Investigating The Reasons Behind D-Wave Quantum (QBTS) Stock's Thursday Drop

Table of Contents

Market Sentiment and Overall Tech Stock Performance

The performance of D-Wave Quantum (QBTS) stock is intrinsically linked to broader market trends and the overall health of the technology sector. Negative sentiment towards tech stocks can significantly impact even companies with strong fundamentals. Several factors can contribute to this overall market mood.

- Correlation between QBTS and the Nasdaq Composite: QBTS, as a technology stock, often mirrors the performance of major tech indices like the Nasdaq Composite. A downturn in the Nasdaq can directly translate into a drop in QBTS's value.

- Influence of interest rate hikes on tech valuations: Interest rate hikes by central banks generally lead to decreased valuations for growth stocks, including those in the tech sector. Higher interest rates make borrowing more expensive, impacting future growth projections.

- Impact of recent investor reports on market confidence: Negative investor reports or downgrades from prominent analysts can significantly influence market sentiment and lead to widespread selling pressure across the tech sector, including QBTS. Recent economic indicators showing slower-than-expected growth could also be contributing factors.

Specific News and Announcements Related to D-Wave Quantum

Beyond general market forces, company-specific news can significantly impact a stock's price. Let's examine potential D-Wave Quantum-related announcements that might have triggered Thursday's drop.

