Should I Buy Palantir Stock Before May 5th? A Data-Driven Perspective

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent performance is crucial before considering buying Palantir stock. Key performance indicators (KPIs) offer valuable insights. We need to examine the trends in earnings per share (EPS), revenue growth, and profit margins to understand the company's financial health. Let's delve deeper:

-

Stock Price Trends: [Insert chart showing Palantir's stock price performance over the past few months. Clearly label axes and highlight key trends.] Observe the volatility and identify any significant price fluctuations.

-

Key Performance Indicators:

- EPS (Earnings Per Share): [Insert data on Palantir's EPS, comparing it to previous quarters and industry benchmarks.] A consistent increase in EPS signals strong profitability.

- Revenue Growth: [Insert data on Palantir's revenue growth, showing year-over-year and quarter-over-quarter comparisons.] Sustained revenue growth is a positive indicator of company health.

- Profit Margins: [Insert data on Palantir's profit margins, highlighting gross, operating, and net margins.] Improving profit margins indicate better efficiency and cost management.

-

Significant Events:

- [List and analyze any significant news impacting Palantir's stock price, such as major contract wins, new product launches, or regulatory changes. Include links to reputable sources.]

- Discuss the positive and negative impacts these events had on the Palantir share price.

-

Financial Stability:

- Debt-to-Equity Ratio: [Insert data and analysis of Palantir's debt-to-equity ratio.] A low ratio indicates strong financial stability.

- Cash Flow: [Insert data and analysis of Palantir's cash flow.] Positive cash flow demonstrates the company's ability to generate cash from its operations.

-

Competitor Analysis: [Compare Palantir's performance to its main competitors like Databricks and Snowflake, focusing on key metrics and market share. Include a comparative chart if possible.]

Upcoming Catalysts Affecting Palantir Stock Before May 5th

Several upcoming events could significantly impact the Palantir share price before May 5th. Understanding these "catalysts" is vital for making informed investment decisions regarding Palantir stock.

-

Earnings Reports: [Analyze the expected date of the next earnings report and discuss the potential impact on investor sentiment. Mention analyst expectations and any potential surprises.] Use keywords like "Palantir earnings date" and "Palantir earnings call."

-

Product Launches and Partnerships: [Discuss any anticipated product launches or significant partnerships that might influence the Palantir stock price. Explain how these events could boost investor confidence.] Use keywords like "Palantir new product" and "Palantir strategic partnerships."

-

Conferences and Presentations: [Mention any upcoming industry conferences or investor presentations where Palantir might make announcements. Highlight the potential for positive or negative news to emerge from these events.] Use keywords like "Palantir conference" and "Palantir investor presentation."

-

Analyst Forecasts: [Summarize the opinions of leading financial analysts on Palantir's future performance and their price targets. Note the range of predictions and any discrepancies.] Use keywords like "Palantir stock forecast" and "Palantir analyst ratings."

Risks Associated with Investing in Palantir Stock

While Palantir offers potential for significant returns, investing in Palantir stock carries inherent risks. A thorough risk assessment is essential before making any investment decisions.

-

Market Volatility: The technology sector is inherently volatile. Broad market downturns can significantly impact the Palantir share price regardless of the company's performance. Use keywords like "Palantir stock volatility" and "tech stock risk."

-

Competition: Palantir faces competition from established players and emerging startups in the data analytics and intelligence market. This competition could pressure profit margins and limit growth. Use keywords like "Palantir competitors" and "competitive landscape."

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. Budget cuts, delays, or changes in government priorities could negatively impact the company's financial performance. Use keywords like "Palantir government contracts" and "government spending risk."

-

High Valuation: Palantir's current valuation might be considered high by some investors. This means that future growth needs to be substantial to justify the current stock price. Use keywords like "Palantir valuation" and "stock valuation risk."

Data-Driven Investment Strategies for Palantir Stock

Based on the analysis above, several data-driven strategies can help you approach investing in Palantir stock:

-

Investment Horizon: Consider your investment horizon – long-term or short-term. Long-term investors may be more willing to weather short-term market fluctuations. Short-term investors need to be more attuned to immediate market shifts.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. It helps mitigate the risk of investing a large sum at a market peak.

-

Portfolio Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to reduce risk.

-

Risk Tolerance: Assess your own risk tolerance before investing in Palantir. This stock is considered higher risk due to its volatility and dependence on government contracts.

