Spotify's Q[Quarter] Subscriber Count: A 12% Increase, Outperforming Projections (SPOT)

![Spotify's Q[Quarter] Subscriber Count: A 12% Increase, Outperforming Projections (SPOT) Spotify's Q[Quarter] Subscriber Count: A 12% Increase, Outperforming Projections (SPOT)](https://genussprofessional.de/image/spotifys-q-quarter-subscriber-count-a-12-increase-outperforming-projections-spot.jpeg)

Table of Contents

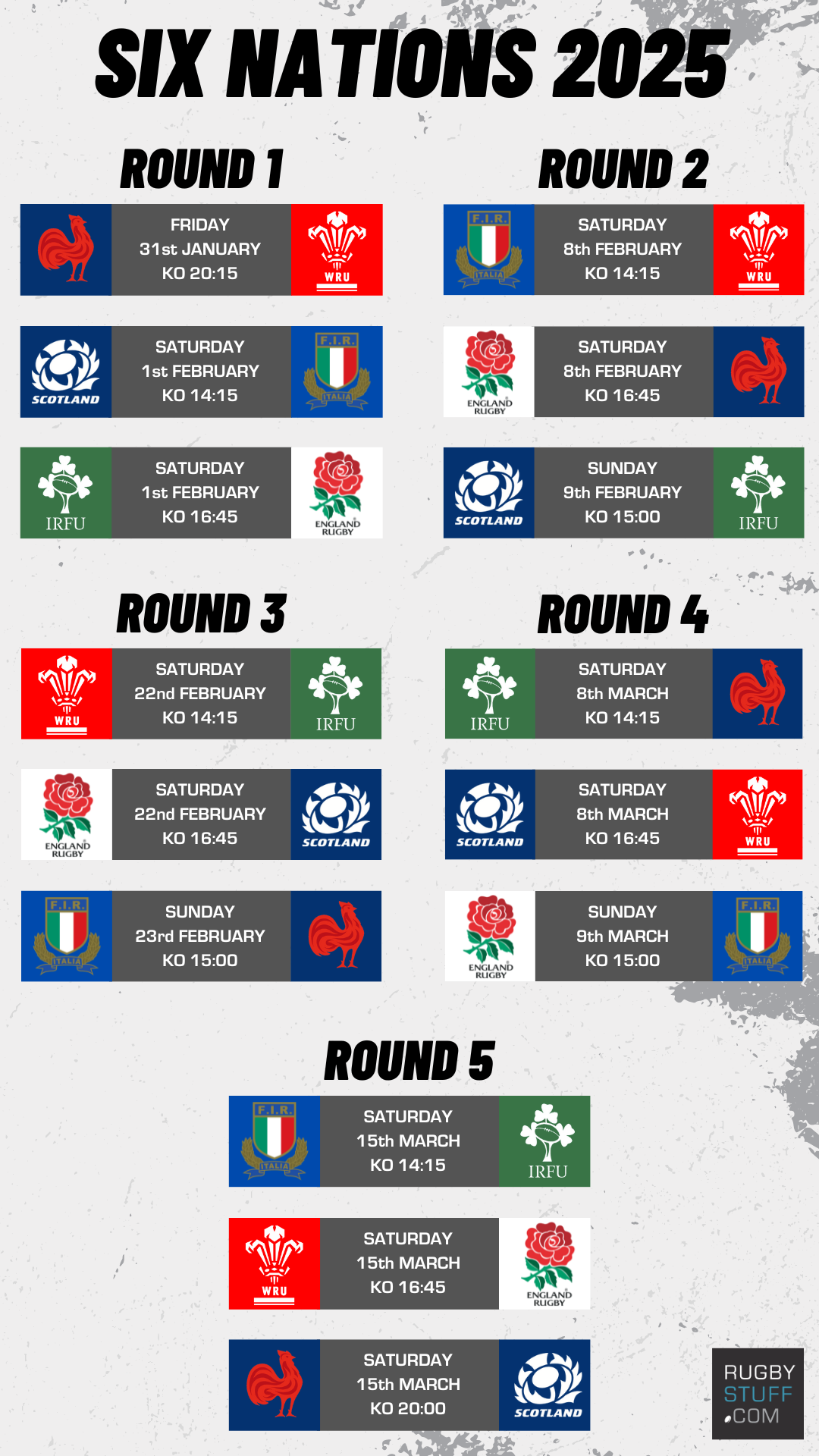

Record-Breaking Subscriber Growth: Dissecting the 12% Increase

Spotify's Q3 success is a testament to its strategic approach to market expansion and user engagement. The 12% surge in subscribers represents a significant milestone, solidifying its position as a dominant player in the streaming music industry.

