Shifting The Balance: Strategies For Reducing U.S. Control Of Canadian Assets

Table of Contents

Strengthening Canadian Regulatory Frameworks

To effectively address the issue of reducing U.S. control of Canadian assets, Canada must strengthen its regulatory frameworks. This involves enhancing existing mechanisms and creating new ones to better scrutinize foreign investment and promote domestic ownership.

Enhancing Investment Review Mechanisms

The Investment Canada Act is a crucial tool for regulating foreign investment. However, it needs significant enhancements to effectively address the challenges posed by substantial U.S. investment. Improvements must focus on:

- Increased Transparency: Greater public access to the review process and its criteria will increase accountability and public trust.

- Stricter Criteria: Expanding the scope of national security reviews to encompass a broader range of sectors and considering the potential impact on Canadian economic independence.

- Faster Processing Times: Streamlining the review process will reduce delays and uncertainties for both investors and the government.

- Increased Penalties for Violations: Implementing stronger deterrents against violations of the Act will ensure compliance and protect Canadian interests.

Legislative changes could include expanding the definition of "national security" to encompass economic security and introducing stricter thresholds for triggering reviews of foreign investments, particularly those from the U.S.

Promoting Domestic Ownership

Encouraging Canadian ownership of key assets in strategic sectors like energy, technology, and natural resources is paramount for reducing U.S. control of Canadian assets. This can be achieved through several initiatives:

- Tax Incentives: Offering targeted tax breaks to Canadian companies investing in strategic sectors.

- Government-Backed Loan Programs: Providing financial support to Canadian businesses acquiring domestic assets.

- Public Awareness Campaigns: Promoting the "Buy Canadian" initiative to encourage consumers to support domestic businesses.

- Promoting Employee Stock Ownership Plans (ESOPs): Empowering employees to become owners and stakeholders in their companies, fostering greater domestic control.

Diversifying International Partnerships

Over-reliance on the U.S. market is a vulnerability that needs to be addressed. Diversifying international partnerships is crucial for reducing U.S. control of Canadian assets and strengthening Canada's economic resilience.

Fostering Trade Relationships with Non-U.S. Countries

Strengthening trade agreements with countries in the UK, the EU, and Asia will open new markets for Canadian goods and services, reducing dependence on the U.S. market. This includes:

- Negotiating new Comprehensive Economic and Trade Agreements (CETAs): These agreements reduce tariffs and other trade barriers, increasing market access.

- Developing niche markets: Focusing on exporting specialized goods and services to diverse markets to reduce reliance on a single major trading partner.

- Fostering technological collaborations: Strengthening research and development partnerships with international companies to drive innovation and competitiveness.

This diversification will create a more balanced and secure economic landscape, mitigating the risks associated with over-reliance on a single trading partner.

Attracting Foreign Investment from Diverse Sources

Actively seeking foreign direct investment (FDI) from non-U.S. sources is essential to counterbalance the influence of American capital. Strategies include:

- Targeted marketing campaigns: Highlighting Canada's strengths as an investment destination, emphasizing stability, skilled workforce, and pro-business environment.

- Streamlining investment processes: Simplifying regulations and procedures to make it easier for international investors to invest in Canada.

- Promoting Canada's economic advantages: Showcasing Canada's diverse economy, strong rule of law, and stable political climate to attract investors.

Empowering Canadian Businesses

A strong and competitive Canadian business sector is essential for reducing U.S. control of Canadian assets. Government support and policies that foster innovation and fair competition are crucial.

Supporting Canadian Innovation and Entrepreneurship

Government initiatives must support the growth of innovative Canadian companies and reduce reliance on foreign technologies. This involves:

- Funding for Research and Development (R&D): Providing increased funding for research and development to foster innovation in key sectors.

- Tax credits for businesses: Offering tax incentives to encourage investment in innovation and technology.

- Support for start-ups and SMEs: Providing mentorship, funding, and resources to support the growth of small and medium-sized enterprises.

- Improving access to capital: Making it easier for Canadian businesses to secure funding for expansion and innovation.

Promoting Fair Competition and Preventing Anti-Competitive Practices

Robust competition laws are essential to level the playing field for Canadian businesses and prevent unfair practices by U.S. companies. This requires:

- Strengthening competition law enforcement: Increasing resources and capabilities for investigating and prosecuting anti-competitive practices.

- Preventing mergers that stifle competition: Scrutinizing mergers and acquisitions to prevent the creation of monopolies that limit competition.

- Promoting a level playing field: Ensuring that Canadian businesses have equal access to markets and resources, without being unfairly disadvantaged by foreign competitors.

