Should You Refinance Your Federal Student Loans?

Table of Contents

Understanding Federal Student Loan Programs and Benefits

Before diving into refinancing, it's crucial to understand the intricacies of federal student loan programs. These programs offer various loan types, each with its own set of terms and conditions. Common types include Direct Subsidized Loans, Direct Unsubsidized Loans, and Grad PLUS Loans. These loans come with significant benefits, which are often lost upon refinancing.

- Income-driven repayment plans: These plans adjust your monthly payments based on your income and family size, making repayment more manageable.

- Deferment and forbearance: These options allow you to temporarily suspend or reduce your payments during periods of financial hardship.

- Student loan forgiveness programs: Certain programs, such as Public Service Loan Forgiveness (PSLF), can lead to the complete forgiveness of your federal student loans after a period of qualifying employment.

However, refinancing your federal student loans means surrendering these valuable protections. Losing access to income-driven repayment, deferment, forbearance, and loan forgiveness programs could have significant long-term financial consequences. Carefully consider the potential drawbacks before making a decision. Weighing the benefits of lower monthly payments against the loss of these crucial federal safeguards is key.

Exploring the Advantages of Refinancing Federal Student Loans

While losing federal protections is a significant consideration, refinancing federal student loans also presents several compelling advantages. Many borrowers find that refinancing offers:

- Lower interest rates: Private lenders often offer lower interest rates than the federal government, potentially saving you thousands of dollars over the life of your loan. Shopping around and comparing student loan refinancing rates is essential to securing the best deal.

- Shorter repayment terms: Refinancing can allow you to shorten your repayment period, leading to faster debt payoff and significant long-term savings. A shorter loan term typically translates to higher monthly payments, so carefully assess your budget before opting for this route.

- Simplified repayment: Consolidating multiple federal loans into a single private loan simplifies your repayment process, managing everything through one lender. This streamlined approach can be very helpful for those juggling several different loan servicers.

The potential savings from lower interest rates and a shorter repayment term can be substantial. Use a student loan refinancing calculator to estimate your potential savings before making a commitment.

Weighing the Disadvantages of Refinancing Federal Student Loans

The decision to refinance your federal student loans isn't without its drawbacks. It's essential to weigh the potential disadvantages carefully before proceeding:

- Loss of federal student loan protections: This is arguably the most significant disadvantage. Once you refinance, you lose access to income-driven repayment plans, deferment, forbearance, and potentially loan forgiveness programs like PSLF.

- Potential for higher fees: Private lenders may charge origination fees or prepayment penalties, adding to your overall borrowing costs. Compare fees across different lenders before making a decision.

- Impact on credit score: Applying for a private loan can temporarily impact your credit score, as lenders perform a hard credit check. This is a temporary impact that will improve with positive credit history after the loan is secured.

- Risk of losing eligibility for public service loan forgiveness (PSLF): If you are pursuing PSLF, refinancing your federal loans will likely disqualify you from the program. This is a crucial point for those employed in public service roles.

Carefully consider these potential downsides, as they could significantly impact your financial situation in the long run.

How to Determine if Refinancing is Right for You

Making an informed decision about refinancing your federal student loans requires a careful and methodical approach. Follow these steps:

- Assess your current loan situation: Determine your total loan balance, interest rates, and repayment terms for each loan.

- Compare interest rates from multiple lenders: Shop around and obtain quotes from several private lenders to compare interest rates, fees, and repayment terms. Use a student loan refinancing calculator to help with this comparison.

- Carefully review loan terms and conditions: Thoroughly read and understand all loan documents before signing any agreements.

- Consider your financial goals and risk tolerance: Evaluate your financial situation, considering your income, expenses, and future financial goals. Determine if you're comfortable with the potential risks associated with refinancing.

Finding the Right Refinancing Lender

Choosing the right refinancing lender is crucial. Consider these factors:

- Interest rates: Look for lenders offering competitive interest rates tailored to your creditworthiness.

- Fees: Compare origination fees, prepayment penalties, and other associated charges.

- Repayment terms: Choose a repayment term that aligns with your budget and financial goals.

