Should You Invest In XRP After Its 400% Increase? Risks And Rewards.

Table of Contents

XRP, the cryptocurrency associated with Ripple Labs, has recently experienced a dramatic 400% price surge. This significant jump has left many investors wondering: is now the time to invest in XRP, or has the price already reached its peak? This article explores the potential rewards and significant risks associated with investing in XRP after such a substantial increase, helping you make an informed decision. We'll delve into the factors driving this price surge, analyze its sustainability, and assess the potential rewards and risks to help you determine if an XRP investment aligns with your financial goals.

Understanding the Recent XRP Price Surge

Factors Contributing to the Increase

Several factors have contributed to XRP's recent price surge. These include:

- Positive Court Rulings (Partial): The ongoing legal battle between Ripple and the SEC has seen some positive developments, boosting investor confidence. While the case isn't fully resolved, certain aspects of the rulings have been interpreted favorably for Ripple, leading to increased optimism.

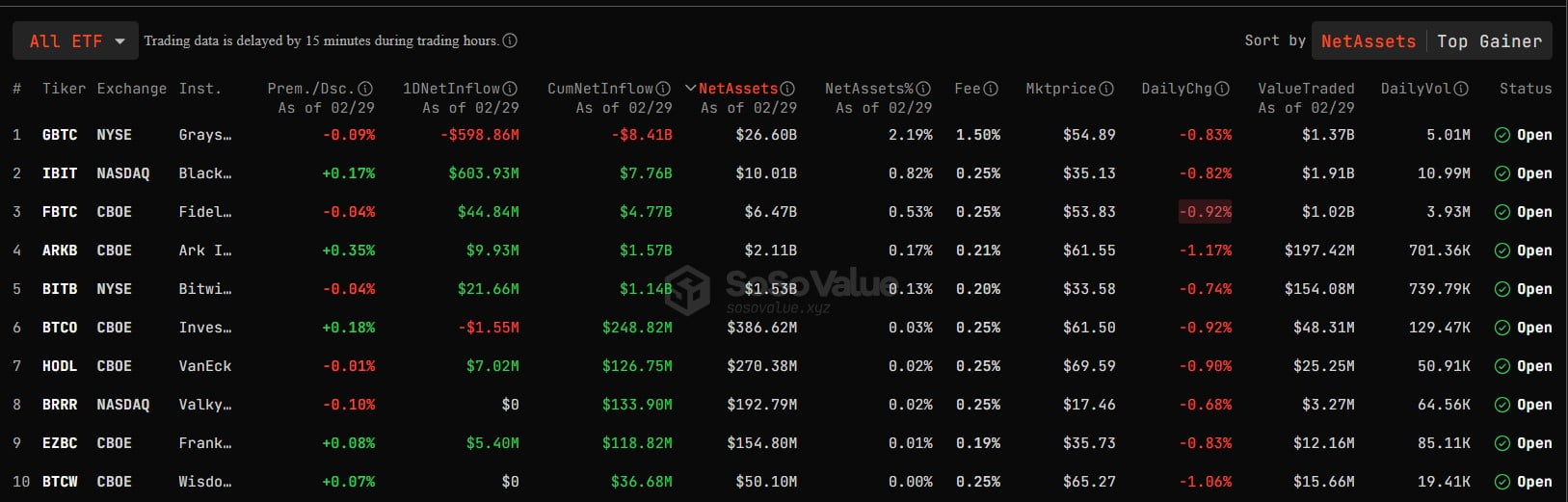

- Increased Institutional Adoption: Some financial institutions are increasingly exploring XRP's use in cross-border payments due to its speed and efficiency. This increased adoption, even if limited, fuels speculation and price increases.

- Positive Market Sentiment: The overall cryptocurrency market sentiment has played a role. Positive news in the broader crypto space often leads to a ripple effect, boosting prices across various cryptocurrencies, including XRP.

- Speculation and FOMO (Fear of Missing Out): Significant price increases often attract speculative investors, leading to a self-fulfilling prophecy where further price increases are driven by fear of missing out on potential profits.

Is This a Sustainable Trend?

