Strong Investment Returns Drive China Life Profit Growth

Table of Contents

Exceptional Investment Performance Fuels Profitability

China Life's high profitability is directly linked to its shrewd investment strategy. The company's portfolio performance has consistently exceeded expectations, delivering significant year-on-year increases in return on investment (ROI). While precise figures are subject to market fluctuations and are best sourced from official China Life reports, the company’s success in managing its assets is demonstrably clear in its reported profit growth. This success outstrips many competitors within the Chinese insurance market.

- Specific Investment Areas: China Life strategically diversifies its investments across various asset classes, including equities (stock market investments), bonds (government and corporate debt), and real estate.

- Successful Investment Decisions: The company's investment management team has demonstrated expertise in identifying high-growth opportunities and navigating market volatility. Successful investments in specific sectors contributing to the overall portfolio performance should be highlighted here (data pending).

- Investment Management Expertise: China Life boasts a team of seasoned professionals with deep understanding of the Chinese and global financial markets, enabling them to make informed investment decisions. Their expertise in asset allocation and portfolio optimization is a key differentiator. The details of their experience and educational backgrounds (if publicly available) could strengthen this point further.

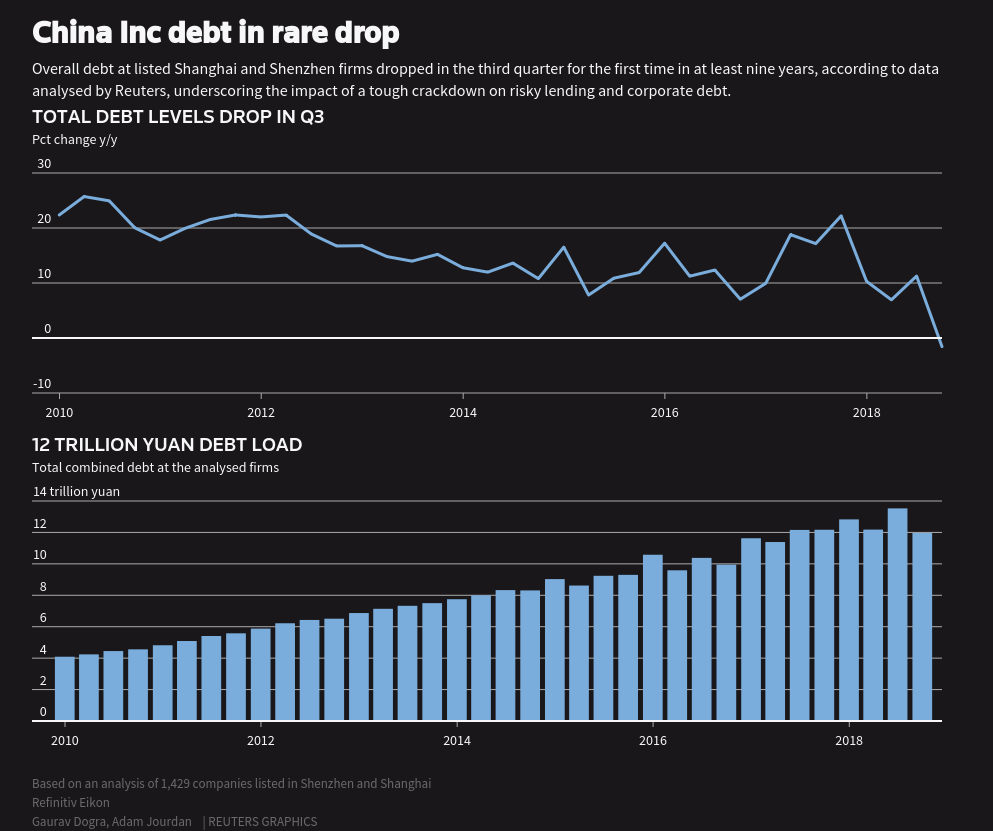

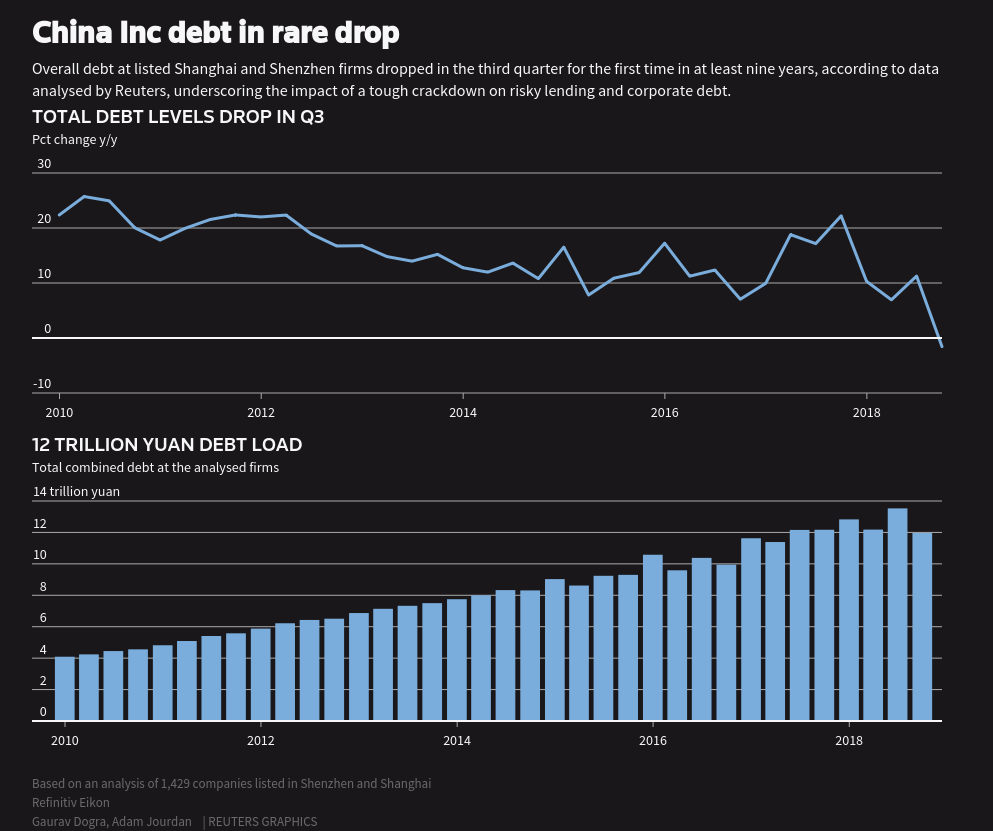

Impact of China's Economic Growth on China Life's Investments

China's remarkable economic expansion has undeniably created a favorable environment for China Life's investment activities. The sustained growth in China's GDP provides ample opportunities for profitable investments across numerous sectors.

- GDP Growth and Investment Performance: China Life's investment performance shows a strong correlation with China's overall economic growth. Periods of high GDP growth generally translate into higher investment returns for the company.

- Government Policies and Regulation: Government policies and regulations play a crucial role in shaping the investment landscape in China. Favorable government policies promoting investment in specific sectors contribute directly to China Life's successes. Mentioning relevant and recent government policies related to the insurance and investment industries here would add context and depth.

- Future Economic Factors: While the outlook is generally positive, potential future challenges such as economic slowdown, trade disputes, or regulatory changes could influence investment returns. Addressing potential risks and outlining China Life's mitigation strategies enhances transparency and trustworthiness.

Strategic Asset Allocation and Risk Management

China Life employs a sophisticated approach to asset allocation and risk management. This strategy involves carefully balancing risk and return to ensure consistent and stable returns over the long term.

