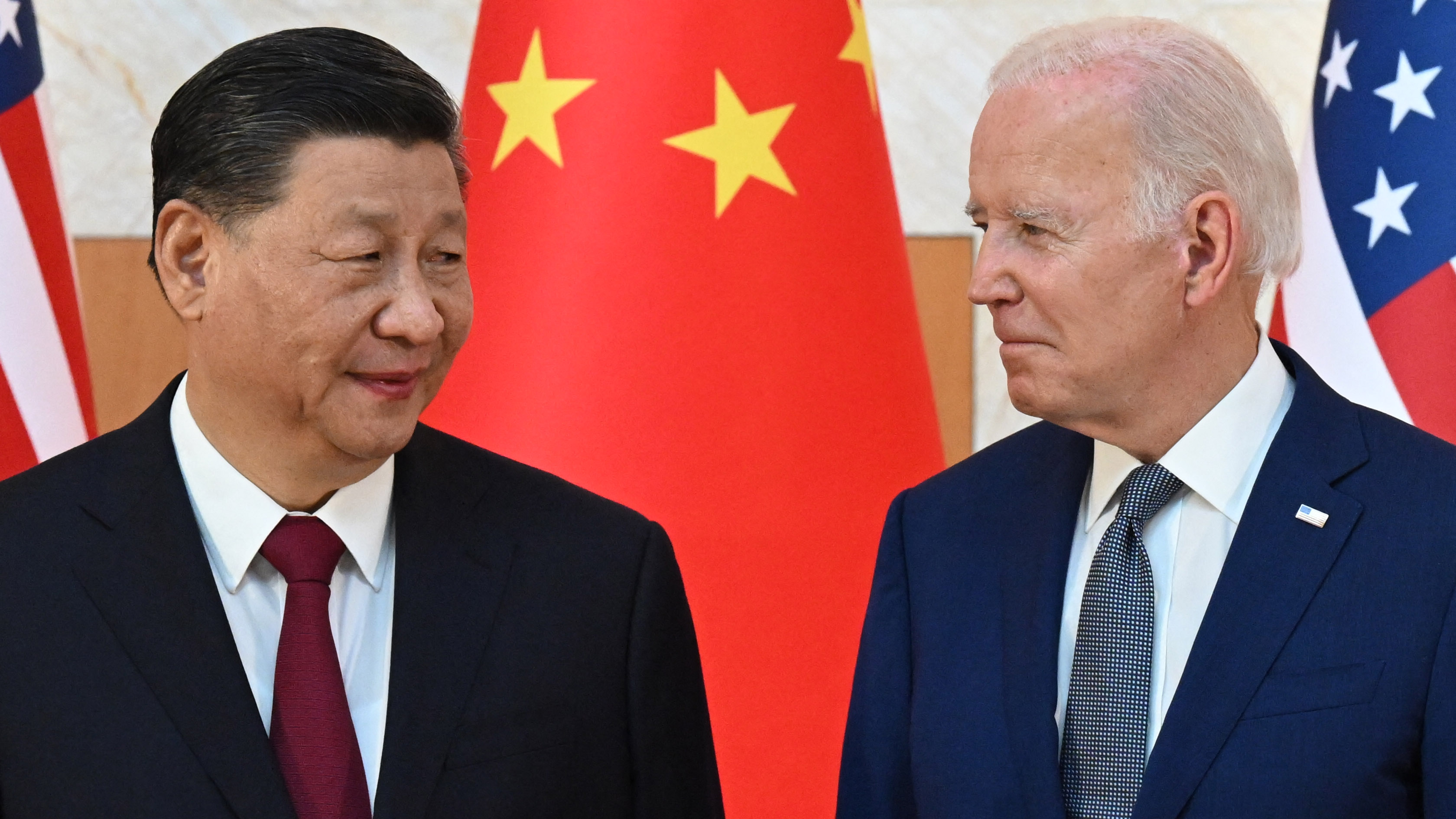

Rising Trade Tensions: Assessing The Risk To China's Export Sector

Table of Contents

The Impact of Tariffs on Chinese Exports

Increased Costs and Reduced Competitiveness

Tariffs imposed by other countries significantly increase the cost of Chinese goods, making them less competitive in the global market. This directly impacts profit margins and forces Chinese exporters to adjust their pricing strategies.