Whether this price increase is sustainable is a complex question. While the positive developments are encouraging, several factors suggest caution:

- Regulatory Uncertainty Remains: The Ripple-SEC lawsuit isn't concluded. A negative ruling could significantly impact XRP's price. Future regulatory actions from other jurisdictions also pose a risk.

- Market Volatility: The cryptocurrency market is inherently volatile. Sharp price corrections are common, and XRP is particularly susceptible to these fluctuations given its relationship with Ripple and its centralized nature.

- Short-Term Predictions are Speculative: Predicting short-term price movements in crypto is extremely difficult and often unreliable. Long-term predictions depend heavily on the resolution of the legal battles and the level of adoption by financial institutions.

The Potential Rewards of Investing in XRP

High Growth Potential

XRP's price history shows periods of significant growth. While past performance isn't indicative of future results, its potential for high returns is a key attraction for investors. This potential is linked to:

- Cross-Border Payments: XRP's speed and efficiency make it a potential competitor in the cross-border payment sector, a multi-trillion dollar market. Wider adoption could significantly increase its value.

- Other Use Cases: Beyond payments, XRP is being explored for other applications, such as decentralized finance (DeFi) and supply chain management, further expanding its potential.

Relatively Low Entry Point (Compared to Previous Peaks)

Compared to its previous all-time high, XRP's current price might seem relatively low for some investors. However, it's crucial to remember that:

- Past performance is not indicative of future results. While the current price might appear attractive compared to past peaks, it's essential to weigh this against the inherent risks.

- Risk/Reward Ratio: The current risk/reward ratio requires careful analysis. The potential for substantial returns must be balanced against the significant risks associated with XRP.

- Thorough Research is Essential: Before making any investment decision, conduct comprehensive research and understand the project's fundamentals and potential risks.

The Risks Associated with XRP Investment

Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC poses a significant risk to XRP.

- SEC Lawsuit Impact: An unfavorable ruling could severely impact XRP's price and trading availability in some markets.

- Future Regulatory Crackdowns: Increased regulatory scrutiny of cryptocurrencies globally could lead to further restrictions or bans on XRP.

- Uncertainty Impacts Investment: This uncertainty makes it difficult to predict XRP's long-term trajectory, deterring some investors.

Market Volatility

The cryptocurrency market is notorious for its volatility.

- External Factors: Macroeconomic conditions, regulatory changes, and overall market sentiment significantly impact XRP's price.

- Sharp Price Drops: Sudden and dramatic price drops are common in the crypto market and pose a substantial risk to XRP investors.

- High Risk Tolerance Required: Investing in XRP requires a high tolerance for risk.

Decentralization Concerns

While often marketed as decentralized, XRP's relationship with Ripple raises concerns.

- Centralized Control: Ripple's control over a significant portion of XRP's supply raises questions about its true decentralization.

- Potential for Manipulation: This centralized control could theoretically be used to manipulate the market, posing risks to investors.

- Comparison to other Cryptocurrencies: Compare XRP's decentralization to truly decentralized cryptocurrencies like Bitcoin to understand the difference.

Diversification and Risk Management Strategies

Importance of Diversification

Diversification is crucial for managing investment risk.

