Uber Technologies (UBER): Investment Potential And Risks

Table of Contents

The Potential Upsides of Investing in UBER:

Massive Market Dominance and Network Effects:

Uber boasts a substantial global presence, holding leading positions in the ride-sharing and food delivery markets. This dominance stems from powerful network effects: the more riders and drivers on the platform, the more valuable the service becomes for everyone. This creates a significant barrier to entry for competitors.

- Key Geographic Markets and Growth: Uber enjoys considerable market share in North America, Europe, and parts of Asia. Future expansion into underserved markets, particularly in developing economies, presents substantial growth potential. The global expansion strategy is a key driver of future revenue for UBER investment.

- Market Share Examples: Uber's dominance is evident in many major cities worldwide. For example, in many US cities, Uber holds over 70% of the ride-hailing market share. This strong market position translates to substantial revenue generation.

- Future Expansion Plans and Acquisitions: Uber continues to actively seek opportunities for both organic growth and strategic acquisitions to further solidify its market position and diversify its offerings within the ride-sharing market and beyond.

Diversification and Future Growth Opportunities:

Uber's strategy extends far beyond its original ride-sharing service. Uber Eats, its food delivery arm, has become a major competitor in the booming food delivery market. Uber Freight targets the logistics sector, while significant investments in autonomous vehicles (self-driving cars) represent a bet on the future of transportation. These diverse revenue streams mitigate risk and offer substantial growth potential.

- Projected Growth Rates: Analysts project significant growth in Uber Eats and Uber Freight, with autonomous driving technology potentially revolutionizing the company's core business in the coming years.

- New Services and Partnerships: Uber consistently explores new services and partnerships to expand its offerings and tap into emerging markets, such as micromobility (e-scooters, e-bikes).

Technological Innovation and Competitive Advantage:

Uber’s substantial investment in technology, encompassing advanced mapping, artificial intelligence (AI), machine learning, and data analytics, provides a significant competitive advantage. This technological prowess allows for efficient operations, optimized pricing, and improved user experience.

- Impact of Technological Innovations: Uber's investment in AI helps optimize driver routing, predict demand surges, and personalize user experiences. The development of autonomous driving technology, if successful, could dramatically reduce operational costs and increase profitability.

- Data Analytics for Improved Efficiency: Uber's massive data sets allow for detailed analysis of rider and driver behavior, enabling more efficient resource allocation and personalized service offerings. This represents a major competitive advantage in the highly data-driven ride-sharing and food delivery sectors.

The Significant Risks of Investing in UBER:

High Competition and Regulatory Uncertainty:

The ride-sharing and food delivery markets are fiercely competitive. Companies like Lyft and DoorDash represent significant challenges, vying for market share and driving down prices. Furthermore, regulatory hurdles and legal challenges in various jurisdictions pose ongoing risks to Uber's profitability and operational efficiency.

- Examples of Regulatory Issues: Different cities and countries have varying regulations concerning driver classification, licensing, and operational requirements, creating a complex regulatory landscape.

- Competitive Pressures: The intense competition from Lyft, DoorDash, and other players necessitates continuous innovation and investment to maintain a competitive edge. Pricing wars and marketing expenses can significantly impact profitability.

Profitability and Sustainability Concerns:

