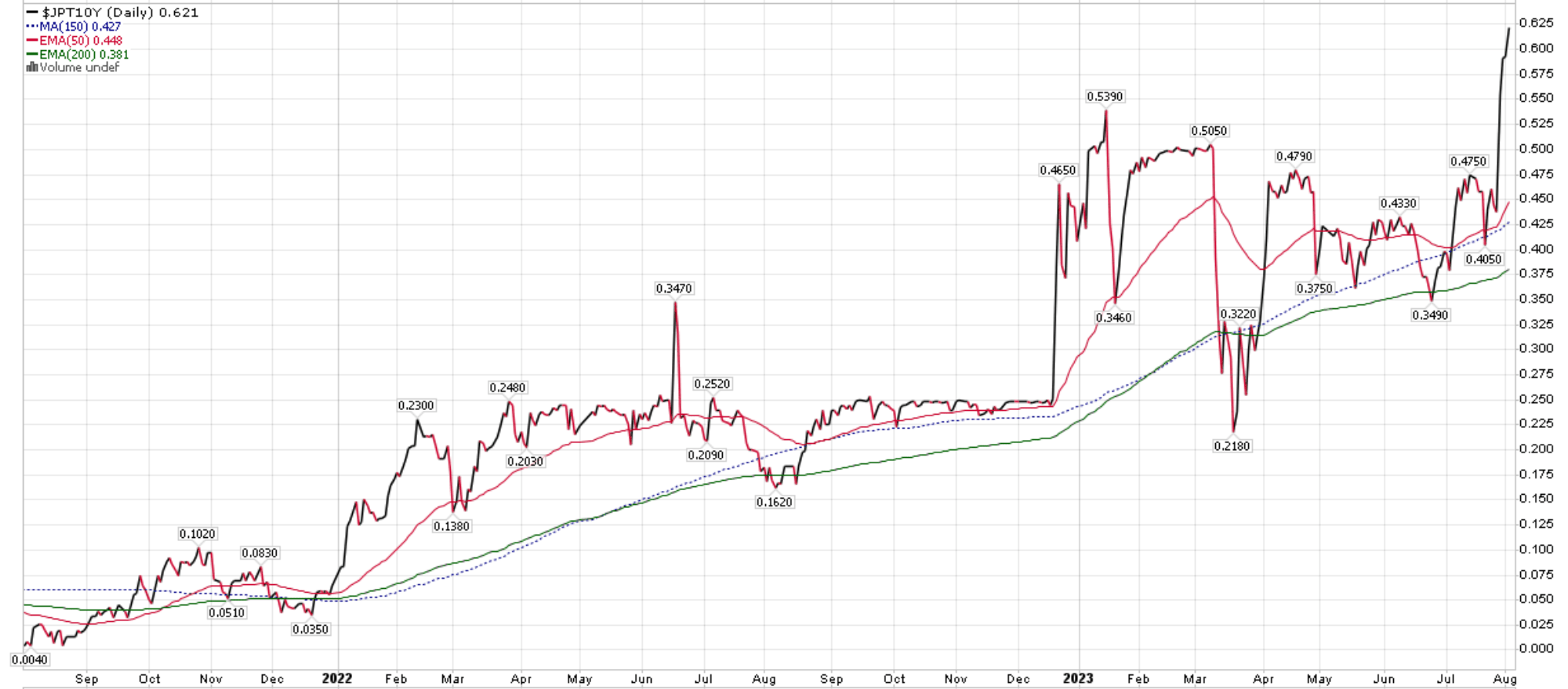

Rising Long-Term Yields: Ueda Highlights Potential Risks And Ripple Effects

Table of Contents

Governor Ueda's Concerns and the Bank of Japan's Response

Governor Ueda's recent statements highlight the growing unease surrounding rising long-term yields. He has expressed concerns about the potential negative impact on the Japanese economy, particularly regarding its already fragile recovery. These rising yields challenge the Bank of Japan's (BOJ) longstanding yield curve control (YCC) policy, designed to keep long-term interest rates low.

-

Ueda's Concerns: Governor Ueda has voiced concerns about the sustainability of the current policy in light of persistent inflationary pressures and the potential for further upward pressure on long-term yields. He has stressed the need for a careful and gradual approach to adjusting monetary policy.

-

BOJ Response to Rising Yields: The BOJ's response has been cautious. While maintaining the YCC framework, they have shown a willingness to adjust the yield target band, allowing for greater flexibility. This reflects the challenge of balancing the need for economic stimulus with the need to manage inflationary pressures exacerbated by rising yields.

-

Potential Future Actions: Future BOJ actions remain uncertain. Options include a complete abandonment of YCC, a widening of the yield band, or a combination of strategies aimed at managing long-term interest rate risks while supporting economic growth. The effectiveness of any strategy will depend on the evolution of inflationary pressures and global economic conditions. The market closely watches the BOJ's every move regarding its response to rising long-term yields.