- Examples: Tariffs on Chinese electronics have reduced export volumes by an estimated X% (cite source if available). Similarly, tariffs on textiles and apparel have led to Y% decrease in exports to key markets (cite source if available). The impact on manufacturing varies greatly depending on the specific sector and the level of tariff applied.

- Detail: The increased costs often cannot be fully absorbed by Chinese exporters, leading to price hikes that diminish their competitiveness against rivals from other countries with lower tariff burdens. This pressure necessitates a careful evaluation of pricing strategies and a focus on efficiency improvements to maintain profitability.

Diversification Strategies and Market Adaptation

Facing tariff barriers, Chinese exporters are actively diversifying their export markets and adapting their product offerings. This involves focusing on emerging markets and investing in product innovation and value-added manufacturing.

- Examples: Increased export focus on markets in Southeast Asia, Africa, and Latin America. Development of higher-value goods and services, moving beyond low-cost manufacturing. Investments in research and development to create more specialized and competitive products.

- Detail: While diversification offers opportunities, it also presents challenges. Navigating different regulatory environments, cultural nuances, and logistical complexities requires significant investment and adaptation. However, successful diversification can help mitigate the impact of trade tensions on individual export markets.

Geopolitical Risks and Supply Chain Disruptions

Trade Wars and Sanctions

Escalating trade wars and sanctions significantly impact China's access to key raw materials and advanced technologies. These disruptions affect various industries, hindering production and export capabilities.

- Examples: Sanctions related to specific technologies (e.g., semiconductors) have hampered the growth of certain sectors. Restrictions on access to rare earth minerals have impacted manufacturing and technology export capabilities. Trade disputes can disrupt supply chains and limit access to essential inputs.

- Detail: Geopolitical uncertainty significantly impacts investor confidence and influences decisions regarding foreign investment in China, affecting both current production and future export growth. The unpredictability of trade relations adds significant risk to long-term business planning.

Supply Chain Resilience and Restructuring

Chinese companies are actively building more resilient supply chains to reduce reliance on potentially unstable regions. This involves shifting production locations and investing in domestic supply chains.

- Examples: Relocation of manufacturing facilities to countries with more favorable trade relations. Increased investment in domestic sourcing of raw materials and intermediate goods. Development of advanced technologies, such as blockchain, to improve supply chain transparency and efficiency.

- Detail: Supply chain restructuring is a long-term strategy that requires significant investment and coordination. It involves careful assessment of risk, geopolitical stability, and the overall cost-effectiveness of different locations. This restructuring is crucial to safeguard China's export sector against future disruptions.

The Role of Domestic Policies and Economic Growth

Government Support and Export Promotion

The Chinese government is actively implementing measures to support its export sector and mitigate the effects of trade tensions. These include subsidies, tax breaks, and export financing programs.

- Examples: Government subsidies for specific export-oriented industries. Tax incentives designed to encourage investment in export-related activities. Provision of low-interest loans and financing programs for exporters. Initiatives focused on upgrading technology and improving productivity.

- Detail: The effectiveness of these policies varies depending on their implementation and the specific challenges faced by individual industries. The overall goal is to strengthen competitiveness and ensure the continued growth of the export sector.

Domestic Demand and Economic Transformation

Reducing dependence on exports necessitates a shift towards a consumption-driven economy. Increasing domestic demand is crucial in mitigating the negative impact of reduced export growth.

- Examples: Government initiatives to stimulate domestic consumption, such as income support programs and tax cuts. Investments in infrastructure projects to boost domestic demand. Policy shifts to promote innovation and higher-value-added services within the domestic market.

