Ripple Settlement Talks: SEC May Classify XRP As A Commodity

Table of Contents

The SEC's Case Against Ripple and the Significance of XRP Classification

The SEC's initial lawsuit against Ripple alleged that the company's sales of XRP constituted unregistered securities offerings, violating federal securities laws. This case has far-reaching implications for the cryptocurrency industry, as it directly challenges the legal definition of digital assets and their regulatory oversight. The crucial distinction lies in how the law defines "securities" versus "commodities."

Securities, under the Howey Test, are investments in a common enterprise with a reasonable expectation of profits derived from the efforts of others. Commodities, on the other hand, are typically raw materials or primary agricultural products. The SEC argued that XRP met the criteria of a security, while Ripple countered that XRP functions more like a currency or a commodity. The XRP classification, therefore, is not just about Ripple's fate; it sets a precedent for how other cryptocurrencies might be regulated.

- SEC's definition of a security under the Howey Test: This test considers whether an investment involves an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

- Arguments for and against XRP being classified as a security: Proponents of the security classification point to XRP's initial distribution and Ripple's involvement in its market. Conversely, arguments against emphasize its decentralized nature and use as a medium of exchange.

- The potential impact on investor confidence and market stability: Uncertainty surrounding the XRP classification has created volatility in the market. A clear ruling will likely bring much-needed stability.

Potential Outcomes of the Settlement and XRP's Future

Several scenarios could emerge from a settlement:

- XRP classified as a commodity: This would likely result in a significant price surge for XRP, as it would remove the regulatory cloud hanging over the cryptocurrency. Increased regulatory clarity would likely attract institutional investment.

- A partial settlement: This could involve Ripple admitting to some wrongdoing while avoiding a complete securities classification of XRP. The outcome would likely be less dramatic than a full commodity classification.

- Continued litigation: This would prolong the uncertainty and continue to negatively impact XRP's price and market sentiment.

Each scenario has different implications for Ripple's business operations, XRP's price, and investor sentiment. The potential for regulatory clarity following a settlement is significant, affecting not only XRP but also other crypto projects facing similar regulatory uncertainty.

- Impact on XRP trading volumes and liquidity: A favorable ruling could lead to significantly increased trading volumes and liquidity.

- Effects on other cryptocurrencies facing similar regulatory uncertainty: The XRP classification will act as a precedent, influencing how regulators approach similar digital assets.

- Potential for increased institutional investment in XRP following a clear classification: Institutional investors are often hesitant to invest in assets with unclear regulatory status. Clarity would likely unlock significant institutional capital.

Implications for Investors and the Cryptocurrency Market

The potential XRP classification presents both risks and rewards for investors. Those holding XRP stand to gain significantly if it's classified as a commodity. However, a negative ruling could severely impact its value.

The SEC's decision will also have a broader market impact. It will influence how other crypto projects are regulated and perceived by investors and potentially lead to regulatory harmonization across jurisdictions. The quest for regulatory clarity is paramount for fostering market growth and stability.

- Advice for investors on managing risk during this period of uncertainty: Diversification and risk management strategies are crucial. Investors should carefully evaluate their risk tolerance and adjust their portfolios accordingly.

- The role of regulatory clarity in fostering market growth and stability: Clear regulatory frameworks are vital for attracting institutional investment and building confidence in the cryptocurrency market.

- Comparison of XRP's potential future with other cryptocurrencies under different regulatory frameworks: The outcome of the Ripple case could set a precedent, shaping the regulatory landscape for other cryptocurrencies.

Conclusion

The potential settlement between Ripple and the SEC, and the accompanying XRP classification, represents a pivotal moment for the cryptocurrency industry. The outcome will profoundly impact Ripple's future, investor confidence, and the broader regulatory landscape. Understanding the potential implications of this significant legal battle is crucial for navigating the complexities of the cryptocurrency market. Stay informed about the ongoing developments surrounding the XRP classification and its effects. The future of XRP, and potentially the entire crypto space, hinges on this pivotal decision. Keep following updates on XRP classification and its effects.

