Ripple And The SEC: XRP's Commodity Classification And Settlement Talks

Table of Contents

The SEC's Case Against Ripple and XRP

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, violating federal securities laws. Their argument hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

-

The Howey Test and XRP: The SEC argues that XRP sales meet the criteria of the Howey Test: an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. They point to Ripple's sales of XRP as evidence of this investment contract.

-

Ripple's XRP Sales: The SEC claims that Ripple's significant sales of XRP to institutional investors and the general public constitute the offering and sale of unregistered securities. This includes programmatic sales, which will be discussed further below.

-

Investor Protection and Market Manipulation Concerns: The SEC further contends that Ripple's actions lacked sufficient investor protection and potentially facilitated market manipulation, harming investors. These concerns are central to their case. The lack of transparency around XRP sales is also a key argument.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's claims, arguing that XRP is not a security but a decentralized digital asset functioning as a currency or utility token.

-

XRP as a Utility Token/Currency: Ripple emphasizes XRP's use in its payment network, arguing that its primary function is as a medium of exchange and not an investment contract. They highlight its usage in cross-border transactions.

-

Decentralization of XRP: A cornerstone of Ripple's defense is the assertion that XRP operates as a decentralized digital asset, outside the direct control of Ripple Labs. They point to its widespread adoption and independent trading.

-

Transparency and Compliance Efforts: Ripple highlights its efforts to promote transparency and comply with existing regulations, further strengthening its argument that they did not intentionally violate securities laws. They cite ongoing collaborations with regulatory bodies.

The Significance of the "Programmatic Sales" Argument

The SEC's focus on Ripple's programmatic sales of XRP is a critical aspect of their case. These automated sales, unlike traditional initial coin offerings (ICOs), are argued to be more akin to a continuous offering of securities.

-

Programmatic Sales and the Howey Test: The SEC claims these programmatic sales directly satisfy the Howey Test criteria, indicating a common enterprise and expectation of profit based on Ripple's efforts to increase XRP's value.

-

Implications for Future Crypto Projects: The legal precedent set by this aspect of the case could significantly impact the future development and regulation of other crypto projects employing similar sales mechanisms. Many projects utilize similar automated sales.

-

Legal Precedent: The court's interpretation of programmatic sales and their relevance to securities laws will create a significant legal precedent for how future crypto projects are classified and regulated. This has major implications for the entire crypto space.

Settlement Talks and Potential Outcomes

Settlement negotiations between Ripple and the SEC are ongoing, with several potential outcomes.

-

Potential Scenarios: A full settlement could involve Ripple admitting wrongdoing and paying a significant fine. A partial settlement might see Ripple agree to some concessions while avoiding a full admission of guilt. Alternatively, the case could proceed to a full court decision, leading to a potentially lengthy and uncertain process.

-

Implications for XRP's Price and the Crypto Market: Each outcome will significantly impact XRP's price and investor sentiment. A favorable outcome for Ripple could trigger a substantial price increase, while an adverse outcome might lead to a considerable drop. This uncertainty affects the whole cryptocurrency market.

-

Impact on Future Regulatory Actions: The resolution of this case will profoundly affect future regulatory actions concerning cryptocurrencies. It will set a critical precedent for how other crypto assets are classified and regulated, impacting the broader crypto regulatory landscape. The outcome will likely inform future SEC enforcement actions.

Conclusion

The Ripple vs. SEC case is a landmark legal battle shaping the future of cryptocurrency regulation. The classification of XRP as a security or a commodity has far-reaching implications for investors, developers, and the entire crypto ecosystem. The outcome of the settlement talks, or a court ruling, will provide crucial clarity on the regulatory landscape for digital assets.

Call to Action: Stay informed about the latest developments in the Ripple and SEC case concerning XRP classification. Understanding the legal intricacies and potential outcomes is crucial for navigating the evolving landscape of cryptocurrency investment and regulation. Follow reputable news sources for updates on the Ripple and SEC case and its impact on XRP's price and the broader cryptocurrency market.

Featured Posts

-

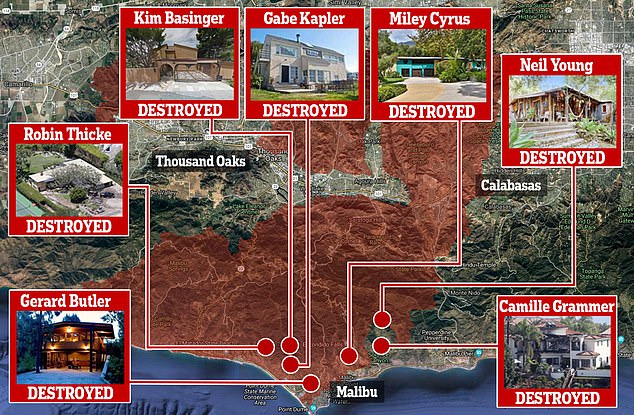

Homes Destroyed Celebrities Impacted By The Palisades Fire

May 02, 2025

Homes Destroyed Celebrities Impacted By The Palisades Fire

May 02, 2025 -

Community Mourns With Manchester United Remembering Poppy Atkinson 10

May 02, 2025

Community Mourns With Manchester United Remembering Poppy Atkinson 10

May 02, 2025 -

Christina Aguilera Fans Accuse Singer Of Excessive Photoshopping In New Photoshoot

