Should You Buy Palantir Technologies Stock Now? A Detailed Investor's Guide

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies is a prominent player in the big data analytics sector, offering sophisticated software platforms to government and commercial clients. Its success hinges on its two core platforms:

-

Gotham: This platform is tailored to government agencies, offering advanced data integration, analysis, and visualization tools to combat threats and enhance national security. Gotham leverages Palantir's expertise in tackling complex data challenges, providing insights for crucial decision-making.

-

Foundry: Designed for commercial clients across various sectors – including finance, healthcare, and energy – Foundry provides a unified platform to integrate and analyze data from diverse sources. This facilitates improved operational efficiency, risk management, and strategic planning.

Palantir's revenue model primarily relies on:

- Subscription fees: Clients pay recurring fees for access to the platforms, ensuring a predictable revenue stream.

- Professional services: Palantir offers consulting and implementation services to help clients effectively utilize its platforms. This provides a higher-margin revenue stream.

Key clients span diverse industries, including:

-

Government: Numerous government agencies utilize Palantir's platforms for intelligence gathering, crime prevention, and national security.

-

Finance: Financial institutions leverage Palantir's technology for fraud detection, risk management, and regulatory compliance.

-

Healthcare: Healthcare providers utilize Palantir's platforms to analyze patient data, improve operational efficiency, and enhance research efforts.

-

Revenue growth trajectory and analysis: Palantir has demonstrated consistent revenue growth, although profitability remains a key focus. Analyzing year-over-year revenue comparisons provides insight into growth momentum.

-

Key contracts and their impact on revenue: Securing large government and commercial contracts significantly impacts Palantir's revenue. Examining these contracts provides a clear understanding of the company's revenue predictability.

-

Market share and competitive landscape: While Palantir holds a strong position in the big data analytics market, it faces competition from established tech giants. Understanding its market share and competitive landscape is crucial.

-

Long-term growth potential: Palantir's potential for expansion into new markets and development of innovative products contributes to its long-term growth outlook.

Financial Performance and Valuation

Analyzing Palantir's financial statements is critical to understanding its investment potential. This involves examining:

-

Revenue, earnings, and cash flow: Reviewing these key metrics provides insights into the company's financial health and growth trajectory.

-

Key financial ratios: The Price-to-Sales (P/S) ratio, for instance, is essential for evaluating Palantir's valuation relative to its revenue. Comparing its P/S ratio to competitors provides context.

-

Profitability and path to profitability: Palantir's journey towards consistent profitability is a crucial factor for investors. Analyzing its profit margins and projections provides critical insights.

-

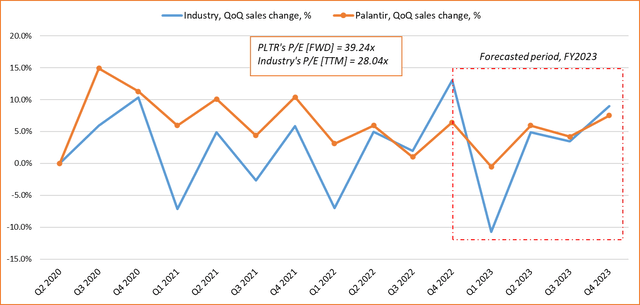

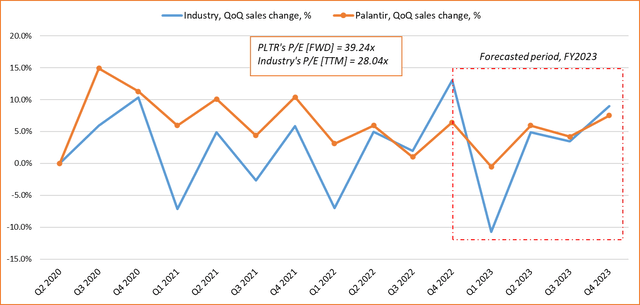

Yearly revenue growth comparison: Year-over-year revenue comparisons illustrate the company's growth rate and consistency.

-

Profit margin analysis and future projections: Analyzing profit margins and future projections offers insights into the company's long-term financial health.

-

Debt levels and financial health: Assessing Palantir's debt levels and financial health helps determine the company's financial stability.

-

Valuation compared to competitors: Comparing Palantir's valuation to competitors in the data analytics sector helps ascertain whether it is overvalued or undervalued.

Risks and Challenges Facing Palantir

Investing in Palantir Technologies involves inherent risks:

-

Competition: Established tech giants pose a significant competitive threat to Palantir.

-

Regulatory changes: Changes in government regulations could impact Palantir's ability to operate effectively, particularly in the government sector.

-

Dependence on government contracts: Palantir's significant reliance on government contracts exposes it to potential risks associated with government funding and policy changes.