Conclusion

Reducing U.S. control of Canadian assets requires a multi-pronged approach encompassing strengthened regulatory frameworks, diversified international partnerships, and empowered Canadian businesses. By implementing the strategies outlined above, Canada can create a more balanced economic landscape, promoting domestic ownership, innovation, and long-term economic prosperity. We encourage you to engage in further discussion and research on this vital topic. Contact your elected officials to advocate for policy changes that support the reduction of U.S. control of Canadian assets and build a more independent and resilient Canadian economy.

Featured Posts

-

World Sbk Star Razgatlioglu Denies Moto Gp Move

May 29, 2025

World Sbk Star Razgatlioglu Denies Moto Gp Move

May 29, 2025 -

The Countrys New Business Landscape A Detailed Regional Analysis

May 29, 2025

The Countrys New Business Landscape A Detailed Regional Analysis

May 29, 2025 -

Jason Isaacs Fears He Ll Be Forgotten After Harry Potter Tv Series

May 29, 2025

Jason Isaacs Fears He Ll Be Forgotten After Harry Potter Tv Series

May 29, 2025 -

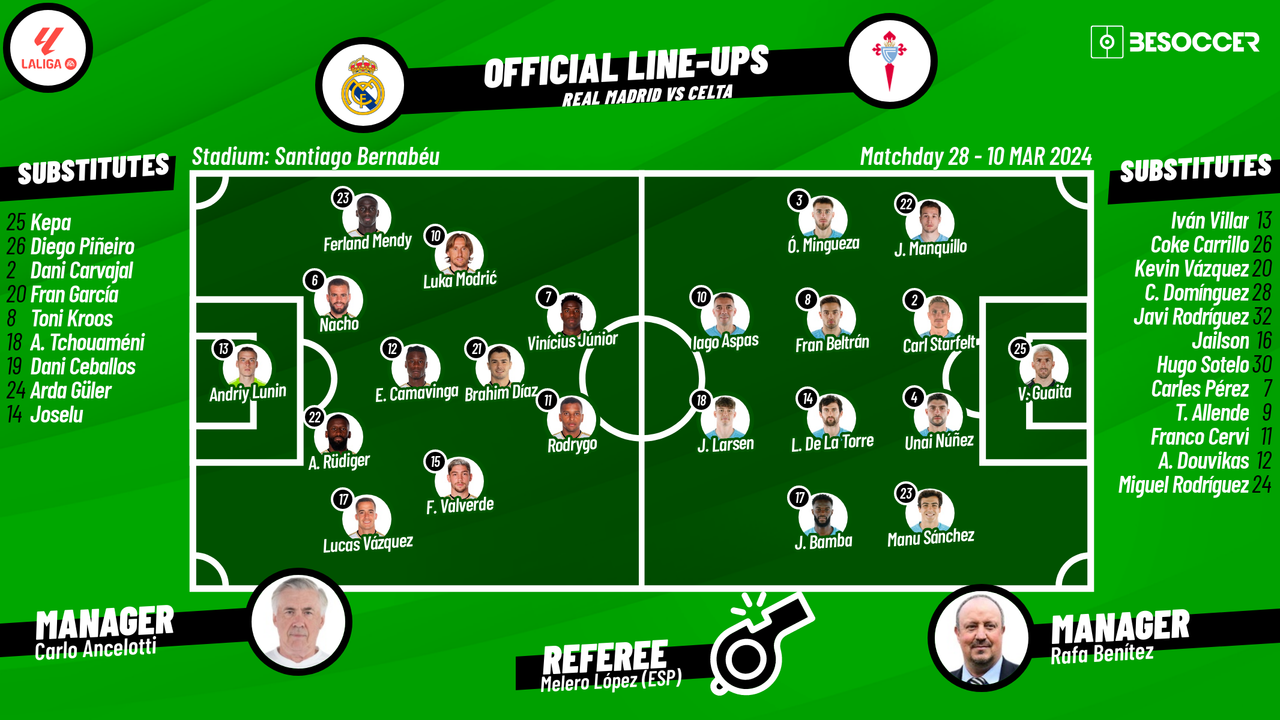

Real Madrid Vs Celta Vigo 3 2 Three Key Talking Points Explained

May 29, 2025

Real Madrid Vs Celta Vigo 3 2 Three Key Talking Points Explained

May 29, 2025 -

Telus Unveils Major Network Upgrade With Five Year Funding Commitment

May 29, 2025

Telus Unveils Major Network Upgrade With Five Year Funding Commitment

May 29, 2025

Latest Posts

-

Giulianis Tribute Remembering Bernie Keriks Patriotism

May 31, 2025

Giulianis Tribute Remembering Bernie Keriks Patriotism

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Former Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025 -

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Report

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Report

May 31, 2025 -

Former Nypd Commissioner Keriks Hospitalization Update On His Condition

May 31, 2025

Former Nypd Commissioner Keriks Hospitalization Update On His Condition

May 31, 2025 -

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025