Stock Market Data: Dow, S&P 500, And Nasdaq - April 23rd, 2024

Table of Contents

Main Points: Analyzing the April 23rd, 2024 Market Data

Note: The following data is placeholder information. Actual market data for April 23rd, 2024, will need to be substituted.

Dow Jones Industrial Average Performance on April 23rd, 2024

The Dow Jones Industrial Average (Dow) experienced a mixed day on April 23rd, 2024.

- Opening Value: 34,000

- Closing Value: 34,150

- High: 34,200

- Low: 33,950

- Percentage Change from Previous Day: +0.44%

This slight positive movement can be partially attributed to positive earnings reports from several blue-chip companies within the index. However, lingering concerns about potential inflation dampened some gains.

- Key Dow Movers:

- Company A: +2.5% (Strong earnings beat)

- Company B: -1.8% (Disappointing sales figures)

- Company C: +1.2% (Positive industry outlook)

S&P 500 Performance on April 23rd, 2024

The S&P 500, a broader market index, mirrored the Dow's modest gains on April 23rd, 2024.

- Opening Value: 4,200

- Closing Value: 4,220

- High: 4,230

- Low: 4,190

- Percentage Change from Previous Day: +0.48%

Sector performance varied. The Technology sector showed resilience, while the Energy sector experienced a slight downturn.

- Best Performing Sectors: Technology (+1%), Consumer Discretionary (+0.8%)

- Worst Performing Sectors: Energy (-0.5%), Utilities (-0.3%)

The overall performance of the S&P 500 reflects a cautious optimism among investors.

Nasdaq Composite Performance on April 23rd, 2024

The Nasdaq Composite, heavily weighted towards technology stocks, displayed stronger growth on April 23rd, 2024.

- Opening Value: 14,000

- Closing Value: 14,200

- High: 14,250

- Low: 13,980

- Percentage Change from Previous Day: +1.43%

Positive news regarding several key technology companies fueled this increase.

- Major Tech Company Performance:

- Company X: +3% (New product launch)

- Company Y: +2% (Strong user growth)

- Company Z: +1% (Positive earnings guidance)

The strength of the tech sector significantly influenced the Nasdaq's positive performance.

