Should You Buy Ripple (XRP) Below $3? A Comprehensive Guide

Table of Contents

Ripple's Current Market Position and Price Analysis

Understanding XRP's Price Volatility

XRP, like most cryptocurrencies, is known for its price volatility. Understanding this volatility is crucial before considering any investment. Historical price fluctuations have been driven by a range of factors, including:

- Past bull and bear markets: XRP's price has mirrored broader cryptocurrency market trends, experiencing significant gains during bull runs and steep drops during bear markets.

- Key events impacting price: The SEC lawsuit against Ripple has been a major catalyst for price swings. Positive news and partnerships have also influenced price movements.

- Technical analysis indicators: Technical indicators like moving averages (MA), Relative Strength Index (RSI), and trading volume can provide insights into potential price trends. However, these are not foolproof and should be used in conjunction with fundamental analysis. Analyzing these indicators around the $3 price point can reveal potential support or resistance areas.

Analyzing the $3 Price Point

The $3 price point holds significance for XRP. It represents a previous resistance level, meaning the price has struggled to break above it in the past. However, it could also act as support, potentially preventing further price declines.

- Past price action: Examining charts illustrating XRP's price action around $3 can highlight previous support and resistance levels.

- Support and resistance levels: Technical analysis can help identify potential support levels (where buying pressure might outweigh selling pressure) and resistance levels (where selling pressure might outweigh buying pressure). A break above resistance could signal a potential price increase.

- Breakout potential: A decisive break above $3 could signal a bullish trend, attracting more buyers and potentially leading to further price increases. Conversely, a failure to break above $3 could lead to further price drops.

Comparing XRP to Other Cryptocurrencies

Comparing XRP to its competitors is essential. While XRP aims to facilitate fast and low-cost cross-border payments, it faces competition from other cryptocurrencies with similar goals.

- Competitors: XRP competes with other cryptocurrencies like Stellar Lumens (XLM), Cardano (ADA), and even established payment networks.

- Market performance: Analyzing the market capitalization and price performance of these competitors helps gauge XRP's relative strength and potential.

- Unique advantages: XRP's speed, low transaction fees, and existing partnerships provide unique advantages. However, the regulatory uncertainty surrounding it remains a key disadvantage.

The Ripple-SEC Lawsuit and its Impact on XRP's Price

Current Status of the Lawsuit

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price. The SEC alleges that XRP is an unregistered security.

- Timeline of key events: Tracking significant developments in the lawsuit, including court filings, expert testimonies, and judge's rulings, is crucial for understanding the ongoing situation.

- Expert opinions: Following expert opinions and legal analysis on the case provides insights into potential outcomes.

- Potential outcomes: Several scenarios are possible: a Ripple victory, an SEC victory, or a settlement. Each outcome has potentially massive implications for XRP's price.

Potential Outcomes and their Impact on XRP's Price

The lawsuit's outcome dramatically influences XRP's price.

- Ripple victory: A win for Ripple could lead to a significant price surge as regulatory uncertainty diminishes.

- SEC victory: An SEC victory could severely damage XRP's price, potentially leading to delisting from exchanges.

- Settlement: A settlement could lead to a mixed reaction, depending on the terms of the settlement.

Regulatory Uncertainty and its Influence on Investment

Regulatory uncertainty surrounding cryptocurrencies, particularly in the US, significantly impacts investor confidence.

- Regulatory developments: Keeping abreast of regulatory changes in different jurisdictions is vital for assessing XRP's future.

- Investor sentiment: Regulatory clarity or uncertainty heavily influences investor sentiment, directly impacting XRP's price.

Ripple's Technological Advancements and Future Potential

XRP Ledger (XRPL) and its Use Cases

The XRP Ledger (XRPL) is a crucial component of Ripple's ecosystem. Its key features offer potential advantages over other payment networks:

- Scalability: The XRPL's scalability allows it to handle a large number of transactions.

- Transaction speed: Transactions on the XRPL are significantly faster than traditional banking systems.