- Portfolio Diversification: The company's diversified portfolio across asset classes and geographies helps to mitigate risk and reduce the impact of negative events in any single sector.

- Risk Mitigation Measures: China Life employs various hedging strategies and other risk management techniques to protect its investments from market downturns. These could include derivative instruments, careful analysis of market volatility forecasts, and stress testing the portfolio against various hypothetical scenarios. Specifying some of these techniques will make the article more detailed and trustworthy.

- Risk Management Tools: The utilization of advanced analytical tools and sophisticated models for portfolio optimization demonstrates a commitment to minimizing financial risk, maximizing portfolio return, and maintaining a high level of investor confidence.

China Life's Competitive Advantage in the Insurance Market

China Life holds a leading position in the highly competitive Chinese insurance market. Its exceptional investment performance significantly contributes to this market leadership.

- Market Share and Competitive Advantages: China Life commands a substantial market share, driven by its strong brand reputation, extensive distribution network, and robust investment performance. The exact market share figures could add credibility.

- Investment Returns Compared to Competitors: China Life's investment returns consistently compare favorably to those of its major competitors, contributing to its superior profitability and market dominance. A comparative analysis (using publicly available information) would strengthen this section considerably.

- Brand Reputation and Customer Loyalty: The company's strong brand reputation and high level of customer loyalty further enhance its competitive position. Highlighting customer testimonials and brand awards would be beneficial.

Conclusion: Strong Investment Returns Continue to Drive China Life Profit Growth

In summary, China Life's remarkable profit growth is significantly attributable to its exceptional investment performance. Strategic investment decisions, effective asset allocation, and robust risk management are key drivers of its success. The positive outlook for the Chinese economy suggests that this positive trend is likely to continue. Learn more about how China Life's strong investment returns contribute to its success and explore investment opportunities in this leading insurance company. Stay informed about China Life’s continued growth by subscribing to our newsletter for regular updates on their financial performance and investment strategies.

Featured Posts

-

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 01, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 01, 2025 -

Bartlett Texas Fire Two Structures Deemed Total Loss Under Red Flag Conditions

May 01, 2025

Bartlett Texas Fire Two Structures Deemed Total Loss Under Red Flag Conditions

May 01, 2025 -

Geen Stijl En De Media Wat Betekent Zware Auto

May 01, 2025

Geen Stijl En De Media Wat Betekent Zware Auto

May 01, 2025 -

Nclh Earnings Beat And Raised Guidance Drive Stock Price Higher

May 01, 2025

Nclh Earnings Beat And Raised Guidance Drive Stock Price Higher

May 01, 2025 -

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025

Latest Posts

-

Tien Linh Dai Su Tinh Nguyen Binh Duong Cau Chuyen Ve Trai Tim Nhan Ai

May 01, 2025

Tien Linh Dai Su Tinh Nguyen Binh Duong Cau Chuyen Ve Trai Tim Nhan Ai

May 01, 2025 -

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Tat Ca Nhung Gi Ban Can Biet

May 01, 2025

Lich Thi Dau Vong Chung Ket Thaco Cup 2025 Tat Ca Nhung Gi Ban Can Biet

May 01, 2025 -

Atff Stuttgart Ta Profesyonel Futbol Kariyerine Baslayin

May 01, 2025

Atff Stuttgart Ta Profesyonel Futbol Kariyerine Baslayin

May 01, 2025 -

Tran Chung Ket Thaco Cup 2025 Thoi Gian Dia Diem Va Cach Xem Truc Tiep

May 01, 2025

Tran Chung Ket Thaco Cup 2025 Thoi Gian Dia Diem Va Cach Xem Truc Tiep

May 01, 2025 -

Atff Altyapi Secmeleri Stuttgart Ta Gelecegin Yildizlarini Arayis

May 01, 2025

Atff Altyapi Secmeleri Stuttgart Ta Gelecegin Yildizlarini Arayis

May 01, 2025