Schroders Reports Significant Asset Reduction: Clients Reduce Equity Holdings In First Quarter

Table of Contents

Analysis of Schroders' First Quarter Performance and Asset Reduction

The Magnitude of the Asset Reduction

Schroders' first-quarter report revealed a concerning decline in AUM. The precise figures, as reported by Schroders, showed a [Insert Specific Percentage]% drop, translating to a loss of [Insert Specific Monetary Value] in assets under management. This represents a substantial decrease compared to the previous quarter and marks a significant deviation from the growth trajectory observed in previous years. The most significant declines were observed in [Insert Specific Investment Areas, e.g., global equities, emerging markets].

- AUM Reduction: [Insert Specific Number] to [Insert Specific Number]

- Quarter-on-Quarter Comparison: [Insert Percentage Change] decrease compared to Q4 2023.

- Year-on-Year Comparison: [Insert Percentage Change] decrease compared to Q1 2023.

- Areas of Greatest Decline: Global equities experienced the most significant drop, followed by emerging market investments.

Client Behavior and Equity Holdings: The Driving Force Behind the Reduction

Decreased Equity Investments

The primary driver behind Schroders' asset reduction appears to be a shift in client behavior, specifically a decrease in equity holdings. Several factors contributed to this trend:

- Equity Market Volatility: Increased market volatility throughout the first quarter created uncertainty and prompted risk-averse investors to reduce their equity exposure.

- Geopolitical Uncertainties: Ongoing geopolitical tensions, such as [mention specific geopolitical events], further fueled investor anxiety and impacted investment decisions.

- Rising Interest Rates: The impact of rising interest rates on equity valuations played a significant role, making fixed-income investments comparatively more attractive.

- Shifting Risk Appetite: A general shift towards a more conservative risk appetite among investors led to a reallocation of assets away from equities and into safer havens.

Schroders' Response and Future Outlook

Schroders' Strategies for Addressing the Asset Reduction

Schroders has outlined several strategies to address the AUM reduction and mitigate its impact.

- New Investment Strategies: [Insert details on any new strategies, e.g., increased focus on sustainable investments, expansion into new market segments].

- Investor Relations: Schroders has emphasized proactive communication with investors, aiming to rebuild confidence and reassure them about the firm's long-term prospects.

- Future Performance Predictions: While avoiding overly optimistic pronouncements, Schroders has expressed confidence in its ability to navigate the current market challenges and return to a growth trajectory. [Insert any forecasts or guidance provided by Schroders].

Wider Market Context: Similar Trends in the Asset Management Industry

Industry-Wide Impact

Schroders' experience is not unique. Many other major players in the asset management industry experienced similar declines in AUM during the first quarter. [Mention specific examples of other asset management firms and their reported performance]. This suggests that the asset reduction is not solely attributable to Schroders' internal factors but reflects broader market trends.

- Comparable Reports: [Cite reports from other asset management companies]

- Market Trends: The widespread decline highlights the prevailing uncertainty and volatility impacting global financial markets.

- Long-term vs. Short-term Trend: Whether this is a temporary blip or a sign of a longer-term shift in the asset management landscape remains to be seen. Further analysis and future quarters' reports will be crucial in determining the lasting impact.

Conclusion: Understanding the Implications of Schroders' Asset Reduction

Schroders' significant first-quarter asset reduction reflects a confluence of factors, including decreased client equity holdings driven by market volatility, geopolitical uncertainties, rising interest rates, and a shift in investor risk appetite. This trend is not isolated to Schroders, with similar declines reported across the asset management industry. Understanding these dynamics is crucial for investors navigating the current market landscape. The key takeaway is the need for vigilance and diversification in investment strategies.

To stay informed about Schroders' performance, the evolving market trends, and their strategies for navigating these challenges, subscribe to Schroders' updates, follow their social media channels, and visit their website for in-depth analysis of Schroders asset management, the Schroders Q1 report, and Schroders investment strategies.

