SEC Review Of Grayscale's XRP ETF: Will It Send XRP To New Highs?

Table of Contents

The cryptocurrency market is known for its volatility, but few assets hold the potential for explosive growth like XRP. The possibility of Grayscale, a titan in the crypto investment world, securing SEC approval for its XRP ETF could be a game-changer. Grayscale's history, marked by both successes and setbacks in its pursuit of ETF approvals, makes this application particularly significant. This article explores whether Grayscale's XRP ETF approval is likely to send the XRP price soaring to new highs. We will delve into the complexities of the SEC's review process, the potential market impact, and the broader implications for the crypto landscape. Understanding the potential implications of Grayscale's XRP ETF is crucial for anyone invested in, or considering investing in, the cryptocurrency market.

2. Main Points:

H2: Understanding Grayscale's Application and the SEC's Role

Grayscale, known for its Bitcoin Trust (GBTC), has a history of pushing the boundaries of cryptocurrency regulation. While its Bitcoin ETF application faced challenges, its experience provides valuable insight into the SEC's approval process. The SEC, responsible for protecting investors, has historically been cautious about approving crypto-based ETFs due to concerns surrounding market manipulation, price volatility, and investor protection. Grayscale's XRP ETF application must navigate these hurdles, presenting a compelling case for its approval.

- SEC Concerns: The SEC's primary concerns often revolve around preventing market manipulation and ensuring adequate investor protection within the volatile cryptocurrency market. They scrutinize the proposed ETF's structure, trading mechanisms, and surveillance-sharing agreements to mitigate these risks.

- Grayscale's Counterarguments: Grayscale will likely address the SEC's concerns by highlighting the robust surveillance mechanisms in place, the established market for XRP, and its commitment to investor protection through transparent reporting and trading practices. They might also emphasize the growing institutional interest in XRP.

- Potential Timeline: The SEC's decision timeline is unpredictable, varying widely depending on the complexity of the application and the prevailing regulatory climate. However, a decision could be expected within months or potentially longer, subject to potential delays and additional requests for information.

H2: The Potential Impact on XRP Price and Market Sentiment

SEC approval of Grayscale's XRP ETF could significantly impact XRP's price and market sentiment. Many analysts predict a substantial price increase due to increased institutional investment and trading volume.

- Price Prediction Models: While precise price predictions are speculative, several models suggest a potential surge in XRP's value, ranging from modest increases to potentially multi-fold growth, depending on market conditions.

- Increased Institutional Interest: ETF approval would likely attract significant institutional investment, boosting XRP's liquidity and overall market capitalization. Large financial institutions, currently hesitant to directly invest in XRP, might participate via the ETF.

- Ripple Effects on Other Cryptocurrencies: The success of a Grayscale XRP ETF could potentially influence the SEC's stance on other cryptocurrency ETFs and have positive ripple effects on the broader cryptocurrency market, signaling a shift toward greater regulatory acceptance.

- Downside Risks: Rejection of the application could negatively impact XRP's price, dampening investor sentiment and potentially leading to a sell-off. The SEC's decision will play a crucial role in shaping the future trajectory of XRP.

H2: Comparing XRP's Position to Other Cryptocurrencies and ETFs

Analyzing XRP's potential in the context of other cryptocurrencies with successful ETFs, like Bitcoin, is vital. While Bitcoin has seen significant growth with its ETF listings, XRP's unique features could further amplify its potential growth if its ETF gains approval.

- Comparison with Bitcoin and Ethereum ETFs: While Bitcoin and Ethereum ETFs have already paved the way for crypto-based ETFs, XRP's focus on cross-border payments and its established network could differentiate its ETF, leading to significant growth.

- XRP's Technological Advantages and Disadvantages: XRP's speed and low transaction costs are key advantages. However, ongoing legal challenges related to Ripple Labs could influence the SEC's decision and potentially impact its long-term prospects.

- Future of XRP and its Use Cases: The potential use cases of XRP, particularly in the realm of cross-border payments and financial settlements, could further enhance its attractiveness to institutional investors.

H3: Factors That Could Influence the SEC's Decision Beyond Grayscale's Application

The SEC's decision will not solely depend on Grayscale's application. External factors will significantly influence its outcome.

- General Crypto Market Trends: The prevailing sentiment in the broader cryptocurrency market will be a factor in the SEC's risk assessment. A bullish market might increase the likelihood of approval, while a bearish market could lead to more caution.

- Broader Regulatory Environment: Ongoing regulatory developments at both the national and international levels will influence the SEC's decision-making process.