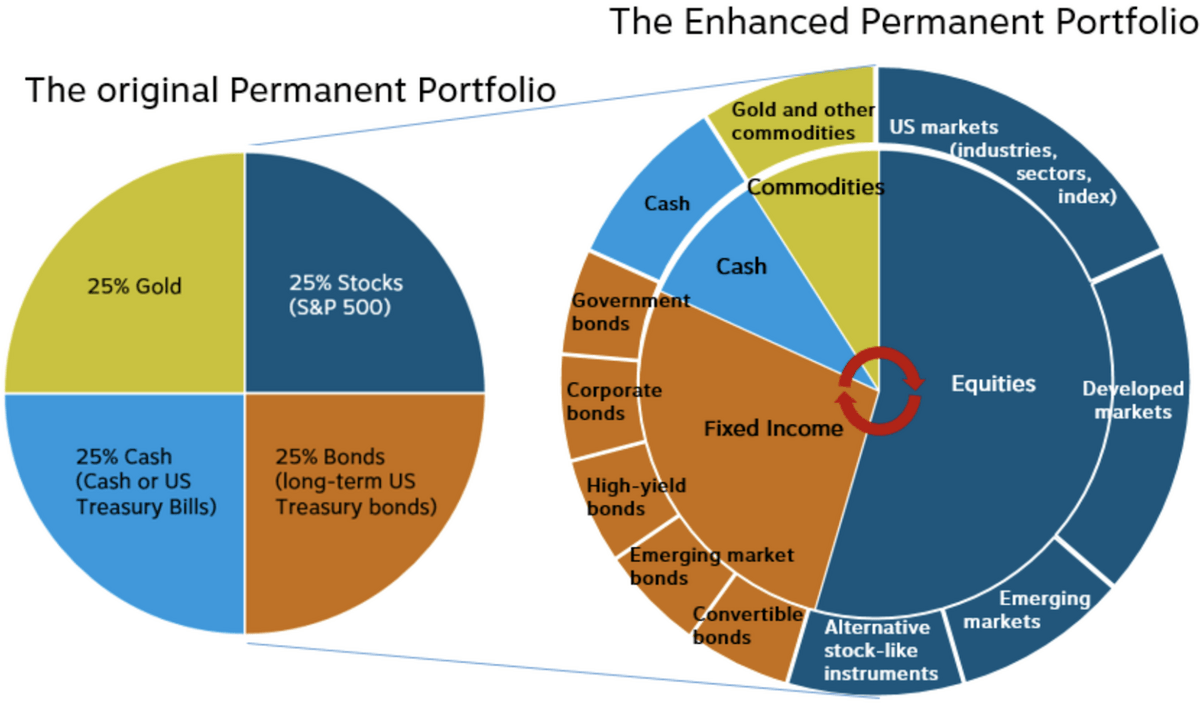

- Don't Put All Your Eggs in One Basket: Spread your investments across different asset classes to reduce exposure to any single asset's volatility.

- Balanced Portfolio: A well-diversified portfolio includes various asset classes (stocks, bonds, real estate, etc.) alongside cryptocurrencies, reducing overall portfolio risk.

- Reduce Exposure to Single Crypto Assets: Diversify your crypto holdings to minimize risk associated with specific cryptocurrencies like XRP.

Setting Realistic Investment Goals

Setting realistic investment goals is crucial for managing risk.

- Manage Expectations: Avoid chasing unrealistic returns. Cryptocurrency investments are high-risk, and significant losses are possible.

- Emotional Discipline: Develop emotional discipline to avoid impulsive decisions based on market fluctuations.

- Financial Advisor: Consult a financial advisor for personalized advice before investing, particularly with significant sums of money.

Conclusion

Investing in XRP after its recent surge presents both exciting opportunities and substantial risks. The potential for high returns is undeniable, but the regulatory uncertainty and inherent market volatility demand careful consideration. A thorough understanding of these factors is crucial before making any investment decision. Before jumping into investing in XRP, take the time to thoroughly research its potential and the associated risks. Remember to diversify your portfolio and approach XRP investment with a well-defined strategy. Only invest what you can afford to lose. Consider researching further on how to invest in XRP safely and responsibly.

Featured Posts

-

Cavs Secure 1 Seed In East After Victory Over Bulls

May 07, 2025

Cavs Secure 1 Seed In East After Victory Over Bulls

May 07, 2025 -

Soldaat Van Oranje De Biografie Van Spion Peter Tazelaar

May 07, 2025

Soldaat Van Oranje De Biografie Van Spion Peter Tazelaar

May 07, 2025 -

Crucial Lessons From The Celtics Rivalry A Cavaliers Stars Analysis

May 07, 2025

Crucial Lessons From The Celtics Rivalry A Cavaliers Stars Analysis

May 07, 2025 -

Lotto 6aus49 Ergebnis 19 April 2025 Gewinnzahlen And Quoten

May 07, 2025

Lotto 6aus49 Ergebnis 19 April 2025 Gewinnzahlen And Quoten

May 07, 2025 -

The Karate Kid Part Iii Comparing It To The Preceding Films In The Series

May 07, 2025

The Karate Kid Part Iii Comparing It To The Preceding Films In The Series

May 07, 2025

Latest Posts

-

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025