Featured Posts

-

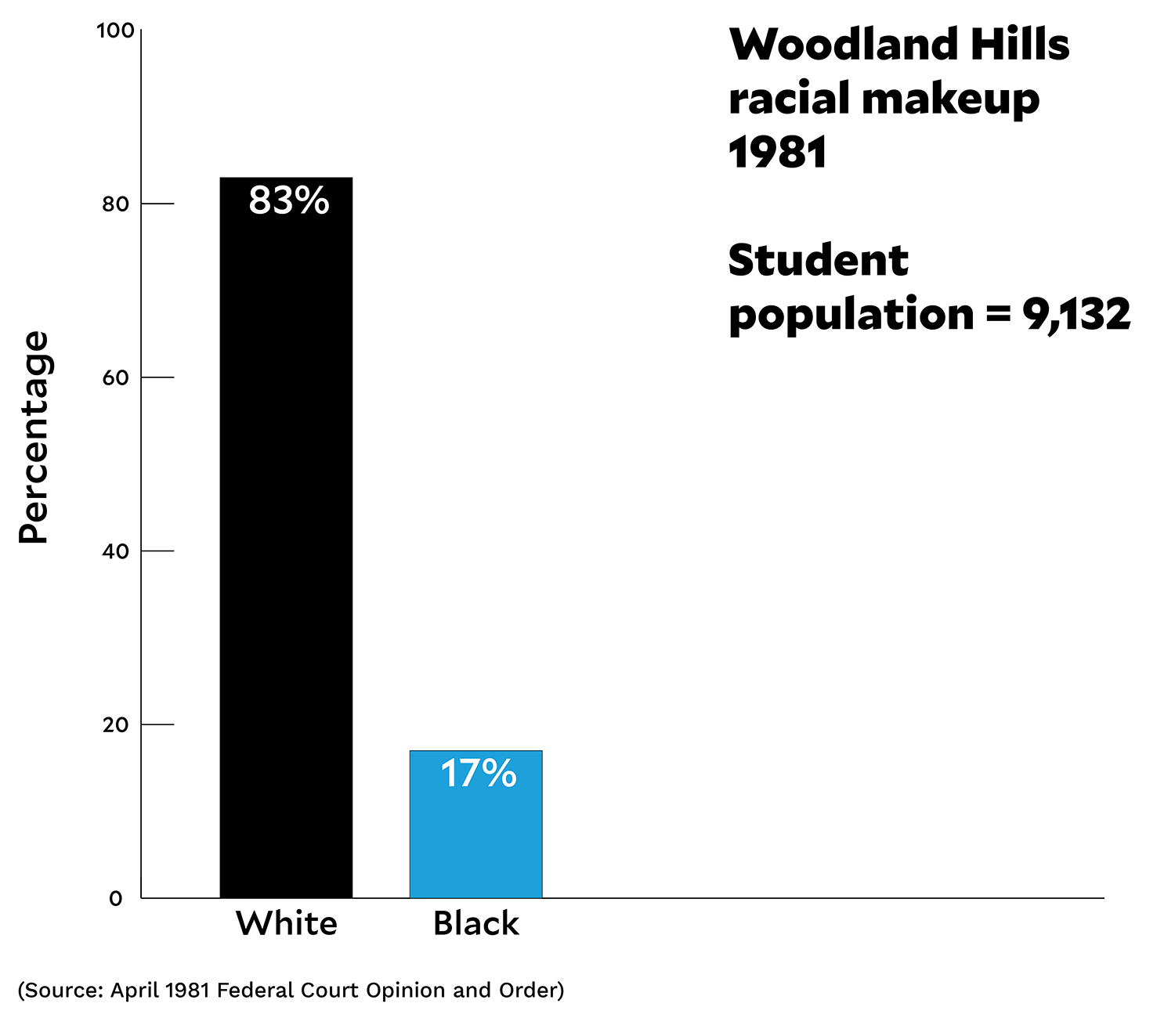

End Of An Era Justice Department Lifts Louisiana School Desegregation Order

May 03, 2025

End Of An Era Justice Department Lifts Louisiana School Desegregation Order

May 03, 2025 -

Fortnite Developer Epic Games Accused Of Large Scale Deceptive Practices

May 03, 2025

Fortnite Developer Epic Games Accused Of Large Scale Deceptive Practices

May 03, 2025 -

Evaluating Reform Uks Commitment To Uk Farmers

May 03, 2025

Evaluating Reform Uks Commitment To Uk Farmers

May 03, 2025 -

The People And Places Of This Country An In Depth Look

May 03, 2025

The People And Places Of This Country An In Depth Look

May 03, 2025 -

School Desegregation Order Terminated Expected Impact On Educational Equity

May 03, 2025

School Desegregation Order Terminated Expected Impact On Educational Equity

May 03, 2025