Stock Market Today: Dow Futures, Gold Prices, And Fed Rate Hikes

Table of Contents

Dow Futures: A Glimpse into Tomorrow's Market

Dow futures are derivative contracts that track the expected price of the Dow Jones Industrial Average (DJIA) at a future date. These pre-market trading instruments offer a valuable glimpse into the potential direction of the market before the opening bell. Analyzing Dow futures trends provides investors with crucial insights and allows for potential strategic positioning.

- Factors Influencing Dow Futures: Economic news releases (e.g., GDP growth, inflation data), geopolitical events (e.g., international conflicts, political instability), and corporate earnings announcements significantly impact Dow futures. Unexpected positive or negative news can lead to substantial price fluctuations.

- Recent Dow Futures Trends and Implications: [Insert analysis of recent Dow futures trends. Example: "Recently, Dow futures have shown a slight upward trend, potentially indicating investor optimism driven by positive economic data. However, this trend needs to be carefully examined in context with other market indicators."]

- Potential Trading Strategies: Based on Dow futures analysis, traders may employ various strategies, such as long positions (betting on price increases) or short positions (betting on price decreases), depending on their market outlook and risk tolerance. Sophisticated strategies might involve options trading based on Dow futures.

Gold Prices: A Safe Haven in Times of Uncertainty

Gold has historically served as a safe haven asset, providing a hedge against inflation and economic uncertainty. Its price is influenced by a multitude of factors, and understanding these is essential for investors considering gold as part of their portfolio. Analyzing current "gold prices" helps understand market sentiment.

- Factors Influencing Gold Prices: Inflation rates, interest rates, the strength of the US dollar, and geopolitical instability all play a crucial role in determining gold prices. High inflation typically drives demand for gold as an inflation hedge.

- Recent Gold Price Trends and Implications: [Insert analysis of recent gold price trends. Example: "Recently, gold prices have experienced some volatility, reflecting concerns about rising inflation and potential economic slowdown. This might suggest a flight to safety amongst investors."]

- Pros and Cons of Investing in Gold: Gold offers diversification benefits and can act as a portfolio stabilizer during market downturns. However, gold generally doesn't produce income and can be susceptible to price fluctuations. It's vital to carefully consider your risk tolerance before investing in gold.

Fed Rate Hikes and Their Market Impact

The Federal Reserve (Fed) plays a significant role in influencing the "Stock Market Today" through its monetary policy decisions, primarily concerning interest rate adjustments. Fed rate hikes aim to curb inflation by making borrowing more expensive. This has far-reaching consequences across the economy.

- Rationale Behind Recent or Anticipated Fed Rate Hikes: [Insert details about the Fed's rationale for recent or anticipated rate hikes. Example: "The recent Fed rate hikes were primarily driven by persistent inflation above the target rate. The goal is to cool down the economy and bring inflation back to a sustainable level."]

- Historical Impact of Fed Rate Hikes: Historically, Fed rate hikes have had a mixed impact on different asset classes. While they can curb inflation, they may also slow down economic growth and negatively impact stock prices in the short term. Bond yields typically increase with rate hikes.

- Potential Effects of Future Rate Hikes: Future rate hikes could further impact the stock market, bond yields, and economic growth. The severity of the impact depends on the magnitude and pace of rate increases, as well as the overall economic climate.

Understanding the Interplay Between These Factors

The movements in Dow futures, gold prices, and the impact of Fed rate hikes are interconnected. For instance, anticipated Fed rate hikes might influence Dow futures negatively while potentially boosting gold prices (as investors seek safe haven assets). Understanding these market correlations is crucial for building a robust investment strategy and effective risk management. Diversification across asset classes is a key element of mitigating risk in such a dynamic environment. Thorough economic analysis helps in making better predictions.

Conclusion

Understanding the "Stock Market Today" requires close attention to Dow futures, gold prices, and the implications of Fed rate hikes. These interconnected factors shape market trends and present both opportunities and challenges for investors. By carefully analyzing these indicators and understanding their interplay, investors can make more informed decisions regarding their investment strategies. Continue monitoring the "Stock Market Today" to stay abreast of these crucial developments. Consider subscribing to financial news sources, consulting a qualified financial advisor, and exploring additional educational resources to refine your understanding of Dow futures, gold prices, and the impact of Fed rate hikes on your investment portfolio.

