Dismissing High Stock Market Valuations: BofA's View For Investors

Table of Contents

Bank of America, a global financial giant, holds significant influence in the market. Their research and analyses are closely followed by investors worldwide, making their perspective on high stock market valuations particularly relevant. This article will delve into BofA's reasoning, highlighting key indicators, potential risks, and suggested investment strategies.

BofA's Rationale for Dismissing High Valuations

BofA's core argument for overlooking seemingly high stock market valuations rests on several key pillars, suggesting that current valuations are justified by underlying economic fundamentals and favorable market conditions. They contend that focusing solely on traditional valuation metrics without considering broader economic factors can lead to a distorted picture.

- Low interest rates: Low interest rates, maintained by central banks globally, make equities a relatively more attractive investment compared to bonds and other fixed-income instruments. The low cost of borrowing fuels corporate investment and stimulates economic growth, supporting higher stock prices.

- Strong corporate earnings growth: Robust corporate earnings growth, exceeding expectations in many sectors, helps offset higher price-to-earnings (P/E) ratios. BofA analysts point to the resilience of many companies in navigating economic uncertainty, continuing to deliver strong profits.

- Potential for further economic growth: BofA's projections often incorporate forecasts for continued economic growth, albeit at a potentially slower pace. This future growth potential fuels their belief that current valuations are sustainable and even offer room for further appreciation.

- Supporting Reports: While specific reports change, referencing specific BofA reports and analyst statements from their published research (linking to these reports when available) adds credibility and supports their claims. For example, their Global Investment Strategy team frequently publishes market outlooks which may include this analysis.

Key Indicators Supporting BofA's Stance

BofA's stance isn't solely based on broad economic factors. They leverage various market indicators to support their view.

