CoreWeave, Inc. (CRWV) Stock Surge: Understanding Thursday's Jump

Table of Contents

CoreWeave's Business Model and Recent Developments

CoreWeave positions itself as a leader in providing AI infrastructure, leveraging its powerful GPU-powered cloud computing platform. This strategic focus is incredibly important in the rapidly expanding AI market, a key driver of the CRWV stock surge.

Focus on AI Infrastructure

CoreWeave's unique selling propositions (USPs) are centered around its specialized infrastructure designed for the intense computational demands of artificial intelligence and machine learning (AI/ML) workloads. This allows them to offer superior performance and scalability compared to more general-purpose cloud providers.

- Specialized GPU cloud computing for AI and ML workloads: CoreWeave offers access to cutting-edge GPUs, optimized for training and deploying large AI models, giving them a significant advantage in the market.

- Sustainable data center infrastructure: Their commitment to environmentally responsible practices is an increasingly important factor for many clients and investors, contributing to their positive brand image.

- Strategic partnerships with major AI players: Collaborations with leading AI companies provide CoreWeave with access to valuable resources and expand their market reach, reinforcing their position in the industry.

- Recent contract wins driving increased revenue projections: Securing significant contracts with major clients demonstrates market confidence in their services and contributes to positive financial expectations, a likely factor in the CRWV stock price increase.

Strong Financial Performance

While specific financial details might require access to official reports, a strong performance in recent quarters, perhaps exceeding expectations for revenue growth and profitability, likely played a crucial role in Thursday's CRWV stock surge. Positive upward revisions to future financial projections, indicating continued growth, would further bolster investor confidence.

- Strong Q[Quarter] earnings exceeding expectations: Surpassing anticipated earnings demonstrates the effectiveness of CoreWeave's business strategy and operational efficiency.

- Increased year-over-year revenue growth: A consistent upward trend in revenue signifies a healthy and expanding customer base.

- Positive outlook for future financial performance: Guidance suggesting continued growth reassures investors and contributes to positive market sentiment.

Industry Trends and Market Sentiment

The explosive growth of the artificial intelligence industry is a major tailwind for CoreWeave, driving the demand for specialized computing resources that the company provides. This powerful industry trend is significantly impacting the CRWV stock price.

Booming AI Market

The AI sector is experiencing unprecedented growth, fueled by advancements in machine learning algorithms and the increasing adoption of AI across various sectors. This heightened demand for high-performance computing resources directly benefits companies like CoreWeave.

- Exponential growth in AI model training and deployment: The complexity and scale of modern AI models require significant computational power, driving demand for CoreWeave's specialized infrastructure.

- Increased demand for high-performance computing resources: The need for faster, more efficient processing is pushing the boundaries of computing infrastructure, creating a favorable environment for CoreWeave's services.

- CoreWeave's leading position in the AI infrastructure market: Establishing a strong market position allows CoreWeave to capitalize on the growth opportunities presented by the booming AI sector.

Overall Market Conditions

The positive market sentiment on Thursday, possibly driven by broader tech sector positivity or positive macroeconomic news, also contributed to the CRWV stock surge. A generally optimistic market environment often creates a ripple effect, boosting the prices of even high-growth, specialized companies like CoreWeave.

- Positive overall market sentiment on Thursday: A favorable general market environment can amplify the impact of positive company-specific news.

- Increased investor confidence in the tech sector: Confidence in the technology sector, particularly in the AI field, is essential for driving investment and stock prices.

- Positive news impacting related technology stocks: Positive developments in related sectors often lead to broader market enthusiasm, benefiting companies within the same ecosystem.

Potential Risks and Considerations

While the current outlook for CoreWeave appears positive, it's crucial to acknowledge potential risks and challenges that could impact its future performance and the CRWV stock price.

Competition in the Cloud Computing Market

The cloud computing market is highly competitive, with established players and new entrants constantly vying for market share. This competitive pressure presents potential challenges for CoreWeave.

- Competition from established cloud providers: Large, established cloud providers pose a significant competitive threat to CoreWeave.

- Potential for new entrants into the AI infrastructure market: New companies might emerge with innovative technologies or business models, increasing competitive pressure.

- Maintaining a competitive pricing strategy: Balancing profitability with competitive pricing is essential to attracting and retaining clients.

Future Outlook and Uncertainties

While the future looks bright, several uncertainties could impact CoreWeave's performance. Investors should remain aware of these potential risks.

