Riot Platforms Stock: What's Happening With RIOT And The Crypto Market?

Table of Contents

Riot Platforms' Business Model and Bitcoin Mining Operations

Riot Platforms' core business is Bitcoin mining. They operate large-scale facilities equipped with specialized hardware (ASIC miners) to solve complex cryptographic problems, earning Bitcoin as a reward. Their operations rely heavily on access to affordable and reliable energy sources. While the specifics of their energy sourcing strategies are constantly evolving, considerations around sustainable practices and environmental impact are becoming increasingly important for the company and the industry as a whole.

- Scale of Operations: Riot Platforms boasts a substantial mining hashrate, indicating their significant contribution to the Bitcoin network's security. The exact number of miners and their hashrate fluctuate based on expansion plans and hardware upgrades.

- Geographic Location: The geographic location of their mining facilities impacts operational costs, access to renewable energy sources, and regulatory considerations. Strategic choices in location are crucial for maintaining profitability.

- Technological Advancements: Riot Platforms continuously invests in upgrading its mining hardware and infrastructure to enhance mining efficiency and reduce operational costs. Adopting the latest ASIC technology and optimizing cooling systems are vital for staying competitive.

The Correlation Between RIOT Stock Price and Bitcoin's Price

A strong correlation exists between the RIOT stock price and the price of Bitcoin (BTC). Historically, when the price of Bitcoin rises, RIOT stock tends to follow suit, and vice versa. This is because the value of Riot Platforms' holdings in Bitcoin and its mining revenue are directly tied to the BTC price.

- Historical Price Movements: Analyzing past price charts clearly illustrates this correlation. Sharp increases in Bitcoin's price typically translate into significant gains for RIOT stock, while Bitcoin price dips often lead to RIOT stock declines.

- Influencing Factors: While the correlation is generally strong, factors such as regulatory changes, overall market sentiment towards cryptocurrencies, and the company's own operational performance can influence the strength of this relationship. Unexpected regulatory hurdles, for example, could decouple the correlation temporarily.

- Potential Decoupling: Several factors might lead to a weaker correlation in the future. Diversification into other cryptocurrencies or blockchain-related ventures could reduce the dependence on Bitcoin's price.

Analyzing Riot Platforms' Financial Performance and Future Outlook

Riot Platforms' financial reports provide insights into their profitability and growth trajectory. Analyzing key metrics such as revenue, operating margin, and debt levels is crucial for assessing their financial health and potential for future growth.

- Key Financial Metrics: Investors should carefully examine Riot Platforms' revenue growth, operating margins, and profitability. These metrics demonstrate the efficiency of their mining operations and their ability to generate profit even during periods of Bitcoin price volatility.

- Balance Sheet and Debt: The company's balance sheet reveals its financial stability and its ability to manage debt. High debt levels could pose a risk, especially during periods of low Bitcoin prices.

- Future Projects and Partnerships: Riot Platforms' future growth strategy is likely to involve expansion of their mining operations, strategic partnerships, and potentially diversification into other blockchain technologies.

Risks and Opportunities Associated with Investing in RIOT Stock

Investing in RIOT stock presents both substantial opportunities and significant risks. The cryptocurrency market is inherently volatile, and regulatory uncertainty adds another layer of complexity.

- Regulatory Risks: Changes in regulations governing Bitcoin mining and cryptocurrency trading can significantly impact Riot Platforms' operations and profitability. Regulatory clarity is essential for long-term stability.

- Market Risks: The price of Bitcoin is highly volatile, and this directly impacts RIOT stock price. Significant Bitcoin price drops can lead to substantial losses for investors.

- Operational Risks: Hardware malfunctions, energy price fluctuations, and competition within the Bitcoin mining industry pose operational risks to Riot Platforms.

- Potential for High Returns: If the price of Bitcoin appreciates significantly, RIOT stock has the potential to generate substantial returns for investors.

Conclusion

Understanding the intricacies of Riot Platforms stock (RIOT) and its dependence on the cryptocurrency market is crucial for making informed investment decisions. The correlation between RIOT's price and Bitcoin's price is strong, presenting both significant opportunities for high returns and substantial risks associated with Bitcoin's volatility and regulatory uncertainty. Conduct thorough due diligence before investing in RIOT stock, considering both the potential rewards and inherent risks. Refer to reputable financial news sources and the Riot Platforms investor relations website for the latest information and financial reports before making any investment choices.