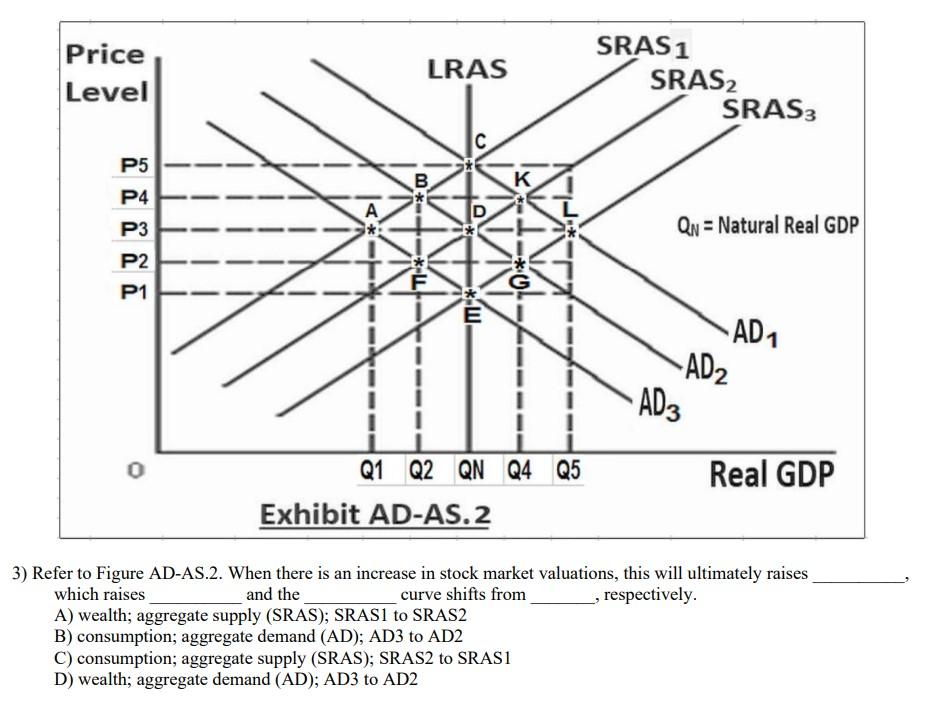

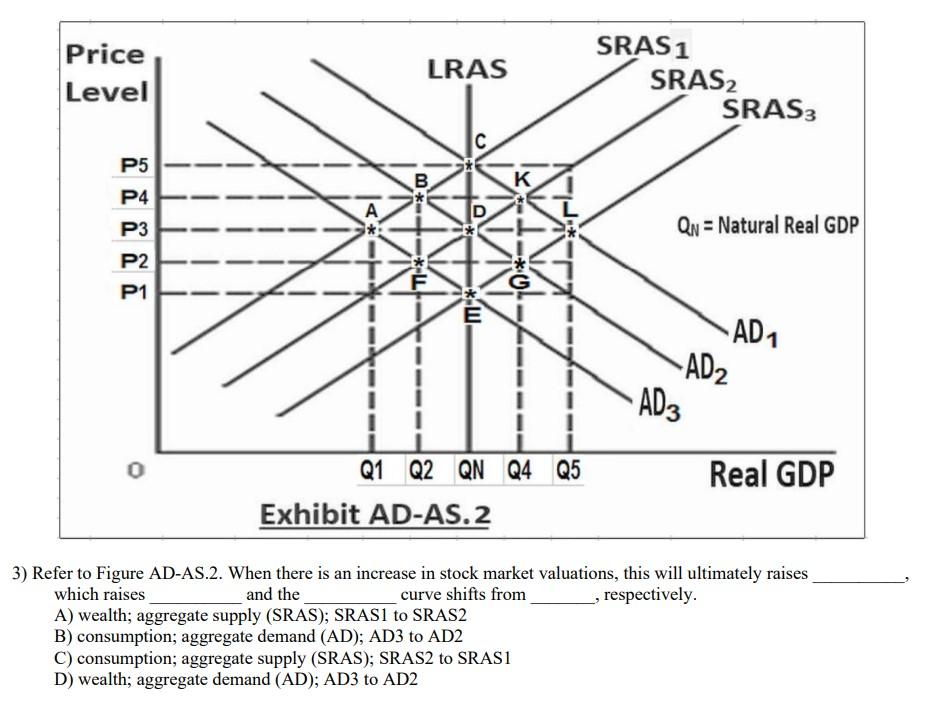

- P/E Ratio Analysis: BofA likely analyzes P/E ratios in comparison to historical averages and performs sector-specific comparisons to gauge whether current valuations are truly excessive or simply reflect sector-specific growth opportunities.

- Shiller PE Ratio (CAPE Ratio): The cyclically adjusted price-to-earnings ratio (CAPE ratio) is a crucial tool used by BofA to account for long-term economic cycles. Their analysis of the CAPE ratio might indicate that while valuations appear high in the short-term, they are within a historically acceptable range when considering the longer-term perspective.

- Dividend Yields vs. Bond Yields: The comparison of dividend yields on equities to bond yields is another key indicator. If dividend yields are comparatively higher than bond yields, this can support the argument that equities offer superior long-term returns, justifying higher valuations.

- Other Valuation Metrics: Beyond P/E ratios and dividend yields, BofA uses a range of other valuation metrics such as price-to-sales ratios, price-to-book ratios, and free cash flow yields to build a comprehensive view of market valuations.

Potential Risks and Counterarguments

It's crucial to acknowledge that BofA's perspective is not without potential drawbacks and counterarguments.

- Inflationary Pressures: Rising inflation could erode corporate earnings, impacting profitability and potentially leading to a correction in stock prices. This is a significant risk that needs careful consideration.

- Rising Interest Rates: An increase in interest rates could make borrowing more expensive for companies, potentially hindering growth and impacting stock valuations. This can make bonds more attractive relative to equities.

- Geopolitical Risks: Geopolitical instability and unexpected global events can significantly impact market sentiment and lead to sharp corrections, irrespective of underlying valuations.

- Alternative Strategies: While BofA might favor equities, investors should always consider alternative investment strategies, such as real estate, commodities, or even a more cautious approach with fixed-income investments, to diversify their portfolios and mitigate risks.

Investment Strategies Based on BofA's Analysis

Based on BofA's optimistic view, investors might consider several strategic approaches:

- Sector-Specific Opportunities: BofA's analysis might highlight specific sectors poised for outsized growth. Investing in these sectors can offer potentially higher returns, though with increased risk.

- Diversification: Regardless of BofA's outlook, diversification remains crucial. Spreading investments across various asset classes and sectors is essential to mitigate risk.

- Long-Term Horizon: BofA's perspective often aligns with a long-term investment horizon. Adopting a long-term approach can help investors weather short-term market fluctuations and benefit from long-term growth potential.

- Investment Vehicles: Investors can implement these strategies using various vehicles, such as Exchange-Traded Funds (ETFs) which provide diversified exposure to specific sectors or the market as a whole, or index funds which offer a passive approach to market tracking.

Conclusion: Dismissing High Stock Market Valuations – Your Next Steps

BofA's arguments for dismissing high stock market valuations are compelling, supported by strong corporate earnings, low interest rates, and projections for continued economic growth. They utilize a range of key indicators including P/E ratios, CAPE ratios, and dividend yield comparisons to support this viewpoint. However, it's crucial to acknowledge the potential risks, including inflation, rising interest rates, and geopolitical uncertainty.

While BofA’s perspective on dismissing high stock market valuations provides valuable insight, remember to conduct your own thorough due diligence. Consult with a financial advisor to create a personalized investment plan that aligns with your risk tolerance and long-term financial goals. Understanding the nuances of dismissing high stock market valuations is key to making informed investment choices.

Featured Posts

-

Stock Market Update Dow Futures Decline Dollar Falls On Trade Worries

Apr 22, 2025

Stock Market Update Dow Futures Decline Dollar Falls On Trade Worries

Apr 22, 2025 -

Is A Pan Nordic Army Feasible Examining Swedish And Finnish Military Assets

Apr 22, 2025

Is A Pan Nordic Army Feasible Examining Swedish And Finnish Military Assets

Apr 22, 2025 -

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 22, 2025 -

Harvard And The Trump Administration A 1 Billion Funding Battle

Apr 22, 2025

Harvard And The Trump Administration A 1 Billion Funding Battle

Apr 22, 2025