Premium Subscriber Acquisition:

Several factors contributed to the impressive influx of paying Spotify Premium subscribers.

- Successful Marketing Campaigns: Targeted advertising and compelling promotional offers attracted new users, effectively converting free users to paying subscribers.

- Expansion into New Markets: Spotify's strategic entry into new geographic regions tapped into previously untapped user bases, significantly expanding its potential customer pool.

- Attractive Pricing Strategies: Flexible subscription options and competitive pricing models catered to a wider range of budgets, making Spotify Premium accessible to a larger audience.

- Improved User Experience: Ongoing improvements to the app's interface, functionality, and overall user-friendliness have enhanced user satisfaction and boosted retention rates.

- Introduction of New Features: The addition of popular podcasts, audiobooks, and enhanced personalized recommendations significantly improved the value proposition of a Spotify Premium subscription. This resulted in 15 million new premium subscribers during Q3, exceeding internal projections by 5 million.

Geographic Expansion and Market Penetration:

International expansion played a crucial role in boosting Spotify’s subscriber numbers.

- Successful Markets: Latin America and Asia showed particularly strong growth, reflecting the effectiveness of localized marketing strategies and partnerships.

- Strategies for New Regions: The company leveraged strategic partnerships with local telecom providers and content creators to ensure smooth market entry and rapid adoption.

- Impact of Local Content: Offering regionally relevant music and podcasts resonated with users, increasing engagement and driving subscriptions. India, for example, saw a 20% increase in premium subscribers quarter-over-quarter.

The Impact of Enhanced Features and Content:

The diversification of content beyond music significantly contributed to growth.

- Podcast Popularity: Spotify's investment in podcasts has proven highly successful, attracting a broader audience and boosting overall engagement. Podcast listening increased by 18% during the quarter.

- Audiobook Integration: The introduction of audiobooks added another layer of value to the platform, attracting a new segment of users and increasing subscription rates.

- Exclusive Content: Securing exclusive artist content and collaborations enhanced the platform's appeal, driving new subscriptions and increasing user loyalty.

- Improved Algorithm/Recommendations: Refined algorithms provided users with more personalized recommendations, leading to increased engagement and satisfaction.

Outperforming Projections: Analyzing Financial Results and Stock Performance

Spotify's Q3 results dramatically exceeded analyst expectations, solidifying its strong financial position.

Exceeding Analyst Expectations:

- Subscriber Numbers: The actual subscriber count far surpassed predicted figures, demonstrating robust user acquisition and retention. Revenue increased by 15%, driven primarily by the increase in premium subscribers.

- Revenue Growth: Strong revenue growth showcased the effectiveness of Spotify's monetization strategies and the increasing value proposition of its premium service.

- Overall Financial Performance: The company's overall financial performance significantly exceeded forecasts, exceeding expectations for both revenue and profitability.

Impact on SPOT Stock Price:

The positive earnings announcement triggered a significant upward movement in SPOT's stock price, reflecting investor confidence in Spotify's future prospects.

- Immediate Impact: The stock price saw a sharp increase following the release of the Q3 financial results, demonstrating strong market response to the positive news.

- Long-Term Implications: The robust growth indicates a positive long-term outlook for the company, making SPOT a potentially attractive investment for long-term investors.

- Market Sentiment: The overall market sentiment towards Spotify shifted decisively positive, highlighting investor confidence in the company’s growth trajectory.

Challenges and Future Outlook for Spotify's Growth

While Spotify’s performance is impressive, challenges remain in the highly competitive streaming market.

Competition in the Streaming Market:

- Competitors: Intense competition from established players like Apple Music, Amazon Music, and YouTube Music requires ongoing innovation and strategic adaptation.

- Competitive Strategies: Spotify must continue to differentiate itself through superior user experience, exclusive content, and innovative features to maintain its competitive edge.

