Should You Buy The Dip In This Entertainment Stock? Analyst Insights

Table of Contents

Understanding the Current Market Conditions for Entertainment Stocks

The entertainment sector’s performance is intricately linked to broader macroeconomic factors and company-specific news. Let's examine both to understand Disney's current position.

Macroeconomic Factors Affecting the Sector

Several macroeconomic factors are impacting entertainment stocks:

- Inflation and Interest Rates: Rising inflation and interest rates increase borrowing costs, potentially impacting production budgets and reducing consumer discretionary spending on entertainment. This can lead to slower subscriber growth and reduced advertising revenue for streaming services.

- Recession Fears: Concerns about a potential recession often lead to investors moving away from riskier assets, like entertainment stocks, in favor of safer investments.

- Streaming Wars: The intense competition in the streaming landscape, with numerous players vying for market share, puts pressure on profit margins and subscriber acquisition costs. Disney+, while a major player, faces competition from Netflix, HBO Max, and others.

- Advertising Revenue Changes: Changes in advertising spending, particularly in a slowing economy, significantly affect the revenue streams of many entertainment companies. Disney relies heavily on advertising revenue across its various platforms.

- Subscriber Growth Trends: Sustained subscriber growth is crucial for streaming services. Slowdowns or declines in subscriber numbers can severely impact stock valuations. Disney’s recent subscriber growth has been a key factor influencing investor sentiment.

Recent data shows a slowdown in global streaming subscriptions, highlighting the challenges faced by companies like Disney.

Company-Specific News and Performance

Disney's recent performance has been a mixed bag. Let's examine some key factors:

- Recent Product Launches: Disney's launch of new content, including movies and series on Disney+, has been crucial to attracting and retaining subscribers. The success of these launches directly impacts the company's financial performance.

- Content Pipeline: A strong content pipeline is vital to sustain subscriber engagement and attract new users. Disney's future content slate is closely scrutinized by analysts and investors.

- Management Changes: Changes in leadership can impact the strategic direction and overall performance of the company. Any significant management reshuffling at Disney would need to be considered.

- Debt Levels: High levels of debt can restrict a company’s financial flexibility and impact its ability to invest in future growth. Disney's debt levels need to be assessed in relation to its revenue and profitability.

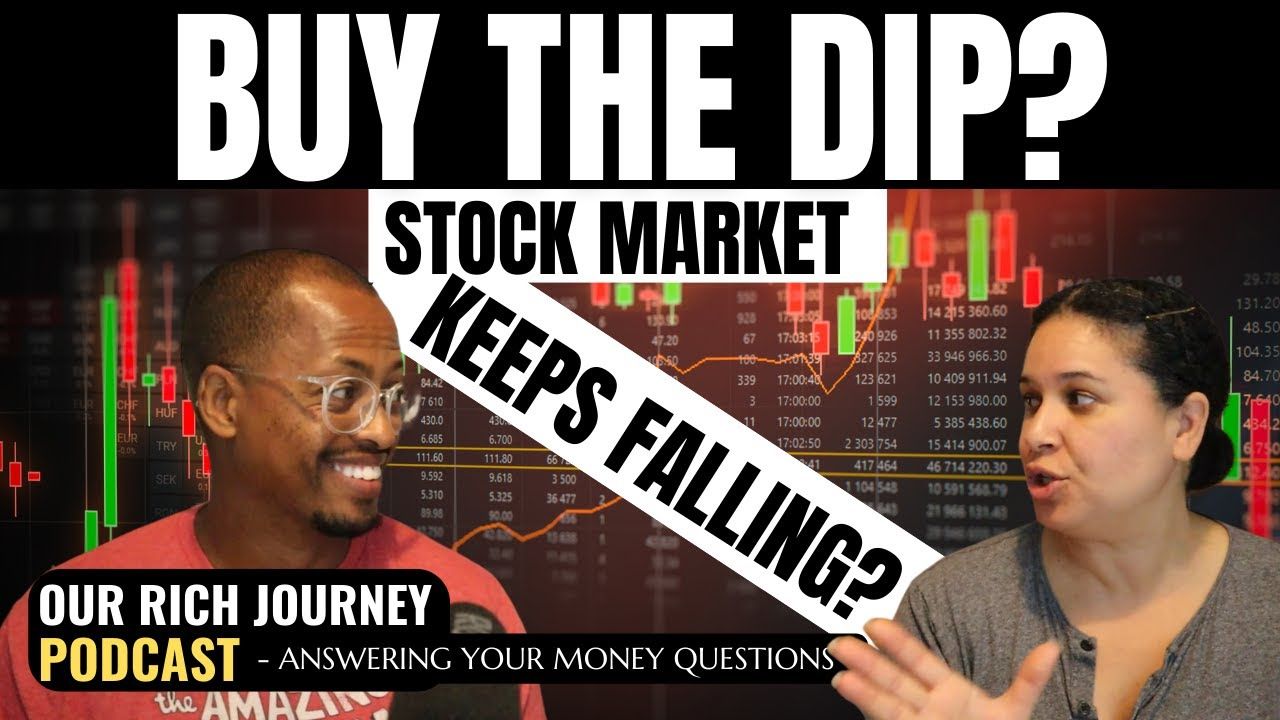

[Insert a chart or graph visualizing Disney's key performance indicators (KPIs) such as revenue, subscriber growth, and profit margins over the past few quarters].

