UK Inflation Surprise: Pound Strengthens As BOE Rate Cut Expectations Fade

Table of Contents

Unexpected Drop in UK Inflation

Lower-than-Expected Inflation Figures

The latest inflation figures released by the Office for National Statistics (ONS) revealed a considerable slowdown in the UK's inflation rate. The Consumer Price Index (CPI) fell to 6.8% in July, down from 7.9% in June and significantly lower than the analyst predictions of around 7.4%. This represents a considerable easing of inflationary pressures compared to previous months and the peak of 11.1% reached in October 2022.

- CPI: July 2023 – 6.8%, June 2023 – 7.9%, Year-on-year change: Significant decrease.

- RPI (Retail Price Index): [Insert July 2023 RPI figure and comparison to previous months].

- Contributing factors include easing energy prices, particularly natural gas, and a moderation in demand due to the ongoing cost of living crisis.

Impact on Consumer Spending

The lower-than-expected inflation figures could positively impact consumer spending. Reduced inflationary pressures may lead to:

- Increased consumer confidence, as households feel less squeezed by rising prices.

- A potential increase in discretionary spending, boosting retail sales and economic activity.

However, it’s crucial to note that inflation remains stubbornly high in specific sectors, such as food and housing, which could continue to constrain consumer spending for many households. The full impact on consumer behaviour remains to be seen and requires ongoing monitoring.

BOE Rate Cut Expectations Diminish

Shift in Monetary Policy Expectations

The unexpected decline in UK inflation significantly reduces the pressure on the BOE to implement further interest rate cuts. The market had previously priced in a substantial likelihood of further reductions in interest rates to stimulate economic growth and combat persistent inflation. However, the latest data suggests that the BOE might pause or even potentially consider a rate hike in the coming months.

- Previous BOE predictions: [Mention previous BOE statements and forecasts regarding interest rates].

- Market reaction: A notable shift in market sentiment is evident in the reduced yield on UK government bonds (gilts) following the inflation announcement.

- Future BOE meetings: The upcoming BOE meetings will be closely watched for clues on the future direction of monetary policy.

This shift has implications for both borrowers and savers. Lower interest rates benefit borrowers by reducing mortgage and loan repayments, while higher rates offer better returns for savers.

Implications for the UK Economy

The unexpected inflation figures and the diminished likelihood of further rate cuts have broad implications for the UK economy.

- Economic growth: Lower inflation could support economic growth by boosting consumer spending and business investment.

- Employment levels: The impact on employment is complex and depends on the interplay of various economic factors.

- Government borrowing costs: Lower inflation could reduce government borrowing costs, improving the UK's fiscal position.

However, the potential downsides also need consideration. Lingering inflation in specific sectors could still hinder growth, while the absence of further rate cuts might not provide sufficient stimulus for a struggling economy.

Pound Sterling Strengthens

Currency Exchange Rate Fluctuations

The surprise drop in inflation has led to a strengthening of the Pound Sterling against other major currencies.

- Exchange rate data: The GBP/USD exchange rate has shown [Insert specific data on exchange rate changes following the inflation announcement], reflecting increased market confidence in the UK economy. Similarly, the GBP/EUR rate has shown [Insert specific data].

- Market trends: This strengthening reflects investor sentiment and suggests a positive outlook for the UK economy.

This fluctuation has implications for UK exporters and importers. A stronger Pound makes UK exports more expensive in foreign markets, potentially impacting export volumes. Conversely, it makes imports cheaper.

Investor Sentiment and Market Confidence

The unexpected inflation figures have boosted investor confidence and market sentiment towards the UK economy.

- Stock market indices: The FTSE 100 index has shown [Insert relevant data on stock market performance].

- Bond yields: [Mention changes in bond yields following the inflation announcement].

The long-term outlook for the Pound depends on several factors, including the trajectory of inflation, the BOE's monetary policy decisions, and global economic conditions. The current strengthening suggests a positive short-term outlook, but sustained strength will rely on continued economic stability.