Featured Posts

-

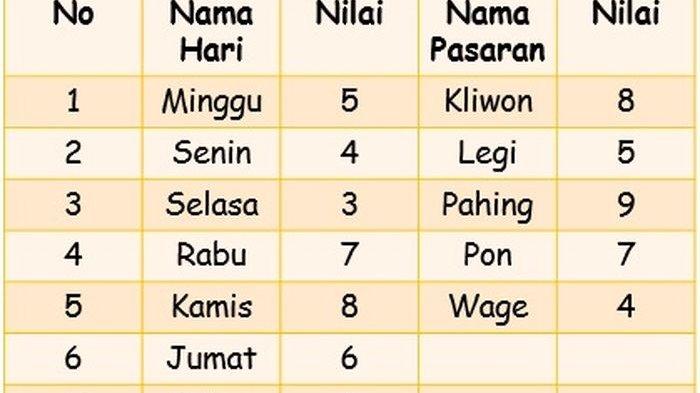

Kecocokan Jodoh Weton Jumat Wage Dan Senin Legi Ramalan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Jumat Wage Dan Senin Legi Ramalan Primbon Jawa

Apr 23, 2025 -

Boeings Jeppesen Divestment A 5 6 Billion Deal With Thoma Bravo

Apr 23, 2025

Boeings Jeppesen Divestment A 5 6 Billion Deal With Thoma Bravo

Apr 23, 2025 -

La Carte Blanche De Marc Fiorentino Une Etude De Cas

Apr 23, 2025

La Carte Blanche De Marc Fiorentino Une Etude De Cas

Apr 23, 2025 -

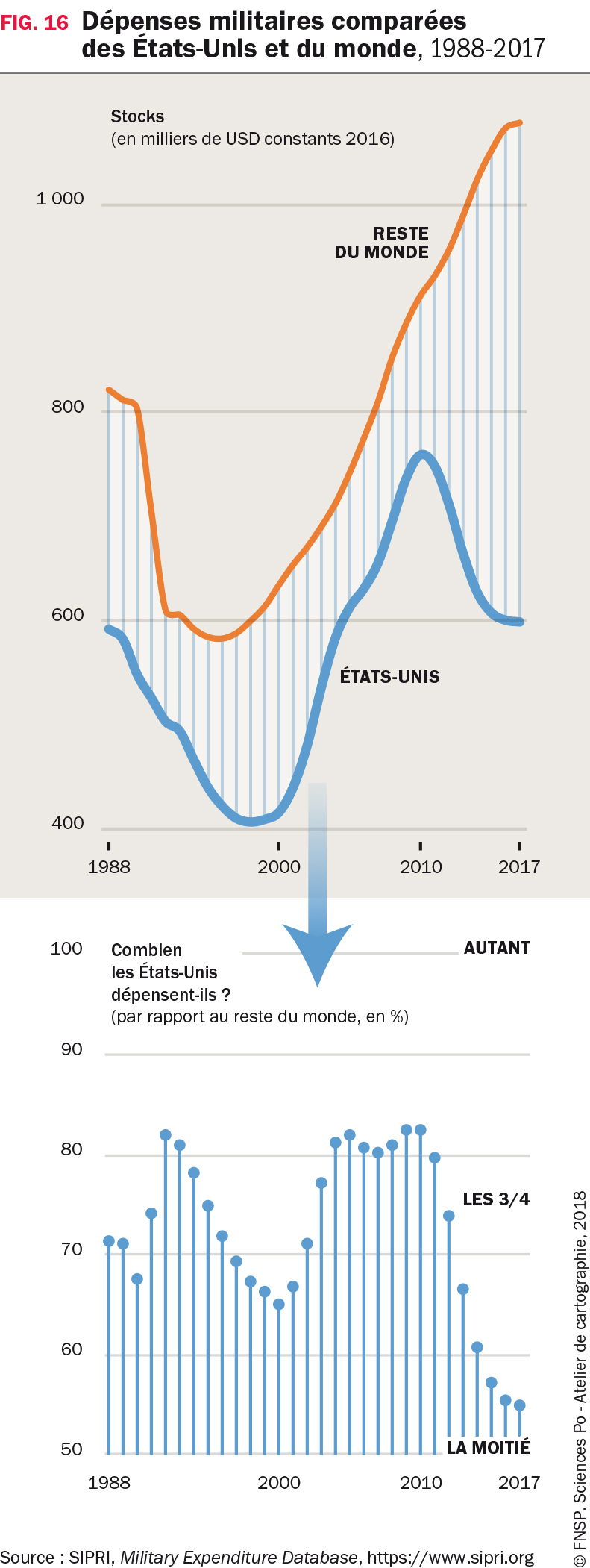

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025

Tensions Geopolitiques L Augmentation Des Depenses Militaires Americaines Et Russes

Apr 23, 2025 -

Power Outages Hit Lehigh Valley Amid High Winds Photo Report

Apr 23, 2025

Power Outages Hit Lehigh Valley Amid High Winds Photo Report

Apr 23, 2025