3. Conclusion: Will the Grayscale XRP ETF Spark a New Bull Run?

The SEC's review of Grayscale's XRP ETF is a pivotal moment for the cryptocurrency market. While approval could trigger a significant surge in XRP's price and attract substantial institutional investment, rejection could lead to negative market consequences. The potential for Grayscale's XRP ETF to spark a new bull run is significant but dependent on many factors, including the SEC's assessment of market risks and the overall regulatory climate. Our analysis suggests a considerable likelihood of positive impact, but remaining informed about developments is crucial. Stay updated on the progress of Grayscale's XRP ETF application and the SEC's decision. Follow the latest news and analysis to make informed decisions regarding your investment strategy. Subscribe to our newsletter or follow us on social media for updates on Grayscale's XRP ETF and other important crypto market developments.

Featured Posts

-

The Most Realistic Wwii Movies A Military Historians Perspective

May 08, 2025

The Most Realistic Wwii Movies A Military Historians Perspective

May 08, 2025 -

The Bitcoin Mining Boom Analyzing This Weeks Unexpected Growth

May 08, 2025

The Bitcoin Mining Boom Analyzing This Weeks Unexpected Growth

May 08, 2025 -

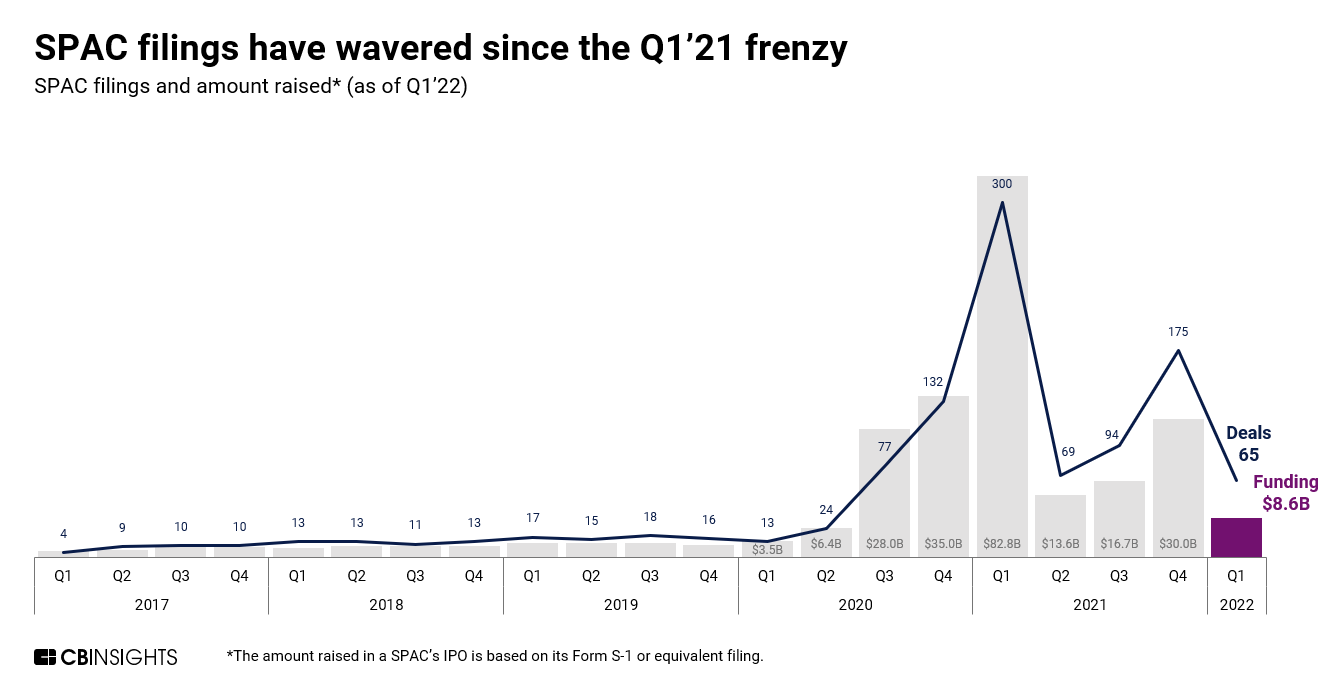

Spac Stock Frenzy Is This The Next Micro Strategy

May 08, 2025

Spac Stock Frenzy Is This The Next Micro Strategy

May 08, 2025 -

Canada Trade Deficit Narrows To 506 Million Amidst Tariff Increases

May 08, 2025

Canada Trade Deficit Narrows To 506 Million Amidst Tariff Increases

May 08, 2025 -

Friday April 18th 2025 Daily Lotto Winning Numbers

May 08, 2025

Friday April 18th 2025 Daily Lotto Winning Numbers

May 08, 2025