Featured Posts

-

Le Mariage Macron Des Annees Plus Tard Des Revelations Sur Leur Intimite

May 03, 2025

Le Mariage Macron Des Annees Plus Tard Des Revelations Sur Leur Intimite

May 03, 2025 -

Lotto 6aus49 Mittwoch 9 4 2025 Die Aktuellen Gewinnzahlen

May 03, 2025

Lotto 6aus49 Mittwoch 9 4 2025 Die Aktuellen Gewinnzahlen

May 03, 2025 -

End Of School Desegregation Order Implications For Education

May 03, 2025

End Of School Desegregation Order Implications For Education

May 03, 2025 -

India Rejects De Escalation Call Reasserts Demand For Justice

May 03, 2025

India Rejects De Escalation Call Reasserts Demand For Justice

May 03, 2025 -

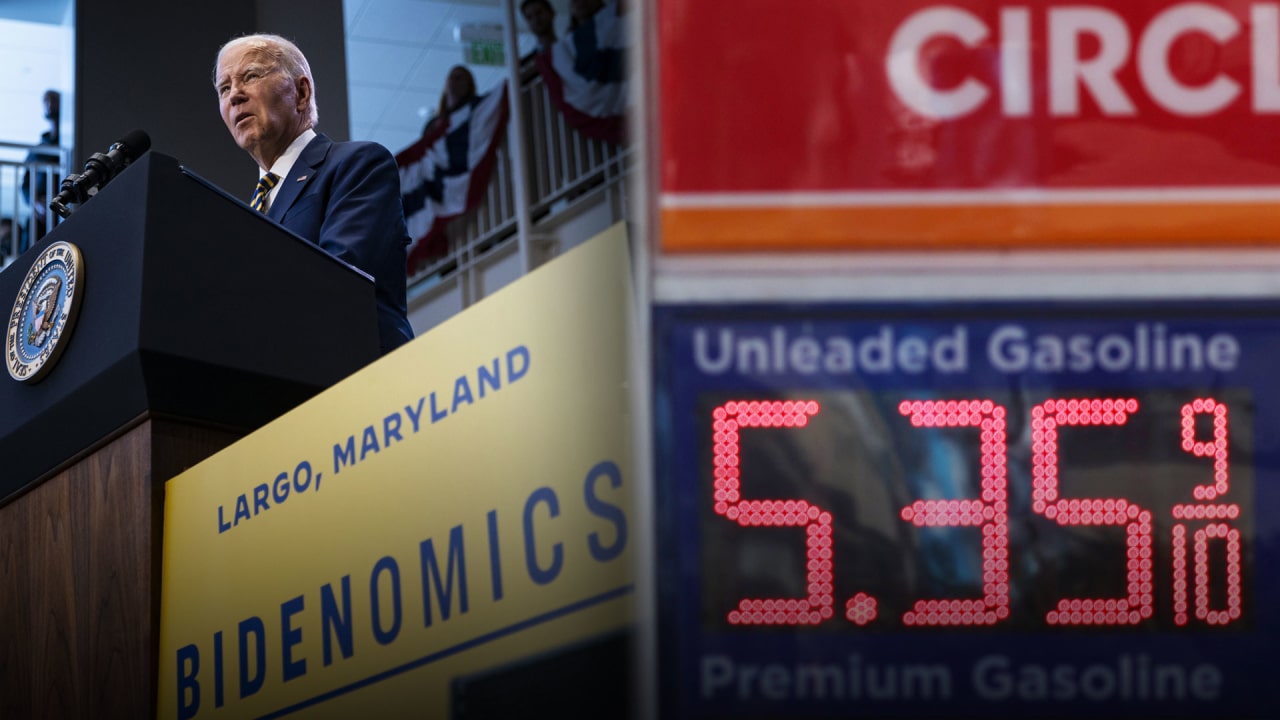

Is Joe Biden Responsible For The Slowing Economy A Critical Analysis

May 03, 2025

Is Joe Biden Responsible For The Slowing Economy A Critical Analysis

May 03, 2025