Conclusion

The unexpected drop in UK inflation has resulted in a significant shift in market expectations, leading to a reduction in BOE rate cut predictions and a strengthening of the Pound Sterling. This development holds significant implications for the UK economy, impacting consumer spending, investor confidence, and the nation’s economic growth trajectory. The interplay between inflation, interest rates, and currency exchange rates remains complex and requires continuous monitoring.

Call to Action: Stay informed about the evolving situation of UK inflation and its impact on the Pound Sterling. Follow our website for further updates and analysis on UK inflation and its influence on the Pound. Regularly check our insights on the UK economy and BOE interest rate decisions. Understanding UK inflation is crucial for navigating the current economic landscape.

Featured Posts

-

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025

Dylan Dreyer And Brian Ficheras Family Celebrates A Joyful Update

May 24, 2025 -

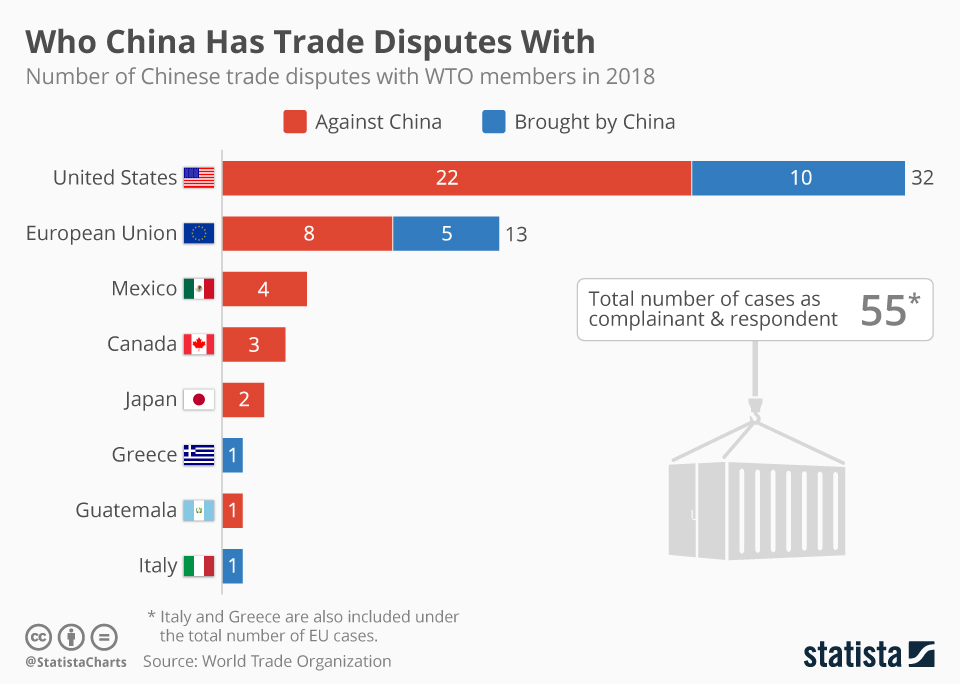

China And Us Trade Relations A Window Of Opportunity

May 24, 2025

China And Us Trade Relations A Window Of Opportunity

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Ricchezza Mondiale 2025 Musk Batte Zuckerberg E Bezos Nella Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

Ricchezza Mondiale 2025 Musk Batte Zuckerberg E Bezos Nella Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

Latest Posts

-

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025 -

Lithuanias Gaubas Defeats Shapovalov In Rome

May 24, 2025

Lithuanias Gaubas Defeats Shapovalov In Rome

May 24, 2025 -

Bjk Cup Kazakhstan Reaches Final Australia Eliminated

May 24, 2025

Bjk Cup Kazakhstan Reaches Final Australia Eliminated

May 24, 2025 -

Kazakhstan Through To Bjk Cup Final After Australia Defeat

May 24, 2025

Kazakhstan Through To Bjk Cup Final After Australia Defeat

May 24, 2025 -

Andreescu Cruises Past First Round At Madrid Open

May 24, 2025

Andreescu Cruises Past First Round At Madrid Open

May 24, 2025