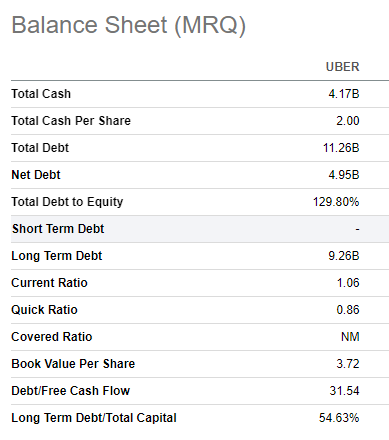

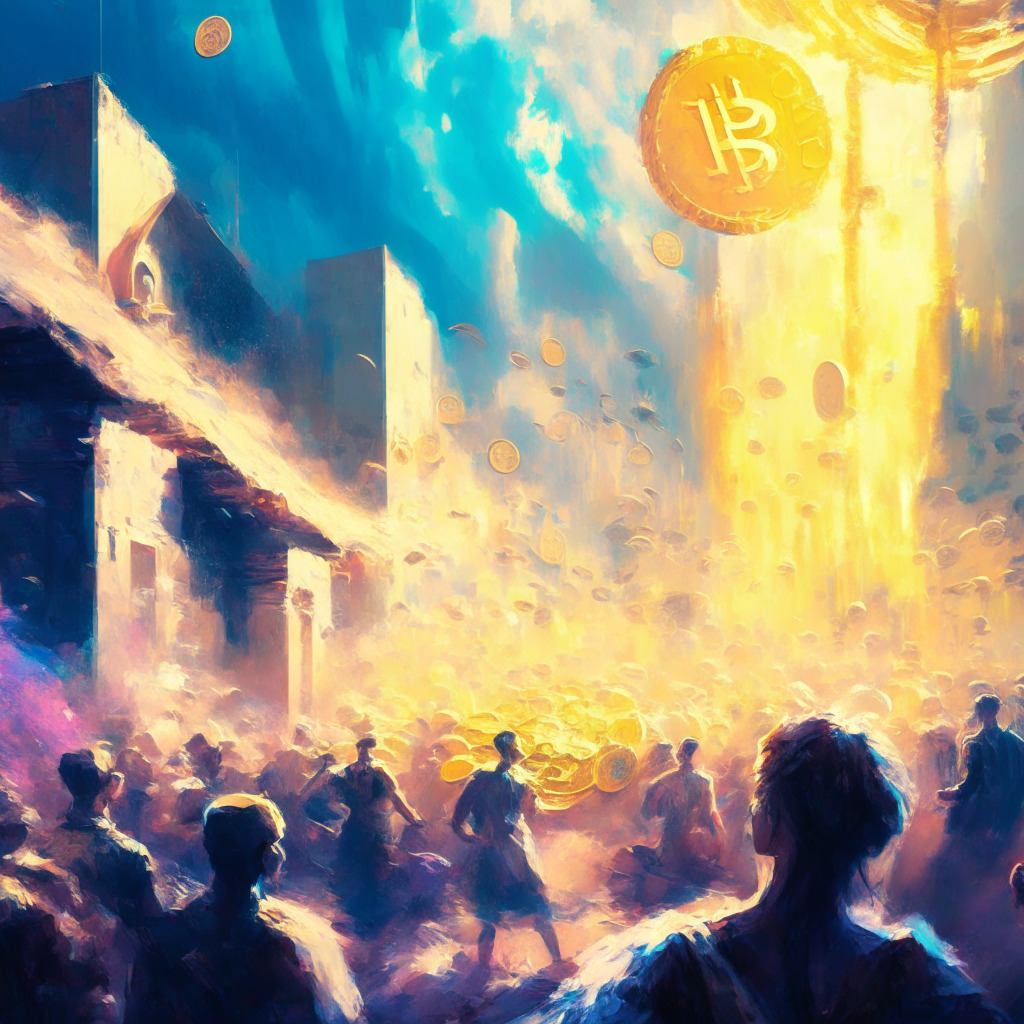

Uber's financial performance has been a subject of scrutiny. While revenue growth has been impressive, profitability has remained elusive for extended periods. High operating expenses, including driver compensation and technological investments, have impacted profit margins. Assessing the long-term sustainability of its business model is crucial for potential investors.

- Key Financial Metrics: Investors should carefully analyze key financial metrics like revenue growth, operating expenses, profit margins, and debt levels before considering UBER investment.

- Analysis of Profitability Trends and Challenges: The path to profitability requires careful scrutiny. Addressing operational inefficiencies, managing driver relations effectively, and navigating regulatory hurdles are key challenges.

Driver Relations and Labor Issues:

The classification of Uber drivers as independent contractors rather than employees is a major source of contention. Ongoing legal battles and labor disputes around worker's rights, compensation, and benefits pose a significant risk. These issues can impact operational costs, brand reputation, and potential legal liabilities.

- Examples of Significant Labor Disputes: Numerous lawsuits and regulatory investigations concerning driver classification have resulted in substantial financial settlements and operational disruptions.

- Potential Legal and Financial Implications: Future changes in labor laws or court rulings could significantly alter Uber’s operating model and financial performance, making thorough due diligence crucial before investing in Uber shares.

Conclusion: Is Investing in Uber Technologies (UBER) Right for You?

Investing in Uber Technologies presents a compelling opportunity, but also significant risks. The company's dominant market position, diversification strategy, and technological innovation offer substantial long-term growth potential. However, intense competition, regulatory uncertainty, profitability concerns, and labor-related issues must be carefully considered.

Before investing in Uber stock, or any UBER share investment, thorough due diligence is paramount. Analyze the company's financial performance, understand the competitive landscape, and assess your own risk tolerance and investment goals. Consider consulting with a qualified financial advisor to determine if an Uber stock investment aligns with your individual circumstances. Remember, investing in Uber shares involves inherent risk, and past performance is not indicative of future results. Conduct further research on Uber Technologies (UBER) and make informed decisions about your UBER investment.

Featured Posts

-

The Bitcoin Mining Boom Analyzing This Weeks Unexpected Growth

May 08, 2025

The Bitcoin Mining Boom Analyzing This Weeks Unexpected Growth

May 08, 2025 -

Soulja Boy Ordered To Pay 6 Million In Sexual Assault And Abuse Case

May 08, 2025

Soulja Boy Ordered To Pay 6 Million In Sexual Assault And Abuse Case

May 08, 2025 -

Canadas Trade Overture Will Washington Listen

May 08, 2025

Canadas Trade Overture Will Washington Listen

May 08, 2025 -

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025

Extradition Bid Malaysia Targets Disgraced Ex Goldman Partner In 1 Mdb Case

May 08, 2025 -

Andor Final Season Bts Cast Insights Into The Rogue One Prequel

May 08, 2025

Andor Final Season Bts Cast Insights Into The Rogue One Prequel

May 08, 2025