Rising Yields And The American Market: A 5% 30-Year Treasury Perspective On Sales

Table of Contents

How Rising Yields Impact Consumer Spending (and Sales)

Rising interest rates directly impact consumer behavior and spending, creating a domino effect on sales across numerous sectors. Higher interest rates translate to increased borrowing costs for consumers, leaving less disposable income for non-essential purchases.

-

Reduced Purchasing Power: Higher mortgage rates, auto loan rates, and credit card interest rates all eat into disposable income. This directly reduces purchasing power, leading to lower demand for goods and services. Consumers are forced to prioritize essential expenses, squeezing discretionary spending.

-

Delayed Purchases: Large purchases, such as homes and vehicles, become significantly more expensive with higher interest rates. This often leads to delayed purchases or a complete abandonment of such plans, negatively impacting sales in the automotive and real estate sectors, as well as related industries like furniture and home improvement.

-

Increased Savings: Facing higher borrowing costs, some consumers opt to increase their savings to build a financial buffer, further reducing immediate spending and impacting sales across the board. This cautious approach to spending reflects a wider uncertainty about the economic outlook.

-

Shift in Consumer Behavior: The shift in spending prioritizes necessities. Sales of luxury goods and discretionary items suffer, while demand for essential products like groceries and healthcare remains relatively stable, but this shift changes the overall sales landscape.

The Effect on Business Investment and Sales

Rising yields don't just impact consumers; they also significantly influence business investment decisions. Higher borrowing costs make expansion, equipment upgrades, and acquisitions more expensive, leading to reduced investment and impacting sales across various business-to-business (B2B) sectors.

-

Reduced Capital Expenditures (CAPEX): Businesses are more hesitant to invest in new projects when borrowing costs increase. This directly reduces capital expenditure (CAPEX), which slows economic growth and dampens sales for businesses supplying equipment, technology, and other capital goods.

-

Impact on Supply Chains: Increased borrowing costs can strain supply chains. Companies may struggle to finance inventory or expansion, leading to production delays and reduced sales as goods become less readily available. This can also lead to increased prices, impacting demand.

-

Lower Hiring Rates: With less money available for investment, businesses might slow or halt hiring plans. This dampens consumer spending as fewer people have jobs and less income, further affecting sales across multiple industries.

-

Increased Inventory Costs: Higher interest rates increase the cost of holding inventory. Businesses might reduce stock levels to minimize these expenses, but this could lead to stockouts and lost sales opportunities.

The 5% 30-Year Treasury Yield: A Key Indicator

The 5% 30-year Treasury yield acts as a significant benchmark for other interest rates. It influences mortgage rates, corporate bond yields, and other borrowing costs, creating a broad and powerful impact across the entire financial system. It’s a leading indicator of market sentiment and future economic expectations.

-

Mortgage Rate Impacts: A direct correlation exists between Treasury yields and mortgage rates. When Treasury yields rise, mortgage rates follow, directly influencing the housing market, real estate sales, and related industries.

-

Corporate Borrowing Costs: Companies rely on borrowing for expansion and operations. Higher Treasury yields translate to higher corporate borrowing costs, making expansion more expensive and potentially affecting business investment and sales.

-

Investor Sentiment: The 5% yield reflects investor concerns about inflation and economic growth. This uncertainty impacts investor confidence, leading to fluctuations in the stock market and affecting sales in related sectors.

Strategies for Businesses to Navigate Rising Yields

Businesses need to adapt their strategies to mitigate the impact of rising yields on sales. Proactive measures are crucial for navigating this challenging economic climate.

-

Pricing Strategies: Businesses must carefully analyze their pricing strategies, balancing profitability with affordability for consumers to maintain sales volume. Value-oriented pricing may be necessary.

-

Inventory Management: Efficient inventory management is paramount in a high-interest-rate environment to minimize storage costs and prevent losses from unsold goods.

