$150 Million Settlement For Credit Suisse Whistleblowers

Table of Contents

The Allegations Against Credit Suisse

The lawsuits against Credit Suisse stemmed from a series of serious allegations detailing years of systematic misconduct. These accusations involved various financial crimes, regulatory violations, and a disregard for ethical business practices. The scale of the alleged wrongdoing underscores the systemic issues within the institution and the courage of those who dared to expose them.

-

Allegation 1: Facilitating Tax Evasion Schemes: Credit Suisse allegedly aided wealthy clients in evading taxes through complex offshore accounts and structured financial products. This involved concealing assets and income from tax authorities, resulting in substantial revenue losses for multiple governments.

-

Allegation 2: Money Laundering Operations: The whistleblowers claimed Credit Suisse knowingly processed funds from illicit sources, turning a blind eye to the origin of the money in order to maintain profitable client relationships. This contributed to the broader issue of global money laundering and jeopardized international financial stability.

-

Allegation 3: Regulatory Violations: Numerous regulatory violations were alleged, ranging from inadequate anti-money laundering (AML) controls to failures in reporting suspicious activity, demonstrating a profound lack of corporate governance and compliance. These breaches violated several international and national financial regulations.

The Role of the Whistleblowers

The $150 million settlement wouldn't have been possible without the courageous whistleblowers who risked their careers and personal safety to expose Credit Suisse's alleged misconduct. Their actions highlight the critical role of internal reporting in uncovering corporate wrongdoing and the substantial challenges faced by those who choose to speak truth to power. These individuals often face intense pressure, risk of retaliation, and lengthy legal battles.

-

Key Whistleblowers: While the identities of many whistleblowers remain confidential to protect them from potential retaliation, their actions demonstrated unwavering dedication to ethical conduct.

-

Reporting Methods: These individuals utilized various methods to report the misconduct, including internal reporting channels, external regulatory agencies, and ultimately, the legal system. Many whistleblowers use a combination of methods for increased protection.

-

Risks Taken: The whistleblowers faced significant personal and professional risks, including job loss, reputational damage, and potential legal repercussions. Their courage should be recognized and lauded as an example of civic duty in the face of significant challenges.

The $150 Million Settlement: Terms and Implications

The $150 million settlement represents a significant financial penalty for Credit Suisse, impacting its bottom line and eroding its reputation. Beyond the financial implications, the settlement also signifies a substantial reputational damage and highlights the need for improved corporate governance and compliance measures. The agreement likely includes specific commitments from Credit Suisse to improve internal controls and bolster compliance programs, though the full details may not be publicly disclosed.

-

Settlement Breakdown: While the exact breakdown isn't fully public, the $150 million likely covers legal fees, penalties, and potentially compensation to the whistleblowers.

-

Credit Suisse Commitments: Credit Suisse is likely committed to implementing significant changes in its compliance procedures, improving internal controls, and increasing transparency in its financial dealings to prevent future misconduct.

-

Impact on Future Legal Actions: The settlement might limit the potential for further legal actions related to the same allegations, but it doesn’t necessarily preclude future whistleblower cases arising from other potential violations.

The Significance of the Settlement for Whistleblower Protection

The $150 million Credit Suisse whistleblower settlement establishes a significant legal precedent for future cases globally. This outcome underscores the importance of robust whistleblower protection laws and the potential impact that such laws can have on corporate accountability within the financial industry. It sends a strong message that those who expose wrongdoing within large financial institutions will be supported.

-

Impact on Legislation: This settlement could push for stronger whistleblower protection legislation in various jurisdictions, offering greater incentives and protection for individuals willing to expose corporate misconduct.

-

Increased Reporting: The outcome is expected to encourage more individuals to report financial misconduct, knowing there is a mechanism for accountability and potential redress.

-

Similar Cases: This settlement will likely embolden individuals involved in similar situations within other financial institutions to come forward, knowing that their actions could lead to significant repercussions for those engaging in unethical behaviour.

Conclusion: The $150 Million Credit Suisse Whistleblower Settlement: A Turning Point?

The $150 million settlement in the Credit Suisse whistleblower case represents a significant victory for financial transparency and accountability. The substantial financial penalty and the potential for broader systemic reform highlight the crucial role of whistleblowers in maintaining financial integrity. This case serves as a stark reminder of the importance of robust whistleblower protection, urging both individuals and corporations to prioritize ethical conduct. Learn more about protecting yourself and reporting financial misconduct. Understanding whistleblower rights is crucial for maintaining financial integrity and holding corporations accountable for their actions. Reporting financial crimes is a critical step in safeguarding our financial systems. Protect whistleblowers and strengthen whistleblower protection laws today.

Featured Posts

-

Young Thug Reacts Prison Release And The Not Like U Reference

May 09, 2025

Young Thug Reacts Prison Release And The Not Like U Reference

May 09, 2025 -

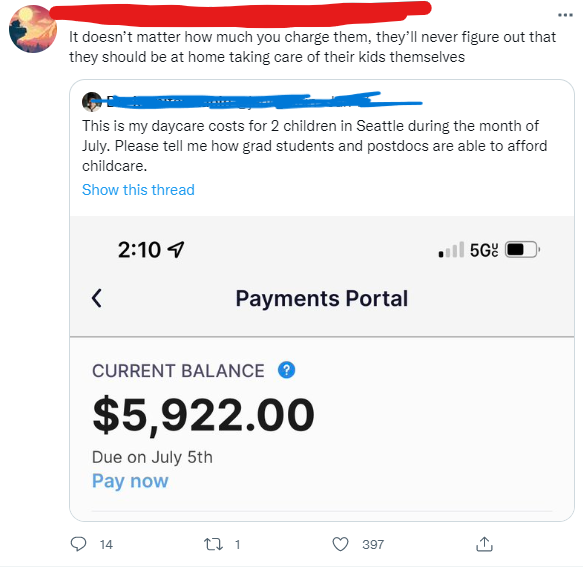

Expensive Babysitting Costs Father Even More In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father Even More In Daycare Fees

May 09, 2025 -

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 09, 2025

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 09, 2025 -

Meet Your Nl Federal Election Candidates A Comprehensive Guide

May 09, 2025

Meet Your Nl Federal Election Candidates A Comprehensive Guide

May 09, 2025 -

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decrease Hurun Global Rich List 2025

May 09, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decrease Hurun Global Rich List 2025

May 09, 2025