-

Expansion challenges: Expanding market share and achieving consistent profitability in a competitive market presents ongoing challenges.

-

Competitive threats from established tech giants: Analyzing the competitive landscape and identifying potential threats from established players is crucial.

-

Potential regulatory hurdles and compliance issues: Assessing potential regulatory hurdles and the company's compliance efforts is vital.

-

Dependence on specific client contracts: Evaluating the concentration of revenue from specific clients highlights potential risks.

-

Risk assessment and mitigation strategies: Understanding how Palantir assesses and mitigates these risks is essential for potential investors.

Future Growth Prospects and Investment Outlook

Palantir's future growth prospects hinge on several factors:

-

Market expansion: Expanding into new markets and sectors presents significant growth opportunities.

-

Product innovation: Developing innovative products and services strengthens its competitive advantage.

-

Strategic partnerships: Strategic partnerships can accelerate market penetration and expansion.

-

Potential new market opportunities and product innovation: Identifying potential new markets and innovative product development is vital for evaluating long-term growth.

-

Growth projections and analyst estimates: Analyzing growth projections and analyst estimates provides insights into the market's expectations.

-

Market sentiment and investor expectations: Understanding market sentiment and investor expectations is crucial for gauging investor confidence.

-

Potential return on investment scenarios: Evaluating different scenarios and potential returns on investment helps in making informed decisions.

Conclusion: Should You Buy Palantir Technologies Stock Now?

This analysis of Palantir Technologies (PLTR) reveals a company with a strong business model, significant growth potential, and considerable risks. While Palantir's innovative platforms cater to a growing demand for data analytics solutions, its dependence on large contracts and intense competition present challenges. Its path to consistent profitability remains a key factor to consider. The decision to buy Palantir stock requires careful consideration of these factors alongside your own risk tolerance and investment strategy. Examining the Palantir stock price and assessing the current market conditions is equally vital.

Ultimately, the decision of whether to buy Palantir Technologies stock rests with you. Remember to conduct thorough due diligence, analyze the Palantir stock price, and consult with a financial advisor before making any investment decisions related to PLTR stock or any other investment. Developing a sound PLTR investment strategy requires careful consideration of all aspects presented in this guide.

Featured Posts

-

100 Days Of Trump Tracing The Shifts In Elon Musks Net Worth

May 09, 2025

100 Days Of Trump Tracing The Shifts In Elon Musks Net Worth

May 09, 2025 -

The Colin Cowherd Jayson Tatum Debate A Renewed Examination

May 09, 2025

The Colin Cowherd Jayson Tatum Debate A Renewed Examination

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

Black Rock Etf Billionaire Investments And 2025 Market Predictions

May 09, 2025

Black Rock Etf Billionaire Investments And 2025 Market Predictions

May 09, 2025 -

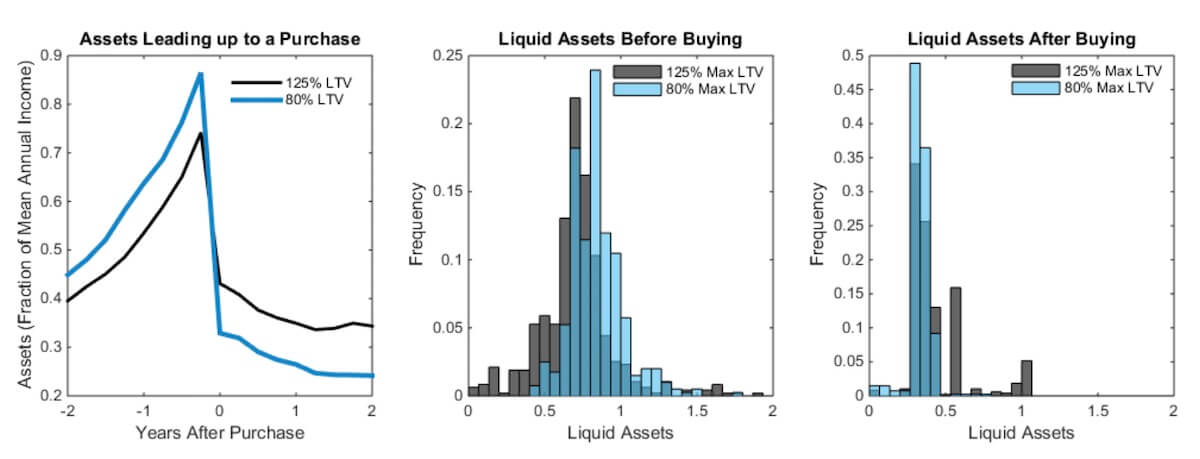

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025

The Impact Of High Down Payments On Canadian Homeownership

May 09, 2025

Latest Posts

-

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025