Stock Market Defies Recession Fears: Investors See Continued Growth

Table of Contents

Strong Corporate Earnings Drive Market Upward Trend

Positive corporate earnings reports are a major driver behind the stock market's surprising strength. Strong corporate profits are fueling investor confidence and countering recessionary predictions.

Positive Q3 Earnings Reports Outperform Expectations

Many major companies exceeded earnings projections in the third quarter of 2023, defying expectations of a widespread slowdown.

- Apple (AAPL): Surpassed analyst estimates, demonstrating continued demand for its products despite inflationary pressures.

- Microsoft (MSFT): Showed strong growth in its cloud computing division, highlighting the resilience of the tech sector.

- Amazon (AMZN): Reported better-than-expected results, indicating robust consumer spending in certain sectors.

This overall trend of strong corporate earnings showcases the underlying health of many businesses and indicates that the economy may be more resilient than initially feared. This positive "earnings season" has significantly boosted investor sentiment and contributed to the ongoing stock market growth despite recession.

Resilient Consumer Spending Fuels Growth

Despite inflation and rising interest rates, consumer spending has remained relatively robust in certain sectors. This resilient consumer confidence is a critical factor supporting business growth and, consequently, the stock market.

- Spending on experiences (travel, entertainment) continues to be strong.

- Demand for certain durable goods remains steady.

- Consumer staples, though seeing some price sensitivity, remain a steady market.

Strong consumer spending suggests that while inflationary pressures exist, consumers are adapting and continuing to drive economic activity. This, in turn, supports corporate profits and reinforces the upward trend in the stock market, defying the predictions of a significant downturn. Understanding this relationship between consumer confidence and inflation-resistant stocks is crucial for navigating the current market.

Factors Mitigating Recessionary Pressures

Several factors are mitigating the anticipated impact of recessionary pressures on the stock market. These elements play a key role in explaining why the stock market defies recession fears.

The Role of the Federal Reserve and Interest Rate Hikes

The Federal Reserve's monetary policy, while aimed at curbing inflation through interest rate hikes, has had a less negative impact on the stock market than some anticipated.

- Targeted rate hikes have aimed to cool specific sectors without causing a widespread market crash.

- The Fed has shown a willingness to adjust its strategy based on economic indicators.

- The current rate environment, while still impacting borrowing costs, has not yet triggered a major economic contraction.

The Fed's careful approach and the market's apparent resilience to interest rate increases have contributed to the stock market's surprising strength. Analyzing the nuances of monetary policy and its impact on the economy is essential for understanding how the stock market defies recession fears.

Technological Innovation and Emerging Industries

Technological innovation and the growth of emerging industries are providing significant support to the stock market, mitigating recessionary risks.

- The AI sector is experiencing explosive growth, attracting substantial investment.

- Renewable energy is another area seeing increased investment and development.

- The growth of these sectors offers opportunities that often outperform more traditional sectors during periods of economic uncertainty.

Investment in these growth sectors, such as tech stocks and renewable energy stocks, demonstrates investor confidence in long-term growth prospects, even amidst short-term economic anxieties. The emergence of these markets provides a buffer against the traditional indicators of an impending recession.

Investor Behavior and Market Sentiment

Changes in investor behavior and market sentiment are also crucial factors in understanding the stock market's resilience.

Shifting Investment Strategies and Risk Tolerance

Investors are adapting their strategies, focusing on specific sectors and asset classes.

- Many are shifting towards growth stocks and sectors less vulnerable to recession.

- Some investors are increasing their risk tolerance, betting on continued growth despite economic uncertainty.

- Portfolio diversification is becoming increasingly important.

Understanding investor risk appetite and investment strategies is essential to grasping the current market dynamics and anticipating future trends. This evolving investor behavior is a key indicator of how the stock market defies recession fears.

The Influence of Geopolitical Events and Global Uncertainty

While geopolitical events and global uncertainty are undeniable factors impacting market volatility, their effect has been less severe than predicted.

- The market has demonstrated a degree of resilience to major global events.

- Investors are seemingly better equipped to navigate unpredictable situations.

- The ongoing evolution of global markets continues to present opportunities and challenges.

The stock market’s ability to absorb shocks from geopolitical risk and global uncertainty showcases its surprising capacity for resilience. This, once again, offers a compelling answer to the question of how the stock market defies recession fears.

Conclusion: Stock Market Defies Recession Fears – What's Next?

In summary, the unexpected growth of the stock market despite recessionary fears is a result of several interconnected factors: robust corporate earnings, mitigating economic pressures from the Federal Reserve and technological innovation, and evolving investor behavior. While uncertainty remains, the positive signals—particularly in certain sectors—suggest a more resilient economic outlook than initially predicted.

The future outlook remains somewhat cautious, with potential challenges still present. However, the stock market's current performance indicates a surprising ability to withstand recessionary pressures. Understanding the nuances of the stock market's defiance of recession fears is crucial for making informed investment decisions. Learn more about navigating this complex landscape and building a resilient portfolio by [link to relevant resource/service].