- Fluctuations in the demand for AI services: Changes in market demand due to economic factors or technological shifts could affect CoreWeave's revenue streams.

- Economic downturns impacting technology spending: Economic uncertainty can lead to reduced technology investment, potentially impacting CoreWeave's growth.

- Regulatory changes affecting the cloud computing industry: New regulations could create compliance challenges or increase operational costs.

Conclusion

The significant increase in CoreWeave, Inc. (CRWV) stock price on Thursday reflects a confluence of factors: its strategic focus on the burgeoning AI infrastructure market, likely strong financial performance, and a positive overall market sentiment. While competitive pressures and economic uncertainties exist, understanding these underlying forces offers a clearer picture of the CRWV stock surge. For continued insights into CoreWeave's trajectory, consistently monitor its financial reports, industry news, and related market trends to make informed decisions about your investment in CoreWeave stock and its future growth potential.

Featured Posts

-

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Du An Trong Diem Ket Noi Dong Nai Binh Phuoc Khoi Cong Thang 6

May 22, 2025 -

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025 -

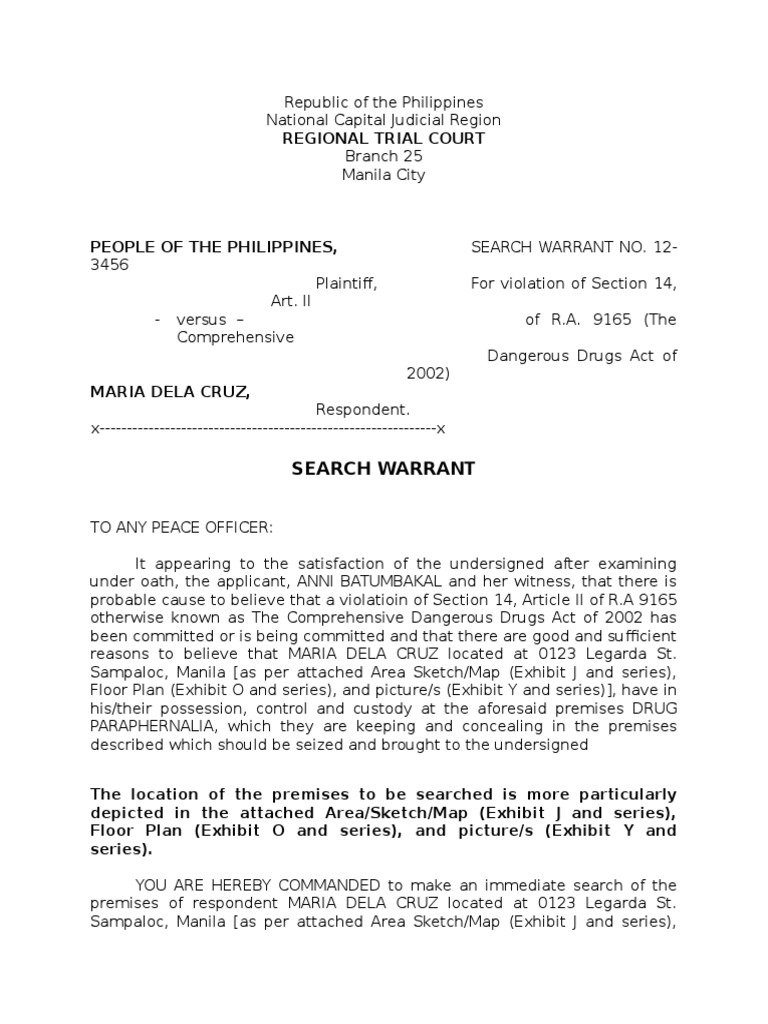

Pennsylvania Fbi Investigation Search Warrant Served In Lebanon County

May 22, 2025

Pennsylvania Fbi Investigation Search Warrant Served In Lebanon County

May 22, 2025 -

Ten Man Juventus Held To Draw By Lazio In Serie A Thriller

May 22, 2025

Ten Man Juventus Held To Draw By Lazio In Serie A Thriller

May 22, 2025 -

Why Did Gas Prices Rise In Akron And Cleveland Ohio Gas Buddy Updates

May 22, 2025

Why Did Gas Prices Rise In Akron And Cleveland Ohio Gas Buddy Updates

May 22, 2025

Latest Posts

-

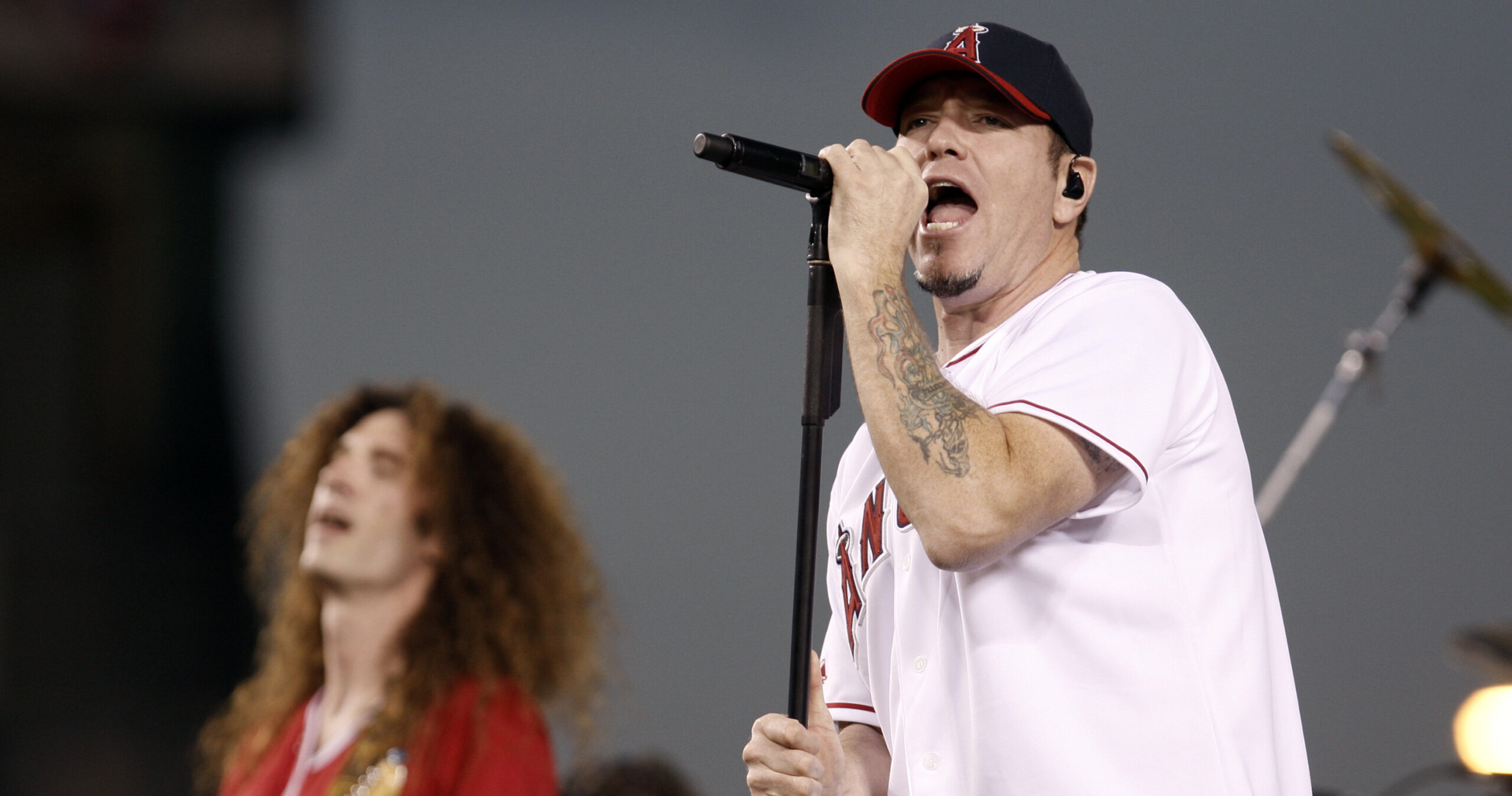

Remembering A Rock Star Frontman Dies At 32

May 22, 2025

Remembering A Rock Star Frontman Dies At 32

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025 -

Rock Icon Dead At 32 Fans Mourn The Loss

May 22, 2025

Rock Icon Dead At 32 Fans Mourn The Loss

May 22, 2025 -

Adam Ramey Dropout King Singer Dies Aged 31 A Tribute

May 22, 2025

Adam Ramey Dropout King Singer Dies Aged 31 A Tribute

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025