Analyzing The Post-Election Australian Asset Market Trajectory

Table of Contents

Impact of Government Policies on Key Asset Classes

The new government's policies will significantly shape the Australian asset market's performance. Let's examine their potential impact on key asset classes:

Australian Real Estate Market Outlook

The Australian property market is highly sensitive to interest rate changes and government policy. The new government's approach to housing affordability and construction will be crucial.

- Interest Rate Impact: Further interest rate hikes by the Reserve Bank of Australia (RBA) are anticipated to cool the property market. Higher borrowing costs will reduce affordability, potentially leading to a slowdown in price growth or even price corrections, particularly in overheated segments of the Australian property market.

- Government Policies: Policies aimed at increasing housing supply, such as infrastructure investments or incentives for developers, could mitigate price declines. Conversely, policies that restrict foreign investment or tighten lending standards could further dampen the market. The housing market forecast will depend heavily on the government's effectiveness in addressing supply-side issues.

- Immigration Impact: Immigration levels significantly influence property demand. Increased immigration generally boosts rental demand and property prices. Changes to immigration policies could therefore have a considerable impact on the Australian property market. Property investment Australia will be influenced by these diverse factors.

Australian Stock Market Performance Predictions

The performance of the ASX (Australian Securities Exchange) is intrinsically linked to the government's economic policies.

- ASX Forecast: A focus on economic growth and business-friendly policies could lead to a positive outlook for the Australian share market. Conversely, increased government spending and potential tax increases might negatively affect corporate profits and investor sentiment. The election impact on ASX will depend on these policy specifics.

- Sector-Specific Winners and Losers: Certain sectors stand to benefit more than others. For example, infrastructure-related stocks could thrive if the government prioritizes infrastructure projects. Conversely, sectors heavily reliant on consumer spending might face headwinds if interest rates continue rising. Careful analysis of individual companies within the Australian share market is essential.

- Global Economic Factors: The Australian economy is not immune to global economic forces. Global recessionary fears or geopolitical instability can negatively influence investor confidence and lead to market volatility, affecting the stock market investment landscape.

Australian Bond Market Analysis

The Australian bond market will be influenced by the government's borrowing needs and the RBA's monetary policy.

- Bond Yields: Government borrowing to fund increased spending could push bond yields higher. Conversely, if the RBA cuts interest rates to stimulate the economy, bond yields might fall. Understanding these dynamics is critical for fixed income investment Australia.

- Inflation and Interest Rates: Inflation directly impacts bond prices. High inflation typically leads to higher interest rates and lower bond prices. The inflation impact on bonds is a significant consideration for investors. Analyzing the interplay between Australian bond market trends and bond yields is essential for informed decisions.

Economic Factors Influencing the Australian Asset Market

Beyond government policies, broader economic factors will significantly impact the Australian asset market.

Inflation and Interest Rate Projections

The RBA's response to inflation will be paramount.

- RBA Interest Rates: Further interest rate hikes are likely as the RBA aims to control inflation. These hikes will affect borrowing costs for individuals and businesses, influencing consumer spending and investment decisions. Keeping abreast of RBA interest rates is crucial for navigating the market.

- Inflation Australia: High inflation erodes purchasing power and can lead to decreased consumer confidence, potentially affecting various asset classes. Closely monitoring inflation Australia and its impact on economic growth Australia is vital. Understanding monetary policy Australia is also important.

Global Economic Uncertainty and its Impact

Global events will continue to impact Australia's economy and asset markets.

- Global Economic Outlook: Global recessionary fears and geopolitical tensions pose considerable risks to the Australian asset market. These global economic outlook factors can lead to increased market volatility and uncertainty.

- Geopolitical Risk: Geopolitical instability can significantly affect investor sentiment and lead to capital flight. Understanding and managing geopolitical risk is vital for diversification.

- Diversification Strategies: Diversifying investment portfolios across asset classes and geographies can help mitigate the impact of global economic outlook uncertainties. Strategic diversification strategies are essential to navigate the complexities of the Australian economy global impact.

Investment Strategies for the Post-Election Period

The post-election landscape presents both opportunities and risks.

Opportunities and Risks

Careful analysis is needed to identify promising investment opportunities while mitigating potential risks. Some sectors may thrive under the new government's policies, while others may face challenges. A thorough understanding of the government's policies and their likely impacts on different asset classes is crucial.

Diversification and Portfolio Management

Diversification remains a cornerstone of effective investment strategies. Spreading investments across various asset classes helps reduce overall portfolio risk. Regular portfolio rebalancing ensures your investments align with your risk tolerance and long-term goals.

