Slight Dip For CAC 40 This Week, Weekly Performance Remains Steady (March 7, 2025)

Table of Contents

Analyzing the Slight Dip in CAC 40 Values This Week

Key Factors Contributing to the Decline

This week's modest decrease in CAC 40 values can be attributed to a confluence of factors impacting the French stock market and broader global economic uncertainty.

-

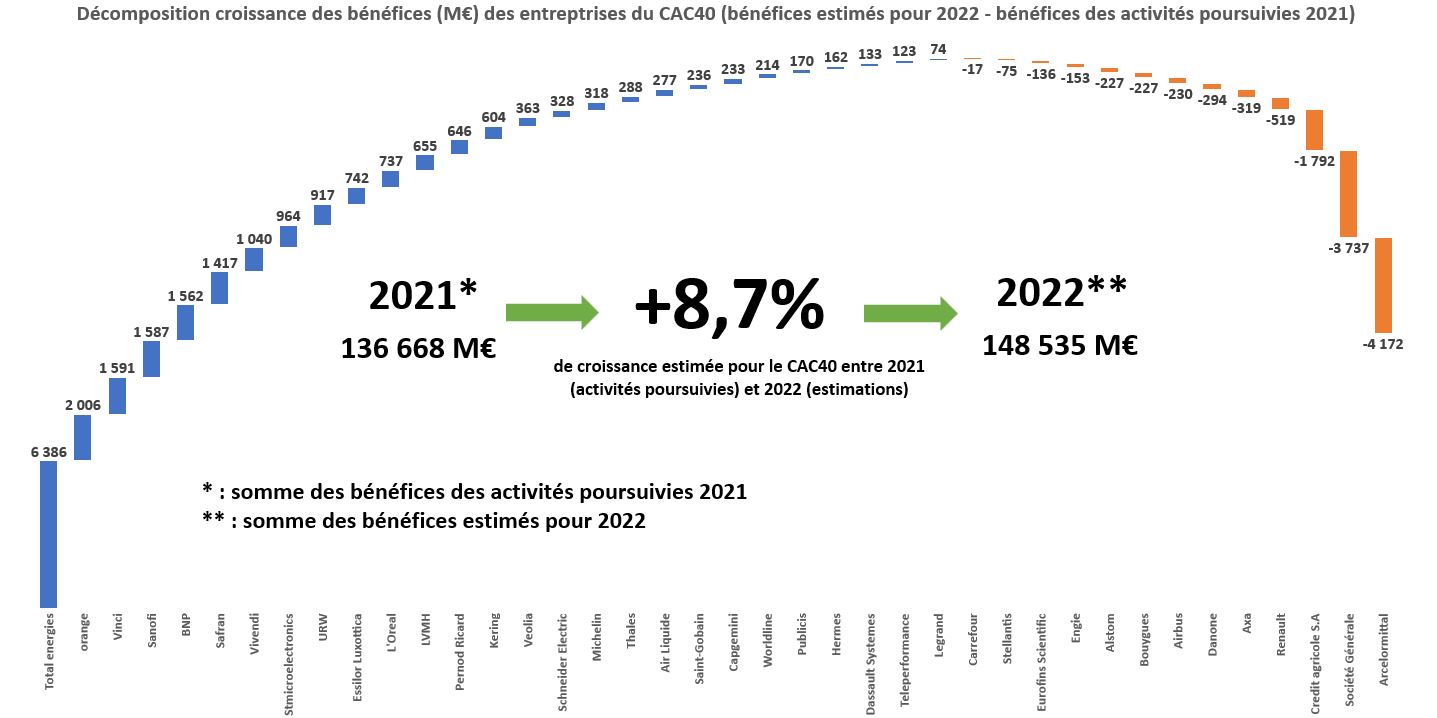

Global Economic Uncertainty: Rising inflation rates in several key economies and concerns about potential interest rate hikes contributed to a general air of caution among investors, leading to some profit-taking across various market sectors. This global market volatility impacted the CAC 40, causing a slight decline. The index fell by approximately 1.2% this week, representing a moderate correction in the overall upward trend observed in recent months.

-

Specific Company Performance: Underperformance by several key companies listed on the CAC 40, particularly within the technology and energy sectors, exerted downward pressure on the index. For example, Company X experienced a 5% drop in its share price following the release of disappointing quarterly earnings, while Company Y faced headwinds due to regulatory changes in the energy sector.