- Detail: Stimulating domestic demand is a complex challenge requiring a multifaceted approach. It involves addressing income inequality, improving social welfare systems, and fostering a culture of consumption.

Conclusion

Rising trade tensions present significant risks to China's export sector. Tariffs reduce competitiveness, geopolitical risks disrupt supply chains, and the need for economic restructuring is paramount. Key takeaways include the urgent need for adaptation, diversification of export markets, and the building of resilient supply chains. The Chinese government's role in supporting its export sector through targeted policies and its efforts to stimulate domestic demand are crucial in navigating this challenging environment. Understanding the dynamics of rising trade tensions is crucial for businesses involved in China's export sector. Stay informed and adapt your strategies to navigate this evolving landscape, continuously analyzing rising trade tensions and monitoring China's export sector to mitigate potential risks and capitalize on emerging opportunities.

Featured Posts

-

Obamacares Future Hinges On Trumps Supreme Court Defense Rfk Jr And The Political Fallout

Apr 22, 2025

Obamacares Future Hinges On Trumps Supreme Court Defense Rfk Jr And The Political Fallout

Apr 22, 2025 -

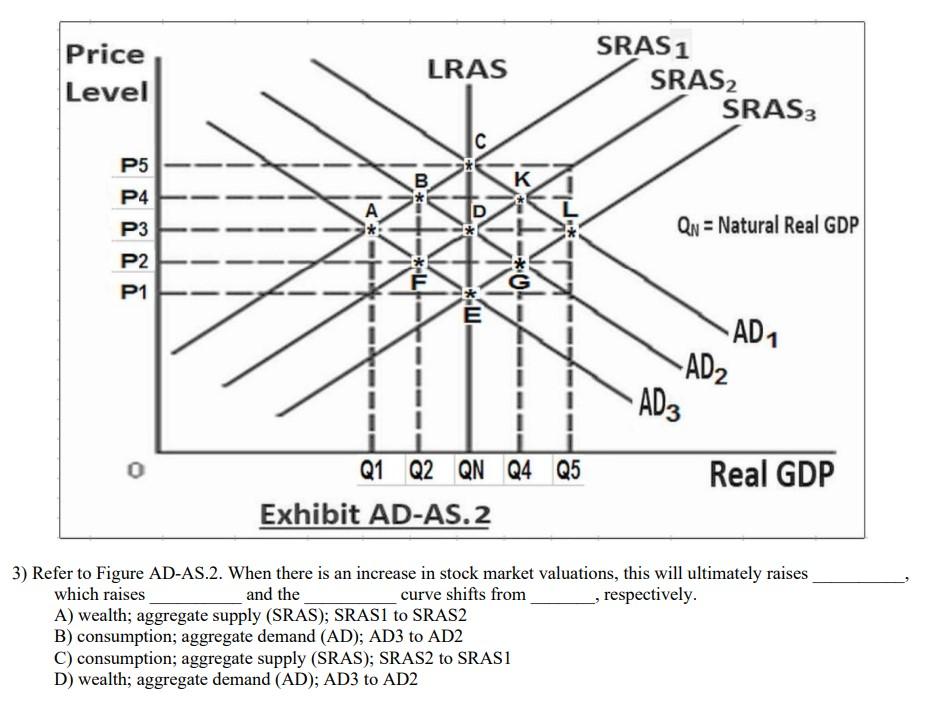

Dismissing High Stock Market Valuations Bof As View For Investors

Apr 22, 2025

Dismissing High Stock Market Valuations Bof As View For Investors

Apr 22, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 22, 2025

Lab Owner Pleads Guilty To Falsifying Covid 19 Test Results

Apr 22, 2025 -

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025 -

Bank Of Canada Holds Rates What Economists At Fp Video Say

Apr 22, 2025

Bank Of Canada Holds Rates What Economists At Fp Video Say

Apr 22, 2025