NCLH: Earnings Beat And Raised Guidance Drive Stock Price Higher

Table of Contents

Strong Earnings Results Exceed Expectations

NCLH's Q[Specific Quarter, e.g., 2] 2024 earnings report showcased impressive growth across key performance indicators. The company significantly outperformed analyst predictions, demonstrating a robust recovery in the cruise sector.

- Revenue Growth: NCLH reported significantly higher-than-predicted revenue for the Q[Specific Quarter]. Revenue increased by X%, exceeding the projected Y% growth. This substantial increase underscores the strong demand for NCLH's cruises.

- EPS Surpasses Estimates: Earnings Per Share (EPS) surpassed analyst estimates by a substantial margin, reaching Z dollars per share compared to the anticipated W dollars. This positive EPS demonstrates improved profitability and operational efficiency.

- High Occupancy Rates: Strong occupancy rates further reinforced the positive trend. The company achieved an occupancy rate of A%, indicating high demand and efficient capacity utilization. This high occupancy directly contributes to increased revenue and profitability.

- Increased Average Booking Value: NCLH also benefited from an increased average booking value, reflecting higher spending per passenger. This demonstrates customer willingness to spend more on premium cruise experiences and added-value services.

Raised Full-Year Guidance Signals Positive Outlook

Beyond the impressive Q[Specific Quarter] results, NCLH's raised full-year guidance solidified investor confidence in the company's future prospects. This upward revision reflects a positive outlook for the remainder of the year and beyond.

- Upward Revision: NCLH raised its full-year revenue guidance from [Previous Guidance] to [Revised Guidance], demonstrating strong confidence in future performance. Similarly, the EPS guidance was increased from [Previous Guidance] to [Revised Guidance].

- Contributing Factors: Several factors contributed to this optimistic outlook. Strong booking trends for future cruises highlight sustained consumer demand. Furthermore, NCLH's pricing power, the ability to increase prices without significantly impacting demand, also played a crucial role.

- External Factors: While the outlook is positive, it's important to acknowledge potential external factors. Fluctuations in fuel costs and the broader economic outlook could impact profitability. However, the raised guidance suggests that NCLH has factored in these potential headwinds and remains confident in its ability to navigate them.

Market Reaction and Investor Sentiment

The positive earnings report and raised guidance triggered a significant positive market reaction. Investor sentiment towards NCLH improved dramatically, leading to a substantial increase in the stock price.

- Stock Price Surge: Following the earnings announcement, NCLH's stock price increased by B%, reflecting the market's enthusiastic response to the positive news. This surge added significantly to the company's market capitalization.

- Increased Trading Volume: The increase in trading volume further underscores heightened investor interest. The surge in trading activity indicates strong buying pressure and increased confidence in NCLH's future.

- Analyst Ratings and Price Targets: Many analysts revised their ratings and price targets for NCLH stock upwards, reflecting the positive sentiment. These upward revisions reinforce the belief that NCLH is poised for continued growth.

- Positive Investor Sentiment: Overall, the investor sentiment surrounding NCLH has shifted significantly towards optimism. The company's strong performance and positive outlook have boosted confidence among investors.

Comparison to Competitors (Optional)

While NCLH's performance is noteworthy, comparing it to competitors like Carnival Corporation (CCL) and Royal Caribbean (RCL) provides further context. [Insert comparative analysis here, including specific data points on revenue growth, occupancy rates, and stock performance]. This comparison will highlight NCLH's competitive advantages and position within the broader cruise industry.

Conclusion

NCLH's impressive earnings beat and raised full-year guidance have significantly boosted investor confidence, leading to a substantial increase in the company's stock price. The strong results reflect positive demand for cruises and indicate a promising outlook for the cruise industry. The company’s ability to exceed expectations and demonstrate strong financial performance has positioned NCLH favorably within a competitive market.

Call to Action: Stay informed about the latest developments in the cruise industry and NCLH's performance by following our analysis and updates on NCLH stock and other cruise line investments. Learn more about investing in NCLH and understanding the potential risks and rewards associated with this dynamic sector. However, remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Momo Watanabe Holds Mercedes Mones Tbs Championship A Plea For Return