Seeking Professional Advice

Before making any significant investment decisions, seeking advice from a qualified financial advisor is highly recommended. They can help you create a personalized investment strategy tailored to your specific needs and risk tolerance, assisting with risk management and portfolio management strategies. Using an investment strategy Australia focused on professional guidance is key.

Charting Your Course in the Post-Election Australian Asset Market

The post-election Australian asset market presents a dynamic and evolving landscape. The new government's policies, coupled with global economic factors, will shape the trajectory of different asset classes. While opportunities exist, it's crucial to carefully consider the inherent risks. Remember, understanding the interplay between the Australian property market, the ASX forecast, and broader economic growth Australia indicators is key to making sound investment decisions. Conduct thorough research, and, most importantly, seek professional advice before investing in the Australian asset market. Navigating the Australian asset market requires a well-informed approach; don't hesitate to seek help to optimize your investing in the Australian asset market strategy.

Featured Posts

-

Who Is Greg Abel Warren Buffetts Successor

May 06, 2025

Who Is Greg Abel Warren Buffetts Successor

May 06, 2025 -

Sam Altman Vs Elon Musk The Race To Build The Ultimate Everything App

May 06, 2025

Sam Altman Vs Elon Musk The Race To Build The Ultimate Everything App

May 06, 2025 -

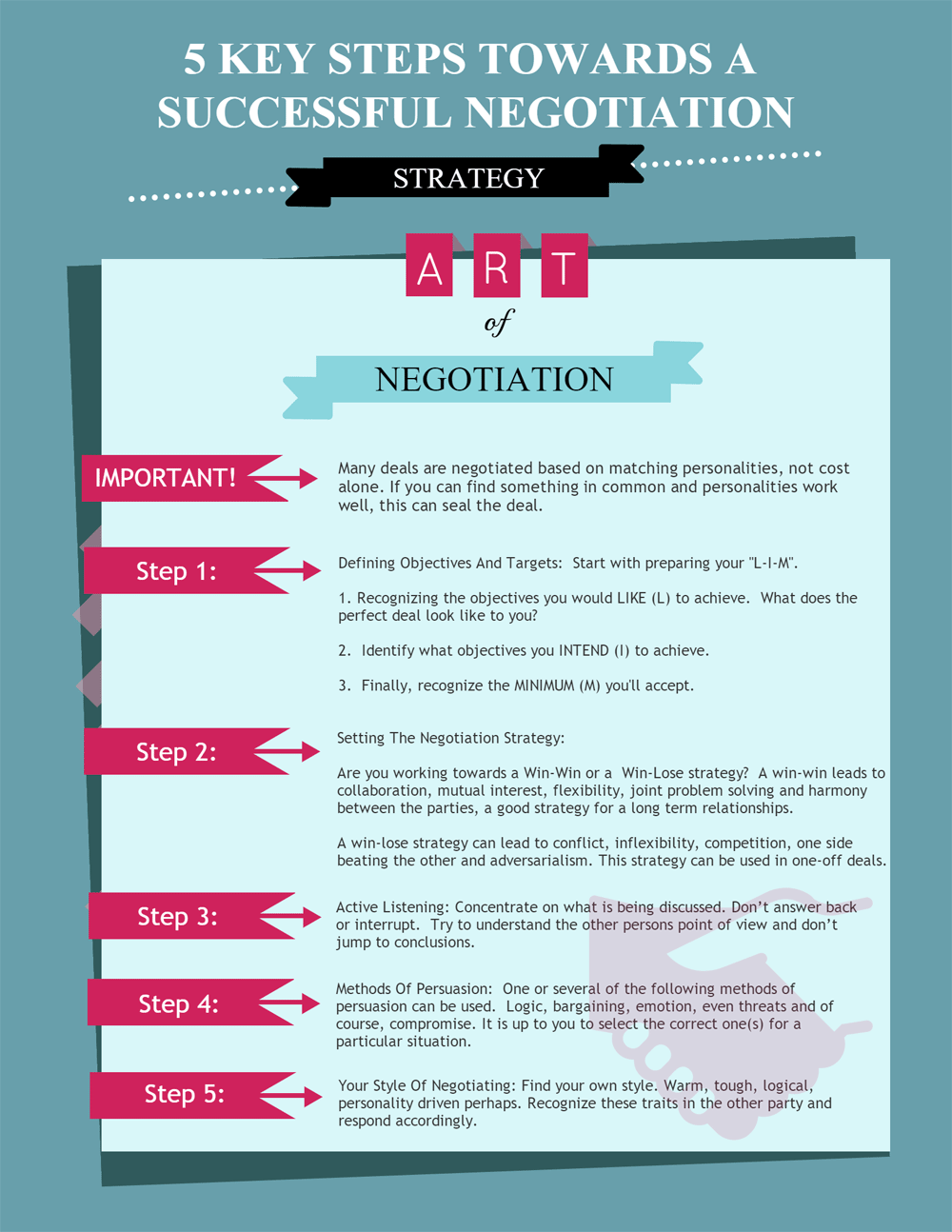

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025 -

Australian Asset Rally Predicted Post Election Analyst Insights

May 06, 2025

Australian Asset Rally Predicted Post Election Analyst Insights

May 06, 2025 -

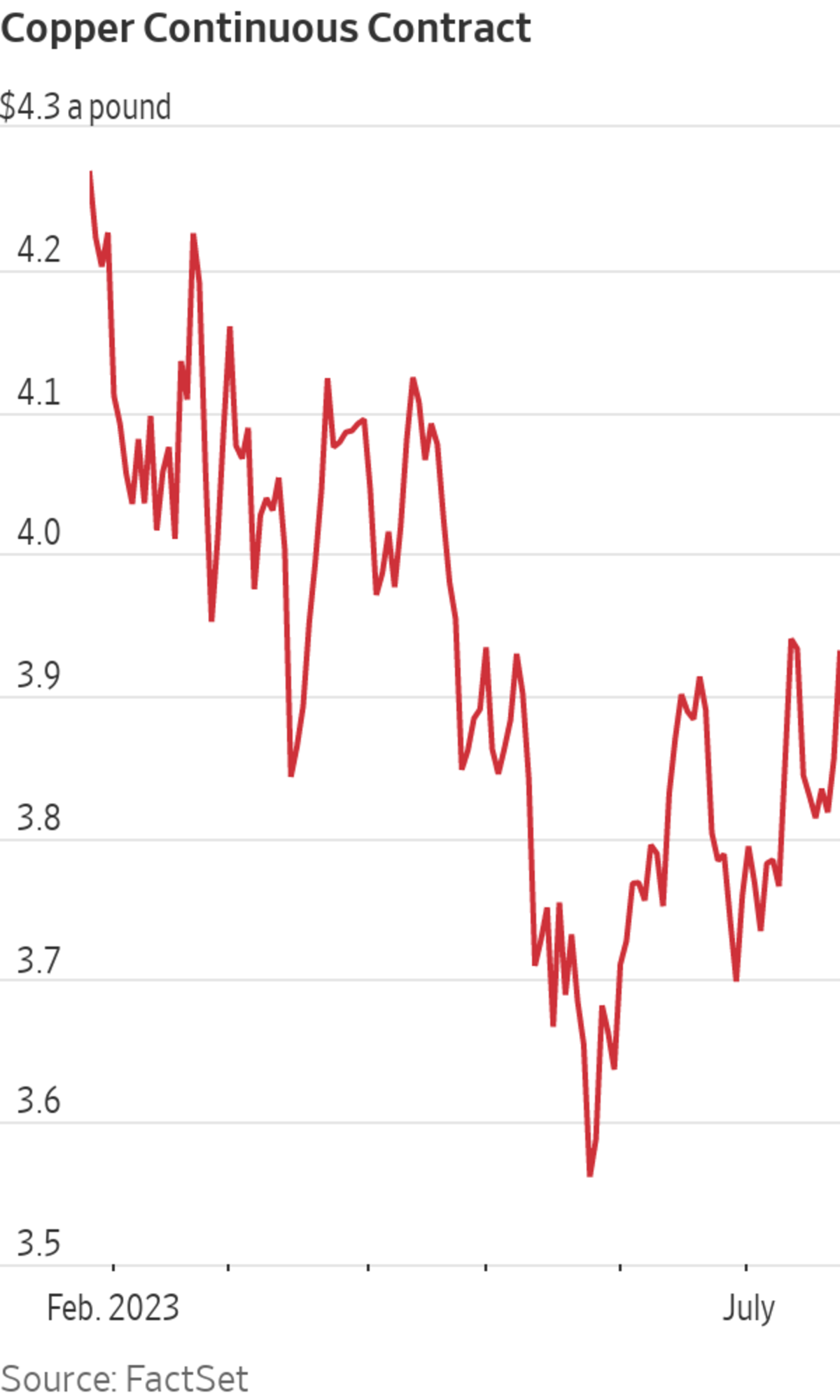

Impact Of China Us Trade Talks On Copper Market

May 06, 2025

Impact Of China Us Trade Talks On Copper Market

May 06, 2025

Latest Posts

-

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025 -

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025