Shifting Sands: Taiwanese Investors Reduce US Bond ETF Holdings

Table of Contents

Declining Confidence in the US Economy

The reduction in Taiwanese investment in US bond ETFs reflects a growing lack of confidence in the US economy's short-term prospects. Two key factors contribute to this: rising interest rates and persistent inflation, and escalating geopolitical concerns.

Rising Interest Rates and Inflation

The US Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have significantly impacted the attractiveness of US bonds.

- Reduced bond yields: Higher interest rates lead to lower bond prices, resulting in reduced yields for existing bond holders.

- Increased risk of capital losses: If interest rates continue to rise, investors holding US bond ETFs face the risk of substantial capital losses as bond values decline.

- Inflation eroding returns: Persistent inflation erodes the real return on US bond investments, making them less appealing compared to assets that can better hedge against inflation.

For instance, US inflation reached a 40-year high in 2022, significantly impacting the real return on US treasury bonds. The Federal Reserve's benchmark interest rate increased from near zero to over 5% in a short period, further dampening investor enthusiasm for US bond ETFs.

Geopolitical Concerns

Geopolitical instability, particularly the escalating tensions between the US and China, plays a significant role in influencing Taiwanese investment decisions.

- Concerns about US-China relations: The ongoing trade disputes and geopolitical rivalry between the US and China create uncertainty in the global market, making investors hesitant to heavily invest in US assets.

- Potential for trade wars: The risk of further trade conflicts or sanctions could negatively impact the US economy and the value of US bond ETFs.

- Impact on global markets: The overall global economic uncertainty created by these geopolitical tensions further contributes to investors' risk aversion and their diversification strategies.

Diversification and Search for Higher Yields

Beyond concerns about the US economy, Taiwanese investors are also actively seeking higher yields and greater portfolio diversification.

Exploring Alternative Investment Opportunities

Taiwanese investors are increasingly exploring alternative investment opportunities offering potentially higher returns and better risk diversification.

- Higher yields in other markets: Emerging markets, particularly in Asia, often offer higher bond yields compared to the US, attracting investors seeking better returns.

- Potential for greater returns: Diversification across different asset classes and geographies reduces the overall portfolio risk and offers the potential for better overall returns.

- Reduced dependence on the US market: By diversifying investments, Taiwanese investors reduce their reliance on the US market and mitigate the risks associated with its economic performance.

Examples of alternative investment destinations include high-yield corporate bonds in emerging Asian markets or investments in other developed economies like those in Europe.

Currency Fluctuations and Hedging Costs

Fluctuations in the USD/TWD exchange rate significantly impact the profitability of US bond ETF investments for Taiwanese investors.

- Increased hedging costs: To mitigate currency risk, investors often use hedging strategies, which can incur substantial costs, impacting overall returns.

- Potential for currency losses: If the Taiwanese dollar (TWD) appreciates against the US dollar (USD), Taiwanese investors face potential currency losses when converting their USD-denominated returns back to TWD.

- Impact on overall returns: The combined effect of lower bond yields, inflation erosion, and currency fluctuations can substantially reduce the overall returns on US bond ETF investments.

Recent data shows significant fluctuations in the USD/TWD exchange rate, making hedging costs a crucial consideration for Taiwanese investors in the US bond market.

Impact on the US and Taiwanese Economies

The shift in Taiwanese investment strategies has implications for both the US and Taiwanese economies.

Reduced Capital Inflows into the US

The decrease in Taiwanese investment in US bond ETFs contributes to reduced capital inflows into the US bond market.

- Potential impact on US interest rates: Lower demand for US treasuries could potentially influence US interest rates, albeit indirectly.

- Reduced demand for US treasuries: Decreased foreign investment could affect the liquidity of the US treasury market and potentially increase borrowing costs for the US government.

Taiwanese investment in US bond ETFs constitutes a significant portion of overall foreign investment; therefore, even a moderate reduction has noticeable effects.

Implications for the Taiwanese Investment Landscape

The shift in Taiwanese investor preferences affects the domestic investment landscape and savings strategies.

- Shift in investment strategies: Taiwanese investors are increasingly adopting more diversified investment strategies, moving away from a heavy reliance on US assets.

- Potential search for alternative high-yield options: The search for higher yields is likely to drive investment into other asset classes and markets, reshaping the Taiwanese investment landscape.

This shift could also impact the Taiwanese financial sector, potentially increasing the demand for services related to international investment and portfolio diversification.

Conclusion

The reduction in Taiwanese investment in US bond ETFs reflects a complex interplay of factors, including concerns about US economic stability, the search for higher yields elsewhere, and the need for greater portfolio diversification. This trend signifies a shift in global investment dynamics and highlights the importance of considering various economic and geopolitical factors when making investment decisions.

Call to Action: Staying informed about the evolving landscape of Taiwanese investment and its implications for the global bond market is crucial. Continue monitoring shifts in Taiwanese investors’ choices regarding US bond ETFs to make informed investment decisions and understand future trends in the global market. For further analysis on Taiwanese investors and their decisions regarding US bond ETFs, continue researching the latest market reports and expert analyses.

Featured Posts

-

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025

Expert Prediction Hargreaves On Arsenal Vs Psg Champions League Final

May 08, 2025 -

Andor Final Season Bts Cast Insights Into The Rogue One Prequel

May 08, 2025

Andor Final Season Bts Cast Insights Into The Rogue One Prequel

May 08, 2025 -

Nereden Izlenir Lyon Psg Canli Mac Yayini

May 08, 2025

Nereden Izlenir Lyon Psg Canli Mac Yayini

May 08, 2025 -

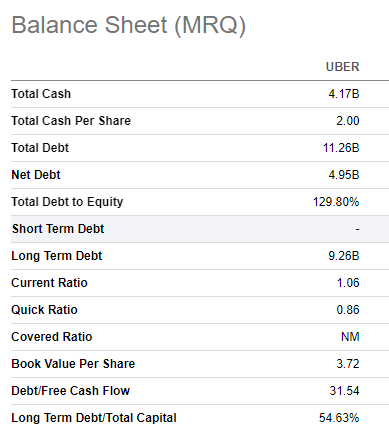

Uber Technologies Uber Investment Potential And Risks

May 08, 2025

Uber Technologies Uber Investment Potential And Risks

May 08, 2025 -

The Vaticans Financial Crisis A Legacy Pope Francis Couldnt Resolve

May 08, 2025

The Vaticans Financial Crisis A Legacy Pope Francis Couldnt Resolve

May 08, 2025