Boeing's Jeppesen Divestment: A $5.6 Billion Deal With Thoma Bravo

Table of Contents

Jeppesen's Core Business and Market Position

Jeppesen's core business revolves around providing essential data and software solutions to the global aviation industry. Its product portfolio encompasses a wide range of services, including:

- Navigation Data: Jeppesen is a market leader in providing highly accurate and up-to-date navigation data, crucial for safe and efficient flight operations. This includes digital charts, airport diagrams, and other essential navigational information for pilots worldwide.

- Flight Planning Software: Airlines and pilots rely on Jeppesen's sophisticated flight planning software to optimize routes, calculate fuel consumption, and comply with regulatory requirements. These tools significantly improve operational efficiency and cost savings.

- Aviation Training: Jeppesen offers comprehensive training programs for aviation professionals, encompassing various aspects of flight operations, navigation, and safety procedures.

Jeppesen holds a significant market share, serving a diverse clientele including major airlines, air navigation service providers (ANSPs), and private aviation operators. Key partnerships with aircraft manufacturers and regulatory bodies further solidify its position within the industry. Its reputation for reliability and accuracy makes it a vital component of the global aviation infrastructure.

- Market leader in digital aviation data.

- Provides crucial navigation and flight planning tools to airlines and pilots globally.

- Offers comprehensive training solutions for aviation professionals.

Why Boeing Divested Jeppesen? Strategic Rationale Behind the Sale

Boeing's decision to sell Jeppesen stems from a broader strategic initiative to streamline its operations and focus on its core competencies: aircraft manufacturing and defense. The divestment allows Boeing to:

- Focus on Core Competencies: By shedding Jeppesen, Boeing can concentrate its resources and expertise on its primary businesses, optimizing efficiency and profitability in these core areas.

- Strategic Realignment: The sale represents a significant step in Boeing's strategic realignment, aiming to enhance its overall financial performance and shareholder value.

- Maximize Shareholder Value: The $5.6 billion price tag underscores the considerable value unlocked through this divestment, directly benefiting Boeing shareholders.

This strategic move allows Boeing to better manage its portfolio and prioritize investments in key areas for future growth and innovation within its aerospace businesses.

Thoma Bravo's Acquisition Strategy and Future Plans for Jeppesen

Thoma Bravo, a prominent private equity firm with a strong track record in software and technology investments, has acquired Jeppesen with a clear vision for its future. Their acquisition strategy likely involves:

- Investment in Technology: Thoma Bravo is known for its ability to leverage technology to improve efficiency and drive growth within its portfolio companies. Expect significant investments in Jeppesen’s technology infrastructure and software development.

- Expansion into New Markets: Thoma Bravo might pursue strategies to expand Jeppesen's market reach into new geographical regions or potentially related service areas within the broader aviation sector.

- Operational Improvements: The private equity firm will likely implement operational improvements to enhance efficiency and profitability at Jeppesen.

This acquisition signifies a significant opportunity for Jeppesen to leverage Thoma Bravo’s expertise and resources to accelerate growth and innovation.

Impact of the Divestment on the Aviation Industry

The Boeing Jeppesen divestment will undoubtedly have a ripple effect across the aviation industry. Some potential impacts include:

- Potential Changes in Pricing and Service Offerings: While the immediate impact remains to be seen, changes in pricing strategies or service offerings are possible under new ownership.

- Impact on Jeppesen's Relationships: The transition to a new owner might affect Jeppesen's relationships with its clients and other aviation stakeholders.

- Implications for Innovation: Thoma Bravo’s investment in technology could lead to significant advancements in navigation and flight planning tools, driving innovation within the industry.

The long-term effects on Jeppesen's clients and employees will depend largely on Thoma Bravo’s strategic direction and operational approach.

Conclusion: Analyzing Boeing's Jeppesen Divestment – Looking Ahead

The $5.6 billion sale of Jeppesen to Thoma Bravo represents a pivotal moment for both Boeing and the aviation industry. Boeing’s strategic decision to divest this division allows it to focus on its core aerospace businesses, while Thoma Bravo’s acquisition positions Jeppesen for potential growth and innovation under new ownership. The long-term implications of this deal remain to be seen, but its impact on the competitive landscape, technological advancements, and customer service within aviation navigation and flight planning is undeniable.

We encourage you to share your thoughts on the Boeing Jeppesen divestment and stay updated on further developments. Follow reputable aviation news sources and industry publications to remain informed about the ongoing evolution of this significant acquisition. What are your predictions for Jeppesen's future under Thoma Bravo's leadership? Let us know in the comments below!