-

Cost Control Measures: Businesses should implement aggressive cost-cutting measures to improve profitability and maintain margins in a challenging economic environment.

-

Marketing & Sales Adjustments: Adapting marketing and sales strategies to focus on value, affordability, and customer retention is essential for maintaining sales levels.

Conclusion:

Rising yields, particularly the significant 5% 30-year Treasury yield, present a considerable challenge to the American market, impacting consumer spending, business investment, and sales across various sectors. Understanding the interplay between rising interest rates and their effects on different market segments is paramount for business survival and growth. By carefully analyzing these trends and implementing proactive strategies, businesses can navigate these challenges and maintain sales growth despite rising yields. Staying informed about rising yields and their effects on the American market is critical for long-term success. Develop a robust strategy to address these challenges and ensure your business is prepared for the continued impact of rising yields on sales.

Featured Posts

-

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025 -

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025

Jutarnji List Tko Je Sve Sjajio Na Premijeri

May 20, 2025 -

Agatha Christies Private Letters Reveal Bitter Dispute Over Key Novel

May 20, 2025

Agatha Christies Private Letters Reveal Bitter Dispute Over Key Novel

May 20, 2025 -

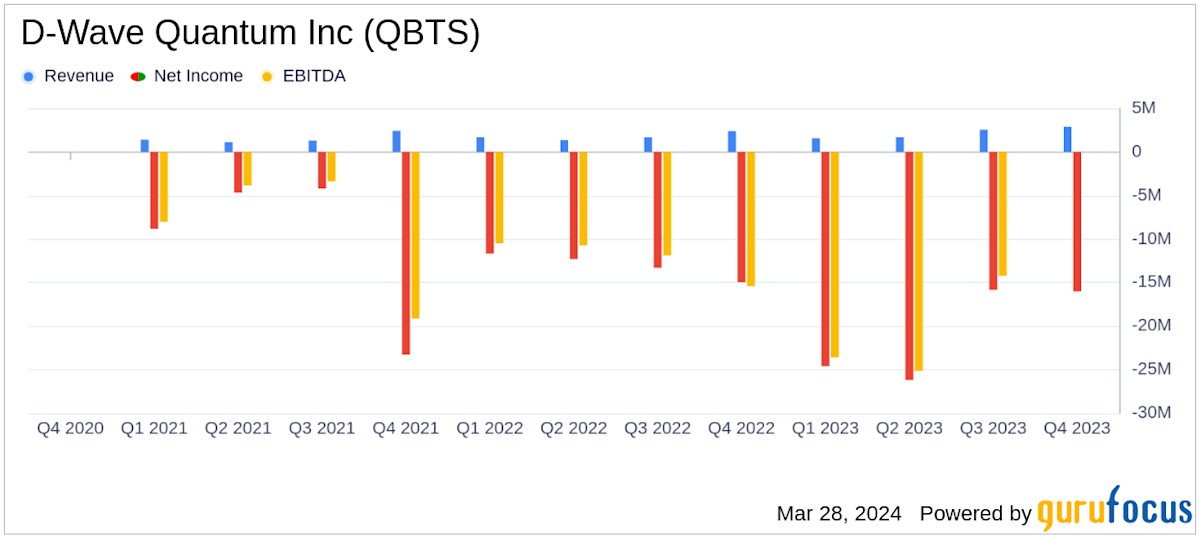

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025 -

Nj Transit Engineers End Strike After Reaching Deal

May 20, 2025

Nj Transit Engineers End Strike After Reaching Deal

May 20, 2025

Latest Posts

-

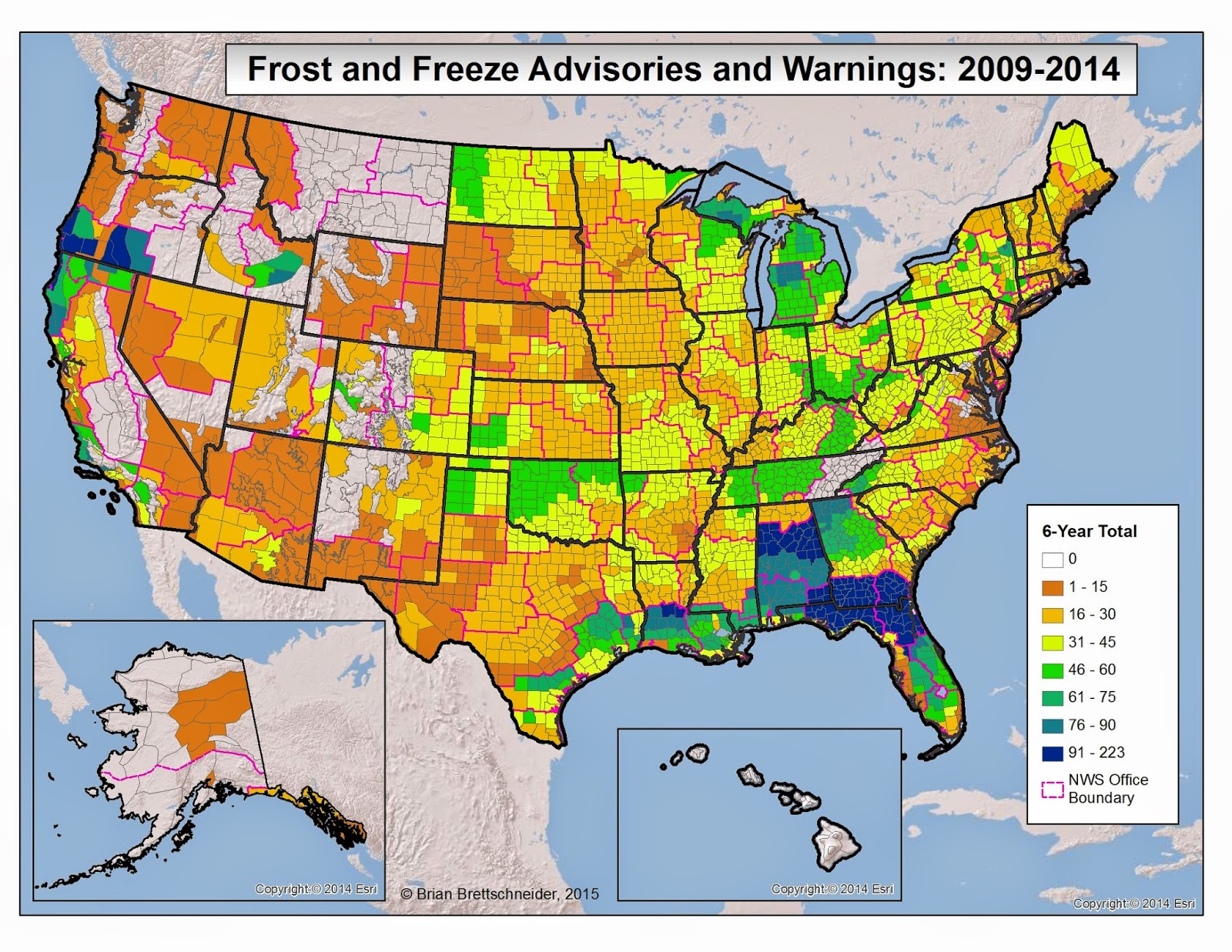

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025 -

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025 -

Preparing For School Delays A Guide To Winter Weather Advisories

May 20, 2025

Preparing For School Delays A Guide To Winter Weather Advisories

May 20, 2025 -

Understanding Winter Weather Advisories And Their Impact On Schools

May 20, 2025

Understanding Winter Weather Advisories And Their Impact On Schools

May 20, 2025 -

Navigating School Delays During Winter Weather Advisories

May 20, 2025

Navigating School Delays During Winter Weather Advisories

May 20, 2025