Shopping Mall Mogul From B.C. Seeks Hudson's Bay Lease Acquisition

Table of Contents

The Driving Force Behind the Acquisition

The driving force behind this ambitious Hudson's Bay lease acquisition is [Name of B.C. Mogul] and their company, [Company Name] (link to relevant news article if available). Their interest stems from a strategic vision for revitalizing a prime piece of Canadian retail real estate. The current Hudson's Bay location offers significant potential for redevelopment and repositioning within the market. Their plans reportedly include extensive renovations, tenant diversification, and potentially even an expansion of the existing footprint. The strategic location, nestled within [City/Area], boasts high foot traffic and proximity to affluent demographics, making it an extremely attractive asset.

- Expected ROI: Analysts predict a substantial return on investment, exceeding [estimated percentage] within [timeframe], based on projected rental increases and the potential for higher-value tenants.

- Target Demographics: The redevelopment strategy focuses on attracting a younger, more affluent demographic, complementing [Company Name]'s existing portfolio and tapping into the growing demand for upscale retail experiences.

- Synergies with Existing B.C. Shopping Mall Portfolio: This acquisition aligns perfectly with [Company Name]'s existing portfolio of successful shopping malls in British Columbia, creating synergies in management, marketing, and tenant relationships.

Financial Aspects of the Hudson's Bay Lease Acquisition

The estimated value of the Hudson's Bay lease is reportedly in the range of [estimated value range], reflecting the property's prime location and potential for future development. [Company Name]'s financing strategy is likely to involve a combination of private equity investment and potentially bank loans, given the considerable investment required. The transaction carries inherent risks, including potential legal challenges during the due diligence process and the unpredictable nature of the retail market.

- Lease Terms and Conditions: The specifics of the lease agreement, including the duration, renewal options, and any associated restrictions, will play a crucial role in determining the overall financial viability of the project.

- Due Diligence Process: A comprehensive due diligence process is essential to identify and mitigate potential risks, including environmental concerns, structural issues, and any outstanding legal claims.

- Potential Legal Challenges: Acquiring a lease of this magnitude could encounter legal hurdles, requiring skilled negotiators and potentially protracted legal proceedings.

Impact on the Canadian Retail Landscape

The Hudson's Bay lease acquisition will undoubtedly have a ripple effect on the Canadian retail landscape. The deal could trigger a wave of redevelopment projects in surrounding areas, potentially leading to increased competition among retailers. Conversely, the enhanced retail experience resulting from the redevelopment may attract consumers away from competing malls, creating a significant shift in market share. The project also has the potential for both job creation through construction and redevelopment, and potential job displacement for existing tenants not included in the new plans.

- Competition Analysis: Existing shopping malls and retailers in the area will need to adapt their strategies to compete with the revitalized Hudson's Bay location, potentially leading to increased price competition and innovative marketing strategies.

- Economic Impact Assessment: A detailed economic impact assessment is necessary to gauge the broader effects of this acquisition, factoring in job creation, increased consumer spending, and the overall contribution to the local economy.

- Consumer Sentiment: Positive consumer sentiment towards the revitalized space is crucial for the success of the project, requiring a careful balance between preserving the heritage of the location and introducing modern amenities.

Securing the Future: The Significance of this Hudson's Bay Lease Acquisition

This Hudson's Bay lease acquisition represents a bold move by a prominent B.C. shopping mall mogul, demonstrating ambition and confidence in the future of Canadian retail real estate. The financial implications are significant, and the project's success will hinge on strategic planning, careful execution, and adapting to the evolving needs of consumers. The wider impact on the Canadian retail landscape remains to be seen, but it's clear that this deal will set a precedent for future redevelopment projects and shape the competitive landscape for years to come. Stay tuned for further updates on this landmark Hudson's Bay lease acquisition and its impact on the Canadian retail landscape, focusing on Canadian retail real estate and B.C. shopping mall development.