Featured Posts

-

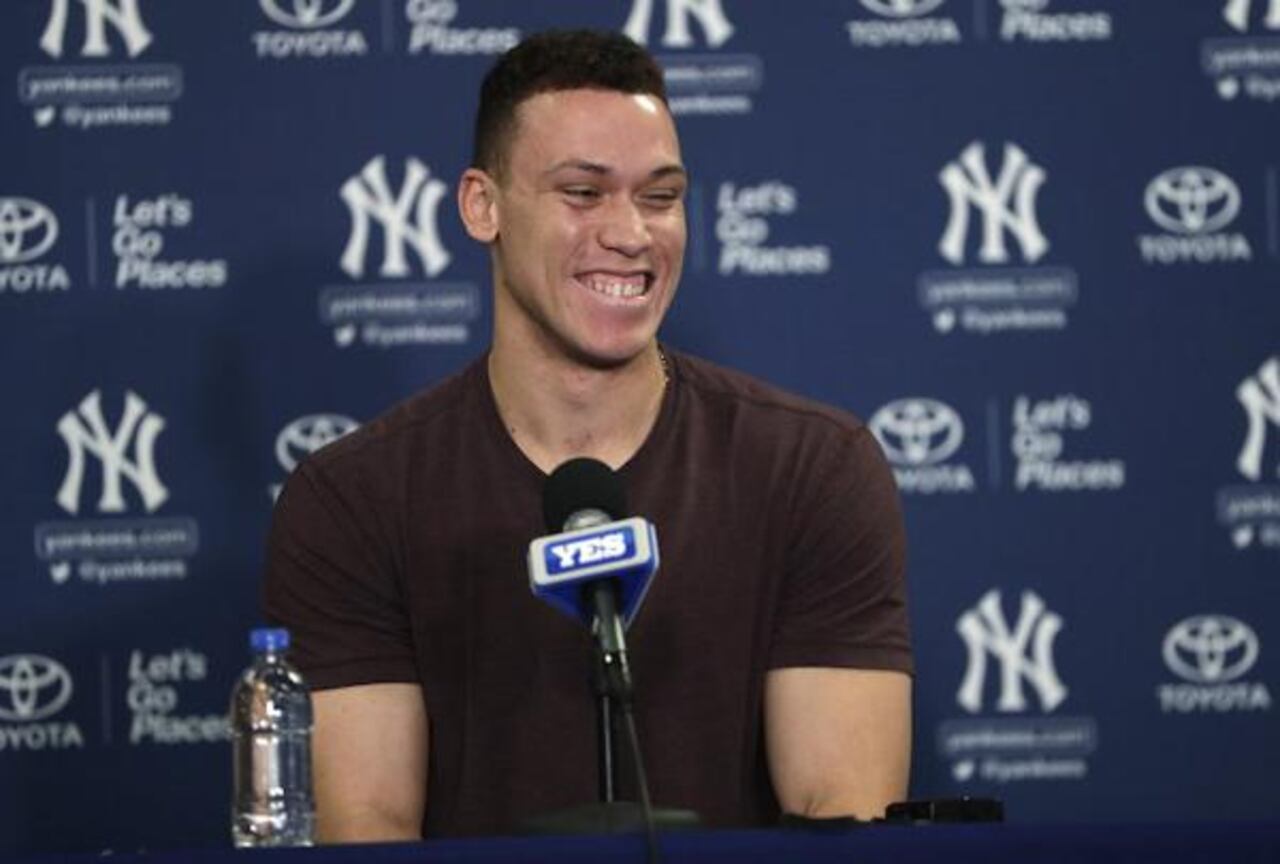

Nine Home Runs In One Game A Historic Night For The Yankees Fueled By Judge

Apr 23, 2025

Nine Home Runs In One Game A Historic Night For The Yankees Fueled By Judge

Apr 23, 2025 -

Program Tv Ramadan 2025 Jadwal Acara Terbaik Untuk Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025

Program Tv Ramadan 2025 Jadwal Acara Terbaik Untuk Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025 -

Office365 Security Failure Millions Stolen Investigation Underway

Apr 23, 2025

Office365 Security Failure Millions Stolen Investigation Underway

Apr 23, 2025 -

Je T Aime Moi Non Plus L Approche D Amandine Gerard Sur Les Relations Europe Marches

Apr 23, 2025

Je T Aime Moi Non Plus L Approche D Amandine Gerard Sur Les Relations Europe Marches

Apr 23, 2025 -

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025

Brewers Vs Diamondbacks Naylors Key Rbi In Diamondbacks Win

Apr 23, 2025