Analyst Opinions and Predictions for the Chosen Entertainment Stock

Analyzing analyst opinions provides valuable insight into the potential future performance of Disney stock.

Consensus Among Financial Analysts

The consensus among financial analysts regarding Disney varies, but a significant portion currently holds a "hold" or "buy" rating. [Cite specific sources like Bloomberg, Yahoo Finance, etc., and include details on the range of price targets]. Many analysts point to Disney's vast content library, strong brands, and potential for future growth in streaming as reasons for their positive outlook.

Divergent Views and Potential Risks

Despite the generally positive sentiment, several risks exist:

- Competitive Landscape: The intense competition within the streaming market represents a significant risk. Disney needs to continue innovating and investing to maintain its market position.

- Regulatory Changes: Changes in regulations, particularly regarding content and data privacy, could impact Disney’s operations and profitability.

- Technological Disruption: New technologies and changing consumer preferences could disrupt the traditional entertainment models, posing a risk to Disney’s business.

- Potential for Further Price Drops: Despite the potential for a rebound, the stock price could still experience further declines depending on market conditions and company performance.

Evaluating the Dip: Is It a Buying Opportunity?

To determine if the current dip in Disney's stock price presents a buying opportunity, both technical and fundamental analysis is necessary.

Technical Analysis of the Stock Price

[Insert a chart showing Disney's stock price with key technical indicators like support and resistance levels, moving averages, and RSI]. Analyzing these indicators can help determine potential entry and exit points. For example, if the price finds strong support at a particular level, it might signal a good buying opportunity.

Fundamental Analysis

Analyzing Disney's fundamental strength reveals the intrinsic value and long-term prospects:

- Price-to-Earnings Ratio (P/E): A low P/E ratio compared to historical averages or competitors could indicate undervaluation.

- Revenue Growth: Consistent revenue growth signals a healthy and expanding business.

- Profit Margins: High profit margins indicate efficient operations and strong pricing power.

- Debt-to-Equity Ratio: A manageable debt-to-equity ratio suggests a financially stable company.

By comparing these metrics to historical data and industry benchmarks, a more comprehensive assessment of Disney's intrinsic value can be made.

Conclusion: Making Informed Decisions About Buying the Dip in Entertainment Stocks

The decision of whether to "buy the dip" in Disney stock is complex and depends on various factors. While the company possesses strong brands and a vast content library, the competitive streaming landscape, macroeconomic uncertainties, and potential for further price drops present significant risks. Analysts offer mixed opinions, with some viewing the current price as a buying opportunity, while others remain cautious.

Our analysis suggests that a thorough evaluation of both the technical and fundamental aspects is crucial. Consider your risk tolerance and investment goals before deciding whether to buy the dip in this entertainment stock. Further research is encouraged before making any investment decisions. Understanding the intricacies of “buy the dip” strategies and conducting in-depth entertainment stock analysis is vital for informed investing. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Malcolm In The Middle Reboot Frankie Muniz Reunites With Bryan Cranston And Jane Kaczmarek

May 29, 2025

Malcolm In The Middle Reboot Frankie Muniz Reunites With Bryan Cranston And Jane Kaczmarek

May 29, 2025 -

Shop Nike Air Max Excee Sale Prices As Low As 57

May 29, 2025

Shop Nike Air Max Excee Sale Prices As Low As 57

May 29, 2025 -

Rising Long Term Yields Ueda Highlights Potential Risks And Ripple Effects

May 29, 2025

Rising Long Term Yields Ueda Highlights Potential Risks And Ripple Effects

May 29, 2025 -

Joshlin Smith And Co Conspirators To Face Sentencing In Human Trafficking Case

May 29, 2025

Joshlin Smith And Co Conspirators To Face Sentencing In Human Trafficking Case

May 29, 2025 -

Quase 20 Anos Depois O Legado De Uma Frase Iconica No Cinema

May 29, 2025

Quase 20 Anos Depois O Legado De Uma Frase Iconica No Cinema

May 29, 2025

Latest Posts

-

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 30, 2025

Metallica To Play Two Nights At Dublins Aviva Stadium In June 2026

May 30, 2025 -

Top Music Lawyers 2025 Billboards Predicted Power Players

May 30, 2025

Top Music Lawyers 2025 Billboards Predicted Power Players

May 30, 2025 -

Metallicas Dublin Aviva Stadium Weekend June 2026 Shows Announced

May 30, 2025

Metallicas Dublin Aviva Stadium Weekend June 2026 Shows Announced

May 30, 2025 -

Role Model Adds More European Dates To No Place Like Home Tour

May 30, 2025

Role Model Adds More European Dates To No Place Like Home Tour

May 30, 2025 -

Additional Paris And London Dates Added To Role Models The Longest Goodbye Tour

May 30, 2025

Additional Paris And London Dates Added To Role Models The Longest Goodbye Tour

May 30, 2025