Impact on Global Financial Markets

The impact of rising long-term yields extends far beyond Japan's borders. The implications are felt across global financial markets, creating a complex web of interconnected consequences.

-

Effect on Global Bond Markets and Investor Sentiment: Rising yields globally impact bond prices inversely. This has led to a reassessment of risk appetite and potential capital flight from bond markets, creating volatility.

-

Potential Impact on Currency Exchange Rates: Changes in interest rates influence currency exchange rates. Rising yields in one country can strengthen its currency relative to others, affecting international trade and investment flows.

-

Influence on Borrowing Costs for Businesses and Governments: Higher long-term yields translate into increased borrowing costs for businesses and governments, potentially hindering investment and economic expansion.

-

Impact on Emerging Markets and their Debt Levels: Emerging markets are particularly vulnerable to rising long-term yields, as they often have high levels of dollar-denominated debt, making servicing these debts significantly more expensive. This can lead to financial instability and debt crises. The global yield curve is therefore closely monitored by emerging market economies.

Potential Risks Associated with Rising Long-Term Yields

Persistently high long-term yields carry significant risks for global economic stability. The potential consequences need careful consideration.

-

Increased Borrowing Costs for Consumers and Businesses: Higher interest rates increase borrowing costs for consumers and businesses, impacting consumer spending and investment decisions. This slowdown in investment has significant implications for economic growth.

-

Slowdown in Economic Growth due to Reduced Investment: Higher borrowing costs discourage investment, leading to a slowdown in economic growth, which is further amplified by reduced consumer spending. The risks of rising long-term yields cannot be overstated in this regard.

-

Increased Risk of Financial Instability and Market Corrections: Rising yields can trigger financial market volatility and potentially lead to abrupt corrections as investors reassess risk and adjust portfolios.

-

Potential for Inflationary Pressures: While initially rising yields may combat inflation by slowing down economic activity, unexpectedly high yields can lead to renewed inflationary pressures through increased production and transportation costs.

Analyzing the Underlying Causes of Rising Long-Term Yields

Several factors contribute to the current upward trend in long-term yields. Understanding these causes is essential to predicting future movements.

-

Inflationary Pressures and Central Bank Responses: Persistent inflationary pressures globally have forced central banks to raise interest rates, influencing long-term yield expectations. This interplay between central bank action and long-term yields is crucial to observe.

-

Changes in Investor Sentiment and Risk Appetite: Shifting investor sentiment and risk appetite can significantly influence long-term yield movements. Positive economic news can push yields down, while uncertainty and negative news can lead to a rise.

-

Government Borrowing and Debt Levels: High levels of government borrowing can exert upward pressure on long-term yields as increased demand for funds competes with other borrowers in the market.

-

Geopolitical Uncertainties and their Influence on Market Sentiment: Geopolitical uncertainties and events frequently impact market sentiment, influencing investor behavior and, consequently, long-term yields.

Conclusion: Understanding and Managing the Implications of Rising Long-Term Yields

Governor Ueda's concerns about rising long-term yields are justified, reflecting the potential for significant negative impacts on the Japanese economy and global financial markets. The associated risks include increased borrowing costs, reduced investment, financial instability, and potential inflationary pressures. Understanding the underlying causes, including inflationary pressures, investor sentiment, and geopolitical factors, is vital to managing these risks.

Key Takeaways: Rising long-term yields present a complex challenge with wide-ranging implications. Central bank responses, global investor sentiment, and geopolitical events all play crucial roles in shaping this trend.

Stay informed about the ongoing developments in rising long-term yields and their potential impact. Consult with financial advisors to mitigate risks associated with these rising interest rates.

Featured Posts

-

Trumps European Envoy Marco Rubios Diplomatic Trip

May 29, 2025

Trumps European Envoy Marco Rubios Diplomatic Trip

May 29, 2025 -

Hyacinth Bulb Planting Schedule Ensuring Vibrant Spring Blooms

May 29, 2025

Hyacinth Bulb Planting Schedule Ensuring Vibrant Spring Blooms

May 29, 2025 -

France To Seize Phones Targeting Drug Dealers And Users Through Mobile Phone Confiscation

May 29, 2025

France To Seize Phones Targeting Drug Dealers And Users Through Mobile Phone Confiscation

May 29, 2025 -

Bring Her Back Reviews Stellar Rotten Tomatoes Score For A24 Horror Film

May 29, 2025

Bring Her Back Reviews Stellar Rotten Tomatoes Score For A24 Horror Film

May 29, 2025 -

League Of Legends Lore Changes Implications For 2 Xko

May 29, 2025

League Of Legends Lore Changes Implications For 2 Xko

May 29, 2025