Featured Posts

-

Spot Stock Up Spotify Reports 12 Subscriber Growth

May 01, 2025

Spot Stock Up Spotify Reports 12 Subscriber Growth

May 01, 2025 -

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 01, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 01, 2025 -

Should You Buy Ripple Xrp Below 3 A Comprehensive Guide

May 01, 2025

Should You Buy Ripple Xrp Below 3 A Comprehensive Guide

May 01, 2025 -

Remembering Priscilla Pointer Actress Dies At 100

May 01, 2025

Remembering Priscilla Pointer Actress Dies At 100

May 01, 2025 -

The Best Shrimp Ramen Stir Fry Recipe

May 01, 2025

The Best Shrimp Ramen Stir Fry Recipe

May 01, 2025

Latest Posts

-

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

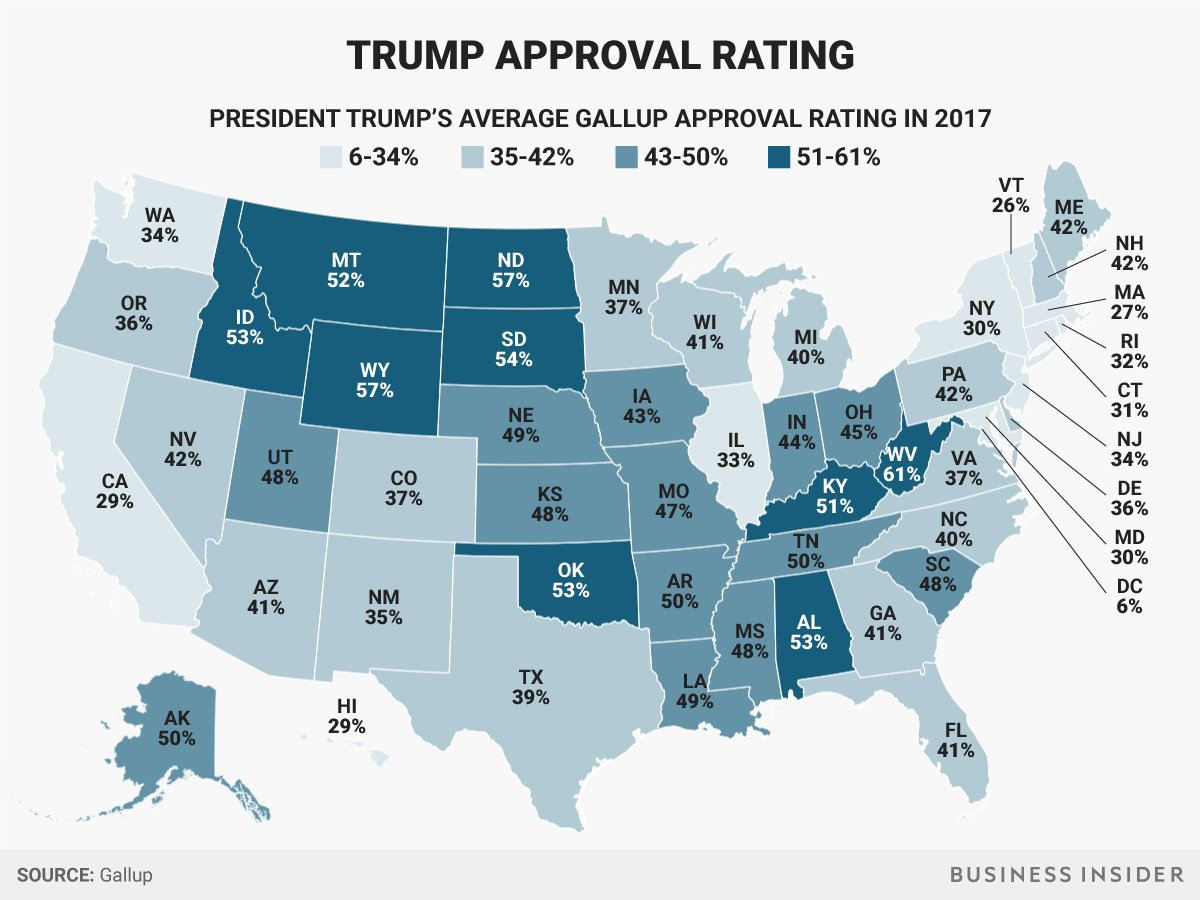

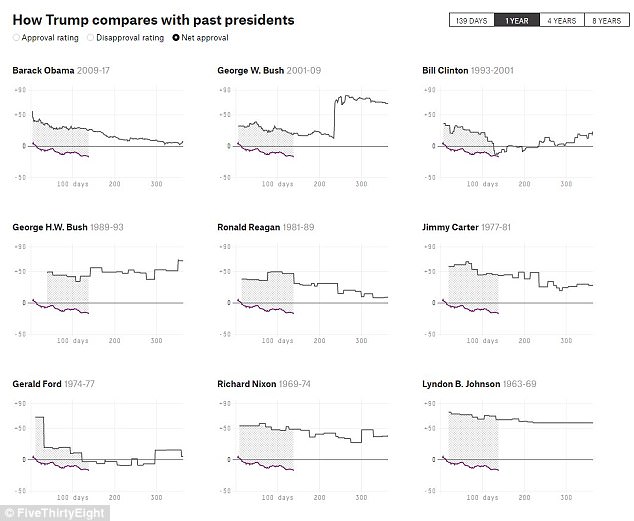

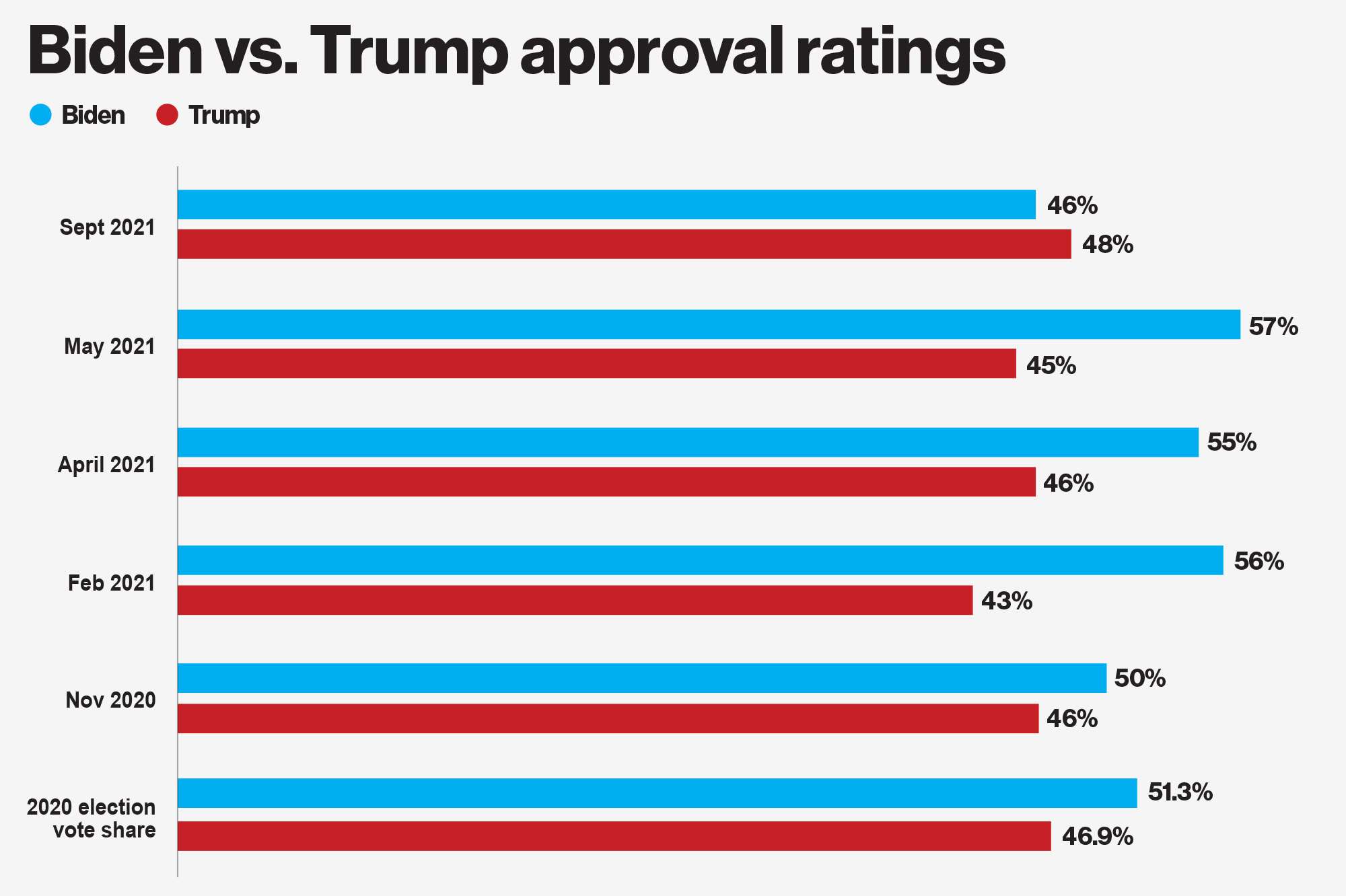

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025 -

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025