Stock Market Live: Tracking Dow Futures And Key Earnings Reports

Table of Contents

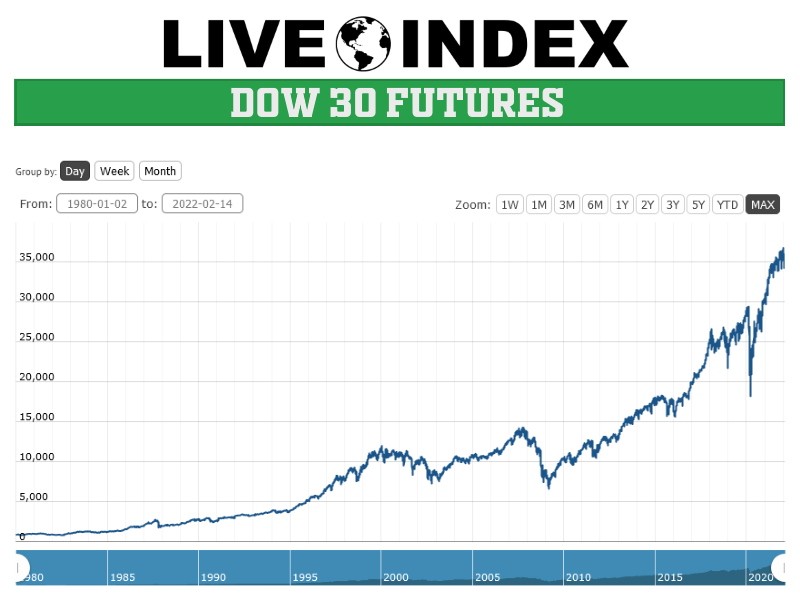

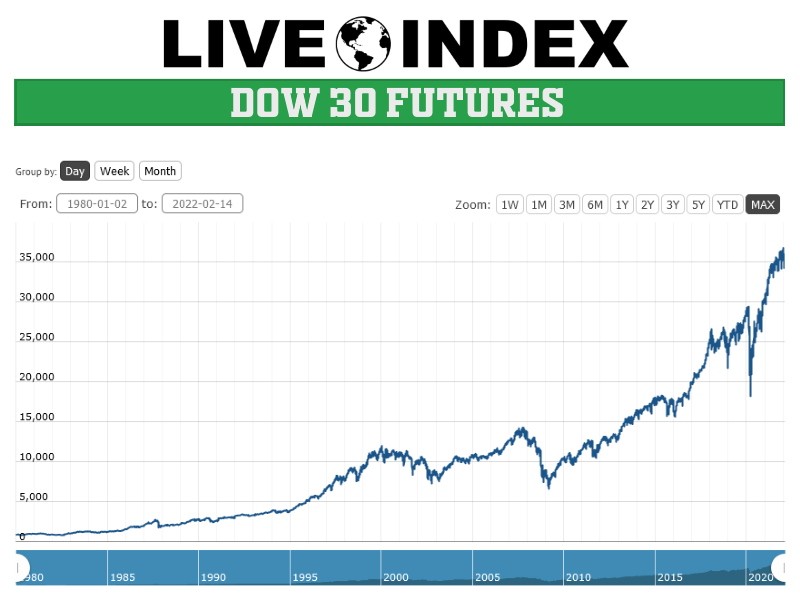

Decoding Dow Futures: A Live Market Indicator

Dow Futures contracts are derivative instruments that track the predicted value of the Dow Jones Industrial Average (DJIA) at a future date. Understanding these contracts is crucial for navigating the live stock market.

Understanding Dow Futures Contracts

- Contract Specifications: Dow Futures contracts specify a particular number of DJIA index points, with each point representing a specific dollar value.

- Trading Hours: These contracts are traded electronically on global exchanges, offering extended trading hours compared to the regular stock market.

- Margin Requirements: Traders need to maintain a margin account to cover potential losses, which involves depositing a percentage of the contract's value.

- Relationship to the DJIA: Dow Futures prices generally mirror the DJIA's movement, offering a preview of potential market shifts before the actual opening of the stock market. However, it's important to note that discrepancies can exist.

- Popular Platforms: Many brokerage platforms and financial websites provide real-time Dow Futures quotes and charting tools.

Analyzing Dow Futures Charts

Technical analysis plays a vital role in interpreting Dow Futures price movements. Traders use various tools to identify trends and potential turning points:

- Moving Averages: These smooth out price fluctuations, revealing underlying trends.

- Support and Resistance Levels: These are price levels where buyers or sellers exert significant influence, potentially reversing the price trend.

- Chart Patterns: Recognizing patterns like head and shoulders, double tops/bottoms, and triangles can predict future price movements. [Insert visual example of a chart pattern here, with a brief explanation].

- Volume and Open Interest: High volume accompanying price movements confirms the strength of a trend. Open interest (number of outstanding contracts) provides insights into market sentiment.