May 02, 2025

Christina Aguilera Fans Accuse Singer Of Excessive Photoshopping In New Photoshoot

May 02, 2025 -

Is Fortnite Down Server Status Update 34 20 Downtime And Patch Notes

May 02, 2025

Is Fortnite Down Server Status Update 34 20 Downtime And Patch Notes

May 02, 2025 -

Restaurant Style Crab Stuffed Shrimp In Lobster Sauce At Home

May 02, 2025

Restaurant Style Crab Stuffed Shrimp In Lobster Sauce At Home

May 02, 2025

Latest Posts

-

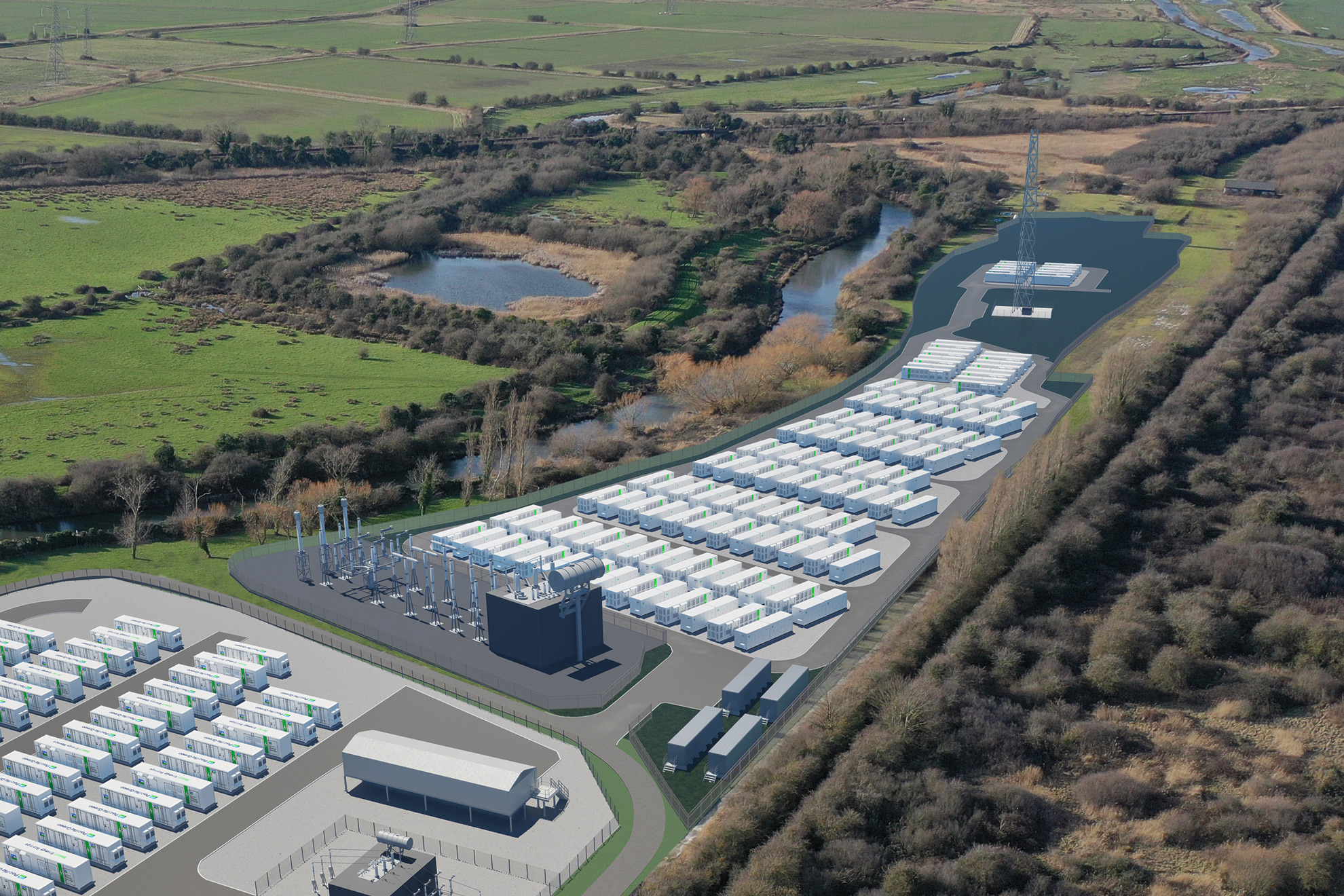

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025