Berkshire Hathaway And Apple: Will Buffett's Succession Impact Apple Stock?

Table of Contents

Warren Buffett's legacy at Berkshire Hathaway is undeniable, and his significant investment in Apple has been a cornerstone of the company's success. With succession planning underway, investors are naturally wondering: Will Buffett's departure affect Berkshire Hathaway's holdings in Apple, and ultimately, Apple's stock price? This article delves into the potential impacts of this transition, examining the scale of Berkshire's Apple investment, the succession plan's implications, and the long-term outlook for Apple itself.

Berkshire Hathaway's Apple Investment: A Deep Dive

The Scale of Berkshire's Holdings:

Berkshire Hathaway's Apple investment is colossal, representing a substantial portion of both company's portfolios. Understanding the sheer size is crucial to assessing the potential impact of any changes in investment strategy.

- Market Value: As of [Insert Current Date], Berkshire Hathaway's Apple holdings are valued at [Insert Current Market Value]. This represents a significant portion of Apple's overall market capitalization.

- Percentage of Berkshire's Portfolio: Apple constitutes a substantial percentage (approximately [Insert Percentage] as of [Insert Date]) of Berkshire Hathaway's overall investment portfolio, making it a cornerstone holding.

- Apple's Position in the Overall Market: Apple consistently ranks among the world's most valuable companies, solidifying its position as a market leader in technology and influencing the broader market's performance.

Keywords: Berkshire Hathaway Apple investment, Apple stock holdings, Berkshire Hathaway portfolio, Apple market capitalization.

Buffett's Rationale for Investing in Apple:

Buffett's decision to invest heavily in Apple wasn't arbitrary. His investment philosophy, focused on long-term value and strong businesses, aligns perfectly with Apple's attributes.

- Apple's Strong Brand: Apple boasts an unparalleled brand recognition and loyalty, creating a powerful moat against competitors.

- Consistent Profitability: Apple consistently delivers strong and predictable profits, providing a reliable return on investment.

- Loyal Customer Base: Apple's customer base displays remarkable loyalty, ensuring recurring revenue streams through product upgrades and services.

- Innovative Products: Apple's history of innovation ensures a continuous stream of new products and services, driving future growth.

Keywords: Warren Buffett Apple strategy, Apple long-term investment, Buffett investment philosophy, Apple brand loyalty, Apple revenue streams.

The Succession Plan and its Potential Implications

The Designated Successors and Their Investment Strategies:

The individuals slated to succeed Buffett, namely [Insert Names of Key Successors], possess varying investment styles and experiences. Their approaches may differ significantly from Buffett's, potentially influencing Berkshire Hathaway's Apple holdings.

- Investment Backgrounds: [Provide brief descriptions of each successor's investment experience and philosophy.]

- Potential Shifts in Investment Philosophy: A shift towards a more active, shorter-term investment strategy, or a focus on different sectors, could lead to changes in Berkshire Hathaway's Apple holdings. This could result in partial or full divestment.

Keywords: Berkshire Hathaway succession plan, Buffett successors, investment strategy change, Berkshire Hathaway investment philosophy.

Market Reaction to Succession Announcements:

Analyzing historical market reactions to similar succession announcements within large corporations provides insights into potential future impacts on Apple's stock.

- Examples of Similar Situations: [Provide examples of large corporations undergoing leadership transitions and the subsequent market response.]

- Market Responses to News: Past examples show that while there can be short-term volatility, the long-term impact often depends on the new leadership's actions and communication.

- Analysis of Investor Sentiment: Investor sentiment surrounding the succession will greatly influence Apple's stock price.

Keywords: Market reaction to succession, investor confidence, stock market volatility, Apple stock price reaction.

Analyzing the Long-Term Outlook for Apple

Apple's Independent Strength:

Apple's financial health and future prospects are strong irrespective of Berkshire Hathaway's involvement. The company’s inherent strengths provide a robust foundation for sustained growth.

- Revenue Streams: Apple’s diversified revenue streams, including iPhones, services, wearables, and Macs, provide resilience against market fluctuations.

- Product Innovation: Apple's continued investment in research and development ensures a constant flow of innovative products.

- Market Dominance: Apple maintains significant market share in several key areas, granting it substantial pricing power.

- Competitive Landscape: While competition exists, Apple's strong brand and loyal customer base provide a competitive advantage.

Keywords: Apple financial performance, Apple future prospects, Apple market share, Apple revenue diversification.