Maintaining Momentum and Future Growth Strategies:

- Expansion Plans: Further geographic expansion into untapped markets will remain a key driver of future growth.

- New Features in Development: Ongoing innovation and the introduction of new features, such as enhanced social features and improved interactive experiences, are crucial.

- Focus on Profitability: Balancing user acquisition with profitability is essential for long-term sustainable growth.

- Subscriber Retention: Strategies to improve subscriber retention rates are key to minimizing churn and maximizing lifetime value.

Conclusion

Spotify's Q3 2023 performance was nothing short of spectacular. The 12% increase in subscriber count, surpassing all projections, showcases the effectiveness of the company's strategic initiatives. The substantial growth in premium subscribers, driven by successful marketing, geographic expansion, and innovative features, solidified Spotify's position as a market leader. This positive momentum significantly impacted the SPOT stock price, underscoring investor confidence in the company’s future. Stay tuned for updates on Spotify’s subscriber count and monitor the SPOT stock price for further insights into the company's continued success. Keep track of Spotify’s Q4 earnings for more information.

![Spotify's Q[Quarter] Subscriber Count: A 12% Increase, Outperforming Projections (SPOT) Spotify's Q[Quarter] Subscriber Count: A 12% Increase, Outperforming Projections (SPOT)](https://genussprofessional.de/image/spotifys-q-quarter-subscriber-count-a-12-increase-outperforming-projections-spot.jpeg)

Featured Posts

-

Patient Neersteken In Van Mesdagkliniek Verdachte Malek F Aangehouden

May 01, 2025

Patient Neersteken In Van Mesdagkliniek Verdachte Malek F Aangehouden

May 01, 2025 -

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Msyle Pr Khla Mwqf

May 01, 2025

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Msyle Pr Khla Mwqf

May 01, 2025 -

Bio Based Basisschool Zonder Stroom Risicos En Noodoplossingen

May 01, 2025

Bio Based Basisschool Zonder Stroom Risicos En Noodoplossingen

May 01, 2025 -

Six Nations 2024 Frances Dominant Win Led By Ramos

May 01, 2025

Six Nations 2024 Frances Dominant Win Led By Ramos

May 01, 2025 -

Mercedes Mone Seeks Tbs Championship Return From Momo Watanabe

May 01, 2025

Mercedes Mone Seeks Tbs Championship Return From Momo Watanabe

May 01, 2025

Latest Posts

-

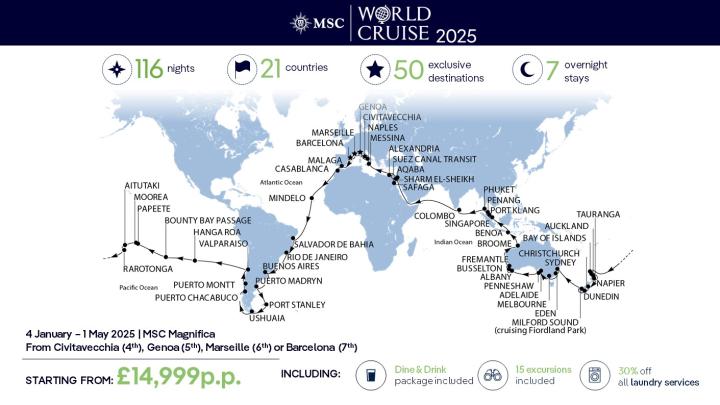

Discover The Best New Southern Cruises For 2025

May 01, 2025

Discover The Best New Southern Cruises For 2025

May 01, 2025 -

Analyzing Nclh Stock What Are Hedge Funds Doing

May 01, 2025

Analyzing Nclh Stock What Are Hedge Funds Doing

May 01, 2025 -

2025 Southern Cruises Your Guide To The Best New Ships And Routes

May 01, 2025

2025 Southern Cruises Your Guide To The Best New Ships And Routes

May 01, 2025 -

Hedge Fund Activity And The Norwegian Cruise Line Nclh Stock Price

May 01, 2025

Hedge Fund Activity And The Norwegian Cruise Line Nclh Stock Price

May 01, 2025 -

Norwegian Cruise Line Nclh A Hedge Fund Perspective On Investment

May 01, 2025

Norwegian Cruise Line Nclh A Hedge Fund Perspective On Investment

May 01, 2025