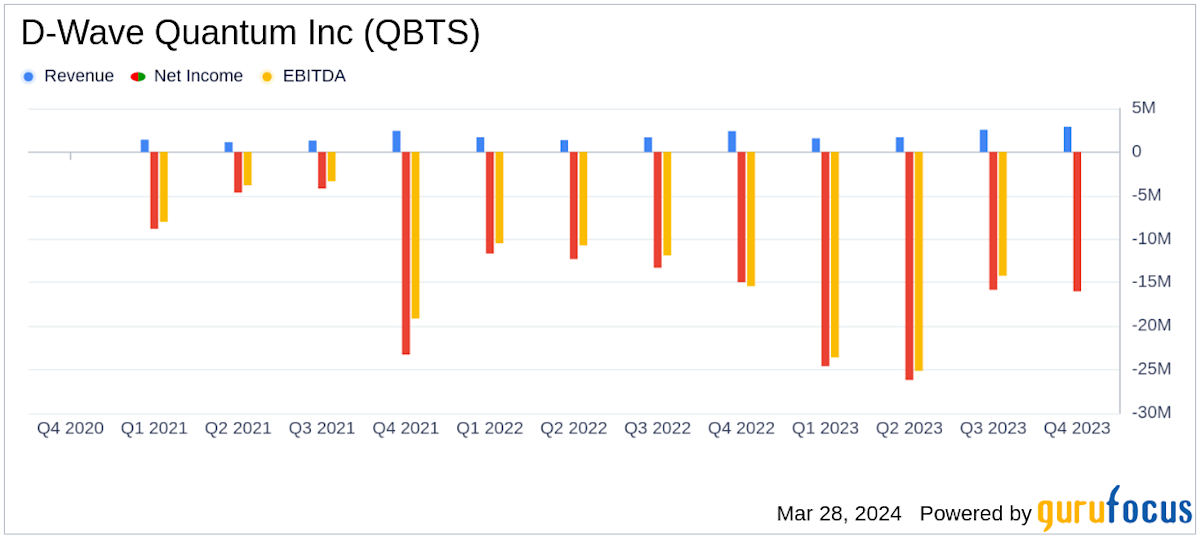

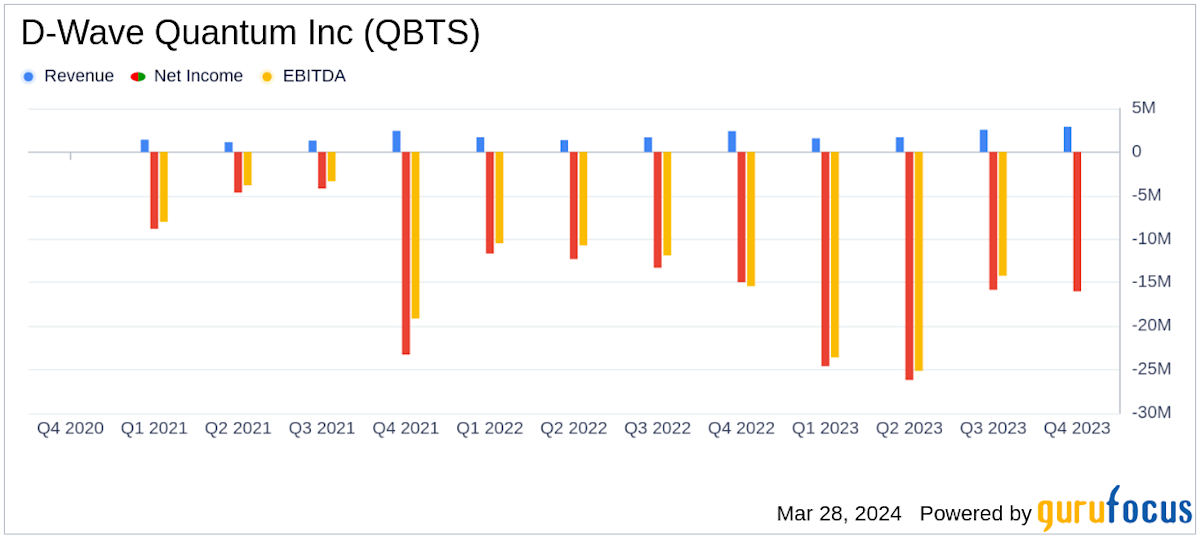

- Analysis of recent D-Wave Quantum earnings reports: Disappointing earnings reports, lower-than-expected revenue, or reduced guidance for future performance can significantly impact investor confidence and lead to sell-offs. Any discrepancies between expectations and actual results could have played a role in the drop.

- Impact of any new competitor announcements or advancements: The quantum computing sector is highly competitive. Announcements from competitors regarding breakthroughs or new product launches could trigger negative sentiment towards D-Wave Quantum, impacting its stock price.

- Effect of any changes in partnerships or collaborations: Any unexpected changes or termination of key partnerships or collaborations could negatively affect D-Wave Quantum's prospects and trigger a price drop. Investors closely watch such relationships for indications of future success.

Quantum Computing Sector Volatility and Investor Behavior

The quantum computing sector is inherently volatile. It's characterized by significant risk and high uncertainty due to its early stage of development. This volatility often leads to exaggerated reactions from investors.

- Risk assessment for investing in early-stage quantum computing companies: Investing in companies like D-Wave Quantum carries a significant level of risk. The long-term viability and profitability of quantum computing technologies are yet to be fully established.

- Comparison of QBTS volatility to other quantum computing stocks: QBTS's volatility is likely to be comparable to other quantum computing stocks. This inherent sector volatility amplifies the impact of both positive and negative news.

- Analysis of investor sentiment towards the future of quantum computing: Investor sentiment plays a major role. Periods of decreased optimism or doubt about the long-term prospects of quantum computing can result in substantial price fluctuations.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart can offer further insights into Thursday's decline. Examining trading volume and candlestick patterns might reveal additional clues.

- Identification of key support and resistance levels: Identifying previous support and resistance levels on the chart can help determine if the price drop broke through significant technical barriers.

- Analysis of trading volume on the day of the drop: High trading volume on Thursday would suggest a significant shift in investor sentiment and could indicate a more substantial and sustained price movement.

- Examination of candlestick patterns for possible indicators: Certain candlestick patterns can signal potential trend reversals or continuation of downward movements. Analyzing these patterns might provide further context to the price drop.

Conclusion: Understanding and Monitoring D-Wave Quantum (QBTS) Stock Performance

D-Wave Quantum (QBTS) stock's Thursday drop was likely a confluence of factors: broader market sentiment impacting the tech sector, potential company-specific news, the inherent volatility of the quantum computing sector, and technical indicators. Understanding these intertwined elements is crucial for navigating the complexities of investing in this emerging field. Remember to carefully analyze market trends, company announcements, and sector-specific news before making any investment decisions in volatile stocks like QBTS. Continue monitoring D-Wave Quantum (QBTS) stock and stay informed about developments in the quantum computing sector for informed investment decisions. Keep an eye on future fluctuations in D-Wave Quantum (QBTS) stock prices and conduct thorough research before investing.

Featured Posts

-

Ktore Pracovisko Preferuju Manazeri Home Office Vs Kancelaria

May 20, 2025

Ktore Pracovisko Preferuju Manazeri Home Office Vs Kancelaria

May 20, 2025 -

O Pechalnom Sostoyanii Shumakhera Otkroveniya Druga

May 20, 2025

O Pechalnom Sostoyanii Shumakhera Otkroveniya Druga

May 20, 2025 -

Tadic Fenerbahce Macerasina Veda Ediyor

May 20, 2025

Tadic Fenerbahce Macerasina Veda Ediyor

May 20, 2025 -

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025 -

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En App De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En App De Citas

May 20, 2025

Latest Posts

-

Redditova Prica Postaje Film Sa Sidnej Sveni

May 21, 2025

Redditova Prica Postaje Film Sa Sidnej Sveni

May 21, 2025 -

Sydney Sweeney To Star In Movie Based On Viral Reddit Story Missing Girl

May 21, 2025

Sydney Sweeney To Star In Movie Based On Viral Reddit Story Missing Girl

May 21, 2025 -

Film Po Popularnoj Redditovoj Prici Sidnej Sveni U Glavnoj Ulozi

May 21, 2025

Film Po Popularnoj Redditovoj Prici Sidnej Sveni U Glavnoj Ulozi

May 21, 2025 -

Javier Baez Salud Rendimiento Y El Futuro En Las Grandes Ligas

May 21, 2025

Javier Baez Salud Rendimiento Y El Futuro En Las Grandes Ligas

May 21, 2025 -

Film Adaptation Of Outrun Video Game Michael Bay At The Helm Sydney Sweeney Confirmed

May 21, 2025

Film Adaptation Of Outrun Video Game Michael Bay At The Helm Sydney Sweeney Confirmed

May 21, 2025