Potential Scenarios for Berkshire Hathaway's Apple Investment Post-Succession:

Several scenarios could unfold following Buffett's departure, each with varying implications on Apple's stock price:

- Maintaining Holdings: Berkshire Hathaway could maintain its significant Apple holdings, signifying continued confidence in the company's long-term prospects. This would likely have a stabilizing effect on Apple's stock price.

- Partial Divestment: A partial divestment could stem from a need for diversification or a shift in investment strategy. This could cause temporary price fluctuations, but the impact would likely be limited given Apple’s overall market strength.

- Complete Divestment: A complete divestment would be a significant event, potentially causing greater volatility in Apple's stock price. However, the impact would ultimately depend on the market's interpretation of the decision.

Keywords: Berkshire Hathaway Apple divestment, Apple stock price prediction, future investment strategies, Apple stock volatility.

Conclusion:

The succession at Berkshire Hathaway presents uncertainty regarding the future of their substantial Apple investment. While Buffett’s departure is a significant event, Apple’s intrinsic strength and diverse revenue streams suggest a resilient outlook. The actual impact on Apple's stock price will depend on the actions and strategies of Buffett's successors and the broader market's reaction to these changes. Predicting the future with certainty is impossible, but careful analysis of the various scenarios highlighted above is crucial for informed investment decisions.

Call to Action: Stay informed about the evolving situation surrounding Berkshire Hathaway and Apple. Continue to monitor the news and analyze the ongoing impacts of the succession plan on Apple stock. Follow us for future updates on the Berkshire Hathaway and Apple relationship and insights into the evolving investment landscape.

Featured Posts

-

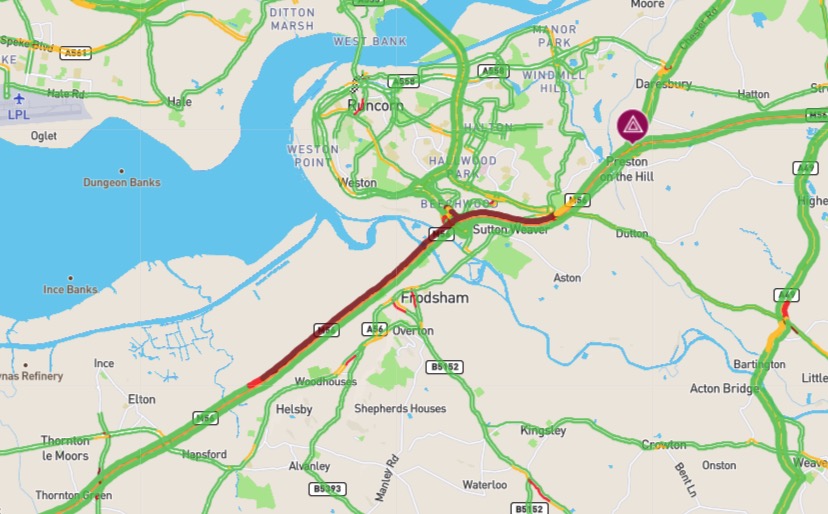

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

Dangerous Fungi And Climate Change Understanding The Risk

May 25, 2025

Dangerous Fungi And Climate Change Understanding The Risk

May 25, 2025 -

Emergency Services Respond To Major Collision Person Hospitalized

May 25, 2025

Emergency Services Respond To Major Collision Person Hospitalized

May 25, 2025 -

Thames Waters Executive Pay Packages Fair Or Unfair

May 25, 2025

Thames Waters Executive Pay Packages Fair Or Unfair

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 25, 2025

Escape To The Country Top Locations For A Tranquil Life

May 25, 2025

Latest Posts

-

Monaco Vs Nice Le Groupe Convoque

May 25, 2025

Monaco Vs Nice Le Groupe Convoque

May 25, 2025 -

Tmdyd Eqd Mynamynw Me Mwnakw Tfasyl Alsfqt

May 25, 2025

Tmdyd Eqd Mynamynw Me Mwnakw Tfasyl Alsfqt

May 25, 2025 -

El Baile De La Rosa 2025 Un Desfile De Alta Costura Y Glamour

May 25, 2025

El Baile De La Rosa 2025 Un Desfile De Alta Costura Y Glamour

May 25, 2025 -

Francis Sultanas Contribution To The Robuchon Monaco Restaurant Design

May 25, 2025

Francis Sultanas Contribution To The Robuchon Monaco Restaurant Design

May 25, 2025 -

Mwnakw Ydmn Bqae Mynamynw Beqd Jdyd

May 25, 2025

Mwnakw Ydmn Bqae Mynamynw Beqd Jdyd

May 25, 2025