Conclusion: Should You Buy Palantir Stock Before May 5th? The Verdict

Investing in Palantir stock before May 5th presents both opportunities and risks. While the company shows potential for growth based on its recent performance and upcoming catalysts, investors should be aware of the inherent volatility in the tech sector and Palantir's dependence on government contracts. This analysis provides a data-driven perspective, but it's not financial advice. The decision of whether to buy Palantir stock rests solely with you. Before making any investment decisions regarding Palantir stock, conduct your own thorough research, consider your risk tolerance, and seek professional financial advice if needed. Remember to carefully assess the risks involved before investing in Palantir shares.

Featured Posts

-

King Mask I Tramp Zradniki Yaki Obozhnyuyut Putina

May 09, 2025

King Mask I Tramp Zradniki Yaki Obozhnyuyut Putina

May 09, 2025 -

Sporedba Dali Neko Mu Parira Na Bekam

May 09, 2025

Sporedba Dali Neko Mu Parira Na Bekam

May 09, 2025 -

150 Million Settlement For Credit Suisse Whistleblowers

May 09, 2025

150 Million Settlement For Credit Suisse Whistleblowers

May 09, 2025 -

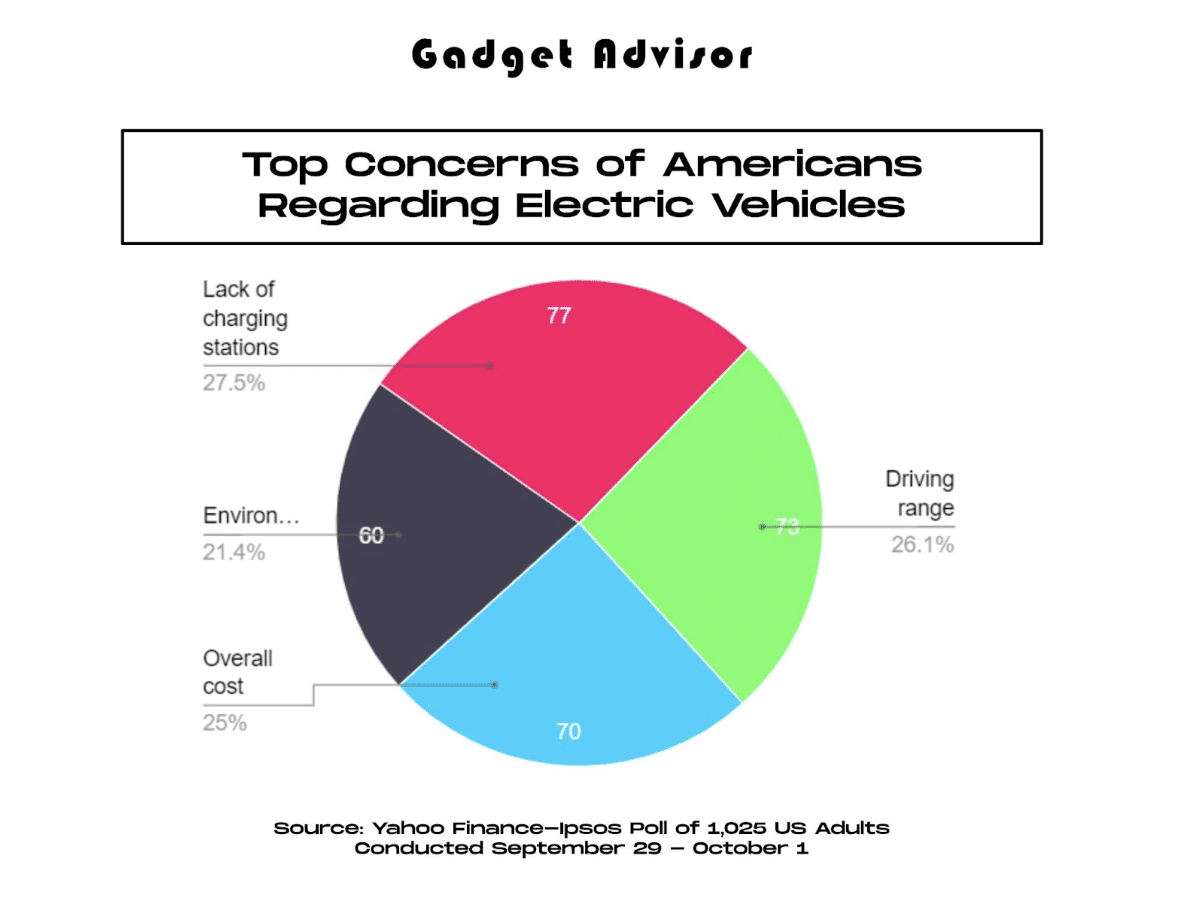

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

May 09, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

May 09, 2025 -

Post Canada Rift China Explores Alternative Canola Sources

May 09, 2025

Post Canada Rift China Explores Alternative Canola Sources

May 09, 2025