Significant Drop In Amsterdam Stock Exchange: AEX Index Down Over 4%

Table of Contents

Causes of the AEX Index Plunge

Several interconnected factors contributed to the dramatic fall of the AEX Index.

Global Market Volatility

The current global economic climate is characterized by considerable uncertainty. Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent geopolitical instability are all putting downward pressure on global markets, impacting the AEX Index significantly.

- Rising inflation: Persistent high inflation erodes purchasing power and increases the cost of borrowing, dampening economic growth and investor confidence. This is evident in soaring energy prices and supply chain disruptions.

- Interest rate hikes: Central banks, including the European Central Bank (ECB), are aggressively raising interest rates to combat inflation. This increases borrowing costs for businesses, potentially slowing economic activity and impacting corporate earnings, leading to lower stock valuations. The Federal Reserve's actions in the US also have a ripple effect on global markets, including the AEX Index.

- Geopolitical instability: The ongoing war in Ukraine, along with other geopolitical tensions, creates uncertainty and risk aversion in global markets. This uncertainty leads investors to seek safer havens, often resulting in a sell-off in riskier assets, like those represented in the AEX Index. This is reflected in the performance of similar indices like the Dow Jones and Nasdaq.

Sector-Specific Weakness

The decline in the AEX Index isn't uniform across all sectors. Certain sectors experienced significantly greater losses than others.

- Technology Sector: The tech sector, particularly companies reliant on high valuations and future growth, has been particularly hard hit, reflecting broader global concerns about a potential tech slowdown. Companies like ASML Holding, a key player in the semiconductor industry, saw significant share price drops.

- Energy Sector: Despite high energy prices, the energy sector also faced headwinds, potentially influenced by concerns about future demand and regulatory changes.

- Financials Sector: Banks and financial institutions also experienced losses, reflecting concerns about the impact of rising interest rates on lending and profitability. ING Groep and ABN AMRO, two major Dutch banking groups, were affected.

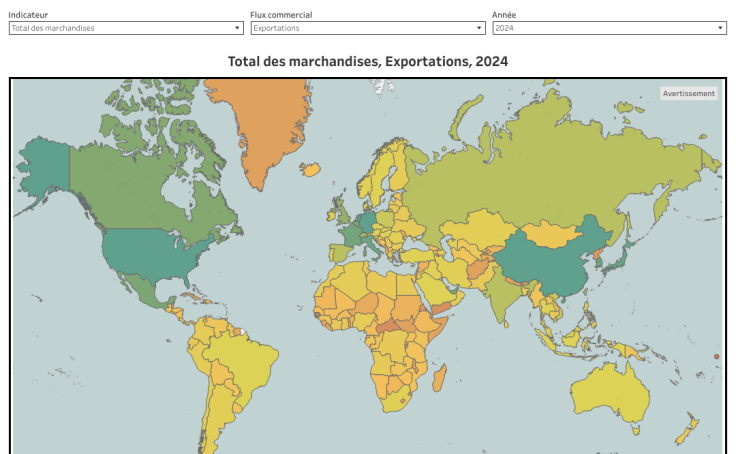

[Insert chart or graph illustrating sector performance here]

Investor Sentiment and Market Psychology

The sharp drop in the AEX Index reflects a significant shift in investor sentiment. Increased risk aversion and a potential sell-off driven by fear and uncertainty are major contributing factors.

- Risk aversion: Investors are moving away from riskier assets, preferring safer investments like government bonds, leading to a sell-off in the stock market.

- Sell-offs: Panic selling exacerbates the decline as investors rush to reduce their exposure to the market. This creates a downward spiral, amplifying the initial drop.

- Analyst comments: "The current market downturn reflects a confluence of global headwinds and concerns about future economic growth," stated [Name of Financial Analyst], senior economist at [Financial Institution].

Impact of the AEX Index Drop

The fall in the AEX Index has wide-ranging consequences.

Implications for Dutch Companies

Listed Dutch companies are directly impacted by the AEX Index decline.

- Lower valuations: Company valuations are directly linked to stock prices; the drop in the AEX Index leads to lower market capitalization for Dutch companies.

- Reduced profitability: Lower stock prices can impact a company's ability to raise capital through equity offerings.

- Investment slowdown: Uncertainty can lead companies to postpone or cancel investment plans, hindering future growth. This impacts job creation and economic development. Examples include companies in the construction and manufacturing sectors.

Economic Consequences for the Netherlands

The AEX Index downturn has broader implications for the Dutch economy.

- GDP Growth: A decline in the stock market can negatively impact consumer and business confidence, potentially slowing down GDP growth.

- Employment: Reduced investment and slower economic growth can lead to job losses and increased unemployment.

- Consumer confidence: The market decline can negatively impact consumer confidence, reducing spending and further impacting economic activity.

Investor Reactions and Strategies

Investors are reacting to the market downturn in various ways.

- Diversification: Investors are likely diversifying their portfolios to mitigate risk, shifting away from heavily impacted sectors.

- Risk Management: Increased focus on risk management strategies such as hedging and stop-loss orders.

- Potential Opportunities: Some investors may view the downturn as a buying opportunity, seeking to acquire undervalued assets.

AEX Index Forecast and Future Outlook

Predicting the future trajectory of the AEX Index is challenging, but analysts offer some insights.

Analyst Predictions

Analysts' predictions for the AEX Index vary. Some forecast a continued decline, while others predict a recovery based on various factors.

- [Analyst 1] predicts further decline due to persistent global uncertainty.

- [Analyst 2] suggests a potential recovery in the medium term based on expectations of easing inflation.

- [Analyst 3] emphasizes the importance of future policy decisions by the ECB in shaping the market's future direction.

Potential for Recovery

Several factors could contribute to a rebound in the AEX Index.

- Easing inflation: A reduction in inflation could boost investor confidence and lead to higher stock valuations.

- Geopolitical stability: Resolution of geopolitical conflicts could reduce uncertainty and attract investment.

- Government intervention: Government policies aimed at stimulating economic growth could help to improve market sentiment.

Conclusion

The significant drop in the AEX Index, exceeding 4%, is a result of a confluence of factors including global market volatility, sector-specific weakness, and shifting investor sentiment. This decline has serious implications for Dutch companies, the broader Dutch economy, and investors. Understanding the intricacies of the AEX Index and the factors influencing it is vital for navigating the current market conditions. Stay updated on the latest developments affecting the AEX Index and understand the risks and opportunities within the Dutch market. Continued monitoring of the AEX Index and related economic indicators is crucial for informed investment decisions.

Featured Posts

-

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025 -

Guccis Massimo Vian Departs Supply Chain Shake Up

May 24, 2025

Guccis Massimo Vian Departs Supply Chain Shake Up

May 24, 2025 -

Us Dutch Trade Conflict Impact On Dutch Stock Market

May 24, 2025

Us Dutch Trade Conflict Impact On Dutch Stock Market

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025