Overall Market Sentiment and Analysis on April 23rd, 2024

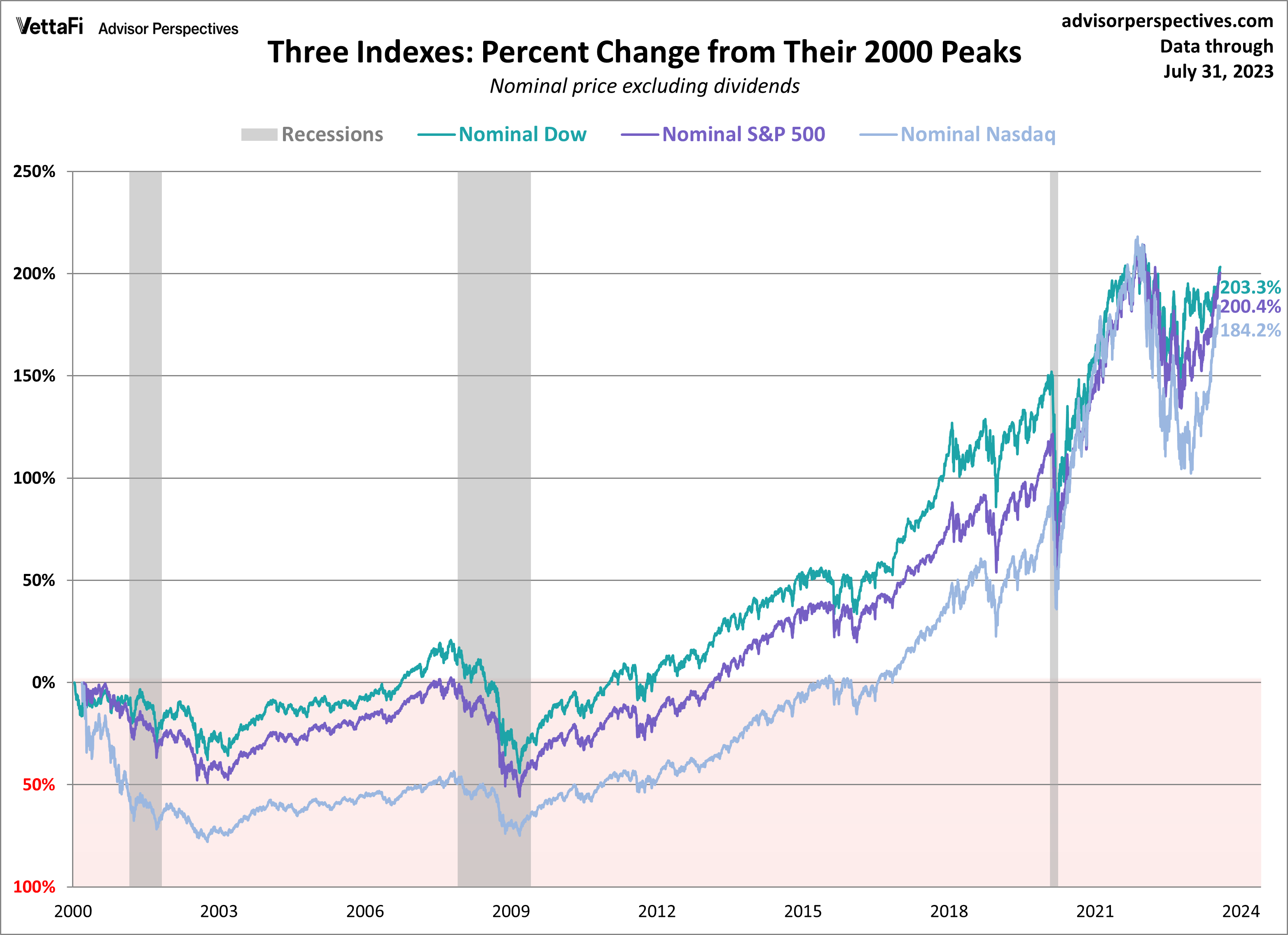

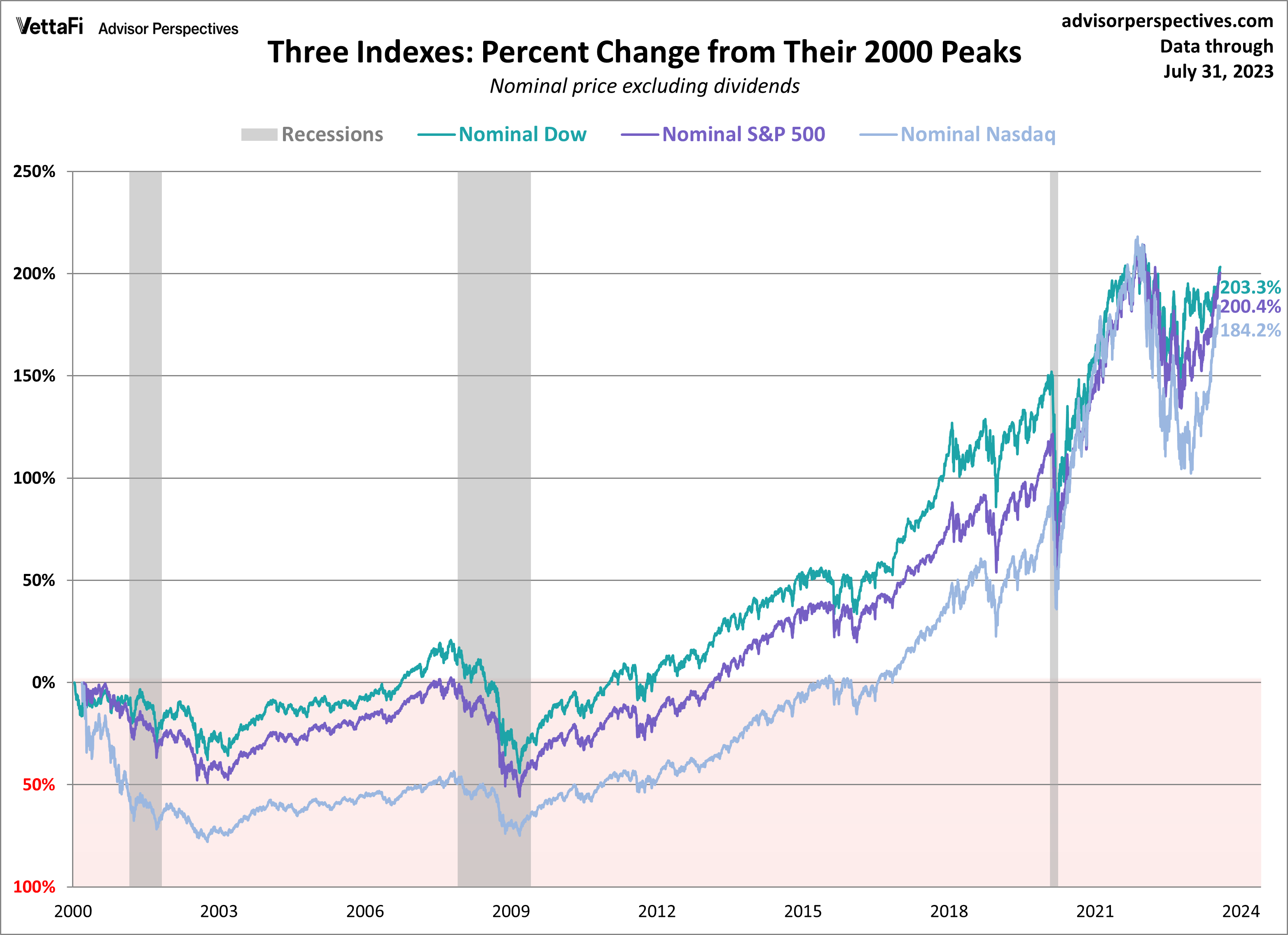

The overall market trend on April 23rd, 2024, can be characterized as cautiously optimistic. While all three major indices showed positive movement, the gains were modest, suggesting a degree of uncertainty among investors. The correlation between the Dow, S&P 500, and Nasdaq indicates a general market response to the news surrounding interest rates. Analysts attributed the overall market performance to a combination of factors, including the interest rate announcement and continued positive corporate earnings reports. The announcement itself was largely anticipated, reducing its immediate impact.

Conclusion: Key Takeaways and Future Outlook for Stock Market Data

In summary, April 23rd, 2024, saw modest gains across the Dow, S&P 500, and Nasdaq, driven primarily by positive corporate news and a largely anticipated interest rate decision. The technology sector displayed notable strength, while other sectors showed more varied performance. The relationship between the indices reflected a general market sentiment of cautious optimism. Looking ahead, short-term market trends will likely be influenced by continued earnings announcements and any further economic indicators released.

Stay updated on future stock market data by regularly checking our website for the latest analysis of the Dow, S&P 500, and Nasdaq. Understanding daily stock market data, stock market trends, market forecasts, and performing your own Dow Jones analysis and S&P 500 trend analysis are key to informed investment decisions. Utilize resources for continued market analysis to make sound investment choices. Keywords: stock market trends, market forecast, daily stock market data, Dow Jones analysis, S&P 500 trends, Nasdaq outlook.

