects in Emerging Economies

Many emerging economies are projected to experience significantly faster economic growth rates than developed economies in the coming years. This robust emerging market growth is driven by several factors:

- Rising middle classes: The expanding middle class in many emerging markets fuels a surge in consumer demand for goods and services, driving economic expansion and creating lucrative investment opportunities.

- Government investments in infrastructure and technology: Significant government investments in infrastructure development and technological advancements further stimulate economic activity and attract foreign direct investment, fostering sustainable growth.

- Favorable demographics: Several emerging economies boast a young and growing population, representing a vast and increasingly productive workforce that fuels economic expansion.

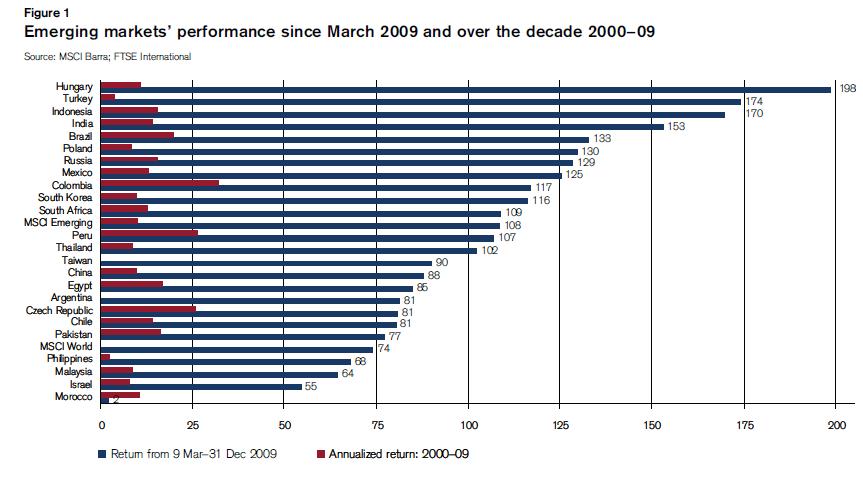

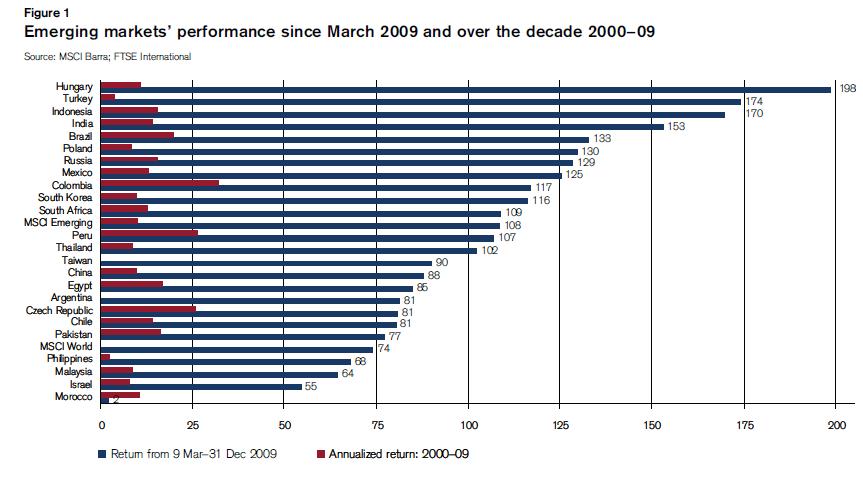

Specific Examples of Outperforming Emerging Markets

Several emerging markets have demonstrated exceptional performance recently. India, for example, has benefited from robust domestic consumption and technological innovation. Vietnam's economic growth has been propelled by its manufacturing sector and foreign investment. Brazil, despite some challenges, has shown resilience due to its vast natural resources and agricultural strength.

- India: Strong domestic demand, technological advancements (especially in IT), and government initiatives have fuelled impressive GDP growth.

- Vietnam: Attractive foreign direct investment, a young and growing workforce, and a focus on manufacturing have propelled its economic progress.

- Brazil: A large agricultural sector and abundant natural resources provide a solid foundation for ongoing economic growth, despite fluctuating commodity prices. Investment in renewable energy is also a key driver.

Factors Affecting US Market Weakness and Their Limited Impact on Emerging Markets

Factors such as inflation and interest rate hikes have contributed to recent US market weakness. However, these factors have had a comparatively limited impact on many emerging markets.

- Different economic structures and vulnerabilities: Emerging markets often have different economic structures and vulnerabilities compared to the US, making them less susceptible to the same pressures.

- Less reliance on certain sectors: Many emerging markets are less reliant on sectors heavily impacted by US policies, reducing their exposure to specific economic downturns.

- Potential for decoupling: The increasing economic independence of many emerging markets suggests a growing potential for decoupling from US economic cycles.

Risks and Challenges in Emerging Market Investments

While the strong performance of emerging market stocks is compelling, it’s crucial to acknowledge the inherent risks:

- Political instability: Political risks, including regime changes and social unrest, can significantly impact investment returns in certain emerging markets.

- Currency fluctuations: Significant currency fluctuations can affect the value of investments, creating both opportunities and risks.

- Regulatory uncertainty: Changes in regulations and policies can impact the operating environment for businesses and investments.

To mitigate these risks:

- Diversification: A well-diversified portfolio across various emerging markets and asset classes is vital.

- Hedging: Strategies like currency hedging can help protect against currency fluctuations.

- Due diligence: Thorough research and understanding of local market conditions are crucial before making any investments.

Conclusion: Understanding the Strong Performance of Emerging Market Stocks

The strong performance of emerging market stocks, even amidst US market weakness, is driven by a combination of factors including diversification benefits, stronger growth prospects in emerging economies, and a relative insulation from certain US-centric economic pressures. However, investors should carefully consider the inherent risks. By understanding these factors and implementing effective risk management strategies, investors can leverage the significant opportunities presented by emerging markets. Learn more about leveraging the strong performance of emerging market stocks to build a robust investment strategy. Contact us today for a personalized consultation, and discover the potential of emerging market investment opportunities.

Featured Posts

-

Vehicle Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025

Vehicle Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025 -

The Los Angeles Wildfires And The Growing Market For Disaster Betting

Apr 24, 2025

The Los Angeles Wildfires And The Growing Market For Disaster Betting

Apr 24, 2025 -

Emerging Market Stocks Outperform Us Year To Date Gains And Market Analysis

Apr 24, 2025

Emerging Market Stocks Outperform Us Year To Date Gains And Market Analysis

Apr 24, 2025 -

Bitcoin Price Surge Trumps Actions Ease Market Concerns

Apr 24, 2025

Bitcoin Price Surge Trumps Actions Ease Market Concerns

Apr 24, 2025 -

Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Storylines

Apr 24, 2025

Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Storylines

Apr 24, 2025