- Use cases: The XRPL's potential applications extend beyond cross-border payments, including supply chain management and other financial applications.

Partnerships and Collaborations

Ripple has established numerous partnerships that could boost XRP adoption and value.

- Key partnerships: Identifying and analyzing Ripple's partnerships with banks and financial institutions provides insights into potential future growth.

- Impact on price: Successful partnerships can increase demand for XRP, driving up its price.

Long-Term Growth Potential and Investment Strategy

XRP's long-term growth prospects depend on several factors, including the outcome of the SEC lawsuit and continued adoption of the XRPL.

- Holding vs. trading: Investors need to decide whether they want to hold XRP long-term or engage in short-term trading.

- Diversification: Diversifying your investment portfolio is always recommended to mitigate risk.

- Realistic expectations: Setting realistic expectations about XRP's potential return is crucial for managing investment risk.

Conclusion

Investing in Ripple (XRP) below $3 involves careful consideration of its current market position, the ongoing legal battle, and its future potential. While the lawsuit poses a significant risk, Ripple's technology and partnerships offer long-term potential. Ultimately, the decision to buy XRP below $3 is a personal one based on your individual risk tolerance and investment goals. Thoroughly research the market, understand the risks, and diversify your portfolio before making any investment decisions. Remember to conduct your own due diligence before buying Ripple (XRP) below $3 or at any price.

Featured Posts

-

Suces Garanti Accompagnement Numerique Pour Vos Thes Dansants

May 01, 2025

Suces Garanti Accompagnement Numerique Pour Vos Thes Dansants

May 01, 2025 -

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025

Michael Sheens 1 Million Debt Relief For 900 Individuals

May 01, 2025 -

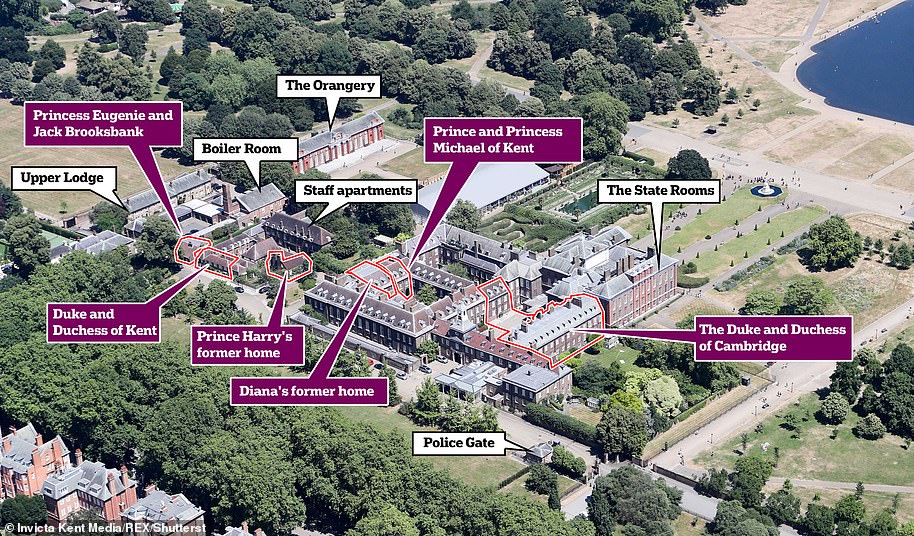

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025 -

Samoas Triumph Miss Samoa Takes Miss Pacific Islands 2025 Title

May 01, 2025

Samoas Triumph Miss Samoa Takes Miss Pacific Islands 2025 Title

May 01, 2025 -

Retailers Sound Alarm Tariff Price Increases Are Inevitable

May 01, 2025

Retailers Sound Alarm Tariff Price Increases Are Inevitable

May 01, 2025

Latest Posts

-

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025 -

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025

39 Approval Trumps First 100 Days And The Impact Of Travel Restrictions

May 01, 2025