- Customer service: Select a lender with a reputation for excellent customer service and responsiveness.

Compare several reputable lenders before making your final decision.

Making the Right Choice on Refinancing Your Federal Student Loans

Refinancing federal student loans offers potential benefits such as lower interest rates and shorter repayment terms. However, it also comes with significant risks, including the loss of crucial federal protections like income-driven repayment and loan forgiveness programs. The decision to refinance is highly personal and depends on your individual financial situation, risk tolerance, and long-term goals. Carefully consider your options and research whether refinancing your federal student loans is the best path for you. Use a student loan calculator to help you weigh the pros and cons before making a decision.

Featured Posts

-

Nestle Shell And Others Push Back Against Musks Boycott Accusations

May 17, 2025

Nestle Shell And Others Push Back Against Musks Boycott Accusations

May 17, 2025 -

The Tom Cruise Tom Hanks 1 Debt A Hollywood Anecdote

May 17, 2025

The Tom Cruise Tom Hanks 1 Debt A Hollywood Anecdote

May 17, 2025 -

Red Carpet Rule Breakers Understanding Guest Misbehavior

May 17, 2025

Red Carpet Rule Breakers Understanding Guest Misbehavior

May 17, 2025 -

David Del Valle Uribe Representando A Reynosa En La Olimpiada Nacional

May 17, 2025

David Del Valle Uribe Representando A Reynosa En La Olimpiada Nacional

May 17, 2025 -

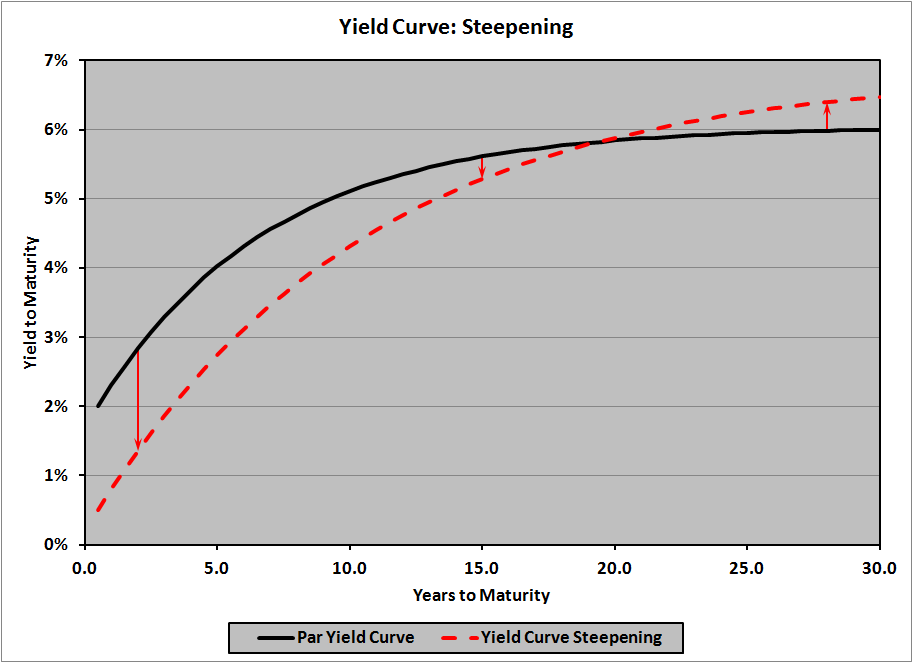

Analyzing Japans Steep Bond Curve Risks And Opportunities

May 17, 2025

Analyzing Japans Steep Bond Curve Risks And Opportunities

May 17, 2025

Latest Posts

-

The Trump Family An Overview Of Its Members And Relationships

May 17, 2025

The Trump Family An Overview Of Its Members And Relationships

May 17, 2025 -

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025 -

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025

Understanding The Trump Family A Genealogy Of The Trump Dynasty

May 17, 2025 -

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025

Donald Tramp Ta Yogo Mati Khto Bula Meri Enn Maklaud

May 17, 2025 -

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025

Meri Enn Maklaud Biografiya Materi Donalda Trampa

May 17, 2025