Dow Futures and Risk Management

Trading Dow Futures involves inherent risks. Effective risk management is crucial for preserving capital:

- Stop-Loss Orders: These orders automatically sell your position when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Never risk more capital than you can afford to lose on a single trade.

- Diversification: Diversifying your investment portfolio across different asset classes reduces overall risk.

The Impact of Key Earnings Reports on Stock Market Live Performance

Earnings reports provide a window into a company's financial health, significantly impacting its stock price and the overall market sentiment.

Identifying Key Earnings Announcements

Finding upcoming earnings reports is straightforward using several reliable sources:

- Financial News Websites: Major financial news outlets (e.g., Yahoo Finance, Google Finance, Bloomberg) provide earnings calendars.

- Company Investor Relations Pages: Companies usually publish their earnings schedule on their investor relations websites.

- Financial Data Providers: Subscription-based services offer comprehensive earnings calendars and data. Focus on companies with substantial market capitalization for greater market impact.

Analyzing Earnings Reports

Focus on these key metrics when analyzing an earnings report:

- Earnings Per Share (EPS): Compares a company's profit to the number of outstanding shares.

- Revenue: Total sales generated by the company during the reporting period.

- Guidance: Management's forecast for future performance. Pay close attention to any changes in guidance.

- Comparing to Expectations: Analyzing whether the reported results exceeded or missed analyst expectations is crucial.

Earnings Reports and Stock Market Reactions

Market reaction to earnings reports is highly variable:

- Positive Surprises: Exceeding expectations typically results in a positive stock price reaction.

- Negative Surprises: Missing expectations usually leads to a negative reaction.

- Market Sentiment: The overall market sentiment can also influence the stock price response to an earnings report. A negative market may amplify negative reactions and dampen positive ones.

Integrating Dow Futures and Earnings Reports for Live Stock Market Analysis

Combining the analysis of Dow Futures and earnings reports allows for a more comprehensive market outlook.

Combining Indicators for Informed Decisions

- Alignment: When Dow Futures point to a bullish trend, and key earnings reports are generally positive, this reinforces a positive market outlook.

- Divergence: If Dow Futures suggest a bearish trend, but strong earnings are reported, it indicates a potential buying opportunity for specific stocks.

Utilizing Real-Time Data

Real-time data is essential for accurate analysis. Consider using:

- Dedicated Financial Data Providers: These offer real-time quotes, charts, and news feeds.

- Brokerage Platforms: Many brokerage platforms provide real-time data access to their clients.

Developing a Trading Strategy

Based on your analysis of Dow Futures and earnings reports, develop a personalized trading strategy:

- Define your risk tolerance: Determine how much you're willing to risk on each trade.

- Set clear entry and exit points: Establish specific price targets for buying and selling.

- Regularly review your strategy: Adjust your approach based on market conditions and performance.

Mastering Stock Market Live with Dow Futures and Earnings Reports

Effectively tracking Dow Futures and key earnings reports provides valuable insights into the live stock market. By combining these analyses, investors can make more informed decisions and potentially improve their investment outcomes. Remember to always practice effective risk management and diversify your portfolio. Stay ahead of the curve by regularly checking our website for the latest updates on Stock Market Live, Dow Futures, and key earnings reports.

Featured Posts

-

Canadian Airbnb Bookings Soar A 20 Increase In Domestic Searches

May 01, 2025

Canadian Airbnb Bookings Soar A 20 Increase In Domestic Searches

May 01, 2025 -

Pentagon Audit Highlights F 35 Inventory Management Failures

May 01, 2025

Pentagon Audit Highlights F 35 Inventory Management Failures

May 01, 2025 -

Developpement Numerique Pour Thes Dansants Accompagnement Et Conseils

May 01, 2025

Developpement Numerique Pour Thes Dansants Accompagnement Et Conseils

May 01, 2025 -

Xrp Future Price Prediction Following Sec Case Developments

May 01, 2025

Xrp Future Price Prediction Following Sec Case Developments

May 01, 2025 -

Cruise Line Complaints Will They Ban You

May 01, 2025

Cruise Line Complaints Will They Ban You

May 01, 2025

Latest Posts

-

Nhl Carlssons Two Goal Performance Overshadowed In Ducks Ot Loss To Stars

May 01, 2025

Nhl Carlssons Two Goal Performance Overshadowed In Ducks Ot Loss To Stars

May 01, 2025 -

Ducks Carlsson Scores Twice But Stars Win In Overtime

May 01, 2025

Ducks Carlsson Scores Twice But Stars Win In Overtime

May 01, 2025 -

Neal Pionk Injury Updates Trade Speculation And Recent Games

May 01, 2025

Neal Pionk Injury Updates Trade Speculation And Recent Games

May 01, 2025 -

Neal Pionk All The Latest News And Highlights

May 01, 2025

Neal Pionk All The Latest News And Highlights

May 01, 2025 -

Fiala Fuels Kings To Shootout Win Over Stars Extends Scoring Run

May 01, 2025

Fiala Fuels Kings To Shootout Win Over Stars Extends Scoring Run

May 01, 2025