Featured Posts

-

L Ascension De Melanie Thierry De Ses Debuts A Aujourd Hui

May 25, 2025

L Ascension De Melanie Thierry De Ses Debuts A Aujourd Hui

May 25, 2025 -

Inside The Hells Angels History Structure And Activities

May 25, 2025

Inside The Hells Angels History Structure And Activities

May 25, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud

May 25, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Wintour Feud

May 25, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 25, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025

Latest Posts

-

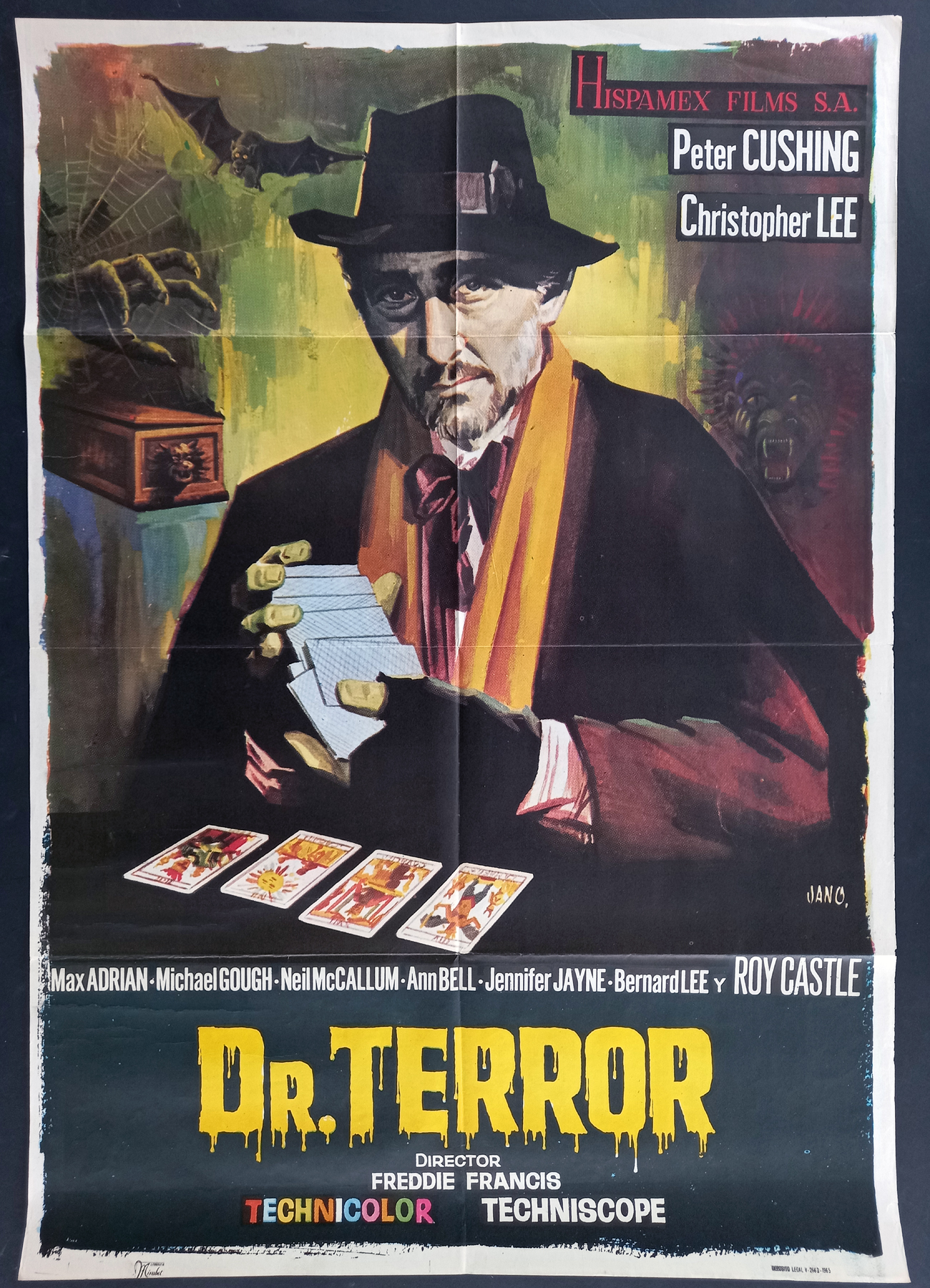

Dr Terrors House Of Horrors Review And Walkthrough

May 25, 2025

Dr Terrors House Of Horrors Review And Walkthrough

May 25, 2025 -

Jenson And The Fw 22 Extended Collection Details And Analysis

May 25, 2025

Jenson And The Fw 22 Extended Collection Details And Analysis

May 25, 2025 -

Jenson And The Fw 22 Extended Collection Unveiled

May 25, 2025

Jenson And The Fw 22 Extended Collection Unveiled

May 25, 2025 -

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025 -

Jenson And The Fw 22 Extended A Comprehensive Guide

May 25, 2025

Jenson And The Fw 22 Extended A Comprehensive Guide

May 25, 2025