May 01, 2025

Momo Watanabe Holds Mercedes Mones Tbs Championship A Plea For Return

May 01, 2025 -

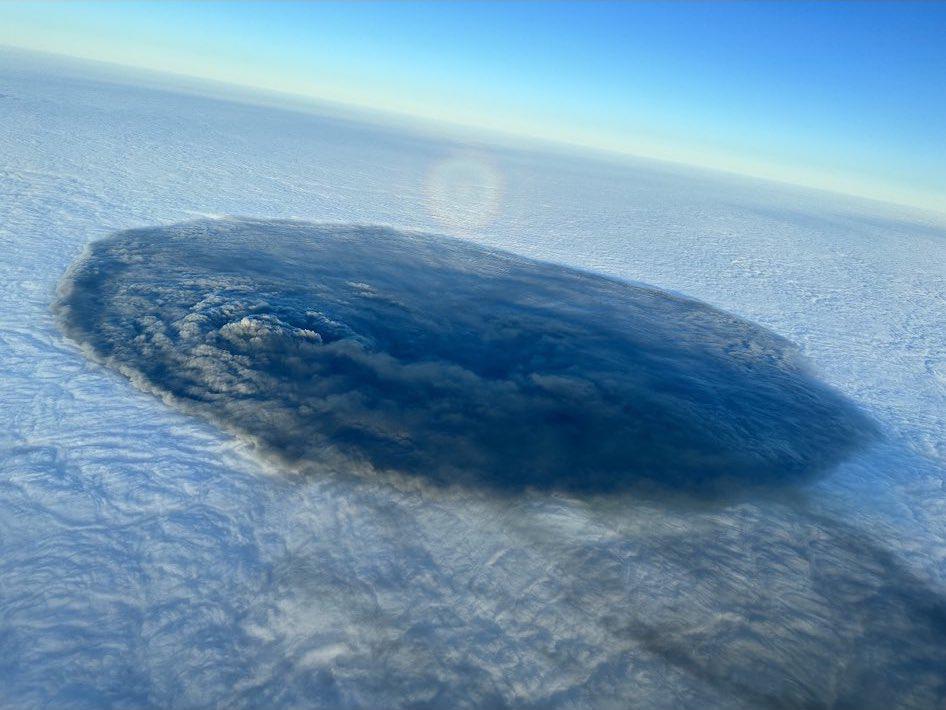

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

May 01, 2025 -

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Rdeml

May 01, 2025

Bhart Ky Kshmyr Palysy Pr Agha Syd Rwh Allh Mhdy Ka Rdeml

May 01, 2025 -

Increased Rent After La Fires A Selling Sunset Stars Accusation

May 01, 2025

Increased Rent After La Fires A Selling Sunset Stars Accusation

May 01, 2025 -

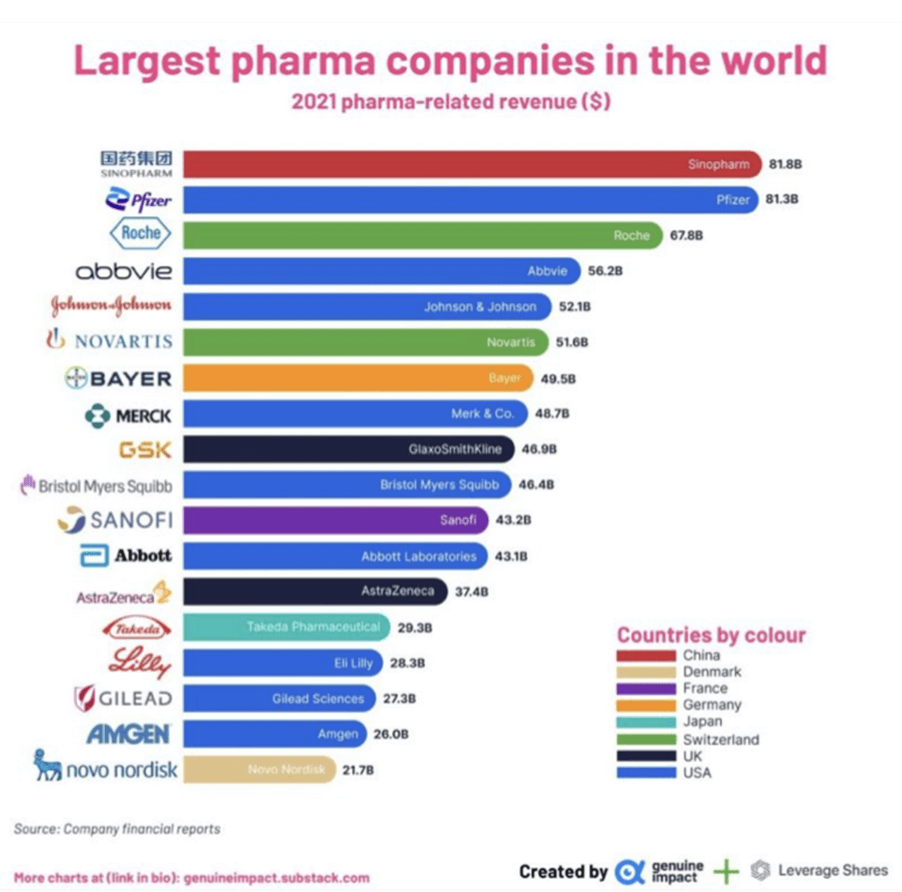

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025

Latest Posts

-

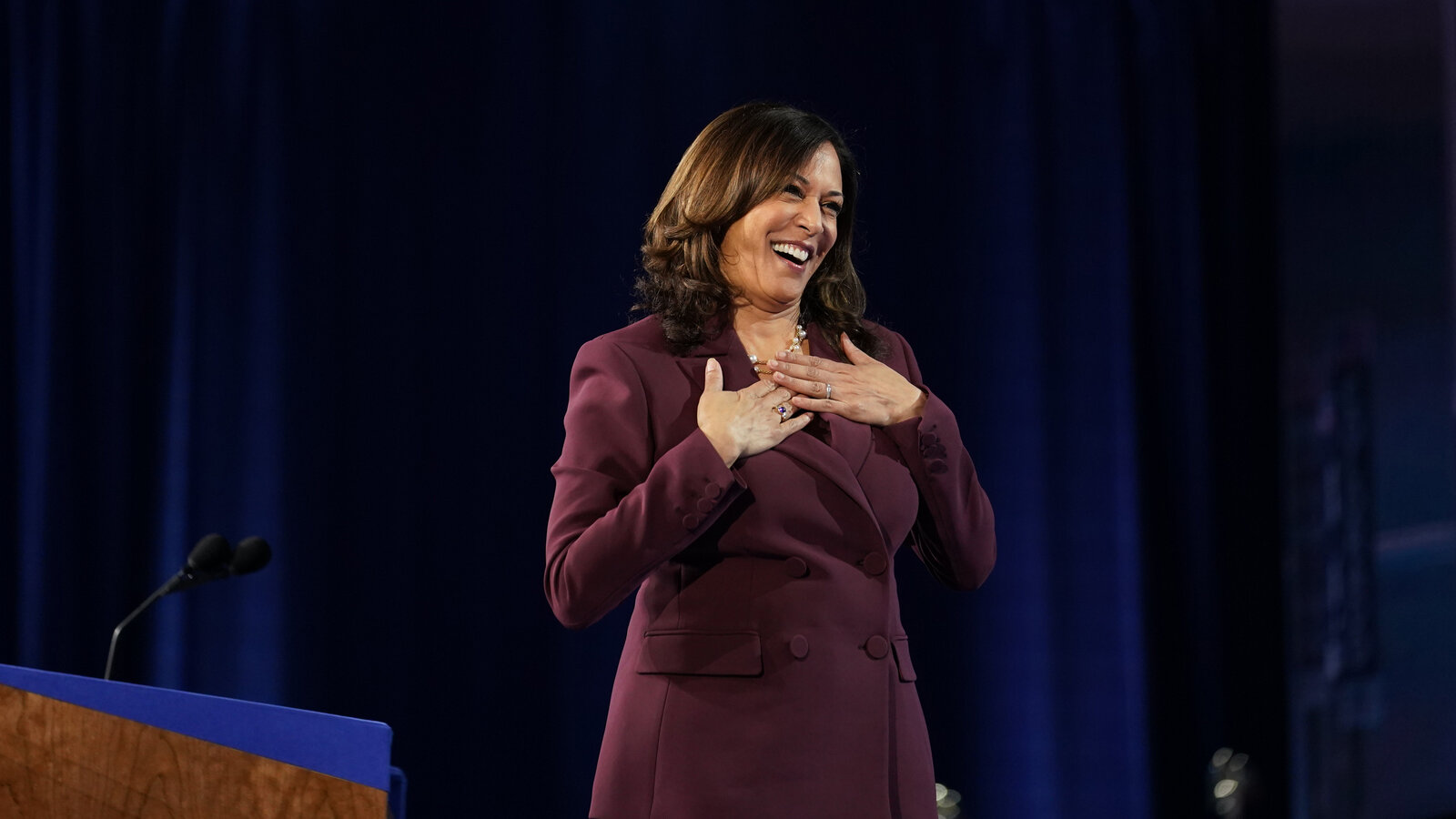

Kamala Harris A New Chapter

May 01, 2025

Kamala Harris A New Chapter

May 01, 2025 -

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025

Emhoff Ousted From Holocaust Memorial Council By Trump Administration

May 01, 2025 -

Did Kamala Harris Broadway Speech Miss The Mark A Detailed Look

May 01, 2025

Did Kamala Harris Broadway Speech Miss The Mark A Detailed Look

May 01, 2025 -

Analysis Kamala Harris Unsuccessful Attempt To Inspire The Louis Armstrong Musical Cast

May 01, 2025

Analysis Kamala Harris Unsuccessful Attempt To Inspire The Louis Armstrong Musical Cast

May 01, 2025 -

Holocaust Memorial Council Shakeup Trump Fires Doug Emhoff

May 01, 2025

Holocaust Memorial Council Shakeup Trump Fires Doug Emhoff

May 01, 2025