Featured Posts

-

Lady Gaga To Converse Unpacking Social Medias Recession Indicators

May 06, 2025

Lady Gaga To Converse Unpacking Social Medias Recession Indicators

May 06, 2025 -

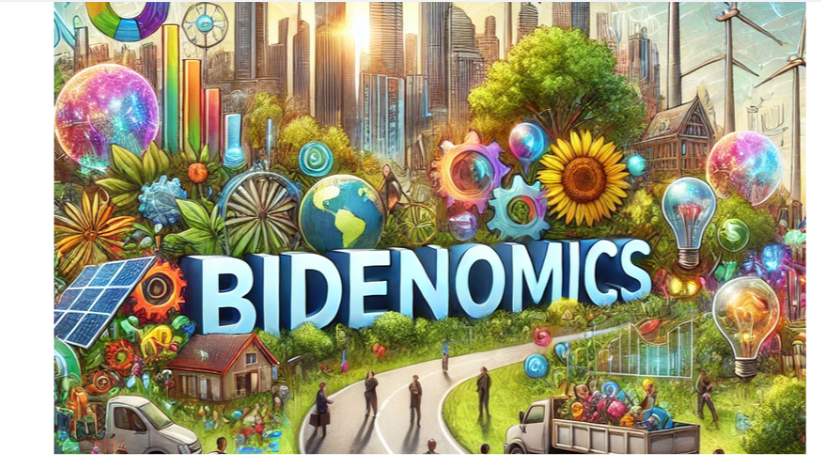

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025

Growth Opportunities Mapping The Countrys Rising Business Centers

May 06, 2025 -

Analyzing The Post Election Australian Asset Market Trajectory

May 06, 2025

Analyzing The Post Election Australian Asset Market Trajectory

May 06, 2025 -

Resistance Mounts Car Dealerships Oppose Ev Mandate Push

May 06, 2025

Resistance Mounts Car Dealerships Oppose Ev Mandate Push

May 06, 2025 -

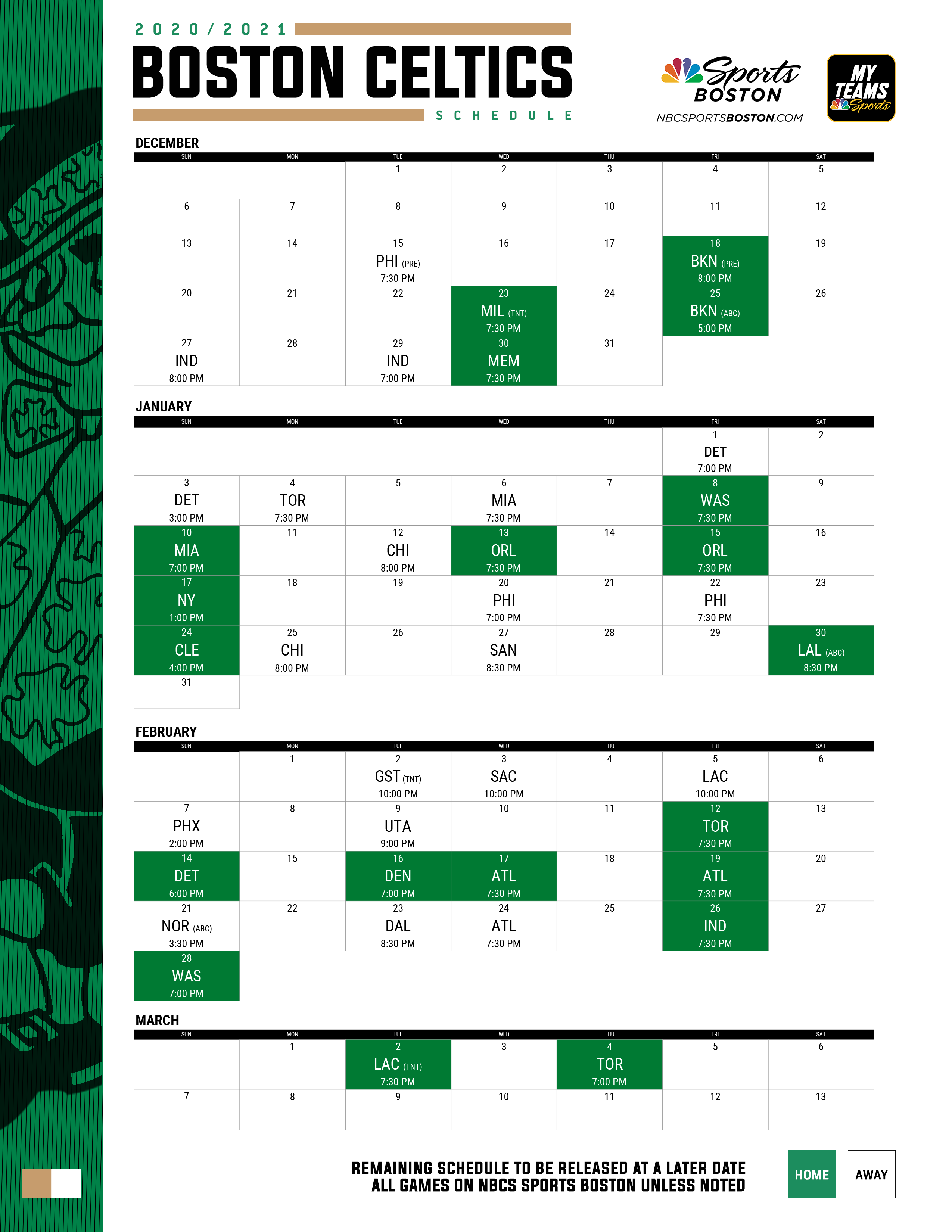

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Latest Posts

-

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025 -

Mindy Kalings Boyfriends From Bj Novak To Present

May 06, 2025

Mindy Kalings Boyfriends From Bj Novak To Present

May 06, 2025 -

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025

Mindy Kalings Peplum Power Hollywood Walk Of Fame Style

May 06, 2025 -

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025