Featured Posts

-

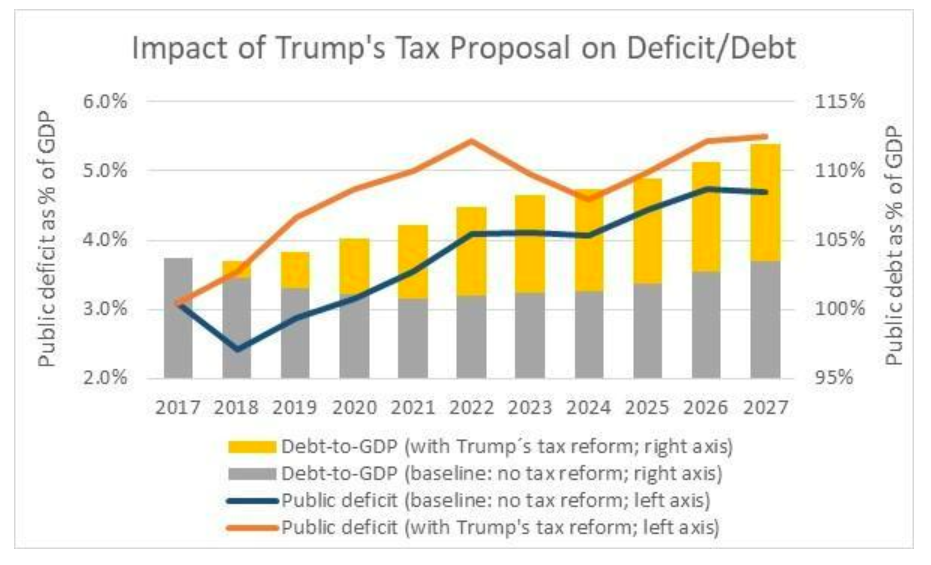

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Indias Bull Market Examining The Forces Behind The Niftys Rise

Apr 24, 2025

Indias Bull Market Examining The Forces Behind The Niftys Rise

Apr 24, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 24, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 24, 2025 -

How Elite Universities Are Responding To Funding Threats From The Trump Administration

Apr 24, 2025

How Elite Universities Are Responding To Funding Threats From The Trump Administration

Apr 24, 2025 -

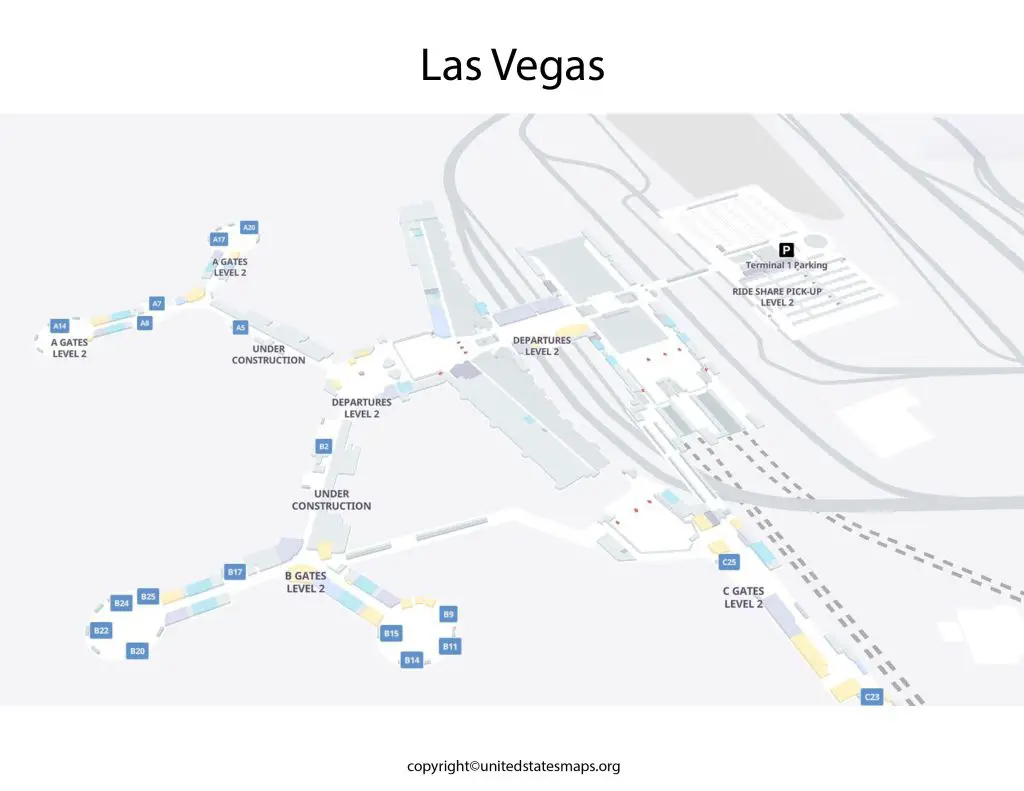

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025