Emerging Market Stocks Outperform US: Year-to-Date Gains And Market Analysis

Table of Contents

Year-to-Date Performance Comparison: Emerging Markets vs. US

Quantifying the Gains:

The data speaks volumes. As of [Insert Current Date], the MSCI Emerging Markets Index has shown a [Insert Percentage]% year-to-date return, significantly outperforming the S&P 500's [Insert Percentage]% return. This disparity is visually striking when presented graphically:

[Insert Chart/Graph comparing MSCI Emerging Markets Index and S&P 500 year-to-date performance].

This substantial difference underscores the potential benefits of diversification beyond traditional US-centric investment strategies. Investors who solely focused on US stocks may have missed significant gains this year.

Sector-Specific Analysis:

The outperformance isn't uniform across all sectors. Specific areas within emerging markets have driven much of the gains. Key contributors include:

- Technology: The robust growth of technology sectors in countries like India and China has exceeded that of their US counterparts. Companies focusing on fintech, e-commerce, and digital infrastructure are leading the charge.

- Commodities: The surge in commodity prices, driven by global demand and supply chain disruptions, has disproportionately benefited emerging market economies rich in natural resources. Countries with significant commodity exports have seen considerable economic growth, reflected in their stock markets.

- Infrastructure: Significant government investment in infrastructure projects across many emerging markets is fueling growth in related sectors, creating new investment opportunities.

Geographic Diversification:

While overall emerging markets have outperformed, performance varies regionally. Asia, particularly certain Southeast Asian nations, has demonstrated robust growth, while Latin America has shown a more mixed performance. African markets present a diverse landscape, with some nations exhibiting strong growth potential while others face significant challenges. This highlights the importance of geographical diversification within the broader emerging market asset class.

Factors Contributing to Emerging Market Outperformance

Economic Growth Potential:

Many emerging markets boast higher projected economic growth rates compared to developed economies like the US. This is a key driver of their stock market performance.

- China's Post-Pandemic Recovery: China's reopening and continued infrastructure spending have stimulated significant economic activity.

- India's Domestic Demand: India's burgeoning middle class and robust domestic demand are fueling considerable economic expansion.

- Other Emerging Markets: Many other emerging markets are experiencing sustained economic growth driven by factors such as population growth, technological advancements, and rising middle classes.

Currency Fluctuations:

The relative strength and weakness of currencies significantly impact investment returns. The fluctuations of the US dollar against emerging market currencies have played a role in the observed outperformance. A weakening dollar can boost the returns for investors holding emerging market assets denominated in other currencies.

Geopolitical Factors:

Geopolitical events, such as the war in Ukraine and evolving US-China relations, have impacted global markets. While these events present risks, they have also created opportunities for some emerging markets to increase their strategic importance, leading to increased investment.

Interest Rate Differentials:

Differing interest rate policies between the US Federal Reserve and central banks in emerging markets have influenced capital flows. Higher interest rates in some emerging markets have attracted foreign investment, boosting their stock markets.

Investment Strategies and Considerations for Emerging Markets

Risk Assessment:

Investing in emerging markets carries inherent risks, including:

- Political Instability: Political risks vary significantly across emerging markets.

- Currency Volatility: Fluctuations in exchange rates can impact returns.

- Regulatory Uncertainty: Regulatory environments can be less transparent and predictable than in developed markets.

Diversification Strategies:

To mitigate risks and optimize returns, investors should employ various diversification strategies:

- Geographical Diversification: Spread investments across multiple emerging markets to reduce exposure to region-specific risks.

- Sectoral Diversification: Invest in a range of sectors within emerging markets to balance risk and potential.

Choosing the Right Investment Vehicles:

Several investment vehicles provide access to emerging markets:

- Exchange-Traded Funds (ETFs): Offer diversified exposure to a basket of emerging market stocks.

- Mutual Funds: Provide professional management and diversification across emerging market assets.

- Individual Stocks: Allow for targeted investments in specific companies within emerging markets, but require more in-depth research and understanding.

Conclusion:

The year-to-date outperformance of emerging market stocks compared to US stocks is undeniable. Factors such as robust economic growth potential, currency fluctuations, geopolitical developments, and interest rate differentials have all played a role. While investing in emerging markets involves risks, diversification strategies and careful consideration of individual market dynamics can help mitigate these risks. Remember, emerging markets offer substantial potential for growth, and including them in a well-diversified portfolio can enhance returns. Diversify your portfolio with emerging market stocks today! Learn more about the opportunities available through [Link to relevant resource].

Featured Posts

-

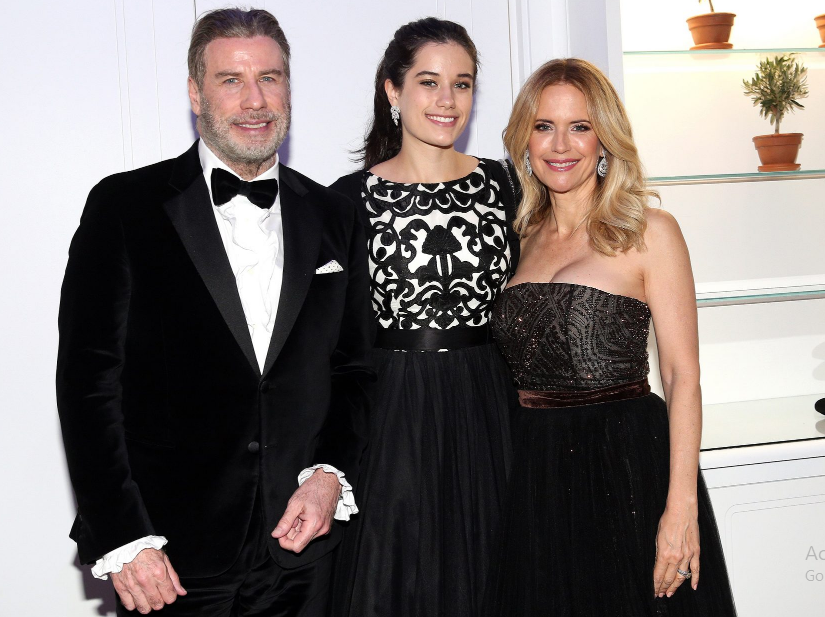

24 Year Old Ella Bleu Travoltas Fashion Magazine Cover A Family Legacy Continues

Apr 24, 2025

24 Year Old Ella Bleu Travoltas Fashion Magazine Cover A Family Legacy Continues

Apr 24, 2025 -

Blazers Fall To Warriors Hield And Paytons Impact From The Bench

Apr 24, 2025

Blazers Fall To Warriors Hield And Paytons Impact From The Bench

Apr 24, 2025 -

Full List Celebrities Affected By The La Palisades Fires

Apr 24, 2025

Full List Celebrities Affected By The La Palisades Fires

Apr 24, 2025 -

New Google Fi 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025

New Google Fi 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025 -

Is Canadas Vision Missing Fiscal Responsibility A Look At Liberal Spending

Apr 24, 2025

Is Canadas Vision Missing Fiscal Responsibility A Look At Liberal Spending

Apr 24, 2025