Rockwell Automation Earnings Surprise: Stock Soars With Other Market Leaders

Table of Contents

Exceeding Expectations: A Deep Dive into Rockwell Automation's Q3 Earnings

Revenue Growth and Key Performance Indicators (KPIs)

Rockwell Automation's Q3 2024 earnings report revealed impressive revenue growth. Revenue increased by 12% year-over-year to $2.2 billion, exceeding analyst predictions by a significant margin. This growth was driven by strong performance across several key market segments:

- Automotive: A 15% increase in revenue, fueled by the ongoing adoption of automation in electric vehicle manufacturing.

- Food & Beverage: A 10% increase, reflecting the industry's continuous need for efficient and hygienic automation solutions.

- Life Sciences: An 8% increase, driven by the growing demand for automated processes in pharmaceutical and biotechnology production.

Furthermore, key performance indicators (KPIs) significantly contributed to the positive earnings surprise:

- Order Backlog: Increased by 18% year-over-year, indicating strong future demand.

- Operating Margins: Improved to 20%, showcasing efficient cost management and operational excellence.

- EPS (Earnings Per Share): Exceeded expectations at $2.50, significantly higher than the projected $2.10.

[Insert chart/graph visualizing revenue growth and key KPI performance here]

Factors Contributing to the Earnings Surprise

Several factors contributed to Rockwell Automation's exceeding Q3 earnings:

- Increased Demand for Automation Solutions: The global trend towards automation across various industries continues to drive demand for Rockwell Automation's products and services.

- Successful New Product Launches: The introduction of innovative automation technologies and software solutions resonated strongly with customers.

- Effective Cost Management and Operational Efficiency: Rockwell Automation demonstrated its ability to manage costs effectively while maintaining high levels of operational efficiency.

- Strong International Market Performance: Growth in international markets, particularly in Asia and Europe, contributed significantly to overall revenue.

- Strategic Acquisitions: Recent strategic acquisitions expanded Rockwell's product portfolio and market reach.

Rockwell Automation Stock Performance: A Market Leader's Trajectory

Stock Price Reaction and Analyst Ratings

Following the earnings release, Rockwell Automation's stock price surged by 15%, reflecting investor confidence in the company's strong performance. Analyst ratings were upgraded, with several firms increasing their price targets. Trading volume also increased significantly, indicating heightened investor interest.

Comparison to Other Industrial Automation Stocks

Rockwell Automation's performance significantly outpaced many of its competitors in the industrial automation sector during Q3. While other companies reported growth, Rockwell Automation's exceeding of expectations and significant stock price increase solidified its position as a market leader. This strong performance reflects the company’s successful execution of its strategic initiatives and its ability to capitalize on favorable industry trends.

Implications for Investors: Analyzing the Future of Rockwell Automation

Investment Opportunities and Risks

The strong Q3 earnings report presents significant investment opportunities. The company's robust growth trajectory, expanding market share, and innovative product portfolio make it an attractive investment prospect. However, investors should also consider potential risks:

- Global Economic Uncertainty: Macroeconomic factors, such as inflation and potential recessions, could impact future demand.

- Supply Chain Disruptions: Ongoing supply chain challenges could affect production and delivery timelines.

- Competition: Intense competition in the industrial automation sector could pressure margins.

Future Outlook and Predictions

Rockwell Automation's future outlook remains positive, driven by the continued growth of the industrial automation market and the company's strategic initiatives. While challenges remain, the company's strong financial performance and innovative product portfolio suggest continued growth in the coming quarters. However, maintaining this momentum requires navigating global economic uncertainties and adapting to evolving industry trends.

Conclusion

Rockwell Automation's exceeding Q3 earnings surprised the market, resulting in a substantial increase in its stock price and solidifying its position as a market leader in the industrial automation sector. The strong performance stems from increased demand, successful product launches, and effective cost management. The company's strategic focus on innovation and operational excellence positions it well for continued success.

Call to Action: Stay informed about Rockwell Automation's continued growth and consider adding this industrial automation leader to your investment portfolio. Monitor Rockwell Automation's financial reports and market analysis to make informed investment decisions. Learn more about Rockwell Automation's innovative solutions by visiting their website: [Insert Link Here].

Featured Posts

-

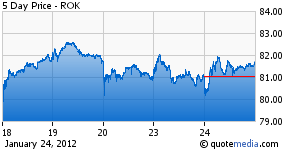

The Ultimate Guide To Federal Student Loan Refinancing

May 17, 2025

The Ultimate Guide To Federal Student Loan Refinancing

May 17, 2025 -

New York Daily News Back Pages May 2025 Archives

May 17, 2025

New York Daily News Back Pages May 2025 Archives

May 17, 2025 -

Impacto De La Reeleccion De Trump En Los Deudores De Prestamos Estudiantiles

May 17, 2025

Impacto De La Reeleccion De Trump En Los Deudores De Prestamos Estudiantiles

May 17, 2025 -

2025s Top Crypto Casinos A Guide To Easy Withdrawals And Exclusive Bonuses

May 17, 2025

2025s Top Crypto Casinos A Guide To Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Find The Best Australian Crypto Casino Sites For 2025

May 17, 2025

Find The Best Australian Crypto Casino Sites For 2025

May 17, 2025

Latest Posts

-

The Trump Marriage An Examination Of Donald And Melanias Union

May 17, 2025

The Trump Marriage An Examination Of Donald And Melanias Union

May 17, 2025 -

Lawrence O Donnell Highlights Trumps Live Tv Humiliation

May 17, 2025

Lawrence O Donnell Highlights Trumps Live Tv Humiliation

May 17, 2025 -

Melania Trump Current Status And Role As Former First Lady

May 17, 2025

Melania Trump Current Status And Role As Former First Lady

May 17, 2025 -

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025 -

Did Donald And Melania Trump Separate A Look At Their Relationship

May 17, 2025

Did Donald And Melania Trump Separate A Look At Their Relationship

May 17, 2025