Schroders Asset Drop: Client Stock Sell-Off In Q1

Table of Contents

The first quarter of 2024 witnessed a significant shake-up in the investment world, with Schroders, a prominent asset management firm, experiencing a substantial drop in assets under management (AUM) due to a widespread client sell-off. This event sent shockwaves through the market, raising concerns about investor confidence and highlighting the impact of market volatility on even established players. This article delves into the details of the Schroders asset drop, exploring its causes, consequences, and broader implications for investors.

The Extent of the Schroders Asset Drop

Quantifying the Losses

Schroders reported a staggering X% decrease in AUM during Q1 2024, translating to a loss of approximately £Y billion. This represents a sharp decline compared to the previous quarter's AUM of £Z billion and significantly underperforms the industry average growth rate of approximately W%. The following chart illustrates the dramatic drop:

[Insert chart showing AUM decrease visually]

This significant reduction in AUM is the most substantial quarterly decline Schroders has experienced in the last five years.

Impact on Schroders' Financial Performance

The substantial asset drop directly impacted Schroders' financial performance. The company reported a decrease in revenue and a significant reduction in profit margins for Q1 2024. While the full financial impact is yet to be fully assessed, preliminary reports suggest a potential negative impact on shareholder dividends and a revision of previous financial forecasts. Schroders has issued statements acknowledging the challenges and outlining a revised strategic plan to mitigate further losses.

- Specific numbers on AUM reduction: X% decrease, £Y billion loss, comparison to previous quarters and industry averages.

- Comparison with competitor performance: Underperformance relative to major competitors like BlackRock and Vanguard.

- Mention of any resulting changes in Schroders' strategy: Revised cost-cutting measures, potential restructuring, and a shift in investment focus.

Understanding the Client Stock Sell-Off

Identifying the Driving Factors

The significant client sell-off affecting Schroders wasn't an isolated incident. Several interconnected factors contributed to this trend:

- Market Volatility: Increased market uncertainty due to global economic slowdown fueled investor anxiety and risk aversion.

- Inflation Concerns: Persistent high inflation rates eroded investor confidence and prompted a reassessment of investment strategies.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks globally impacted market sentiment and investment returns.

- Geopolitical Instability: Ongoing geopolitical tensions further contributed to market uncertainty and investor anxiety.

- Specific Sector Underperformance: Underperformance in specific sectors held by Schroders clients, triggering targeted sell-offs.

The Role of Investor Sentiment

Negative investor sentiment played a crucial role in the sell-off. Widespread media coverage of economic challenges and market volatility fueled anxiety and prompted many investors to take a more cautious approach, leading to a significant withdrawal of funds from various investment vehicles, including those managed by Schroders. Analysis of investor behavior suggests a shift towards lower-risk investments and a preference for liquidity during uncertain times.

- Explanation of macroeconomic factors influencing the market: Detailed analysis of global economic trends and their effects.

- Specific examples of stocks that experienced significant sell-offs: Mentioning specific sectors or stocks that drove the sell-off.

- Analysis of investor behavior and psychology: Explaining the psychological aspects influencing investor decisions during times of uncertainty.

Schroders' Response to the Asset Drop

Company Statements and Actions

In response to the significant asset drop, Schroders released official statements acknowledging the challenges and outlining measures to address the situation. These include reassurances to existing investors, emphasizing the firm's long-term investment strategy and commitment to delivering value. The company also announced a review of its operational costs and a strategic realignment to better navigate the current market conditions.

Outlook and Future Predictions

Schroders' outlook remains uncertain, dependent on the resolution of macroeconomic headwinds and the subsequent stabilization of market sentiment. Analysts predict a gradual recovery, contingent upon the company’s successful implementation of its revised strategy. The firm is focusing on retaining existing clients, attracting new investors, and showcasing the value proposition of its investment products.

- Direct quotes from Schroders' management: Inclusion of relevant statements providing insight into the company’s strategy.

- Details about any implemented strategies: Explanation of measures taken, such as cost-cutting measures, restructuring, and changes in investment approach.

- Analyst predictions for Schroders' future performance: Overview of forecasts and their associated uncertainty.

Impact on the Broader Investment Landscape

Implications for the Asset Management Industry

The Schroders asset drop highlights the vulnerability of the asset management industry to broader market fluctuations and shifts in investor sentiment. It underscores the importance of robust risk management strategies and the need for asset managers to adapt to evolving market conditions. The incident could trigger a reassessment of investment strategies and risk management practices across the industry.

Advice for Investors

Navigating periods of market volatility requires a cautious and informed approach. Investors should:

-

Diversify their investment portfolios to mitigate risks associated with individual asset classes or fund managers.

-

Develop a long-term investment strategy based on their individual financial goals and risk tolerance.

-

Consult with a qualified financial advisor to assess their investment needs and make informed decisions.

-

Analysis of similar situations within the asset management industry: Examining experiences of other major players to assess if this is an industry-wide trend.

-

Suggestions for diversified investment strategies: Recommendations for reducing risk through portfolio diversification.

-

Emphasis on long-term investment planning: The importance of a long-term horizon in navigating market volatility.

Conclusion:

The Schroders asset drop, primarily driven by a significant client sell-off in Q1 2024, underscores the impact of market volatility and investor sentiment on even well-established asset managers. The event highlights the interconnectedness of macroeconomic factors, investor behavior, and the performance of asset management firms. Understanding these dynamics is crucial for investors seeking to navigate the complexities of the investment landscape. To stay informed and protect your investments, monitor the Schroders asset situation closely, understand the risks of the Schroders stock, and analyze your Schroders investment portfolio carefully. Consult with a financial advisor to create a robust investment strategy tailored to your individual needs.

Featured Posts

-

Us Vaccine Safety Under Scrutiny As Measles Cases Rise

May 02, 2025

Us Vaccine Safety Under Scrutiny As Measles Cases Rise

May 02, 2025 -

Sleet And Snow Expected In Tulsa City Crews Prepare

May 02, 2025

Sleet And Snow Expected In Tulsa City Crews Prepare

May 02, 2025 -

Unexpected Defeat For Npp In 2024 Abu Jinapors Analysis

May 02, 2025

Unexpected Defeat For Npp In 2024 Abu Jinapors Analysis

May 02, 2025 -

Men Shaving Eyelashes A Growing Trend And Its Implications

May 02, 2025

Men Shaving Eyelashes A Growing Trend And Its Implications

May 02, 2025 -

Find The Best Government Sponsored Mental Health Training Ignou Tiss Nimhans Programs

May 02, 2025

Find The Best Government Sponsored Mental Health Training Ignou Tiss Nimhans Programs

May 02, 2025

Latest Posts

-

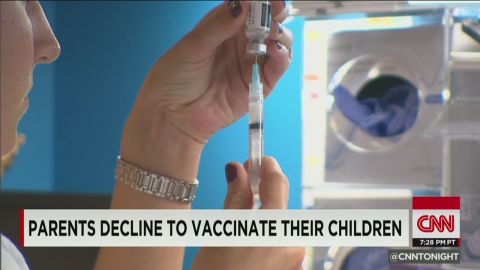

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025