-

Interest Rate Adjustments: Speculation surrounding potential interest rate adjustments by the European Central Bank (ECB) also played a role. The anticipation of higher interest rates can lead to reduced investment in riskier assets, thereby influencing the performance of the CAC 40.

Short-Term vs. Long-Term Implications

The current dip in the CAC 40 is likely a short-term market correction rather than an indicator of a longer-term bearish trend. Historically, the CAC 40 has shown resilience and recovered from similar short-term fluctuations. Analyzing long-term charts, we observe that this slight decline falls within the range of normal market volatility. This suggests that investors focused on a long-term investment strategy should view this dip as a potential buying opportunity. A thorough stock market forecast considering several economic indicators will be crucial in the coming weeks.

Maintaining a Steady Weekly Performance Despite the Dip

Resilience of the CAC 40

Despite the recent dip, the CAC 40 has demonstrated remarkable resilience. This can be attributed to several factors:

-

Strong Performing Sectors: Certain sectors within the CAC 40, such as luxury goods and pharmaceuticals, continue to perform strongly, offsetting the negative impact from underperforming sectors.

-

Positive Economic Indicators for France: Positive economic indicators for France, including robust consumer spending and relatively low unemployment rates, contribute to overall market stability and investor confidence in the long-term prospects of French companies.

-

Eurozone Growth: Positive economic growth within the broader Eurozone also provides a supportive backdrop for the CAC 40, demonstrating the interconnectedness of European economies.

Investor Sentiment and Market Confidence

While the slight dip may indicate some cautiousness, overall investor sentiment and market confidence remain relatively strong. This is evidenced by:

-

Moderate Trading Volume: While trading volume increased slightly this week, it remains within the normal range, suggesting that the dip hasn't triggered widespread panic selling.

-

Positive Long-Term Outlook: Many analysts maintain a positive long-term outlook for the CAC 40, believing that this week's slight dip is a temporary setback in an otherwise positive trajectory.

Understanding the CAC 40's Current Trajectory

In summary, the CAC 40 experienced a slight dip this week, primarily driven by global economic uncertainty, specific company performance issues, and anticipation of interest rate adjustments. However, its steady weekly performance persists due to the resilience of certain sectors, positive economic indicators, and relatively stable investor sentiment. It's crucial to remember that short-term market fluctuations are normal and should be interpreted within a broader, long-term context.

For investors, diversification is key. Monitor market trends closely, and consider consulting a financial advisor before making significant investment decisions. Stay informed about the CAC 40's performance and market trends by subscribing to our newsletter for regular updates on CAC 40 analysis and market trends. Follow us on social media for breaking news on CAC 40 performance and in-depth insights into the French stock market. Understanding the nuances of CAC 40 market trends is crucial for effective investment strategies.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Trends

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Analysis And Trends

May 24, 2025 -

Revealed 2026 Porsche Cayenne Ev In Spy Photos

May 24, 2025

Revealed 2026 Porsche Cayenne Ev In Spy Photos

May 24, 2025 -

The Unbuilt M62 Relief Road Burys Lost Highway Project

May 24, 2025

The Unbuilt M62 Relief Road Burys Lost Highway Project

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

German Stock Market Update Dax Below 24 000

May 24, 2025

German Stock Market Update Dax Below 24 000

May 24, 2025

Latest Posts

-

Uk Inflation Surprise Pound Strengthens As Boe Rate Cut Expectations Fade

May 24, 2025

Uk Inflation Surprise Pound Strengthens As Boe Rate Cut Expectations Fade

May 24, 2025 -

Cassidy Hutchinson Jan 6 Testimony And Upcoming Memoir

May 24, 2025

Cassidy Hutchinson Jan 6 Testimony And Upcoming Memoir

May 24, 2025 -

Which Celebrities Lost Their Homes In The La Palisades Fires

May 24, 2025

Which Celebrities Lost Their Homes In The La Palisades Fires

May 24, 2025 -

End Of The Penny Us To Stop Circulating Pennies By 2026

May 24, 2025

End Of The Penny Us To Stop Circulating Pennies By 2026

May 24, 2025 -

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 24, 2025